Get the free Hst Rebate Form

Get, Create, Make and Sign hst rebate form

Editing hst rebate form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hst rebate form

How to fill out hst rebate form

Who needs hst rebate form?

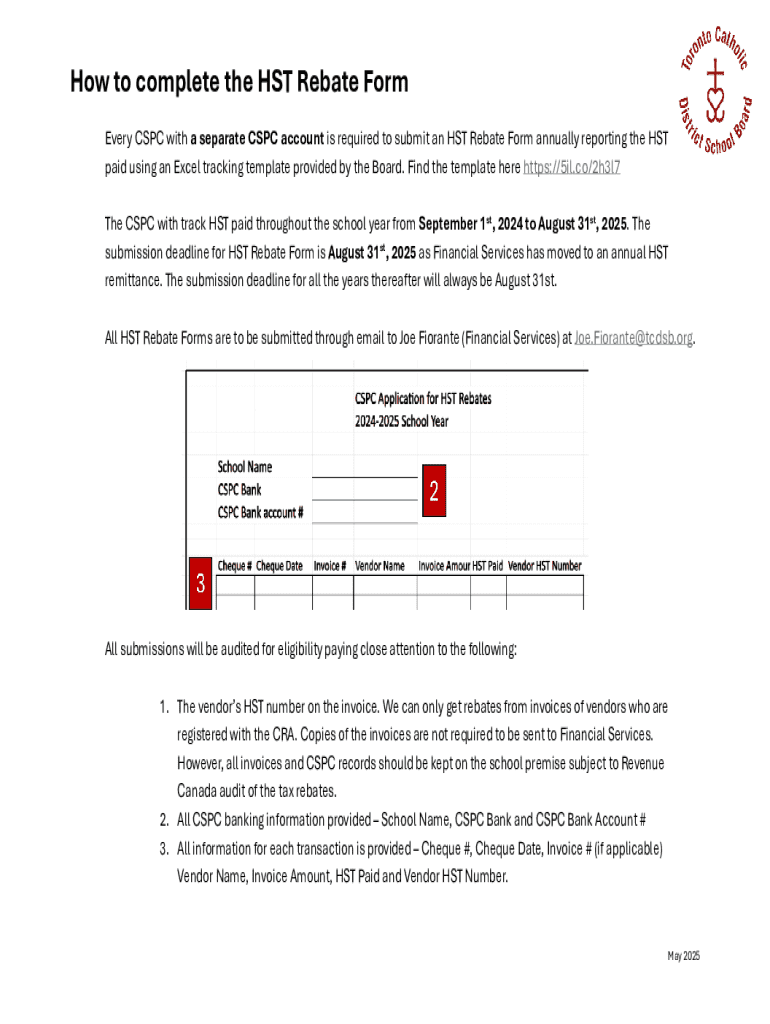

HST Rebate Form: A Comprehensive How-To Guide

Understanding the HST rebate form

The HST rebate is a financial relief for homeowners in Canada, designed to offset the cost of the HST (Harmonized Sales Tax) incurred on qualifying products and services related to residential property. It serves to lessen the financial burden of home ownership, particularly in relation to renovations and energy-efficient upgrades that benefit both the homeowner and the environment. By submitting the HST rebate form, homeowners can potentially recover a significant portion of the HST paid, which can lead to substantial savings.

Utilizing the HST rebate form not only streamlines the process of claiming this beneficial rebate but also ensures that homeowners are taking full advantage of available savings. Whether you are improving your home’s energy efficiency or undertaking essential renovations, understanding the value and structure of the HST rebate form is crucial for maximizing your benefits.

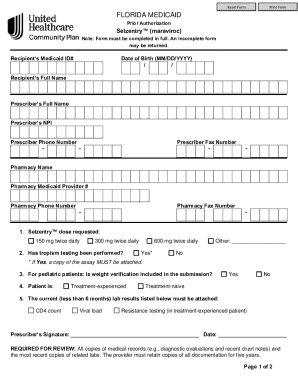

Eligibility criteria for the HST rebate

To qualify for the HST rebate, homeowners must meet specific requirements. One primary condition is home ownership; the property must be a principal residence for at least a portion of the year during which the expenditures were made. Depending on the province, eligible energy-efficient products may include items such as insulation, windows, and heating systems that meet specific energy standards.

Additionally, it’s crucial to be aware of seasonal limitations and adherence to federal regulations that dictate eligibility. Generally, claims must be submitted within two years from the date of the purchase of qualifying goods and services. Understanding these criteria will ensure that homeowners can confidently navigate the process of claiming their HST rebate without setbacks.

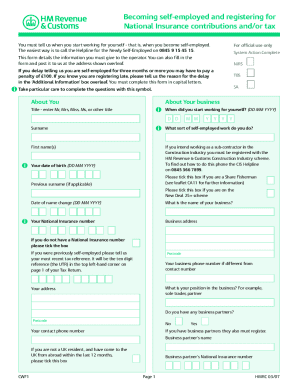

Gathering necessary documents

Before diving into the HST rebate form, gathering the necessary documents is essential to facilitate a smooth application process. Homeowners will generally need proof of purchase for each energy product eligible for the rebate, which includes detailed invoices that outline the items purchased and the HST paid.

Additionally, documentation proving residential property ownership is required, which could be in the form of a property tax bill or a title deed. Staying organized during this stage will simplify the completion of the HST rebate form. A recommended method is to create a checklist to ensure all pieces of documentation are accounted for and neatly filed, making it easier to reference them when required.

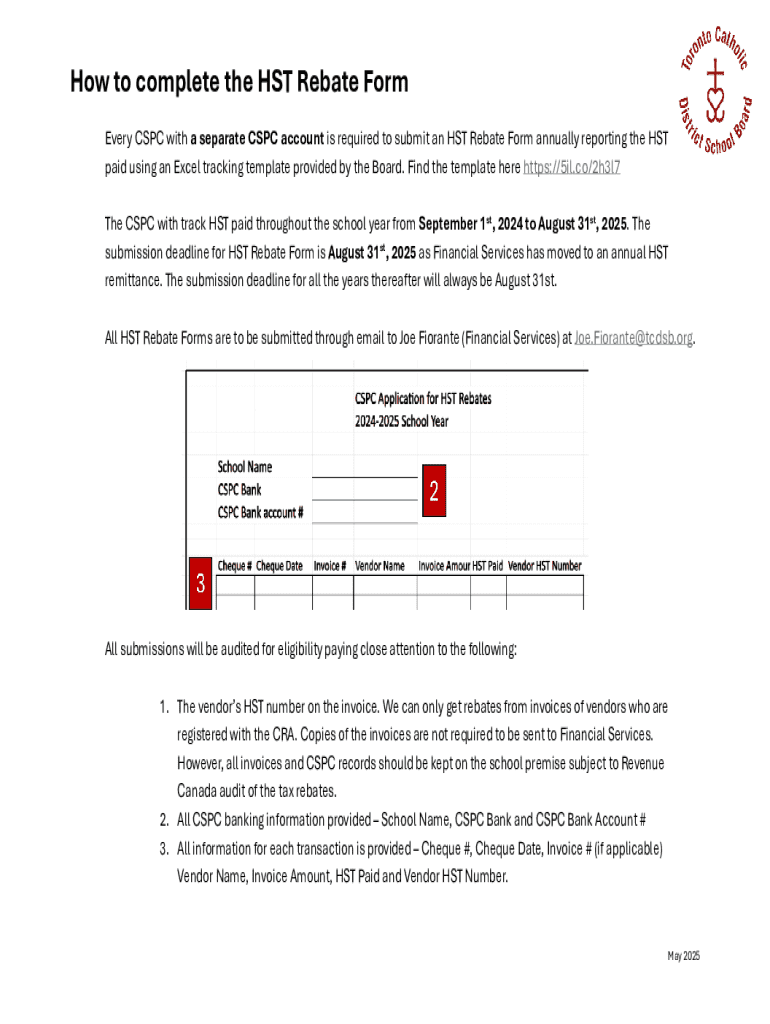

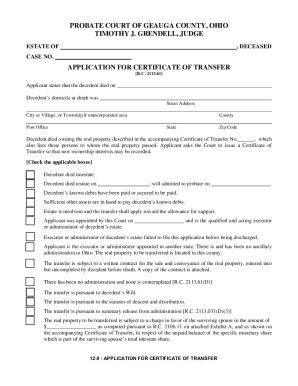

Step-by-step guide to completing the HST rebate form

Completing the HST rebate form can seem daunting, but breaking it down into manageable sections will help ensure accuracy and completeness. The first section typically requires personal details, including your name, address, and contact information. Following this, you’ll need to provide detailed information about the property in question, including the address and ownership details.

The next major section involves detailing the qualifying purchases you’ve made. It’s crucial to ensure that all information given relates to purchases that meet the eligibility criteria. Common mistakes here include omitting purchases or misreporting the amount of HST paid. Take your time to cross-check your entries against the invoices to prevent errors that could delay your rebate application.

How to apply for the HST rebate

After successfully completing the HST rebate form, it’s time to submit it. You can apply online through the official government portal, providing a quick and efficient route for processing. If you prefer, there are alternative methods for submitting your application including mail-in options, which typically require you to print the completed form and any attached documentation. Make sure to check specific submission addresses based on your province to avoid misdirection.

If your local office allows in-person submissions, this could also be a viable option for those who prefer direct communication. Be mindful of application deadlines; ensuring that your submission is made within the stipulated time frame is crucial for a successful rebate claim. Each province can have different timing, so be sure to refer to local guidelines.

Tracking your HST rebate application status

Once you've submitted your HST rebate application, you might wonder how to track its status. Most provinces offer online systems where you can enter your application details and get updates on its progress. This is highly beneficial as it gives you real-time information without needing to wait for correspondence.

Understanding response times can vary from province to province; however, you can generally expect feedback within a few weeks. If you do experience delays or issues, knowing who to contact is vital. It's advisable to keep your application reference number handy when reaching out for assistance, as this will expedite any inquiries.

Estimated processing time for HST rebate applications

Processing times for HST rebate applications can fluctuate based on various factors such as the volume of applications received or the completeness of your submission. Typically, you can expect to wait anywhere from 4 to 8 weeks for an application to be processed. It’s important to patiently follow up if you have not heard back within this window.

Certain factors, such as incomplete forms or discrepancies between your documentation and application details, can lengthen processing times. If you're in urgent need of your rebate, ensure your application is complete and accurate; mistakes can lead to extended waiting periods. For urgent inquiries, contact the designated government office directly; most provide dedicated customer service lines for this purpose.

Cost considerations

It's essential to assess the financial implications surrounding the HST rebate form. Generally, there is no fee for submitting the HST rebate form itself, meaning homeowners can pursue these savings at no upfront cost. However, costs may arise from purchasing energy-efficient products, and home improvement projects often come with their own expenses.

Understanding these costs helps homeowners gauge the overall financial impact of pursuing the rebate. While the initial investment may seem high, the potential savings through the HST rebate can make these upgrades worthwhile, especially in reducing future energy bills and improving property value.

Before you start: Key considerations

Before embarking on the HST rebate application journey, it’s integral to prepare adequately. Consider creating a checklist that ensuring all documentation is in order, including eligibility requirements for each item being claimed. Another critical aspect is to diligently double-check that all the expenditures you intend to claim on your HST rebate form are indeed eligible and substantiated by receipts or invoices.

Taking these preparatory steps can not only enhance your chances of success but also relieve potential stress throughout the process. By being thorough and organized, you can expedite your application and maximize your rebate, potentially transforming the financial layout of your home maintenance projects.

Utilizing pdfFiller for your HST rebate form

Using pdfFiller can greatly simplify the process of managing your HST rebate form. This platform offers essential features like easy editing of PDF forms, which is particularly useful when filling out application details. You can quickly make adjustments or corrections, ensuring accuracy on each item claimed, directly within the interface.

Moreover, pdfFiller allows you to e-sign documents if needed and collaborate with others involved in the application process. Uploading your HST rebate form is seamless, as pdfFiller manages document storage within a cloud-based platform. This means you can access your documents anywhere, anytime, alleviating the worry of misplacing vital paperwork during submission.

Post-submission tips

After submitting your HST rebate form, it’s wise to remain proactive. Regularly check your application status through the official tracking methods provided by your local revenue authority. Staying informed can ease anxiety over the processing duration and ensure your potential rebate arrives promptly.

Additionally, be aware of any changes in rebate policies that could affect future applications. Staying updated on guidelines ensuring that your future HST rebate submissions comply with any new regulations or adjustments, thus enhancing the ease of future claims.

Frequently asked questions (FAQs)

As you navigate the HST rebate application process, several questions may arise. One common inquiry is regarding the eligibility requirements: What specific purchases qualify for the HST rebate? Simply put, any qualifying products or services related to property, meeting governmental criteria, may be eligible.

Another frequent concern revolves around documentation. Many applicants wonder if they need to maintain copies of their invoices and proof of purchase after submitting the rebate form. The answer is yes; retain these records for your documentation until you have received confirmation or your rebate has been completed. If processing delays occur, keeping these documents accessible can support any clarifications required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit hst rebate form online?

How can I edit hst rebate form on a smartphone?

How do I fill out hst rebate form on an Android device?

What is hst rebate form?

Who is required to file hst rebate form?

How to fill out hst rebate form?

What is the purpose of hst rebate form?

What information must be reported on hst rebate form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.