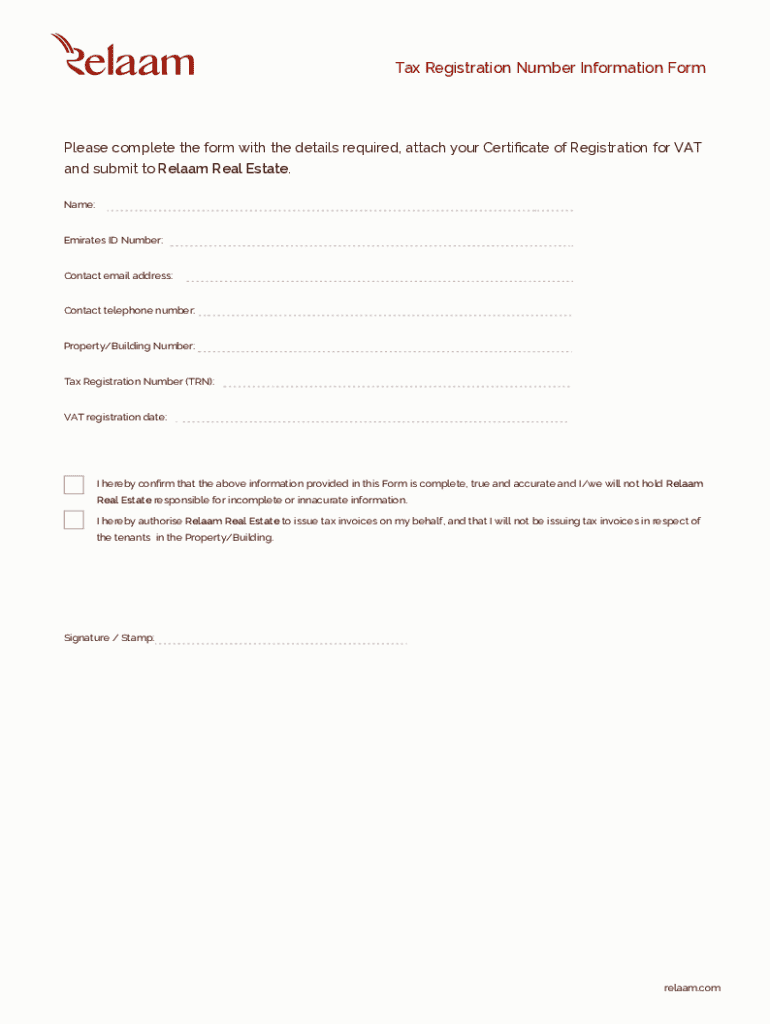

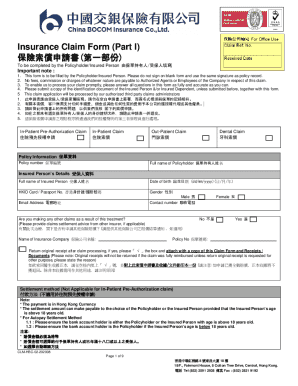

Get the free Tax Registration Number Information Form

Get, Create, Make and Sign tax registration number information

Editing tax registration number information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax registration number information

How to fill out tax registration number information

Who needs tax registration number information?

Tax Registration Number Information Form: A Comprehensive Guide

Understanding the tax registration number

A Tax Registration Number (TRN) is a unique identifier allocated to individuals and businesses in order to track tax obligations and compliance within various jurisdictions. It plays a pivotal role in ensuring that entities can accurately report their income and appropriately remit taxes owed. Without a TRN, confusion can arise, leading to penalties and other complications.

The importance of a TRN cannot be overstated, as it serves as a method of accountability for tax authorities. Compliance relies heavily on having this number. It facilitates the ease of tax administration and can affect businesses' ability to apply for permits, licenses, or financing. Essentially, if you are earning income, whether as an individual or as a corporation, obtaining a TRN is essential for fulfilling your tax responsibilities.

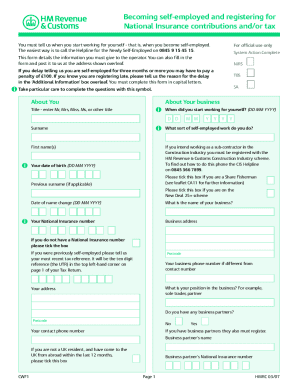

So, who needs a TRN? Generally, every individual who earns taxable income should be registered. This includes employees, freelancers, and self-employed individuals. For businesses, any entity that generates revenue must also acquire a TRN, regardless of size. New businesses should prioritize this process, as it is a cornerstone of operating legally and effectively.

The necessity of the tax registration number information form

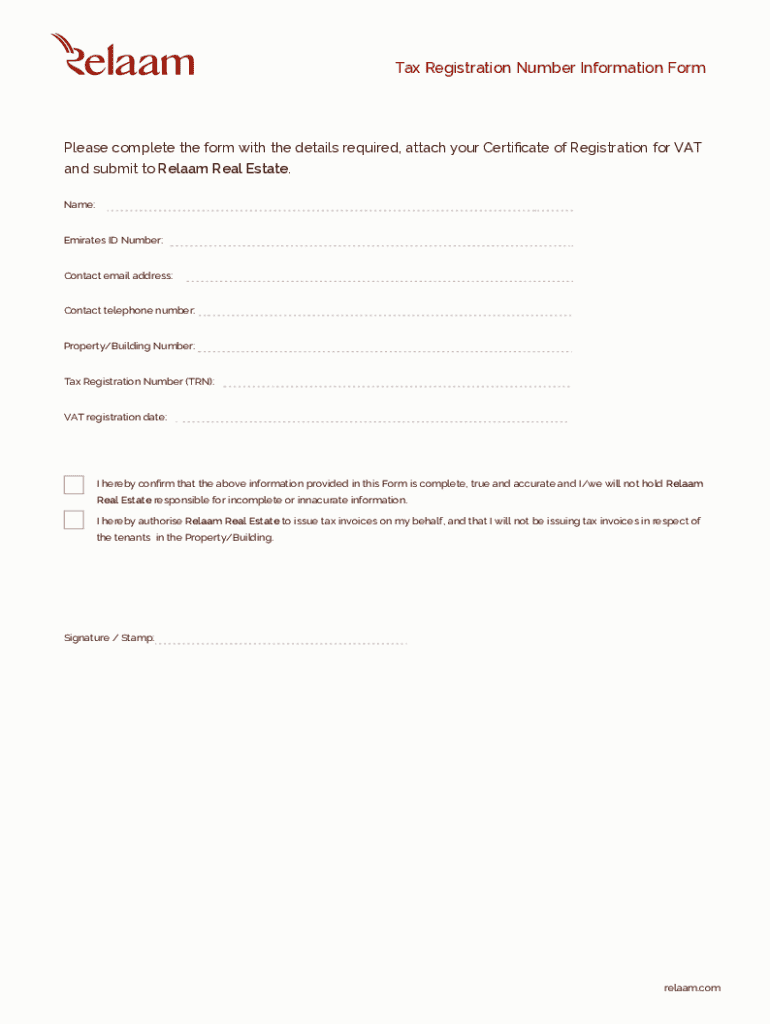

The Tax Registration Number Information Form serves as the official document required for the application of a TRN. By completing this form, individuals and businesses provide essential data that tax authorities need to issue a TRN. It is a vital step in securing your tax identification, ensuring that you are legally compliant with tax laws. The information is used to verify identities, assess tax obligations, and track payments accurately.

Accurate and thorough completion of the Tax Registration Number Information Form not only speeds up the application process but also minimizes the risk of errors that could delay your registration or lead to administrative issues in the future. Benefits include immediate access to your tax identification number, which is necessary for filing returns and making payments legally.

How to fill out the tax registration number information form

Filling out the Tax Registration Number Information Form can seem daunting, but with a step-by-step guide, you can navigate it easily. Start by gathering all necessary documentation to ensure you have detailed information at your fingertips.

Common mistakes to avoid when filling out the form

Completing the Tax Registration Number Information Form requires attention to detail. One of the most common mistakes is submitting incomplete information. This can lead to delays in receiving your TRN, or worst, the necessity to start over from scratch.

Misidentifying your tax classification is another frequent error — understanding the implications of being an individual versus a corporation can significantly affect your tax obligations. Lastly, always keep copies of submitted forms for your records; not having documentation may hinder your ability to resolve queries down the line.

Submitting the tax registration number information form

Once your form is complete, it’s time to submit it for processing. You typically have several options for this: submitting online or via paper. Paper submissions may involve mailing the form to the pertinent tax authority, which can slow the registration process, whereas online submissions are generally faster and more convenient.

For users who opt for online submission, platforms like pdfFiller offer user-friendly interfaces to fill out and submit your form. Additionally, using tools that allow for digital signatures can streamline the process even further. Keep an eye on your submission status, as many jurisdictions provide a tracking feature to check on the progress of your application.

Alternatives for registering for a tax registration number

If traditional forms of registration do not suit you, consider exploring alternative methods. Many tax authorities now offer online registration options that can simplify the process significantly, often allowing individuals to register within minutes.

In-person registration at local tax offices is another effective option if you prefer face-to-face interactions. Moreover, some jurisdictions even allow phone registration, where a representative can guide you through the process.

What to do if you're unsure about your registration status

If you're uncertain whether you already possess a TRN, it’s advisable to check your status using the online services provided by your tax authority. This can usually be done through their official website, offering a hassle-free way to locate your registration.

If you find that your information is incorrect or outdated, contact your tax authority immediately to rectify the records. An essential step here is requesting a Notice of Registration (IT150) if you need formal proof of your registration.

Interactive tools and resources available on pdfFiller

pdfFiller offers an array of interactive tools designed to simplify the management of tax forms, including the Tax Registration Number Information Form. Its intuitive platform allows users to edit PDFs effortlessly, ensuring that all your personal information is accurately reflected.

With e-signature capabilities, completing and submitting your form has never been easier. Collaborate with team members on tax registration documents seamlessly, leveraging built-in features that enhance productivity.

Frequently asked questions about the tax registration number

Several common queries arise concerning TRNs. Individuals often worry about what to do if they lose or forget their number. In such cases, contacting the tax authority to retrieve or reset this identifier is recommended, as it is crucial for tax filings.

Another important aspect to consider is the need for promptly updating your TRN information. Whenever there are changes in your personal details or business structure, it’s essential to notify the tax agency to ensure your records remain correct and up-to-date.

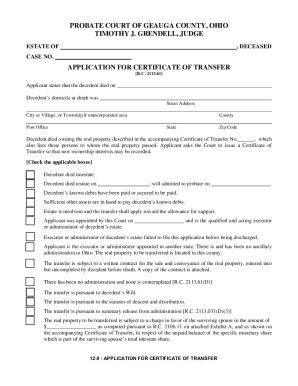

Related forms and documents you may need

When dealing with tax matters, several related forms may be necessary in conjunction with the Tax Registration Number Information Form. These may include Income Tax Return forms, business registration documents, and more.

Most of these forms are readily available online through your country's tax authority's website. Additionally, pdfFiller provides enhanced accessibility to a variety of documents, consolidating your tax management into one convenient platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get tax registration number information?

How do I execute tax registration number information online?

How do I complete tax registration number information on an iOS device?

What is tax registration number information?

Who is required to file tax registration number information?

How to fill out tax registration number information?

What is the purpose of tax registration number information?

What information must be reported on tax registration number information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.