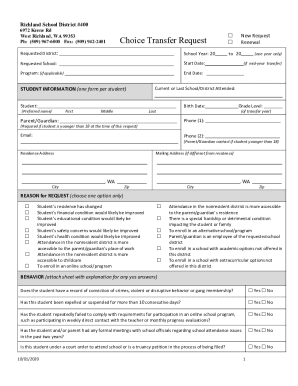

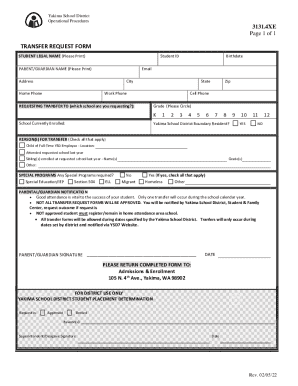

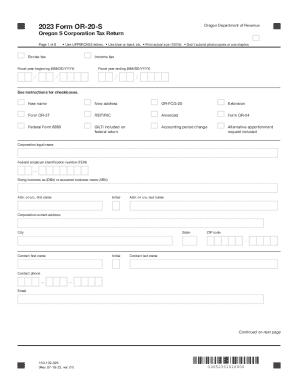

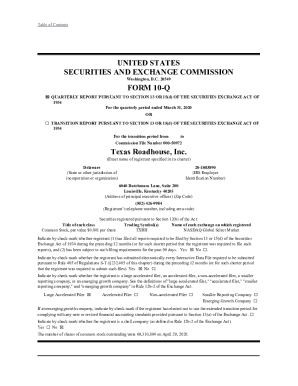

Get the free Dr 8496

Get, Create, Make and Sign dr 8496

How to edit dr 8496 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dr 8496

How to fill out dr 8496

Who needs dr 8496?

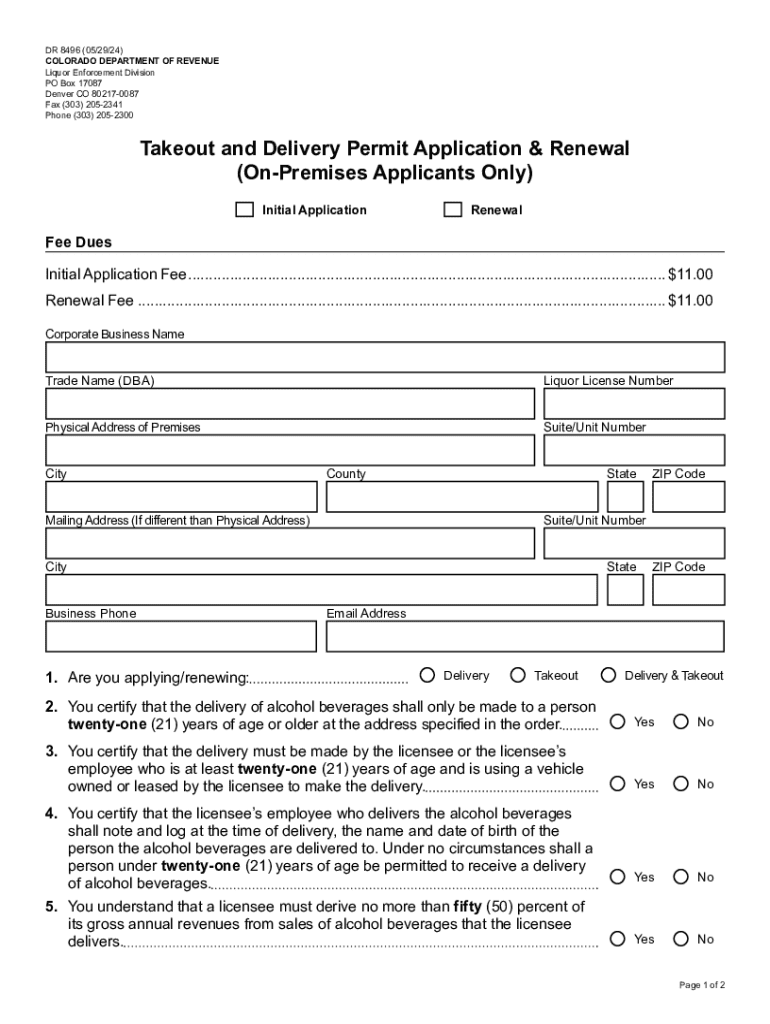

A Comprehensive Guide to the DR 8496 Form

Overview of the DR 8496 form

The DR 8496 form is a critical document utilized primarily in state tax-related processes, specifically concerning the assessment of property and local government tax relief programs. This form serves as a declaration to provide essential financial information that supports tax calculations and eligibility for exemptions.

The significance of the DR 8496 form lies in its ability to streamline tax assessments, providing a structured way for individuals and organizations to report their financial statuses to state offices. Accurate completion can lead to tax reductions and benefits, fostering a beneficial interaction with state tax authorities.

Who needs the DR 8496 form?

Typically, the DR 8496 form is required by property owners, businesses, and entities seeking eligibility for local tax relief programs. Individuals who may benefit from the DR 8496 form include homeowners claiming property tax exemptions or businesses applying for reduced tax assessments based on financial hardship.

Common scenarios where the DR 8496 form is applicable include transitioning to a new property, applying for exemptions following a financial setback, or reporting changes in financial status that may influence tax obligations. Understanding who needs the form is vital in ensuring compliance with state regulations.

Key features of the DR 8496 form

The DR 8496 form includes unique attributes that require attention. Key fields typically consist of personal information, property details, and comprehensive financial records. Notably, users must accurately report income levels, any applicable deductions, and insights into property valuation.

One major pitfall users face involves incomplete or inaccurate entries, which can delay processing, cause rejections, or lead to erroneous tax calculations. Awareness of common mistakes, such as misreporting financial figures or failing to include required signatures, is essential for form success.

Compliance and legal relevance

The DR 8496 form must adhere to compliance standards set by state offices. These regulations can vary significantly between states, with specific criteria requiring explicit data. As a result, it's crucial for filers to familiarize themselves with the relevant compliance criteria applicable to their jurisdiction before submission.

Legal relevance extends beyond submission; maintaining accurate records of submitted forms supports transparency and assists in any necessary audits by state authorities. Understanding the legal implications of the DR 8496 form can prepare filers for future interactions with tax offices.

Step-by-step instructions for filling out the DR 8496 form

Preparation is vital before starting to fill out the DR 8496 form. Gather necessary documents, including tax statements, income records, and property assessments. Familiarizing yourself with the structure of the form will simplify the filling process.

Once ready, proceed with these step-by-step instructions:

Be aware of common pitfalls during the form-filling process, such as forgetting to review all entries before submission. Many users also express concerns about specific wording or data requirements; checking FAQs can provide clarity and confidence.

Editing and modifying the DR 8496 form

Editing the DR 8496 form becomes straightforward with tools such as pdfFiller. To modify your form, begin by uploading it into the platform.

Once uploaded, you have access to a variety of editing features. PdfFiller allows users to modify text, insert annotations, and even collaborate with team members in real-time, streamlining the review process.

Collaboration benefits

The ability to collaborate within pdfFiller means multiple team members can contribute insights or modifications to the DR 8496 form efficiently. This feature enhances productivity and ensures all relevant data is accurately represented before the final submission.

Signing the DR 8496 form

E-signing the DR 8496 form holds significant importance in today’s digital documentation landscape. Legal validity of electronic signatures means that once signed, the document holds the same power as a conventional hard copy.

Using pdfFiller’s secure e-signing features, users can confidently complete this critical step. Here’s how to navigate the eSigning process:

Ensuring a smooth signing process safeguards the integrity of your submission and expedites interaction with state tax offices.

Submitting the DR 8496 form

Once the DR 8496 form is filled and signed, submission options vary based on state regulations. Filing through e-filing via state portals is increasingly common, offering a swift alternative to traditional methods.

Printing and mailing the form remains an option for those preferring hard copies. Detailed instructions include:

Monitoring your submission can help verify processing status and ensure timely responses from state authorities.

Managing your DR 8496 form with pdfFiller

PdfFiller also provides powerful features for document storage and organization. Users can categorize and tag documents, ensuring easy retrieval whenever necessary.

Additionally, sharing forms securely with colleagues or stakeholders fosters a collaborative work environment. Best practices involve using built-in sharing tools to maintain document security while allowing convenient access.

Conclusion

Utilizing the DR 8496 form effectively can significantly influence tax-related outcomes for individuals and businesses. Leveraging pdfFiller enhances this experience, providing tools to seamlessly edit, eSign, and manage the document efficiently.

PdfFiller empowers users to handle their forms with confidence, ensuring compliance with state regulations while maximizing tax relief opportunities.

Additional notes

Accuracy and timeliness are essential when dealing with the DR 8496 form. Ensure all details are accurate and up-to-date to avoid delays or complications. Exploring related forms and resources available on pdfFiller can provide further assistance and insights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in dr 8496?

How can I fill out dr 8496 on an iOS device?

How do I fill out dr 8496 on an Android device?

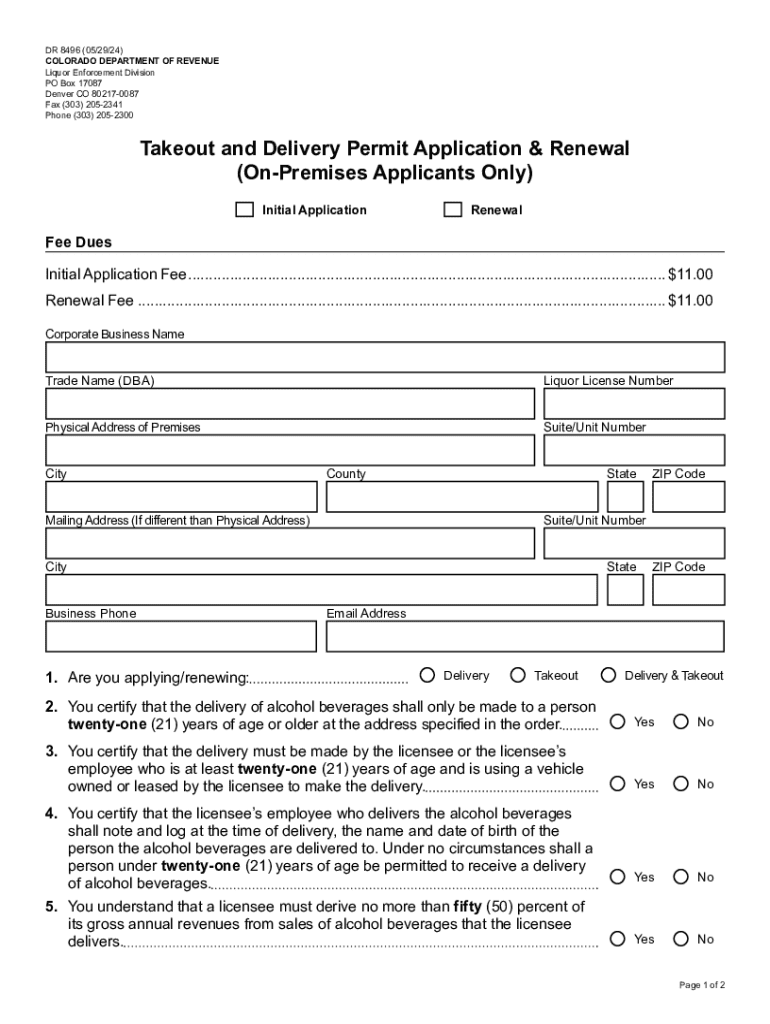

What is dr 8496?

Who is required to file dr 8496?

How to fill out dr 8496?

What is the purpose of dr 8496?

What information must be reported on dr 8496?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.