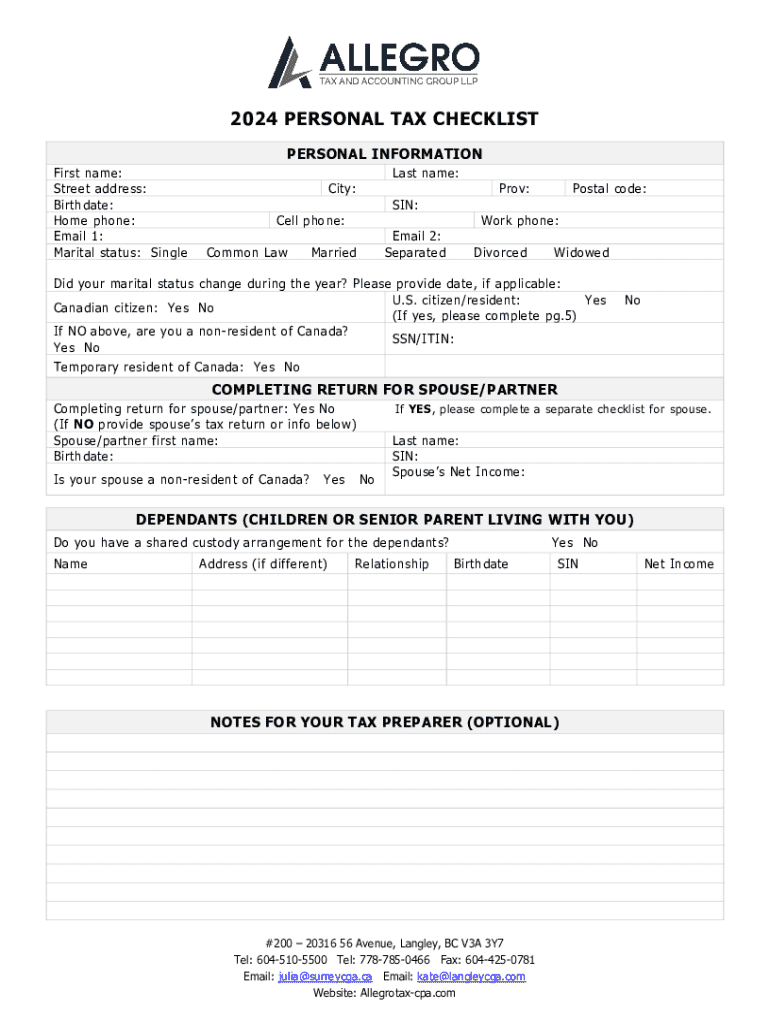

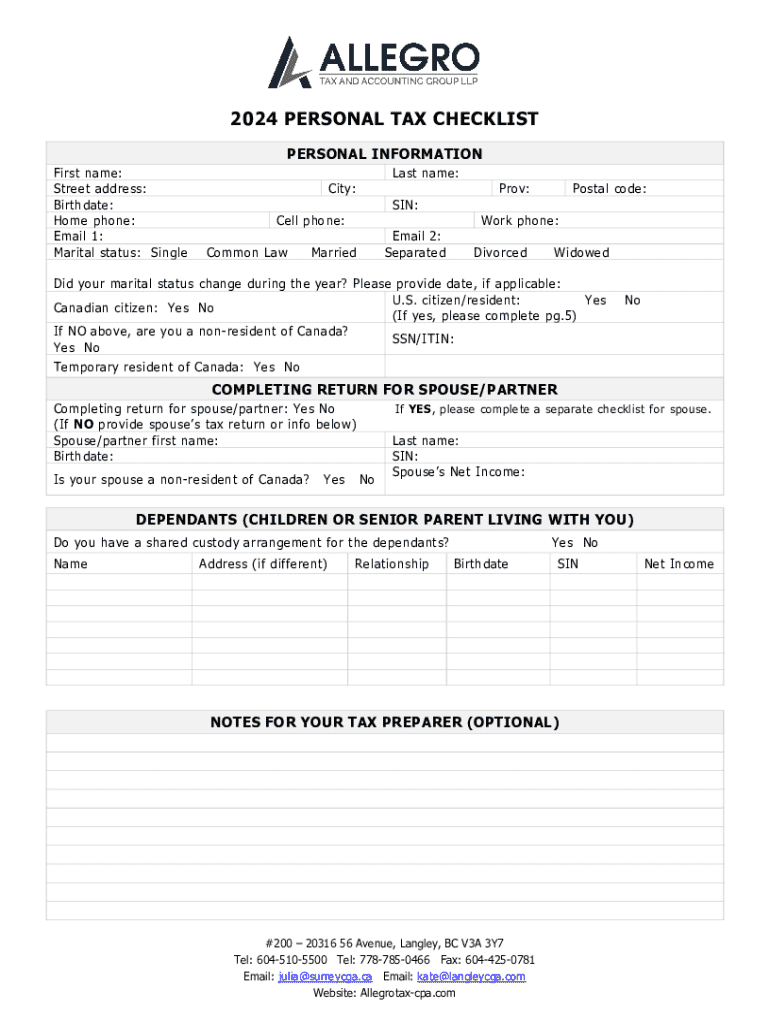

Get the free 2024 Personal Tax Checklist

Get, Create, Make and Sign 2024 personal tax checklist

How to edit 2024 personal tax checklist online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 personal tax checklist

How to fill out 2024 personal tax checklist

Who needs 2024 personal tax checklist?

Your comprehensive guide to the 2024 personal tax checklist form

Overview of the 2024 personal tax checklist

The 2024 personal tax checklist serves as a vital tool for individuals preparing their income tax returns. This checklist streamlines the tax preparation process, ensuring that you don't miss any critical details when filing your annual taxes. Given the ever-changing nature of tax laws and regulations, a dedicated checklist helps taxpayers stay informed and compliant.

Several key updates have emerged for the 2024 tax year, impacting personal tax returns. Keeping abreast of these changes is essential for preparing your taxes accurately. For instance, 2024 sees adjustments in income tax brackets and increases in the standard deduction amounts, which can significantly affect your taxable income.

Utilizing a checklist for personal tax preparation offers ample benefits, including better organization, increased efficiency, and a more straightforward review process. It enables individuals and teams to keep track of documents and ensures nothing is overlooked in the rush to meet tax deadlines.

Preparing for your 2024 personal taxes

Preparation for your 2024 personal taxes begins with gathering the necessary documents. This foundation is essential for smooth and efficient filing. Start with your W-2 and 1099 forms, which report your income from various sources. Collecting these forms early can help you identify any discrepancies with your financial records.

Additionally, gather receipts for any deductions you plan to claim, as they serve as proof of expenses. Having last year’s tax return on hand also provides a useful comparison point, helping you anticipate changes and adjustments in your current tax situation.

Understanding your tax filing status is another critical step. Your status affects your tax rates and eligibility for certain credits. The options include Single, Married Filing Jointly, and Head of Household. Each status has distinct implications that can significantly influence your overall tax bill.

Detailed steps for completing your 2024 personal tax checklist form

To effectively complete your 2024 personal tax checklist form, follow these organized steps. Step 1 entails organizing your financial records by creating a dedicated folder for all important documents. This folder can be physical or digital, depending on your preference. If you choose to keep digital copies, consider employing a secure cloud storage solution to ensure accessibility and safety.

Step 2 focuses on determining the deductions and credits available to you. Common deductions include the standard deduction and itemized deductions, with taxpayers needing to evaluate which option provides the most benefit. Furthermore, tax credits can directly reduce the amount of tax owed and are often overlooked, so it’s essential to investigate any that apply to your situation.

Step 3 involves choosing your preferred filing method. You can opt for tax software, which often streamlines the process with user-friendly interfaces and guided assistance, or you could seek a professional tax preparer. On the other hand, you may choose between eFiling and traditional paper filing. eFiling is generally quicker and may lead to faster refunds, while paper filing provides a tangible record of your submission but can delay processing times.

Interactive tools available on pdfFiller

pdfFiller stands out as a cloud-based platform that offers interactive tools for managing your 2024 personal tax checklist form. Accessing the editable checklist directly on pdfFiller enables you to tailor the document to your specific tax preparation needs. Whether you are filing individually or collaborating within a team, the platform's capabilities can greatly enhance your filing experience.

One of the standout features is the Smart Fill option, which automatically populates relevant fields based on the information provided. This saves time and ensures accuracy when completing forms. Additionally, pdfFiller's auto-calculation features help in computing totals effectively, reducing the potential for human error. Team filers can also leverage collaboration tools to work together seamlessly, ensuring that everyone is on the same page throughout the filing process.

Common mistakes to avoid

When navigating your 2024 personal tax checklist, it’s crucial to recognize and avoid common mistakes that could lead to complications. Frequently, individuals overlook critical documentation that can impact their taxes, such as forgetting to include all income forms like 1099s or missing out on essential deductions.

Errors in personal information, such as incorrect Social Security numbers or misspelled names, can lead to delays in processing and potential rejections from the IRS. Furthermore, many taxpayers fail to exhaustively review available deductions and credits, thus missing out on potential savings that could significantly alter their tax obligations.

Frequently asked questions about the 2024 personal tax checklist

Navigating tax season can prompt various questions. One frequent concern is how to correct mistakes once a return has been filed. It’s critical to act swiftly; amendments can be made using Form 1040-X to rectify any errors after submission.

Another common inquiry relates to situations where taxpayers cannot pay the taxes owed. It's vital to communicate with the IRS to explore payment options or installment agreements. Lastly, determining how long to keep tax records is essential. Generally, maintaining records for three to seven years is advised, depending on the complexity of your tax return.

Tips for a smooth tax filing experience

Establishing a timeline for each stage of the tax preparation process can enhance your filing experience. Setting specific deadlines for gathering documents, completing your checklist, and filing your tax return can mitigate stress and help avoid last-minute scrambles. By utilizing pdfFiller’s comprehensive resources for document management, users can further streamline their workflow.

Staying informed about changes in tax laws is also pivotal for future preparedness. Engaging with reliable tax news sources can alert you to modifications that may affect subsequent tax filings, while scheduling reviews of your financial situation regularly can ensure you're always prepared.

Real-life examples and case studies

Real-life instances showcase the value of using a tax checklist effectively. One individual recounted how implementing a structured approach using a checklist enabled them to save significant amounts on deductions they had overlooked previously. By methodically tracking their expenses throughout the year, they maximized their return efficiently.

In team settings, collaborating within pdfFiller has led to striking improvements in tax filing accuracy. Teams have reported reduced filing times and increased accuracy, as the collaborative features allow multiple users to contribute and verify entries, eliminating potential errors and enhancing efficiency.

Success stories

Many users of pdfFiller have shared testimonials regarding their enhanced tax preparation experiences. A small business owner remarked on the transformation in workflow efficiency made possible by using the platform. The intuitive features allowed them to edit and prepare tax documents quickly, enabling timely filings without unnecessary complications.

Another user praised the clarity of using pdfFiller’s templates for tax forms, expressing that the user-friendly interface significantly reduced the complexity often associated with annual tax compliance. This ease of use has empowered them to manage their finances confidently, fostering improved accuracy and adherence to deadlines.

Getting started with pdfFiller

Embarking on your tax preparation journey with pdfFiller begins with creating an account and selecting a suitable plan. Once logged in, the user-friendly dashboard allows you to navigate through various templates readily available for the 2024 personal tax checklist form. Tailoring a workspace specifically for your tax documentation ensures that everything you need is organized and easily accessible.

Setting up your document workspace for the 2024 taxes is straightforward with pdfFiller. You can upload necessary forms, use provided templates, or create your documents anew. The platform's versatility ensures that you can handle any tax-related tasks, from editing forms to digital signing, all in one place.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2024 personal tax checklist online?

How do I fill out 2024 personal tax checklist using my mobile device?

How do I edit 2024 personal tax checklist on an Android device?

What is personal tax checklist?

Who is required to file personal tax checklist?

How to fill out personal tax checklist?

What is the purpose of personal tax checklist?

What information must be reported on personal tax checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.