Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

A comprehensive guide to Form 990: Understanding, filling out, and filing

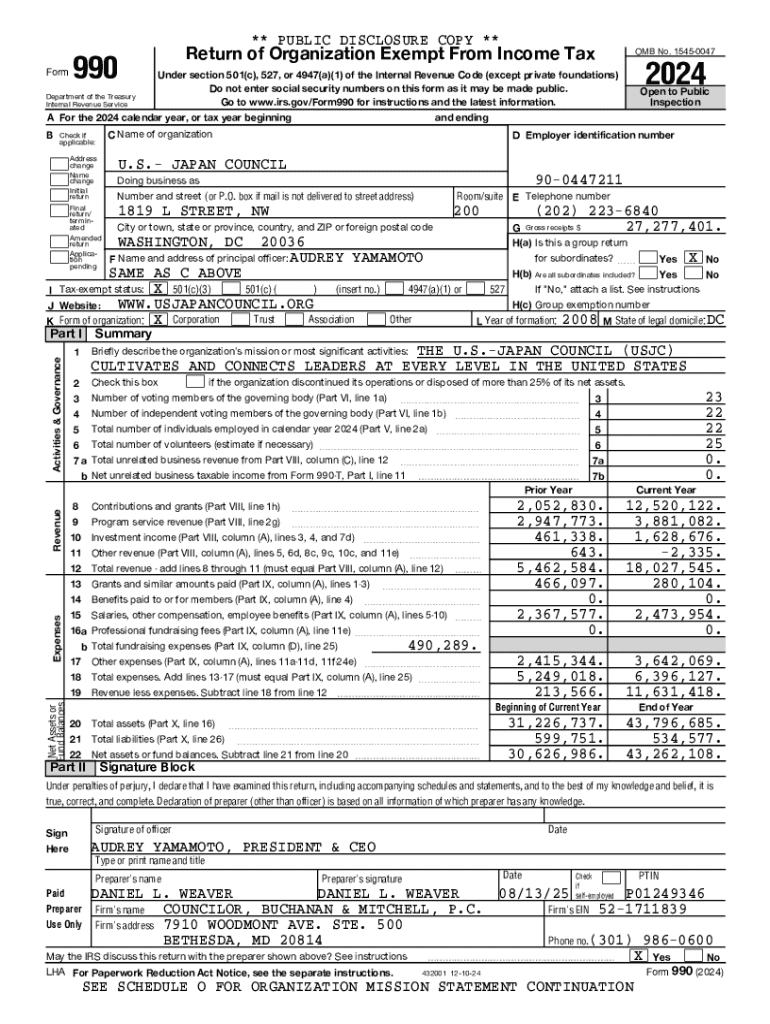

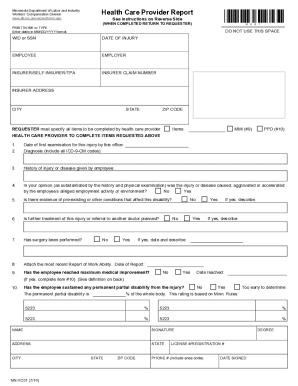

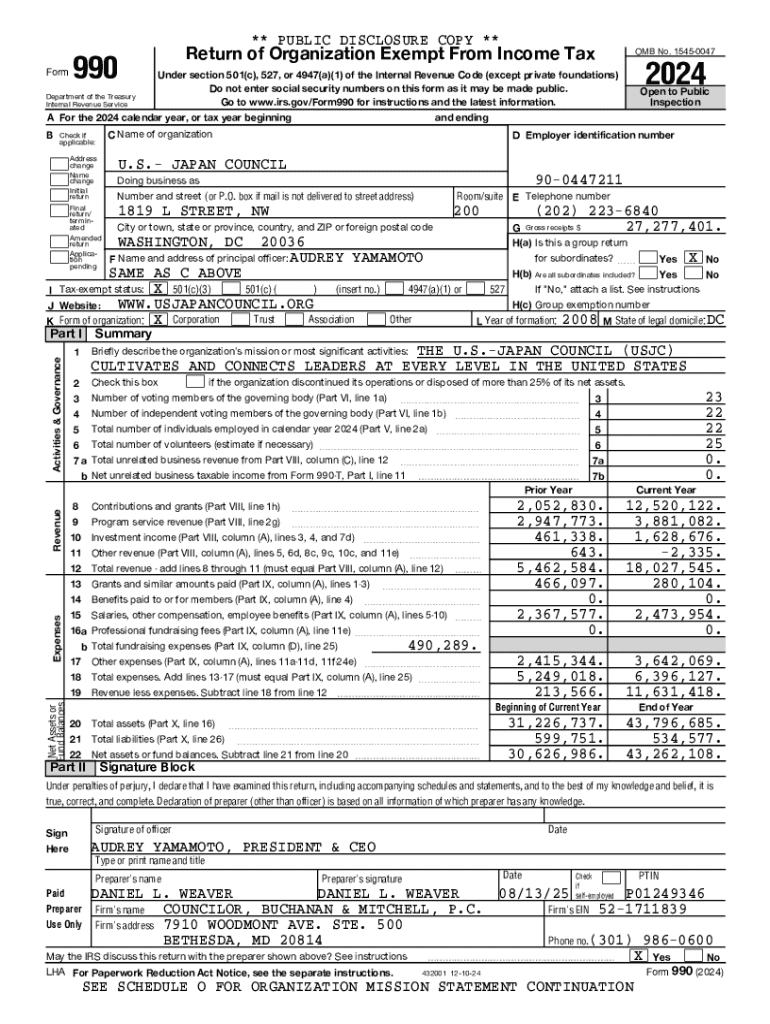

Understanding Form 990

Form 990 is a vital document that nonprofit organizations in the United States are required to file with the IRS annually. Its primary purpose is to ensure transparency in financial operations, serving as a public record that details the organization’s activities, finances, governance, and more. This form not only helps nonprofits maintain their tax-exempt status but also allows the public to assess how organizations utilize grant funds and donations.

For nonprofit organizations, filing Form 990 is a legal requirement that carries significant importance. This document reflects the financial health and operational integrity of an organization, allowing potential donors, grantors, and stakeholders to make informed decisions based on disclosed information. Nonprofits that fail to file or inaccurately report information on Form 990 may face penalties, loss of tax-exempt status, and reputational harm.

The structure of Form 990

Form 990 is divided into several key sections, each catering to specific disclosure requirements. Understanding the layout is essential for accurate completion. The notable parts include:

Moreover, Form 990 includes financial statements, particularly focusing on Part X, which contains the balance sheet. This part reveals the organization’s assets, liabilities, and net assets, providing a snapshot of financial stability. Parts VIII and IX detail sources of revenue and expenses, giving insight into operations and financial management.

Filling out Form 990

Completing Form 990 can seem daunting, but breaking it down into manageable steps simplifies the process. Each section has specific requirements that must be adhered to. To start, gather necessary financial documents, including bank statements, income reports, and expenditure records.

Avoiding common pitfalls is essential during this exercise. Misreporting financial data, neglecting to include required schedules, or failing to adhere to the filing deadline can have severe consequences. Keeping meticulous records and reviewing all entries before submission can prevent these issues.

Leveraging tools like pdfFiller can significantly ease the experience of filling out Form 990. This online platform facilitates seamless document creation and editing, ensuring that users can focus on entering accurate data without worrying about formatting or compliance issues.

Editing and managing Form 990

After filling out Form 990, revisiting the document for edits or enhancements is crucial. With pdfFiller, users can easily make annotations or comments, highlight specific sections, and even choose from customizable templates tailored to the requirements of Form 990.

Electronic signatures are another advantage of using pdfFiller. This method allows for secure and quick approval of the document without the hassles of printing and scanning. Upon final approval, securely submitting Form 990 to the IRS via electronic filing or physical mail becomes a streamlined task.

Managing versions of your document is equally important. pdfFiller provides document storage options along with version control capabilities, ensuring that all edits are tracked, and earlier versions are accessible if needed—an invaluable feature for audits and organizational reviews.

Best practices for filing Form 990

Preparing thoroughly in advance is one of the best practices for filing Form 990. Assemble all necessary financial documentation and engage with stakeholders, ensuring accuracy and completeness of disclosures. Involving key personnel from finance and administration can facilitate a thorough review process, ultimately leading to a more precise filing.

Internal reviews allow for a detailed examination of the completed Form 990 before it is filed. This review is pivotal for ensuring that all information is accurate and that there are no misrepresentations that might lead to negative repercussions from the IRS. A thorough external audit can provide an additional layer of confidence.

Navigating regulatory changes

Regulatory changes can significantly impact nonprofit organizations and their requirement to file Form 990. Keeping abreast of updates from the IRS is crucial to ensure compliance. Recent changes may include alterations in reporting frequency, new schedules, or adjustments in disclosure requirements. Staying informed helps organizations adapt effectively and avoid potential penalties.

Utilizing reliable sources such as industry newsletters, IRS updates, or professional organizations will aid in tracking these changes. Instituting a regular review process within your team can ensure that everyone is aligned with the latest information related to Form 990.

Support and resources for non-profits

Organizations adhering to nonprofit regulations and the demands of filing Form 990 can find many resources to assist them. Various organizations offer guidance on filling out Form 990, ensuring that nonprofits receive the necessary support during the process. These resources can range from detailed guides to workshops aimed specifically at nonprofit compliance.

pdfFiller's support options are another excellent resource. Their customer service team is available to assist users with questions or issues that may arise during the completion of Form 990. Additionally, the platform offers detailed tutorials and help documents to guide new users and streamline the filing process.

Frequently asked questions about Form 990

Common questions regarding Form 990 focus primarily on filing deadlines and procedures for amendments. If a nonprofit organization misses its filing deadline, it’s essential to file the form as soon as possible during the grace period, if applicable. The IRS offers mechanisms to rectify missed deadlines through extensions or late filings; however, ongoing failure might lead to penalties or loss of tax-exempt status.

Understanding key terms used in Form 990 is also crucial. Words like 'unrelated business income,' 'tax-exempt status,' and '501(c)(3)' can appear frequently, and having clarity on these terms can assist with accurate reporting. Familiarizing yourself with these concepts can enhance compliance and transparency within your organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 990?

How can I edit form 990 on a smartphone?

How do I fill out form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.