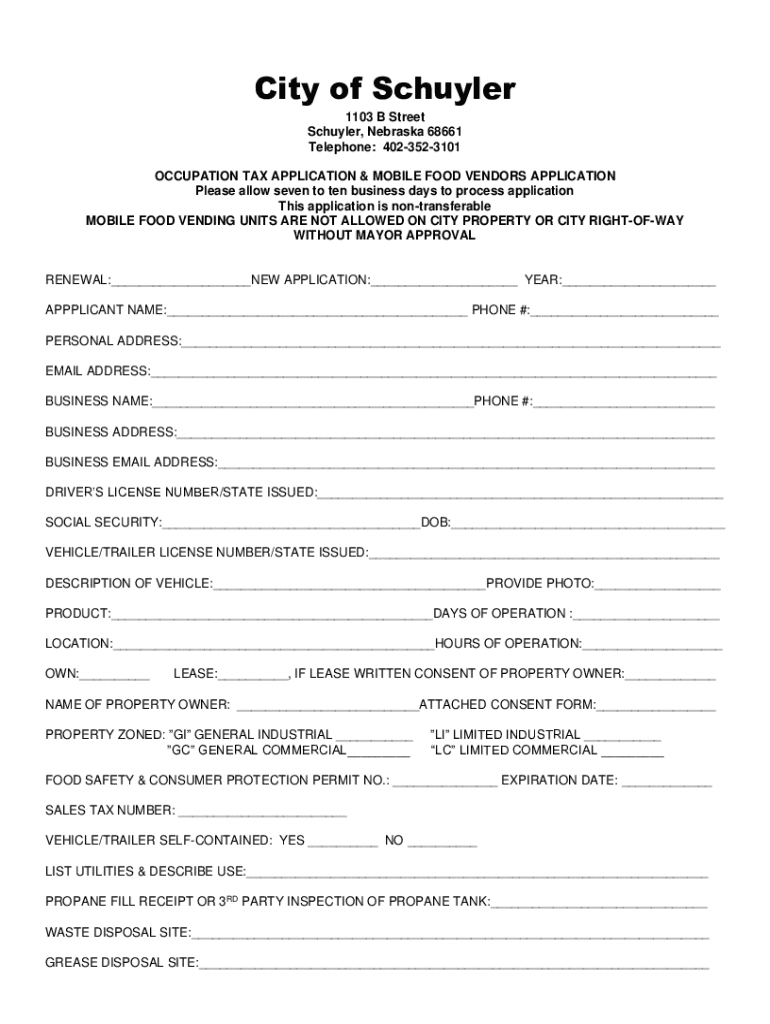

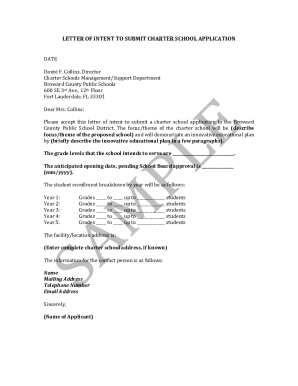

Get the free Occupation Tax Application & Mobile Food Vendors Application

Get, Create, Make and Sign occupation tax application mobile

How to edit occupation tax application mobile online

Uncompromising security for your PDF editing and eSignature needs

How to fill out occupation tax application mobile

How to fill out occupation tax application mobile

Who needs occupation tax application mobile?

Occupational Tax Application Mobile Form: A Comprehensive Guide

Understanding the occupational tax application

An occupational tax is a fee imposed on individuals or businesses for working within a certain jurisdiction, often tied to their gross receipts or revenue generation. This tax is essential as it contributes to local government revenues, funding services such as public safety, education, and infrastructure. The occupational tax application serves as a necessary means for authorities to track and assess this fee from various professionals and businesses operating within their city limits.

Filing the occupational tax application through digital platforms, such as a mobile form, is increasingly important in today's fast-paced environment. Not only does it simplify the process, but it also provides numerous benefits including easy access, reduced paperwork, and quicker processing times. By leveraging technology, individuals and teams can save time, reduce errors, and ensure compliance more effectively.

Key features of the mobile form

One of the most significant advantages of the occupation tax application mobile form is the ability to access it from anywhere, as long as you have an internet connection. This cloud-based solution enables users to complete their applications on their smartphones or tablets, making it convenient for busy professionals.

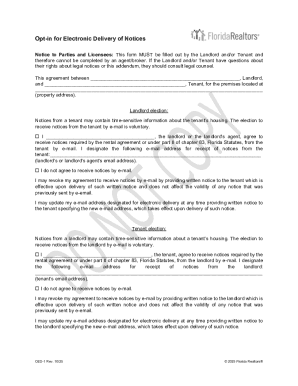

Moreover, the mobile form is equipped with interactive fields that offer a seamless completion experience. Users can click through various sections, automatically receiving prompts and tips to guide them through the necessary questions. eSigning capabilities allow applicants to approve their forms quickly and efficiently, eliminating the need for printing, signing, and scanning documents.

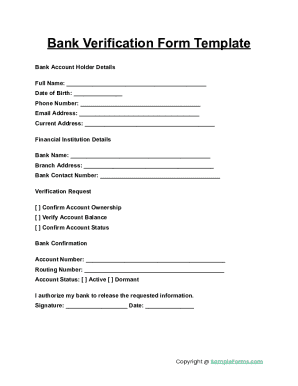

Implementing document management features helps applicants track and organize their applications, ensuring all necessary documentation is accounted for. This includes uploading relevant supporting materials such as prior tax documents or proof of business registration, critical in enforcing accurate assessments.

Who needs to fill out the occupational tax application?

The occupational tax application is essential for a wide range of individuals and teams. Most notably, professionals operating within specific categories, such as retail businesses, service providers, and contract workers must complete this application. Generally, if you generate income from work conducted within city limits, you may need to file an application.

Common scenarios that necessitate filling out the occupation tax application include starting a new business, relocating a business within the city, or expanding existing operations. Moreover, businesses undergoing changes such as acquiring new employees or altering their service offerings might also be required to reassess their tax obligations and submit an updated application.

Preparing to fill out the mobile form

Before diving into the occupation tax application mobile form, gather all necessary documents and information. You'll typically need your business license, federal or state tax identification number, financial statements such as profit and loss statements, and, depending on your locality, previous tax certificates or bills.

Effectively organizing your data will facilitate a smoother application process. Make sure to understand your tax liabilities, ensuring you’re informed of how various aspects of your business affect your tax rate. This preparation not only boosts your confidence in navigating the form but can also allow you to take advantage of any available deductions or credits.

Step-by-step instructions for using the occupation tax mobile form

To help you successfully navigate the occupational tax application mobile form, follow these detailed steps.

Common mistakes to avoid when completing the form

Filing your occupation tax application can be straightforward, yet certain pitfalls are common among applicants. One of the most frequent mistakes is overlooking fields or sections that are vital for proper assessment, which could lead to unnecessary delays in processing your application.

Moreover, miscalculations in reporting gross receipts or business income can complicate the tax assessment, potentially resulting in a higher tax liability or even a rejection of your application. Be diligent in double-checking numbers and ensuring all supplemental documents are attached before submitting to avoid unnecessary complications.

Frequently asked questions (FAQs)

As you navigate the occupation tax application, you may have several questions. Here are some frequently asked questions to shed light on the process and alleviate concerns.

Contact information for assistance

If you encounter any difficulties while filling out the occupation tax application mobile form, various customer support options are available to assist you. Typically, you can reach out via email, phone, or live chat through the pdfFiller platform. For those who prefer face-to-face interaction, visiting local tax offices can also provide guidance.

It's advisable to reach out well ahead of deadlines if you have specific tax inquiries or concerns. The earlier you address potential issues, the smoother your application process will be.

ATTENTION: Important notices for Union City taxpayers

For Union City taxpayers, staying updated on specific guidelines and deadlines is crucial for successful tax processing. Be sure to check local regulations, as changes in tax laws can directly affect your occupational tax application. Resources are typically available online to help you map out the tax implications specific to your profession or business situation.

Local tax authorities often announce changes that might require you to adjust how you fill out your mobile form. Regularly monitoring updates will ensure you remain compliant and avoid penalties.

User testimonials and success stories

Many individuals who have transitioned to utilizing the occupation tax application mobile form note enhanced efficiency and ease of use. Users report that the application streamlined their document management processes and improved their ability to stay compliant with local tax laws.

Quotes reflecting these sentiments highlight the functionality and support provided by pdfFiller in this process. Successful applicants often express satisfaction with how the mobile form simplifies submission and tracking, transforming what could be a daunting task into a manageable and straightforward process.

Explore more features of pdfFiller

Beyond just filling out occupational tax applications, pdfFiller offers additional features that enhance document management. The platform provides advanced editing options, allowing users to revise PDFs fluidly, ensuring all documentation is current and accurate.

Collaboration tools are also integrated, making team projects more manageable, allowing multiple users to participate in filling out forms concurrently. Furthermore, robust security features protect your personal information, providing peace of mind as you submit sensitive data.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get occupation tax application mobile?

How do I edit occupation tax application mobile online?

How do I complete occupation tax application mobile on an Android device?

What is occupation tax application mobile?

Who is required to file occupation tax application mobile?

How to fill out occupation tax application mobile?

What is the purpose of occupation tax application mobile?

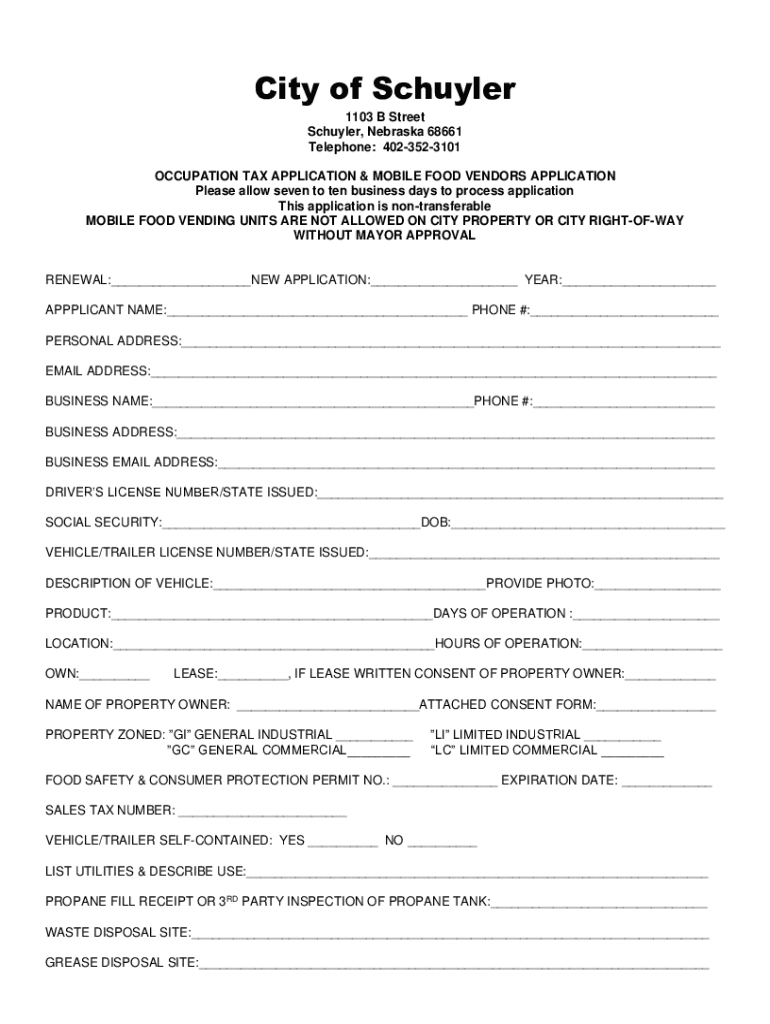

What information must be reported on occupation tax application mobile?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.