Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 form: A Comprehensive How-to Guide

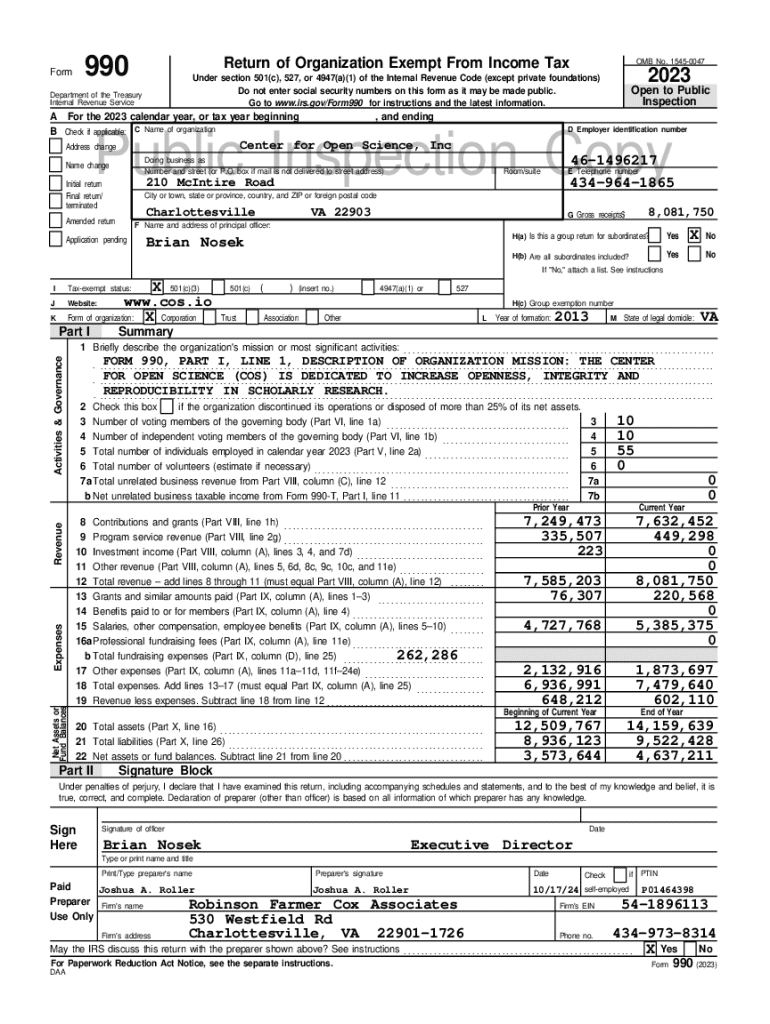

Understanding Form 990

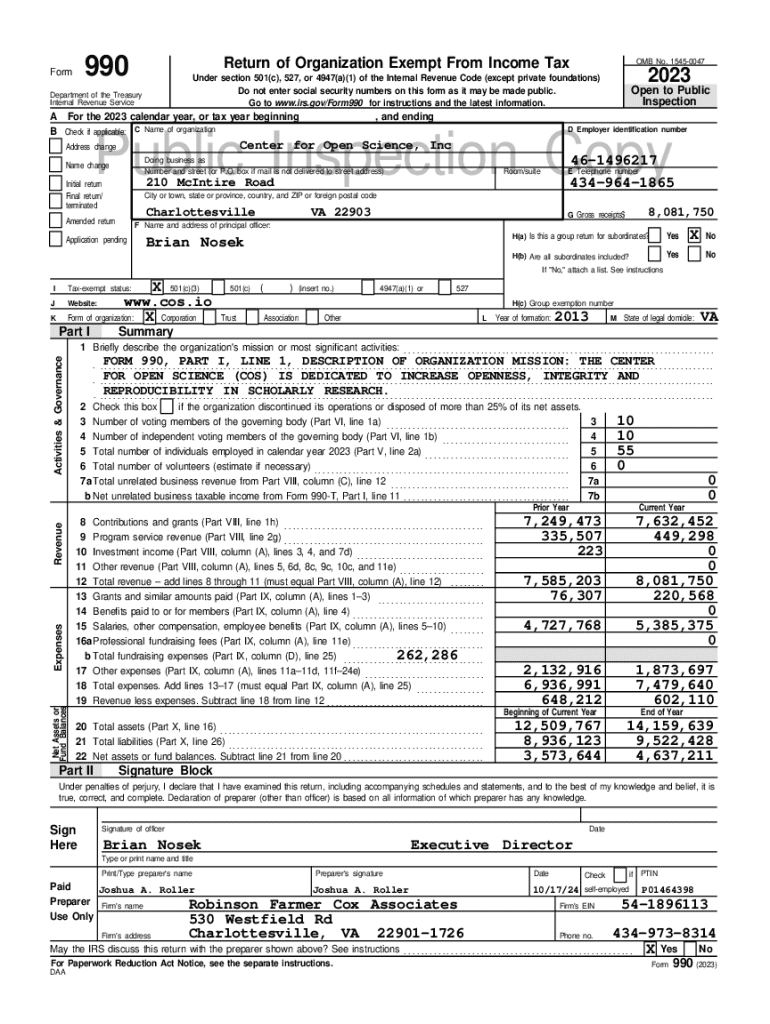

Form 990 is a crucial document for tax-exempt organizations that provides insight into their financial health, governance practices, and operations. The primary purpose of this form is to ensure transparency and accountability amongst non-profit organizations, enabling the IRS and the public to access vital information.

Understanding the significance of Form 990 is essential for any tax-exempt organization. Not only does it serve as a financial report, but it also acts as a declaration of public accountability. By necessitating the disclosure of revenue sources, expenses, and operational impact, Form 990 helps ensure these organizations fulfill their missions effectively.

Types of organizations required to file

Not all organizations need to file Form 990. The eligibility criteria are primarily based on the organization’s annual gross receipts. Generally, tax-exempt organizations, such as nonprofits, foundations, and other charitable entities, must file this form if they make over $200,000 a year or have total assets exceeding $500,000.

The structure of Form 990

Form 990 consists of multiple sections, each designed to provide detailed insights into an organization's functioning. The key sections include financial statements, governance information, and compliance details. Each of these sections plays a significant role in promoting transparency and accountability in the operations of tax-exempt organizations.

For instance, the financial statements reveal the sources of revenue and types of expenses incurred, while governance information outlines the organization’s managerial structure and practices. Understanding these sections helps stakeholders, including the public and governmental bodies, assess the organization’s operational integrity.

Common terminology in Form 990

Familiarity with the terminology used in Form 990 is crucial to accurately filling it out. Terms such as 'contributions' refer to monetary gifts made to the organization, while 'program service revenue' details income generated directly from the organization's mission-related activities.

Step-by-step guide to completing Form 990

Filing Form 990 can be an involved process, but breaking it down into manageable steps can simplify the task. The first step involves gathering all the necessary financial records and compliance documentation. This includes tax details, program descriptions, and any other information relevant to your organization’s operations.

Once you have the required information, filling out each section becomes straightforward. Here’s how to tackle each segment:

Common challenges and how to overcome them

Many organizations face pitfalls in the Form 990 submission process. One common error includes misreporting figures or failing to provide adequate detail, which can lead to complications or an audit. Being meticulous and double-checking all entries against your financial records is essential.

To navigate IRS regulations effectively, staying updated with any changes is vital. This includes understanding new forms, deadlines, or amendments to existing regulations. Regularly checking the IRS website or subscribing to relevant updates can help ensure compliance.

Tools for filling out Form 990

Utilizing digital tools can simplify the Form 990 filing process remarkably. Platforms like pdfFiller offer interactive features that make document management easier. With pdfFiller, organizations can edit PDFs directly, eSign forms, and collaborate in real-time, encouraging greater efficiency in fulfilling the filing requirements.

Beyond basic editing capabilities, pdfFiller’s cloud-based system allows seamless access from any device, creating a flexible workflow suitable for any organizational structure. Users can also take advantage of templates and past submissions to streamline the process.

Filing and after submission

Once Form 990 is completed, the next step is submission. Organizations have several filing options, including e-filing and paper submissions. It is crucial to understand the preferred method as recommended by the IRS, as e-filing tends to be more efficient and reduces the risk of lost documents.

After submission, organizations should be aware of the review process. The IRS typically takes several months to review submitted forms. During this time, organizations may receive requests for further information or clarification — staying responsive and organized is key.

Frequently asked questions

Organizations often encounter challenges that prompt them to seek clarity on filing guidelines. Common queries include what to do if a deadline is missed, how to amend a filed Form 990, or where to seek additional support if encountering difficulties during the form-filling process.

Addressing these concerns proactively is essential. Keeping abreast of filing deadlines and having a plan in place can help organizations manage their compliance efficiently.

Finding further information and assistance

For organizations aiming to deepen their understanding of Form 990, numerous resources are available through the IRS directly. Their detailed guides and up-to-date regulations provide clarity on filing requirements and changes in policy.

Engaging with professional support can also be beneficial. Organizations often turn to accountants or tax professionals for insights on best practices tailored to their unique circumstances. pdfFiller connects users with experts who can assist in filing and compliance, ensuring organizations can navigate these complex waters effectively.

Real-world examples and case studies

Examining completed Form 990s can be incredibly educational for organizations new to the filing process. Sample documents illustrate best practices in documenting revenue, expenses, and program accomplishments. Transparent and clear examples set a standard for reporting.

Success stories from other organizations that have mastered Form 990 filing using pdfFiller showcase the platform's utility. Allowing collaborative capabilities and document sharing has made the filing process less daunting and more successful for many nonprofits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990 on a smartphone?

How do I complete form 990 on an iOS device?

How do I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.