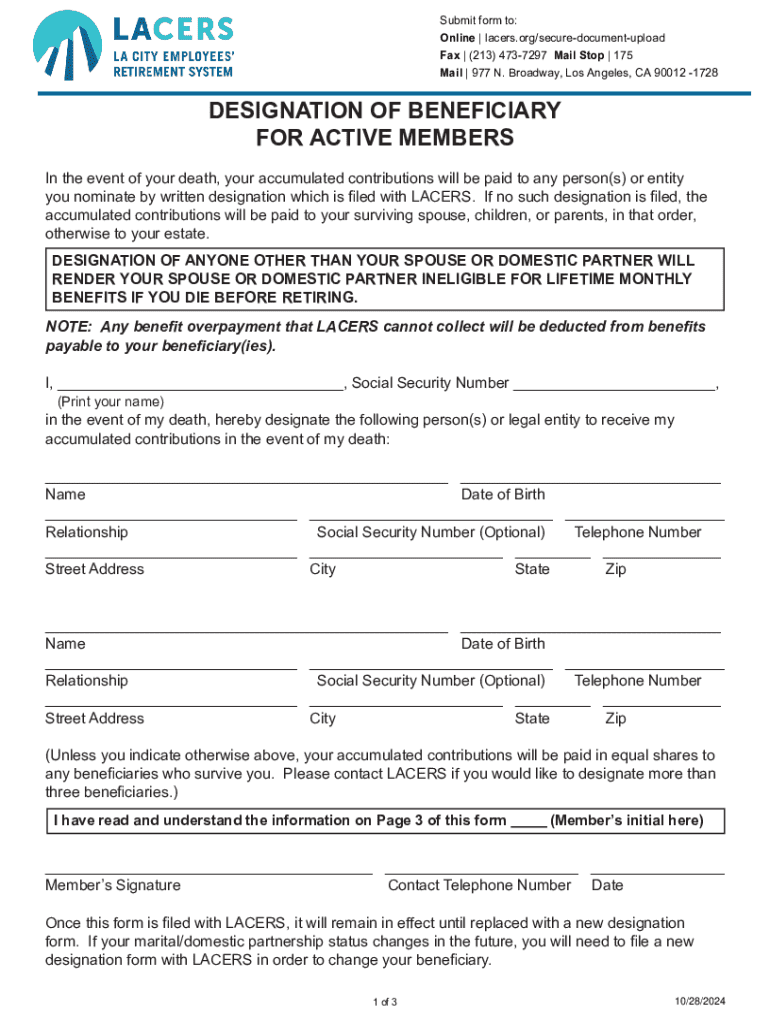

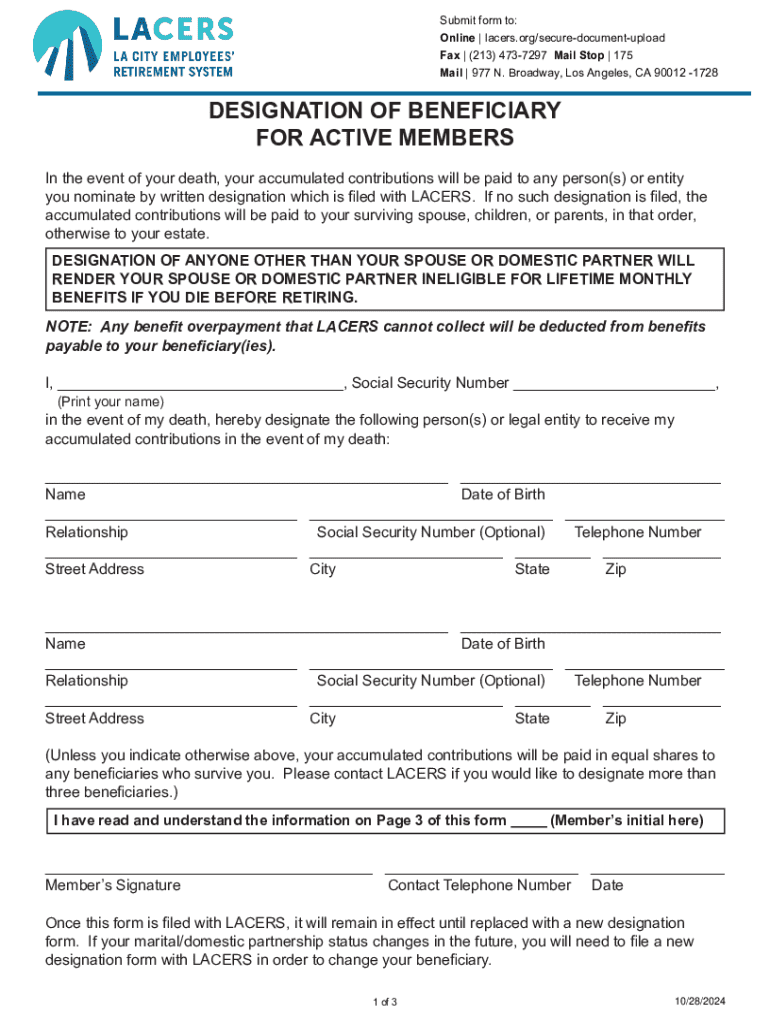

Get the free Designation of Beneficiary for Active Members

Get, Create, Make and Sign designation of beneficiary for

How to edit designation of beneficiary for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out designation of beneficiary for

How to fill out designation of beneficiary for

Who needs designation of beneficiary for?

Designation of Beneficiary for Form: A Comprehensive Guide

Understanding the designation of beneficiary

A beneficiary is a person or entity designated to receive assets from a trust, will, or insurance policy when the owner passes away. The significance of this designation cannot be overstated—it determines who benefits from your life insurance benefits, retirement plans, and other assets after your death. Failing to designate a beneficiary can lead to complex probate proceedings and unintended distributions of your estate.

Common misconceptions about beneficiary designation include the belief that an estate will automatically inherit assets. In reality, designated beneficiaries typically take precedence over the estate, often streamlining the process during a challenging time.

Overview of the beneficiary designation process

The process of designating a beneficiary involves several key steps, from understanding your options to filling out the necessary forms accurately. To get started, you'll primarily need to understand the different types of beneficiary designations and familiarize yourself with critical terminology like primary, contingent, and revocable beneficiaries.

Various factors affect the designation of your beneficiary, including your family dynamics, financial goals, and any legal stipulations. Moreover, keeping your information updated on government websites and forms is essential for ensuring the correct allocation of your assets.

Who can be designated as a beneficiary?

Beneficiaries can be individuals or entities. Common choices include family members, such as spouses, children, or grandchildren. Friends may be named as well, particularly when there are no immediate family members.

Special considerations must be made for minors or dependents. Often, a guardian must be appointed to manage financial distributions, emphasizing the importance of proper legal guidance during the designation process.

How to designate a beneficiary

Designating a beneficiary on a form involves a few straightforward steps, ensuring that your preferences are clearly articulated and legally binding.

When it comes to ensuring accurate designations, consider utilizing available resources on websites like pdfFiller that provide templates and guidance on completing these forms correctly.

Types of beneficiary designation forms

Several forms exist for designating a beneficiary, each tailored to specific situations. Basic life insurance policies often require one type of form, while retirement plans might necessitate another.

Understanding how each form applies to your situation is crucial for ensuring the correct beneficiaries are designated according to existing laws and regulations.

If you are an active employee

As an active employee, you may be required to complete a beneficiary designation form in your workplace. Guidelines for filling this out will often be provided by your HR department or through internal websites.

Understanding these guidelines can greatly mitigate the risk of confusion when your intentions for asset distribution are carried out.

If you are a federal retiree or compensationer

For federal retirees or compensationers, there are unique aspects to consider regarding beneficiary designation. Many federal benefits come with specific regulations that dictate how beneficiaries should be named.

Retirees should proactively engage in managing their beneficiary designations, ensuring they understand the impact of their choices in the distribution of their assets.

Common mistakes in beneficiary designation

Many individuals encounter pitfalls during the beneficiary designation process. Identifying these common mistakes can help you avoid costly errors or unintended consequences.

Awareness of these pitfalls can guide you in taking the necessary steps to secure your beneficiaries without facing legal complications later.

Keep your designation of beneficiary current

Reviewing your beneficiary designation regularly is essential, as life events like marriage, divorce, or the birth of a child can necessitate updates to your choices.

Keeping your designation current ensures that your assets are allocated according to your most recent wishes, safeguarding against potential disputes or delays.

The order of precedence in beneficiary designation

The order of precedence is a framework that determines who receives your assets if no beneficiary is explicitly designated. Understanding this can clarify asset distribution and guide you in making an informed designation.

Being knowledgeable about these processes can help you navigate potential complexities more effectively.

Interactive tools for managing your beneficiary designation

Leveraging interactive tools can significantly simplify the process of managing your beneficiary designations. Platforms like pdfFiller offer features that enhance the accessibility and usability of these forms.

Utilizing these tools can streamline the management process, allowing you to focus more on the essential aspects of your planning.

FAQs about designation of beneficiary

Understanding the nuances of beneficiary designation can lead to many questions. Here are some common FAQs that help clarify the most pressing concerns.

Addressing these FAQs not only alleviates confusion but empowers individuals to take charge of their beneficiary designs effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit designation of beneficiary for from Google Drive?

How can I send designation of beneficiary for for eSignature?

How can I fill out designation of beneficiary for on an iOS device?

What is designation of beneficiary for?

Who is required to file designation of beneficiary for?

How to fill out designation of beneficiary for?

What is the purpose of designation of beneficiary for?

What information must be reported on designation of beneficiary for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.