Get the free Campaign Finance Receipts and Expenditures Report

Get, Create, Make and Sign campaign finance receipts and

Editing campaign finance receipts and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts and

How to fill out campaign finance receipts and

Who needs campaign finance receipts and?

Understanding Campaign Finance Receipts and Forms

Understanding campaign finance receipts

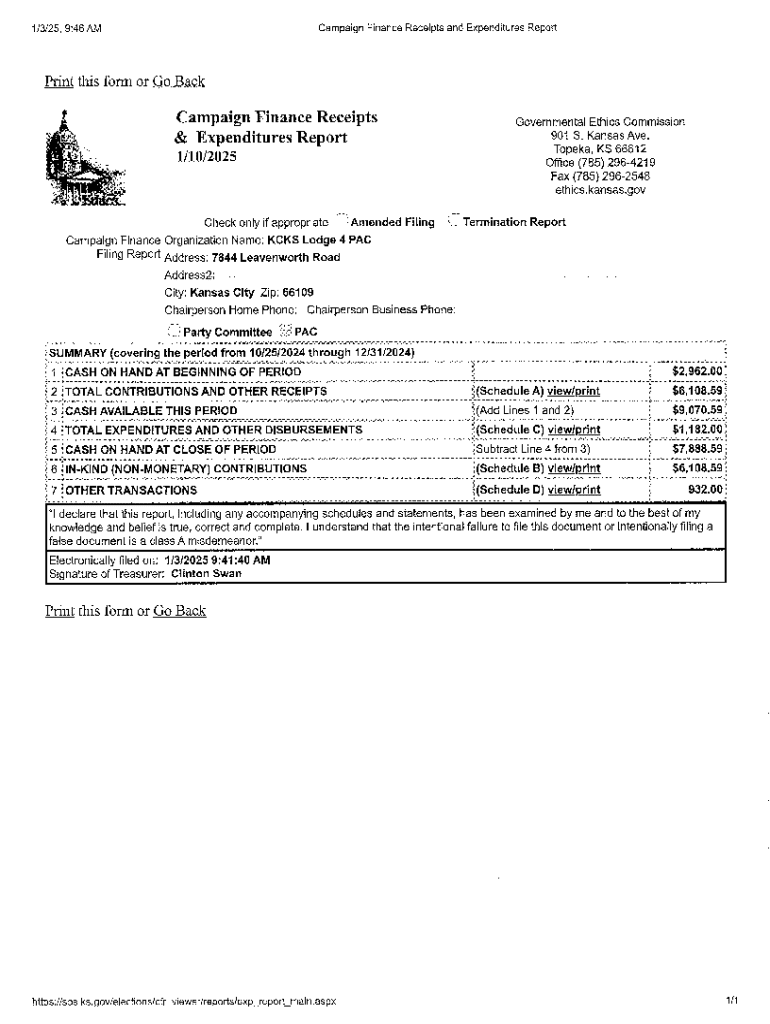

Campaign finance receipts refer to the official documentation of funds received by a political campaign. These receipts play a crucial role in maintaining compliance with legal regulations and ensuring transparency in political fundraising. Each receipt provides details about the contributor, the amount donated, and the date of the contribution, serving as a verifiable record of the financial transactions that power a campaign. Tracking these receipts is fundamental for candidates and committees to ensure they remain accountable to voters and regulatory agencies alike.

The importance of tracking campaign finance receipts cannot be overstated. With increasing scrutiny on political funding, campaigns must ensure meticulous documentation of every contribution. This transparency fosters trust among voters and mitigates legal risks associated with misreporting or failing to report contributions.

Purpose of campaign finance receipts

The primary purpose of campaign finance receipts is to provide a clear record of financial contributions, a requirement imposed by various laws governing political fundraising. These records help in documenting contributions for submission to election commissions and ensuring adherence to limits set on campaign donations. When a campaign can accurately record receipts, it enhances its financial reporting, allowing for better accountability and more strategic resource allocation.

Moreover, detailed receipts highlight the campaign's fundraising efforts, showcasing support from various sectors of the community. This visibility can enhance a candidate's reputation and help build momentum among potential voters, emphasizing the campaign's viability and community backing.

Types of campaign finance forms

The landscape of campaign finance is marked by different forms required at federal and state levels of government. Federal campaigns are governed by the Federal Election Commission (FEC), necessitating specific forms such as the FEC Form 1 for candidate registration and Form 3 for financial reports. In contrast, each state has its own rules and forms; for example, in California, candidates might use the Form 460 for campaign disclosure.

Understanding whether a campaign is federal or state-affiliated is crucial for compliance. Because regulations vary widely, candidates and their committees must be diligent in utilizing the correct forms—failure to do so could lead to penalties or disqualification from election processes.

Key information required on these forms typically includes: 1. Contributions - detailing amounts and sources. 2. Expenditures - outlining how funds were utilized. 3. Candidate and committee details - ensuring proper identification for transparency and accountability.

Step-by-step guide to filling out campaign finance forms

Filling out campaign finance forms meticulously is essential for accurate reporting. Preparing to fill out the form begins with a review of regulations to understand specific requirements and limits regarding contributions and expenditures. Candidates must compile necessary documents such as receipts, donor information, and previous reports, which can streamline the data entry process.

Detailed instructions for each section of the form are as follows: - Section 1: Contributions To report contributions, record details such as the contributor's name, the amount donated, and the date. Itemizing contributors requires attention to detail, ensuring no errors occur. - Section 2: Expenditures Include types of expenditures requiring documentation, including campaign materials, advertising costs, and event expenses. Proper classification helps in providing clarity in audits. - Section 3: Summary Information This section aggregates total contributions and expenditures; accuracy is paramount. Cross-checking entries against source documents can prevent discrepancies.

Interactive tools for supporting compliance

With the advent of technology, electronic filing options have become increasingly popular for campaign finance documentation. Various platforms facilitate the electronic submission of forms, which can minimize the possibility of errors while saving time. Users can leverage these electronic tools to ensure compliance with filing deadlines and facilitate quicker audits.

One of the leading tools in document management is pdfFiller, providing features that enhance the campaign finance filing process. With pdfFiller, users can edit forms for quick adjustments, utilize e-signing for rapid approvals, and collaborate efficiently within campaign teams. Such capabilities empower candidates to manage their campaign finances with ease and accuracy.

Common mistakes to avoid when filling out campaign finance forms

Several common pitfalls can occur during the completion of campaign finance forms. One significant risk is inadequate data entry, where missing information can lead to incomplete reports. Consequences include fines or legal challenges, underscoring the importance of thoroughness. A checklist of required fields, such as donor names, contribution amounts, and expenditure details can prevent oversight.

Misclassification of contributions and expenditures poses another critical mistake. For instance, failing to differentiate between personal funds and donations could lead to misreporting that might complicate audits. Additionally, timeliness is vital; late submission of forms can incur severe penalties, including loss of candidacy eligibility. Adhering to reporting deadlines specific to different jurisdictions is imperative for successful compliance.

Maintaining accurate and compliant campaign finance records

Effective campaign finance management is grounded in robust record-keeping practices. Establishing document retention policies helps ensure that all receipts and forms are preserved for the required duration, allowing for easy access during audits. Organizing receipts by date or donor can facilitate streamlined reference and accuracy in reporting.

Regular auditing and review of campaign finance records are necessary for overall compliance. Audits should occur at defined intervals, ideally after major fundraising events or expenditures. During these reviews, campaigns should focus on identifying discrepancies, ensuring all receipts are matched with reported data, and confirming that all contributions comply with legal limits. A proactive approach to records management strengthens transparency and fosters trust with supporters and regulatory bodies.

Resources and tools for campaign finance management

Access to templates and examples of campaign finance forms is invaluable for ensuring proper completion. Many election offices provide sample forms online that can guide candidates in understanding expectations and requirements. Leveraging these templates simplifies report preparation, enabling campaigns to focus on their messaging and outreach initiatives.

Helpful links to federal and state election offices provide candidates with essential regulatory updates and contacts for inquiries. These resources can serve as lifelines for both novice and seasoned candidates seeking clarity in the nuances of campaign finance laws. Establishing relationships with the appropriate offices can yield support, assistance, and guidance throughout the campaign journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete campaign finance receipts and online?

How do I make changes in campaign finance receipts and?

How can I edit campaign finance receipts and on a smartphone?

What is campaign finance receipts?

Who is required to file campaign finance receipts?

How to fill out campaign finance receipts?

What is the purpose of campaign finance receipts?

What information must be reported on campaign finance receipts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.