Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Complete Guide to SEC Form 4: Filings, Requirements, and Tools

Understanding SEC Form 4

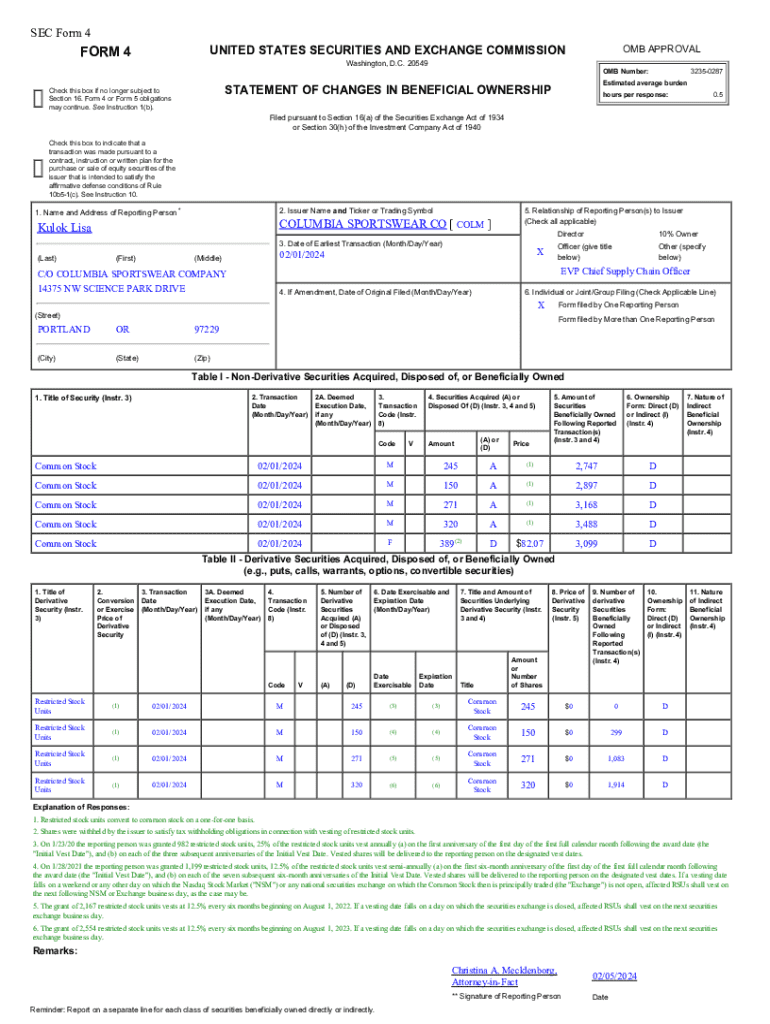

SEC Form 4 is a vital document for ensuring transparency in the securities market. It is specifically designed for insiders of publicly traded companies to report their trades in the company's stock. This form's primary purpose is to provide the SEC and the investing public with details of any significant changes in ownership, thereby promoting accountability and trust in the financial marketplace.

The importance of SEC Form 4 cannot be overstated. It serves as a crucial tool for monitoring insider trading activities, which can influence market perceptions and investment decisions. By documenting these transactions, insiders help ensure that all stakeholders have access to important information about ownership trends and significant insider moves.

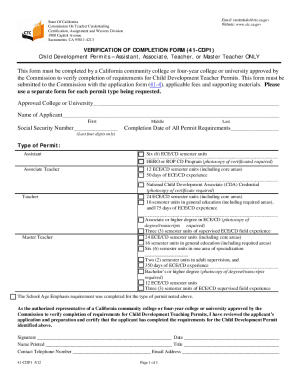

Overview of who must file

Insiders are defined as individuals who have access to non-public, material information about a company. This includes executives, directors, and large shareholders who own more than 10% of the company's stock. The scope of reportable transactions extends beyond outright purchases or sales; it also covers various forms of ownership, such as stock options, warrants, and other derivative securities that insiders might acquire or dispose of.

Key components of SEC Form 4

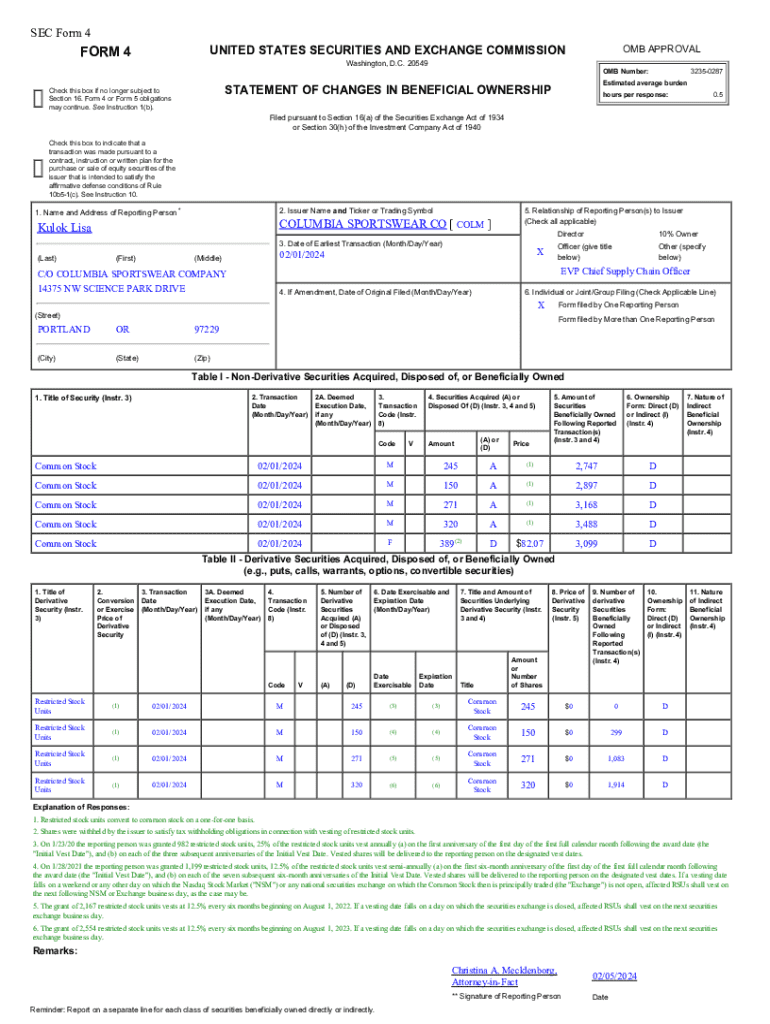

SEC Form 4 includes several key sections that provide crucial details about the insider's transactions. The primary components of the form consist of identifying information, such as the insider's name, position, and the name of the issuing company, as well as specific transaction details, which clarify the nature and amount of the securities involved.

Specific terminologies that must be understood when filling out SEC Form 4 include the 'nature of the transaction,' which can represent a variety of actions ranging from buys, sells, and gifts to conversions and exercise of options. Additionally, the distinction between derivative securities and direct ownership is paramount, as it influences reporting requirements and the nature of insider trades.

Step-by-step instructions to fill out SEC Form 4

When preparing to fill out SEC Form 4, several pre-filling considerations need to be addressed. Gather all necessary information related to your identity as an insider, your relationship with the company, and details of the transaction you intend to report. Having complete, accurate data will make the process smoother and help avoid common pitfalls.

Follow these detailed steps to complete the form: 1. Enter your personal information, including your full name and title. 2. Clearly specify your relationship to the company, whether as an officer, director, or significant shareholder. 3. Document the type of transaction, indicating whether it's a purchase, sale, or another type of transfer. 4. Report the purchase or sale amount and the effective date of the transaction. 5. Finally, sign and date the form to affirm that the information provided is true.

Common mistakes to avoid include omitting essential information, selecting the wrong transaction type, or failing to file on time, as these errors can lead to penalties and complications with the SEC.

Editing and managing SEC Form 4

Once you've completed your SEC Form 4, it's essential to ensure accuracy and clarity. Using tools like pdfFiller can enhance this process significantly. By uploading your form to pdfFiller, you can easily edit the document using a variety of interactive tools provided by the platform, ensuring that all details are correct before submission.

Managing document versions is equally important. Keeping track of revisions is crucial, especially if multiple transactions are being reported over time. By saving templates for future use, insiders can streamline their filing process, thereby reducing the complexity involved each time a new report is filed.

Navigating the filing process

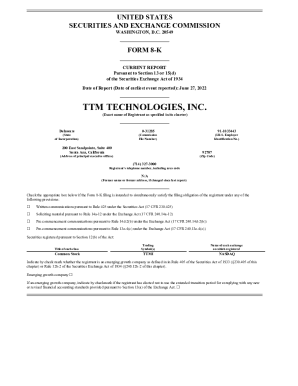

Timeliness of filing is a critical aspect of completing SEC Form 4. Insiders must submit their filings within two business days of executing a transaction. Understanding these deadlines can help avoid late fines and ensure compliance with SEC regulations.

There are multiple submission methods available, including electronic and paper filing. E-filing is encouraged as it provides numerous advantages such as faster processing, quicker confirmations, and improved tracking of submitted forms. It also reduces the likelihood of human errors associated with paper filings.

Understanding compliance and legal implications

Filers of SEC Form 4 bear significant legal responsibilities. Late filings can result in substantial consequences, including financial penalties and reduced reputational credibility in the market. Potential fines can vary based on severity and frequency of offenses.

The SEC plays a vital role in overseeing these filings, ensuring that all insiders comply with disclosure laws to maintain a fair and transparent trading environment. By adhering to these regulations, insiders contribute to the integrity of the financial system.

Frequently asked questions about SEC Form 4

A common question among insiders is 'What if I miss the filing deadline?' In such cases, it is crucial to file as soon as possible and to be prepared to explain the delay to the SEC, as they may impose fines depending on the circumstances.

Another frequent inquiry is how to correct an error post-filing. In situations where inaccuracies need addressing, a new Form 4 can be filed to amend the prior submission. This process ensures that the records remain accurate and up-to-date.

Lastly, insiders often wonder if multiple transactions can be reported on one Form 4. The SEC allows this, but each transaction must be clearly defined and reported accurately to avoid confusion or misinterpretation.

Practical examples and case studies

Understanding SEC Form 4 is easier through real-life examples. A completed Form 4 might show an executive reporting the purchase of additional shares in their company, detailing the number of shares acquired, the purchase price, and the transaction date. Such clarity is critical for shareholders and investors monitoring insider trades.

An analysis of common filing errors further educates prospective filers. For example, a case study may reveal that failing to specify the precise nature of a transaction led to an inquiry from the SEC. These insights emphasize the importance of accuracy and completeness in filings.

Furthermore, insights from successful insiders demonstrate that adhering to best practices can make the filing process both efficient and effective, affirming the role of diligent reporting in maintaining investor confidence.

Utilizing tools to enhance filing experience

The features available in pdfFiller enhance the experience of filing SEC Form 4 significantly. Cloud-based solutions allow for accessible document management, which is especially beneficial for busy insiders who may be managing multiple transactions at once.

With interactive features, pdfFiller not only facilitates easy editing and signing but also encourages collaboration among teams. The advantage of eSigning ensures that all involved parties can finalize and authorize documents without the need for physical meetings or mailing, expediting the filing process.

Final thoughts on SEC Form 4

SEC Form 4 is more than just a regulatory requirement; it's an opportunity for insiders to take ownership of their responsibilities within the financial markets. By utilizing tools like pdfFiller, insiders can ensure ongoing compliance with minimal stress, thereby enhancing their credibility and reliability in the eyes of shareholders and the market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the sec form 4 electronically in Chrome?

Can I create an electronic signature for signing my sec form 4 in Gmail?

Can I edit sec form 4 on an iOS device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.