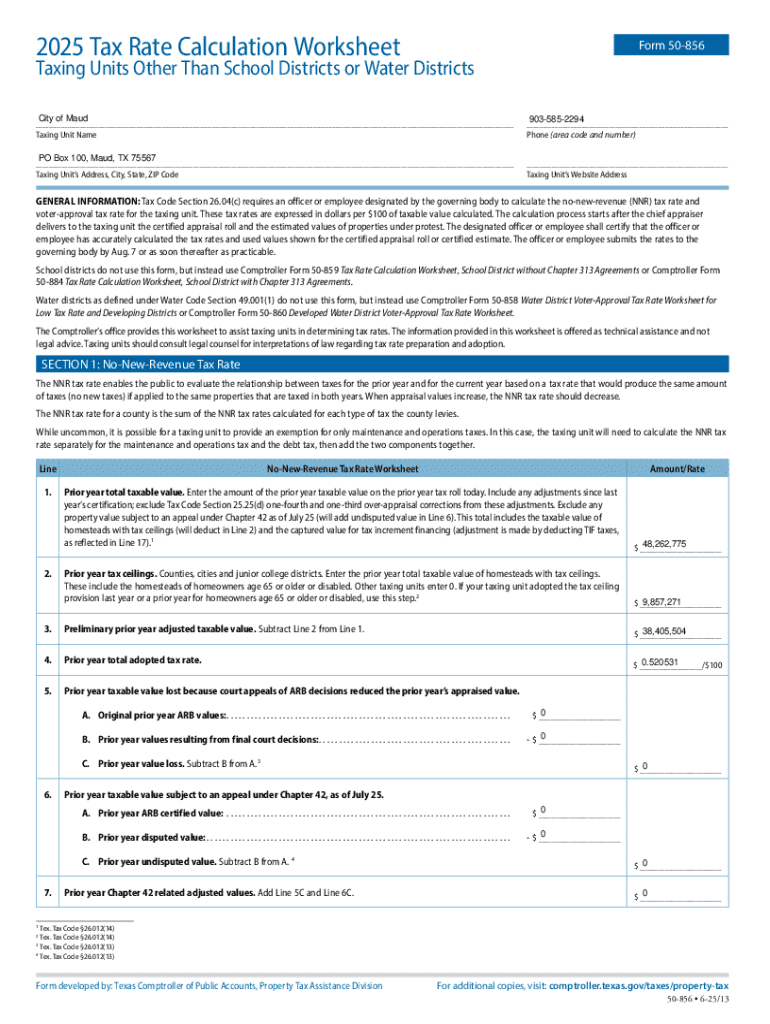

Get the free 2025 Tax Rate Calculation Worksheet

Get, Create, Make and Sign 2025 tax rate calculation

How to edit 2025 tax rate calculation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 tax rate calculation

How to fill out 2025 tax rate calculation

Who needs 2025 tax rate calculation?

2025 Tax Rate Calculation Form: A Comprehensive Guide

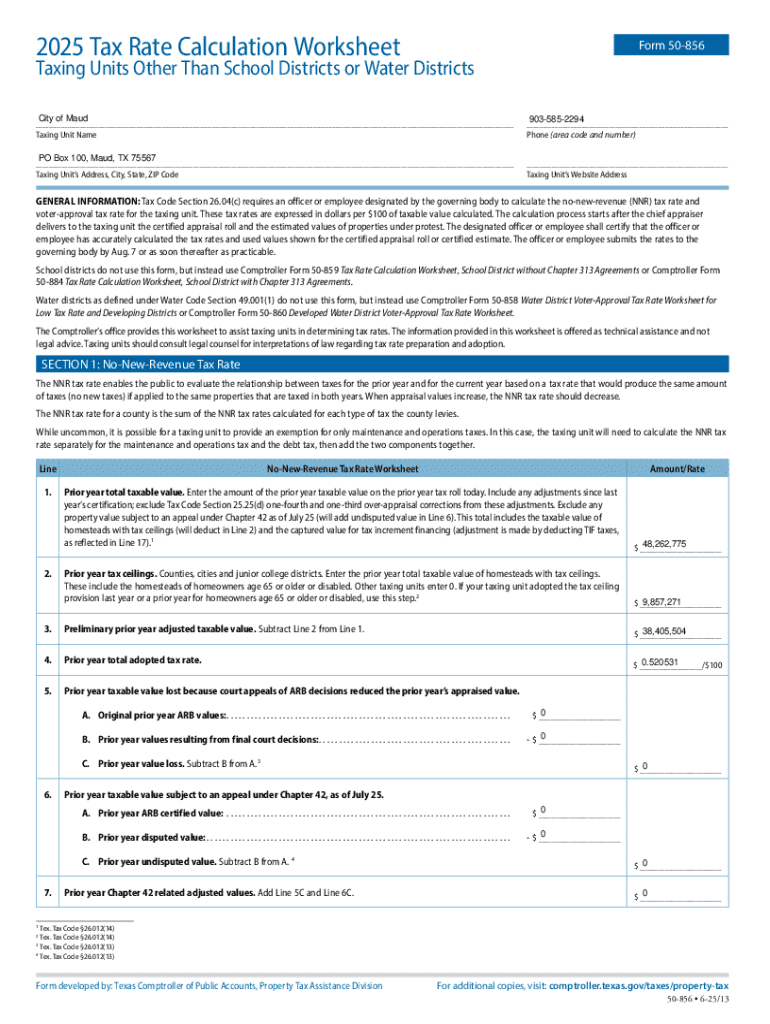

Understanding the 2025 tax rate calculation

Tax rate calculation forms are essential tools for individuals and businesses to determine their tax liabilities accurately. In 2025, these forms will undergo refinements aiming to simplify the tax filing process and ensure compliance with evolving tax laws. As taxpayers, understanding how to effectively use the 2025 tax rate calculation form is crucial, as it directly influences the amount of taxes owed or refunded.

Accurate tax rate calculations in 2025 are indispensable for several reasons. They help taxpayers avoid overpaying or underpaying taxes, which can lead to penalties or interest charges. Moreover, accurate calculations facilitate the effective planning of annual budgets. Utilizing the 2025 tax rate calculation form ensures that individuals and businesses stay in tune with the current tax landscape, providing a roadmap for successful financial management.

Key components of the 2025 tax rate calculation form

The 2025 tax rate calculation form incorporates several key components that impact how taxes are assessed. Understanding these components is vital for an accurate calculation of your tax liabilities.

Step-by-step guide to completing the 2025 tax rate calculation form

Filing taxes can be daunting, but breaking down the process into manageable steps simplifies the task. Here's how to effectively complete the 2025 tax rate calculation form.

Interactive tools for facilitating the 2025 tax rate calculation

In today's digital age, tax forms have become increasingly sophisticated, and pdfFiller offers innovative interactive tools designed to help users with tax rate calculations effectively. The customized tax rate calculator on pdfFiller stands out as a key resource for taxpayers.

Frequently encountered challenges and resolutions

Tax filing can be fraught with mistakes that might complicate the process and lead to costly delays. Identifying these challenges in advance allows for effective strategizing.

Managing your tax filing with pdfFiller

pdfFiller provides an all-in-one solution for managing your tax forms efficiently. From the initial calculations to final submissions, users can edit, sign, and collaborate seamlessly.

Strategies for efficient tax planning in 2025

Approaching tax filing as a proactive venture can yield substantial benefits in financial management. A well-structured tax strategy minimizes liabilities and maximizes returns, ensuring a positive financial outcome.

Comprehensive updates on tax rules and laws for 2025

Tax regulations are subject to frequent updates, and understanding these changes is essential for effective filing. The new rules for 2025 can significantly impact how tax calculations are made.

Conclusion on the importance of accurate tax filing

Using the 2025 tax rate calculation form not only ensures compliance but also maximizes potential refunds and minimizes tax liabilities. The advantages of accurately filling out your tax forms are numerous, ranging from avoidance of penalties to potential savings from applicable credits.

Employing pdfFiller’s tools and resources supports a smoother tax filing process, making the journey through your financial obligations more manageable. By embracing a proactive approach to tax planning and filing in 2025, individuals and teams can achieve confident compliance and insulate against unwelcome surprises.

Glossary of key tax terms relevant to 2025

Understanding tax terminology is essential for effective communication and comprehension when dealing with forms and reports. Below are definitions of several critical terms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 2025 tax rate calculation?

How do I fill out 2025 tax rate calculation using my mobile device?

How do I complete 2025 tax rate calculation on an iOS device?

What is tax rate calculation?

Who is required to file tax rate calculation?

How to fill out tax rate calculation?

What is the purpose of tax rate calculation?

What information must be reported on tax rate calculation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.