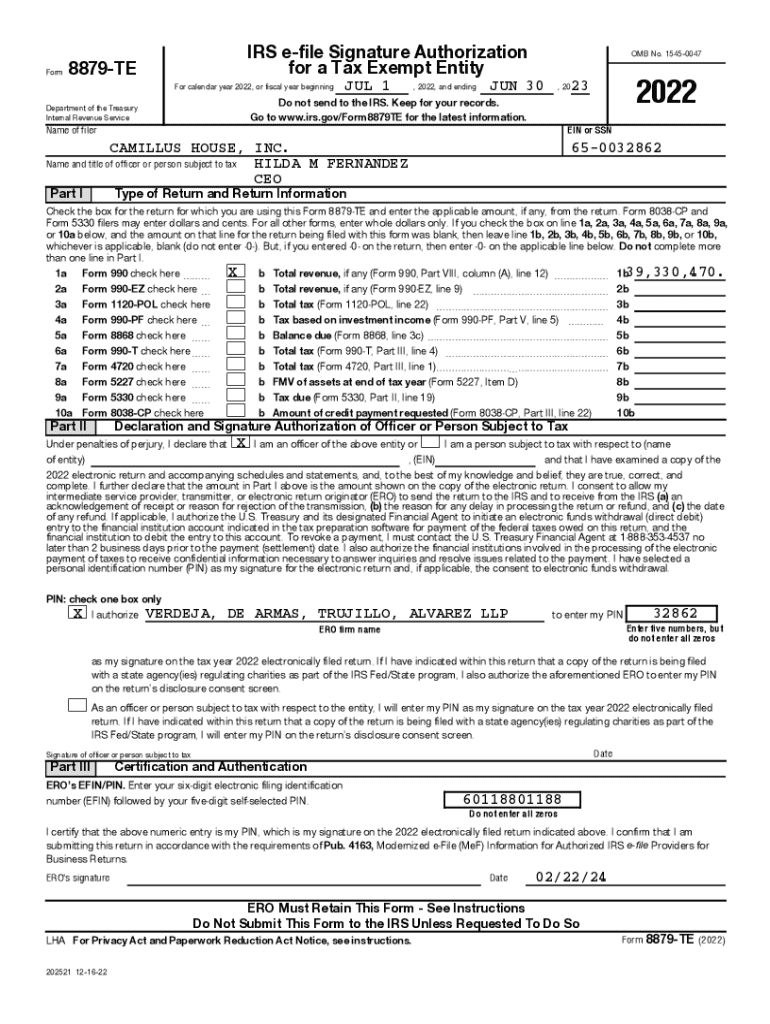

Get the free Form 8879-te

Get, Create, Make and Sign form 8879-te

How to edit form 8879-te online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8879-te

How to fill out form 8879-te

Who needs form 8879-te?

A comprehensive guide to filling out the 8879-TE form

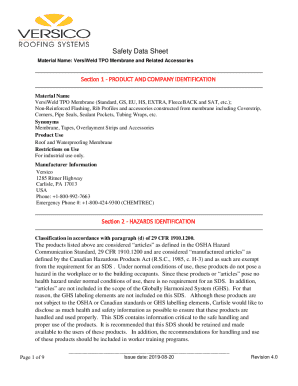

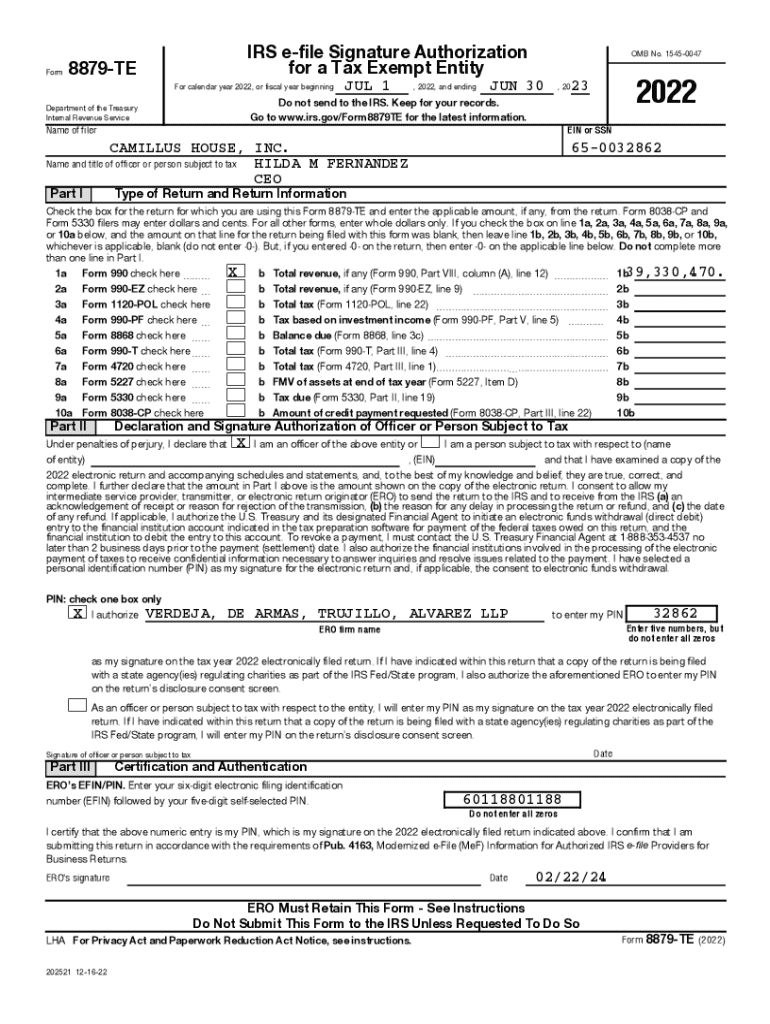

Understanding the 8879-TE Form

The 8879-TE form, also known as the IRS e-file Signature Authorization for the Form 990, 990-EZ, or 990-PF Tax Returns, serves a vital function in the electronic filing of specific tax returns. This form essentially acts as an affirmation of the authenticity of the tax return being filed electronically, granting the tax preparer permission to submit the return on behalf of the taxpayer. By completing the 8879-TE form, individuals can help streamline the tax filing process while ensuring compliance with IRS regulations.

Understanding who must use this form is equally important. Organizations such as charities and non-profits that file the Form 990 series are required to use the 8879-TE whether they file directly or through a tax professional. Furthermore, entities must comply with the IRS requirements regarding electronic signatures to validate their submissions.

Who needs to use the 8879-TE form?

Any organization that files Form 990, 990-EZ, or 990-PF must file the 8879-TE form if they choose to e-file. The eligibility is primarily determined by the type of organization and its annual income. For instance, if a charity has gross receipts of $200,000 or more or total assets of $500,000 or more at the end of its tax year, it will likely need to file Form 990 along with the 8879-TE.

Understanding this eligibility criteria helps tax professionals and organizations navigate the requirements more efficiently while ensuring compliance with IRS regulations.

Preparing to fill out the 8879-TE form

Before you begin filling out the 8879-TE form, it’s crucial to gather all necessary information. Typically, this includes the organization’s name, address, Employer Identification Number (EIN), and details from the specific tax returns. Having all the relevant information at your fingertips will streamline the process and reduce the chances of errors.

Utilizing tools such as pdfFiller for editing PDFs can significantly enhance your experience. With features like cloud-based access, you can manage documents from anywhere and make necessary adjustments on the go.

Step-by-step instructions for completing the 8879-TE form

Filling out the 8879-TE form can seem daunting, but breaking it down into sections makes it manageable. Start with Section 1, where you'll input the organization's personal information such as its name, address, and EIN. Ensure accuracy across all fields, as any mistakes here can lead to processing delays.

In Section 2, you will be reporting critical tax information. It’s here where many users encounter pitfalls. Common mistakes include misreporting income or misplacing deductions which can trigger an audit. Take the time to review this section carefully.

Finally, in Section 3, affirmation via signature is essential. Electronically signing the document using tools like pdfFiller not only simplifies the process but ensures that your consent is documented securely.

Editing and modifying your 8879-TE form

As the tax landscape evolves, you might find that corrections are needed after you have initially completed your 8879-TE form. pdfFiller offers robust editing tools to facilitate this process. Its features allow you to adjust text, add notes, or replace content swiftly.

Collaboration is essential in the tax preparation process. Sharing the form with team members or tax professionals through pdfFiller’s platform allows for seamless communication and ensures all parties are aligned on the necessary changes.

Managing your 8879-TE form after completion

Once the 8879-TE form is completed, managing it effectively is crucial. Saving and storing the document electronically provides a secure backup and facilitates easy retrieval. Use pdfFiller to store your completed forms in an organized manner, making compliance checks or audits far less stressful.

Filing the 8879-TE form can be done either through e-filing or traditional mail. Ensure you perform a final check before submission, verifying all figures and signatures are accurate to avoid unnecessary delays from the IRS.

Troubleshooting common issues

Filling out forms can sometimes lead to confusion or mistakes. Common issues might include insufficient signatures, неверные данные, or missing information. To avoid these hurdles, it’s beneficial to regularly consult Frequently Asked Questions (FAQs) related to the 8879-TE form.

If technical problems arise while using pdfFiller, their support team is available to assist. Accessing customer service can provide troubleshooting and problem-solving assistance, ensuring you can file without hassle.

Additional features of pdfFiller that enhance your document experience

Beyond just the capabilities for the 8879-TE form, pdfFiller provides a comprehensive document management solution. Users can effectively handle various document types from tax forms to receipts all within a single interface, enhancing productivity while minimizing frustration.

Integration with other platforms helps users achieve a more robust tax preparation experience. Whether for team collaboration or individual document management, pdfFiller's all-in-one solution clearly supersedes conventional methods.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 8879-te online?

Can I sign the form 8879-te electronically in Chrome?

How do I edit form 8879-te on an Android device?

What is form 8879-te?

Who is required to file form 8879-te?

How to fill out form 8879-te?

What is the purpose of form 8879-te?

What information must be reported on form 8879-te?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.