Get the free Form No. 13

Get, Create, Make and Sign form no 13

How to edit form no 13 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form no 13

How to fill out form no 13

Who needs form no 13?

Form No 13 Form: A Comprehensive How-to Guide

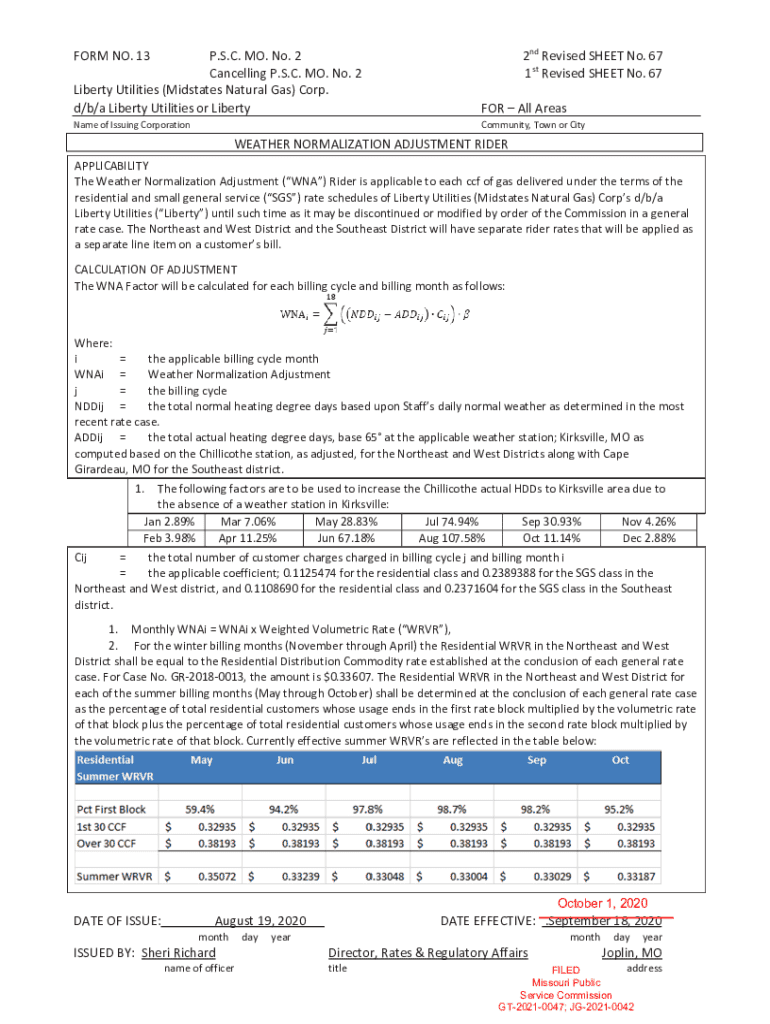

Understanding Form No 13

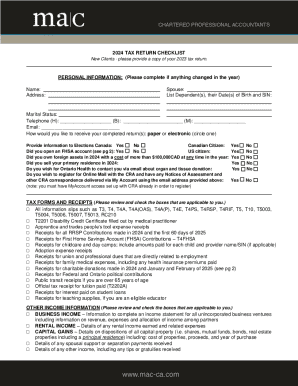

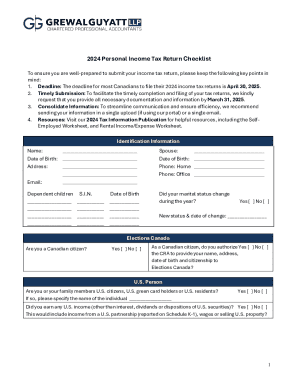

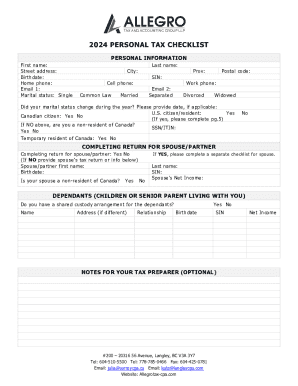

Form No 13 is a standardized document widely used in various administrative processes, often serving to collect essential information for governmental, legal, or organizational purposes. It is integral for processes such as tax submissions, applications for licenses, or any situation requiring official record-keeping. The precise nature of the form can vary depending on the jurisdiction and context, but it typically demands personal and financial information crucial for the processing entity.

Accurate completion of Form No 13 is critical. Inaccuracies can lead to delays, rejections, or penalties. Understanding the form's structure and requirements can greatly enhance the efficiency of both the preparer and the processing authority.

Key features of Form No 13

Form No 13 is designed with several essential components that ensure it captures vital information efficiently. Key features include clearly defined sections for personal information, financial data, and certifications. Each part of the form is crafted to guide the user in providing specific details necessary for effective processing.

For example, the personal information section often asks for full name, address, contact information, and sometimes identification numbers. The financial information segment may require income details, assets, liabilities, and other relevant fiscal data. Understanding the terminologies and definitions within each section is crucial to avoid misunderstandings that could lead to incomplete submissions.

Step-by-step guide to filling out Form No 13

Before beginning to fill out Form No 13, preparation is key. Gather all necessary information such as your personal identification, financial statements, and any relevant documentation. Familiarizing yourself with the submission process specific to your context will also save time and reduce errors.

When you are ready to complete Form No 13, you'll start filling out Section 1, which typically requires personal details. This may include your full name, address, contact details, and identification numbers. Ensure each entry is accurate to prevent issues during processing.

Continuing to Section 2, financial information, be diligent about providing precise details regarding your income, assets, and liabilities. This is where many make common mistakes, such as misreporting income or failing to include certain assets.

In the final Section 3, signatures and certifications, it’s imperative to review the information carefully before signing. This signature affirms the legitimacy of the document, and in today's digital age, you may also have the option of electronic signing, which can streamline the submission process.

Editing and managing Form No 13

Accessing your Form No 13 online is straightforward through platforms like pdfFiller. Once logged in, you can retrieve your form seamlessly from anywhere. This digital accessibility is not just convenient; it also allows for real-time updates and collaboration.

Using tools provided by pdfFiller, such as adding comments, annotations, or merging your document with others, makes editing simple. If you need to provide additional context or receive input from collaborators, these features facilitate effective communication. Furthermore, it's essential to ensure document integrity and security, which pdfFiller upholds with advanced encryption and storage solutions.

Signing Form No 13 electronically

The trend toward electronic signatures has revolutionized how documents are signed. Benefits include speed, reducing the processing time significantly, as well as enhanced convenience for remote dealings. With pdfFiller, users can choose among various eSigning methods, such as typed, drawn, or using an uploaded image of a signature.

Once the signature is added, it is crucial to verify its authenticity. pdfFiller incorporates mechanisms that ensure that the signatures are genuine, thus safeguarding against potential fraudulent claims. Moreover, it’s important to note that eSigned documents are legally valid in many jurisdictions, making them more reliable than ever.

Collaborating on Form No 13

Collaboration can be pivotal when completing Form No 13, especially for teams handling complex forms. Utilizing the inviting capabilities within pdfFiller allows you to bring in team members for input, feedback, or approvals.

With tools designed for real-time feedback, discussing changes and suggesting revisions becomes instantaneous. Keeping track of changes and revisions is also streamlined, promoting a more organized workflow and enhancing the accuracy of the final form.

Submitting Form No 13

Once Form No 13 is completed, it is crucial to submit it through the appropriate channels. Options generally include online submission via government or institutional platforms, or physical mailing. Each submission type may have different processes that need to be followed.

Be aware of important deadlines to ensure timely processing. Create a schedule that allows adequate time for review and resubmission if necessary. Furthermore, once submitted, it may be useful to follow up with the relevant authorities to confirm receipt and ask about the processing timeframes.

Troubleshooting common issues

When filling out Form No 13, there are common errors to be vigilant about. Misentered personal information or financial figures are frequent pitfalls that can lead to submission rejections. Understanding the common reasons for rejection can help in avoiding them.

If a submission is rejected, carefully review the feedback provided. Often, this will specify missing or problematic areas. Resources such as help guides from pdfFiller can assist in understanding the requirements better and provide support for successful resubmission.

Frequently asked questions about Form No 13

Many individuals have questions concerning Form No 13, especially about how specific details should be filled out or alternative submission methods. Addressing frequently asked queries can often clarify common doubts and enhance the process overall.

Expert tips emphasize the importance of thoroughly reviewing your form, understanding the particular requirements based on the context, and ultimately ensuring all information is accurate to increase the likelihood of acceptance with minimal hassle.

Utilizing pdfFiller for Form No 13 management

pdfFiller provides unique capabilities specifically designed for users seeking to manage Form No 13 effectively. The platform’s cloud-based document solutions allow users to access and handle their documents from any location, ensuring flexibility and convenience. This can dramatically enhance productivity while minimizing the risk of errors.

Additional benefits include the ease of collaboration, real-time editing, and enhanced security features that help deliver peace of mind when it comes to data integrity. Testimonials from satisfied customers highlight the successful navigation of complex document workflows, showcasing the platform's reliability in these endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form no 13 directly from Gmail?

How do I make edits in form no 13 without leaving Chrome?

Can I create an electronic signature for signing my form no 13 in Gmail?

What is form no 13?

Who is required to file form no 13?

How to fill out form no 13?

What is the purpose of form no 13?

What information must be reported on form no 13?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.