Get the free Financial Assessment Application

Get, Create, Make and Sign financial assessment application

Editing financial assessment application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial assessment application

How to fill out financial assessment application

Who needs financial assessment application?

Comprehensive Guide to the Financial Assessment Application Form

Understanding the financial assessment application form

The financial assessment application form is a crucial document used by individuals and organizations to evaluate financial statuses comprehensively. It systematically gathers essential information about a person's income, expenses, assets, and liabilities to assess their financial health. This assessment plays a pivotal role, particularly in determining eligibility for various financial services, benefits, or assistance programs.

Completing a financial assessment allows organizations to tailor their offerings to meet the exact needs of individuals, ensuring that assistance is allocated efficiently and fairly. Essential components of this form include personal identification details, complete financial history, and supporting documentation to validate the claims made.

Purpose of the financial assessment application form

The primary purpose of the financial assessment application form is to assess the financial needs and capabilities of individuals who require support or wish to access certain services. Notably, this form is beneficial for various demographics, including low-income families, students seeking financial aid, or individuals undergoing significant life changes, such as retirement or unemployment.

Once completed, the financial assessment results guide organizations in strategic planning, from determining service eligibility to resource allocation. The outcomes influence decisions on granting loans, scholarships, or any form of financial assistance, thus having a substantial impact on an individual's future financial stability.

How to access the financial assessment application form

Accessing the financial assessment application form is straightforward through pdfFiller, a user-friendly document management platform. Users can easily navigate to the platform's homepage or search for specific form templates. The form is typically available in PDF format, enabling easy filling, signing, and submission.

Whether you're using a mobile device or a desktop browser, pdfFiller ensures seamless access to the application form. Smart features allow users to fill out forms on-the-go, ensuring flexibility and convenience. Additionally, the online version of the form includes interactive fields that guide users through the process step by step.

Step-by-step guide to filling out the financial assessment application form

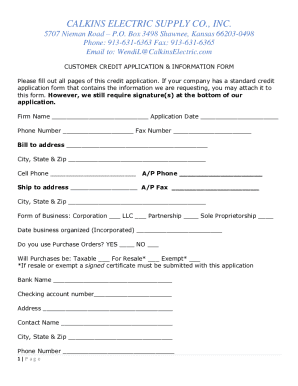

**Personal Information Section**: This is where you input your basic details such as name, contact information, and social security number. Accuracy is crucial here as any discrepancy may lead to delays in processing.

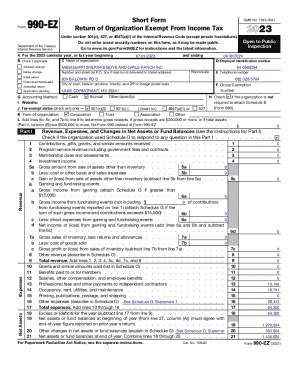

**Financial Information Section**: It’s vital to comprehensively overview your income, including salaries, self-employment earnings, and any passive income streams like dividends. Include documentation such as pay stubs or bank statements as proof of income.

**Expenses and Obligations Section**: List all regular monthly expenses, including utilities, rent/mortgage, and transportation costs. Additionally, disclose other financial obligations like loans and credit card debts for a thorough assessment.

**Supporting Documents Section**: Be sure to attach necessary documentation such as tax returns, recent bank statements, and proof of income. pdfFiller facilitates easy uploading, allowing you to attach documents directly within the form.

Tips for efficiently completing the financial assessment application form

To streamline the process of filling out the financial assessment application form, organization is key. Keep all relevant documentation at hand before starting to fill out the form. Utilize pdfFiller's tools, such as spell check and auto-fill options, to minimize errors.

Common mistakes to avoid include neglecting to provide complete information and overlooking to verify the accuracy of your documents. Double-checking your entries can save time and increase the chances of a swift assessment.

Customizing your financial assessment application form

pdfFiller doesn't just stop at providing a basic form; it offers extensive customization options. Users can modify fields, add comments, or include interactive fields tailored to their specific financial situation, making the form fit their needs perfectly.

Saving and retrieving customized versions of your financial assessment application form is easy – simply employ the saving features available within the platform. This functionality not only enhances convenience but also allows for quick edits and updates in subsequent assessments.

Collaborative features for teams

For teams involved in the financial assessment process, pdfFiller offers remarkable collaborative features. Users can share the financial assessment application form with team members for input and feedback. This ensures all relevant data is considered before submission.

Real-time tracking features allow team members to see changes as they happen, reducing the chances of data miscommunication. Additionally, tasks can be assigned within the application process to ensure every aspect of the form is handled efficiently.

Signing and submitting your financial assessment application form

Once the financial assessment application form is completed, it's vital to ensure that you sign and submit it correctly to avoid any delays. pdfFiller incorporates an easy-to-use eSignature feature that allows users to sign their form securely.

When submitting your form, always verify that all sections are filled out entirely. Best practices for submission include keeping copies of your documents for personal records and ensuring the form is sent to the correct department or agency. Confirming your submission and tracking any feedback is also essential for following up and ensuring a smooth processing experience.

Frequently asked questions about the financial assessment application form

One common question regarding the financial assessment application form is about the expected turnaround time for assessments. While this varies depending on the organization and volume of requests, most users can expect a response within a few business days.

Another important query is how to update financial information after submission. Typically, organizations allow users to resubmit the form or make revisions through a follow-up communication. If you encounter issues with the online form, pdfFiller’s customer support can assist you in troubleshooting the problem.

Related templates and tools available on pdfFiller

Beyond the financial assessment application form, pdfFiller provides an array of related templates and tools designed to assist in diverse financial matters. For example, the investment preferences poll can help gauge investment interest, while the expense report form helps track expenditures systematically.

Additionally, users can find loan application forms designed specifically to facilitate quicker processing. Each of these related templates enhances your ability to manage your financial documentation efficiently.

About pdfFiller’s document management solutions

pdfFiller stands out as a cloud-based document management solution that empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents. It's particularly beneficial for financial assessments because it offers diverse functionalities that cater to users’ needs for accuracy and efficiency.

The platform's ease of use, coupled with robust security measures and user support, makes it an ideal choice for individuals and teams looking to maintain comprehensive financial records while ensuring compliance and data integrity.

Contact and support options

Should you need assistance with the financial assessment application form, pdfFiller offers various support options. Users can access live chat for immediate help or send email inquiries for more detailed questions.

Additionally, feedback mechanisms are in place for users to suggest enhancements to improve the platform continuously. With user support readily available, pdfFiller ensures a seamless experience throughout the form completion process.

Legal considerations

When dealing with financial assessment application forms, it's important to understand the legalities involved. Misrepresentation of information can have serious legal consequences, making honesty and accuracy paramount during the completion of the application.

Furthermore, pdfFiller prioritizes data privacy and security measures, helping users protect their sensitive financial information. Understanding these regulations, alongside the importance of maintaining accurate records, can significantly aid in the successful navigation of the financial assessment process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in financial assessment application?

Can I create an electronic signature for the financial assessment application in Chrome?

Can I create an eSignature for the financial assessment application in Gmail?

What is financial assessment application?

Who is required to file financial assessment application?

How to fill out financial assessment application?

What is the purpose of financial assessment application?

What information must be reported on financial assessment application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.