Get the free What Are Business Credit Application Forms Definition & ...

Get, Create, Make and Sign what are business credit

Editing what are business credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out what are business credit

How to fill out what are business credit

Who needs what are business credit?

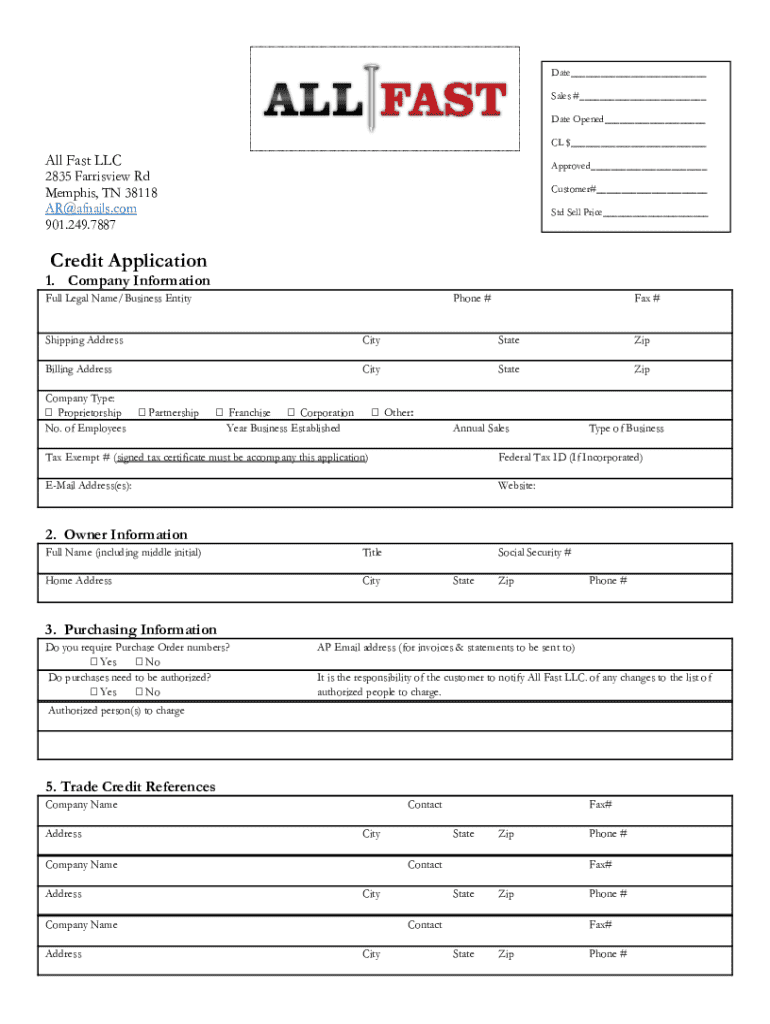

What are business credit forms

Understanding business credit forms

Business credit forms are essential documents that businesses use to apply for credit, establish creditworthiness, and manage financial transactions. These forms enable creditors to assess a company’s credit risk based on the information provided, such as financial history, business structure, and credit references. The importance of these forms cannot be overstated, as they serve as the foundational elements in any financial relationship between a business and a creditor.

Business credit forms come in various types, catering to different purposes within the credit application process. These include credit application forms, personal guarantees, and vendor credit applications. Understanding the differences between these types is key to selecting the right form for each situation.

The role of business credit forms in financial management

Establishing business credit is crucial for any entity looking to thrive in a competitive environment. Business credit forms play an instrumental role in this process by presenting a comprehensive picture of a company's financial viability to creditors. Accurate representation of business data—like revenue, expenses, and financial history—ensures that creditors have the information they need to assess creditworthiness effectively.

Further, the impact of these forms on cash flow and financing is significant. When completed accurately, business credit forms can streamline the financing process by expediting the review and approval stages. For instance, businesses that present a clear and organized credit application are more likely to receive positive responses from lenders, which can lead to timely funding essential for operational needs.

How to create and use business credit forms

Creating effective business credit forms involves several key steps. First, you must gather all necessary business information, including the business name, address, and legal structure. This information lays the groundwork for a credible credit application, allowing creditors to verify your business quickly.

Next, it is crucial to include essential terms and conditions that clarify the expectations for both parties. Designing the form for clarity and ease of use will also increase the likelihood of accurate completion. Pay attention to formatting and organization, making sure each section flows logically.

When it comes to filling out business credit forms, certain sections require particular attention. Key areas such as financial history and credit references should be completed thoroughly, as they can significantly influence the outcome of the application. Common mistakes include providing outdated information or omitting crucial details; thus, double-checking the accuracy and completeness of each form is vital.

Interactive features and tools for managing business credit forms

Utilizing tools like pdfFiller for document management can significantly enhance your experience in handling business credit forms. This cloud-based platform allows businesses to create, edit, and share credit forms seamlessly. By providing access from anywhere, pdfFiller empowers teams to collaborate effectively on financial documents, ensuring that all team members are informed and aligned.

Furthermore, the ability to integrate eSigning and secure sharing features adds an extra layer of efficiency. With pdfFiller, you can digitally sign business credit forms and ensure they are shared securely with creditors. This not only speeds up the document approval process but also maintains confidentiality and compliance.

Common challenges with business credit forms and solutions

Despite their importance, businesses often encounter challenges when completing credit forms. Common issues include incorrect financial reporting, incomplete information, and misunderstanding of terms. These errors can negatively affect credit approval, leading to potential financial setbacks.

To combat these challenges, businesses should adopt best practices for ensuring accurate and compliant credit forms. Double-checking information, understanding credit terminology, and utilizing platforms like pdfFiller for document integrity can prevent these common pitfalls. Additionally, having a well-defined internal review process can minimize errors during submission.

Case studies: Success stories using business credit forms

Real-life examples highlight the effectiveness of business credit forms in securing funding and establishing vendor relationships. For instance, a tech startup utilized credit forms to present its business model and financial forecasts, leading to a successful funding round that enabled them to launch their product on time.

Similarly, an established retail business streamlined its vendor credit application process by implementing organized credit forms, resulting in quicker approvals from suppliers. These success stories emphasize the critical role that properly designed and utilized credit forms play in business operations.

These cases reinforce that a strategic approach to credit documentation not only enhances credibility but also fosters strong business relationships in the long run.

Future trends in business credit documentation

The shift toward digital documentation is becoming increasingly pronounced in the realm of business credit forms. Digital formats not only expedite the application process but also enhance the accuracy and security of the information shared. As more businesses adopt digital solutions, the need for paper applications diminishes, leading to more environmentally friendly practices.

Emerging technologies, such as AI and automation, are further transforming the landscape of credit forms. These innovations streamline data analysis and verification processes, allowing creditors to evaluate applications swiftly and with greater accuracy. As the business world evolves, staying ahead of these trends by utilizing cutting-edge tools like pdfFiller will provide a competitive advantage in fostering successful financial relationships.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in what are business credit?

How can I edit what are business credit on a smartphone?

How do I complete what are business credit on an Android device?

What are business credit?

Who is required to file what are business credit?

How to fill out what are business credit?

What is the purpose of what are business credit?

What information must be reported on what are business credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.