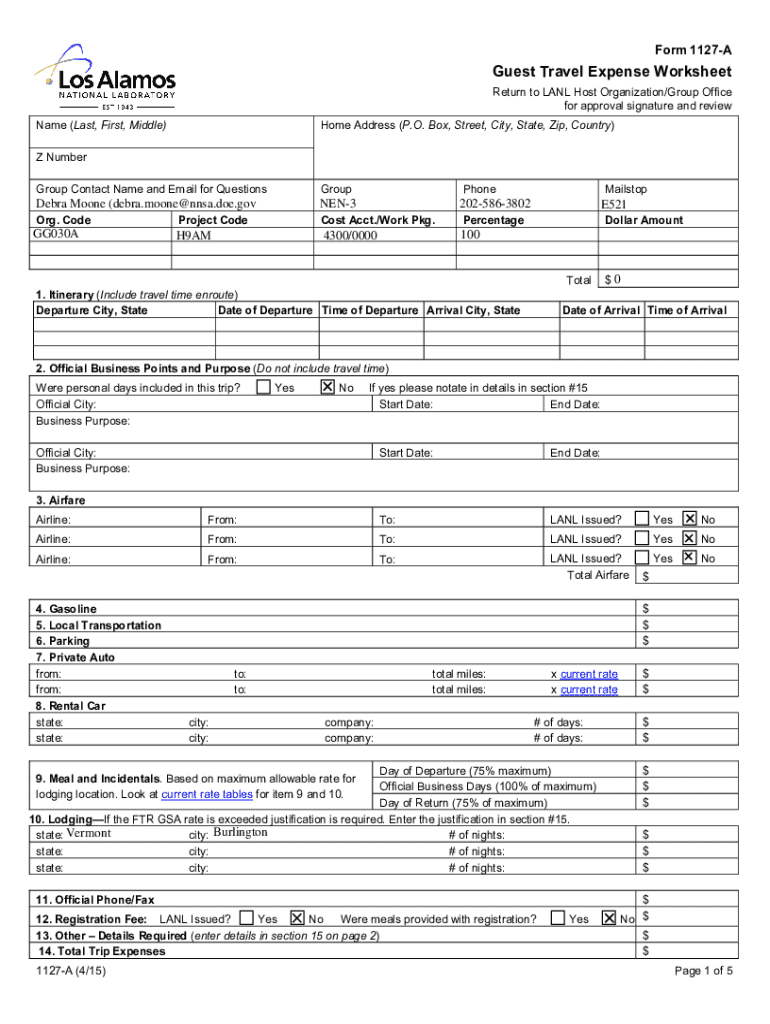

Get the free Form 1127-a

Get, Create, Make and Sign form 1127-a

How to edit form 1127-a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1127-a

How to fill out form 1127-a

Who needs form 1127-a?

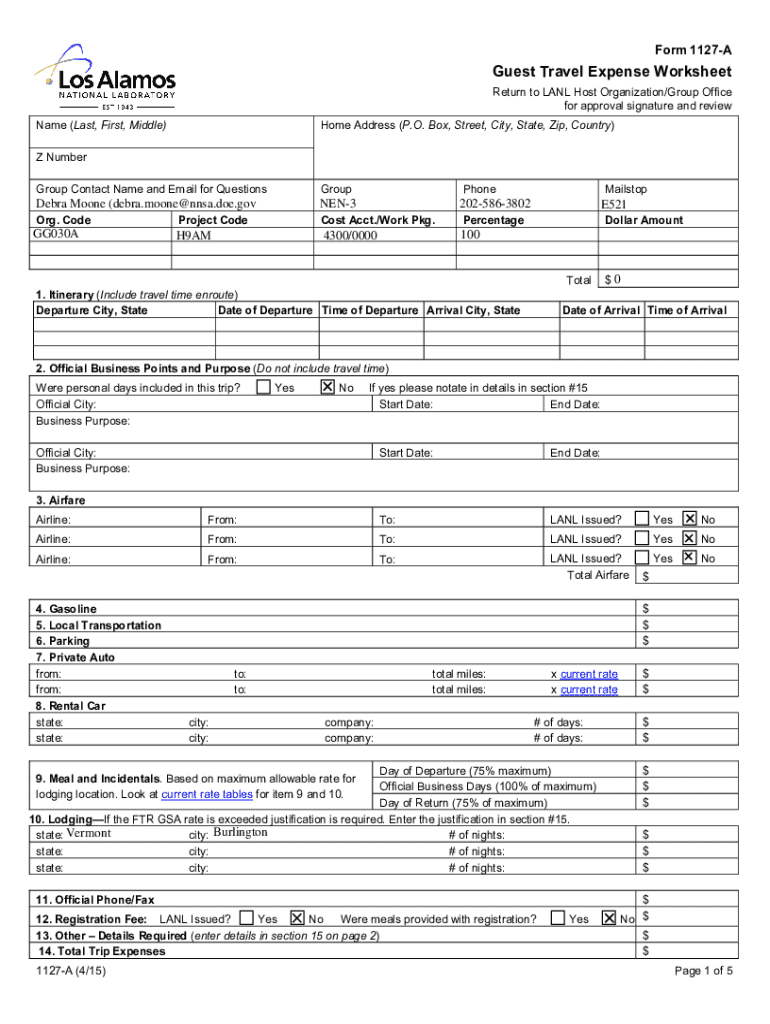

Form 1127-A Form: A Comprehensive Guide

Understanding the Form 1127-A

The Form 1127-A is an essential document provided by the IRS that allows taxpayers to request an extension of time to pay their taxes without incurring immediate penalties. Its primary purpose is to help individuals and businesses experiencing financial hardships delay payment while avoiding excessive penalties and interest. This form is crucial, especially during times of unexpected financial strain, such as medical emergencies, job loss, or natural disasters, allowing taxpayers the peace of mind to manage their finances.

Many tax situations necessitate the use of Form 1127-A, particularly when taxpayers find themselves unable to pay the full amount of taxes due by the original deadline. This form is vital for ensuring tax compliance while providing some relief to those facing financial difficulties. Proper documentation regarding the hardship is equally important, as it lays the foundation for justifying the extension request.

Eligibility criteria for using Form 1127-A

Eligibility for using Form 1127-A extends to both individuals and businesses who are confronting financial challenges that hinder their ability to meet tax deadlines. Common examples of financial hardships can include sudden unemployment, medical expenses, business losses, or substantial debt. Understanding the specific qualifications is vital, as not all financial struggles may qualify for this extension.

To support eligibility for an extension, taxpayers must gather specific documentation, which may include financial statements, pay stubs, tax returns from previous years, and any relevant medical bills. This documentation not only substantiates their claim but also strengthens the overall case for a payment extension.

Step-by-step guide to filling out Form 1127-A

Filling out Form 1127-A requires attention to detail. Here’s a breakdown of how to navigate each section of the form effectively:

To avoid common pitfalls when completing the form, ensure all fields are filled accurately, double-check for any arithmetic errors, and include all required attachments. A slight oversight could delay your request or lead to denial.

Key dates and deadlines associated with Form 1127-A

Meeting deadlines is critical when dealing with Form 1127-A. The form must be submitted before the original tax payment deadline to avoid penalties. A taxpayer requesting an extension should be aware that general timelines dictate when the request needs to be initiated—typically before tax day in April for individuals. Further, taxpayers must familiarize themselves with no-payment options available for extensions and their respective deadlines.

Submissions beyond the deadline could jeopardize eligibility for the payment extension, leading to immediate penalties. Hence, being proactive and prepared is vital for securing a favorable outcome.

Alternative options to Form 1127-A

While Form 1127-A is a practical choice for many taxpayers, alternative tax relief options also exist. Notably, Form 4868 provides an automatic six-month extension for filing tax returns, allowing taxpayers additional time to gather information.

Considering alternatives is key to effectively navigating financial pressure. Each option has its benefits, and understanding when to opt for a different route may ultimately hinge on the taxpayer’s unique financial scenario.

Managing penalties and interest post-extension

Late payment penalties and interest can accrue significantly if taxes are not paid promptly, even with an extension. After the extension period ends, if any outstanding taxes remain unpaid, penalties might take effect based on the unpaid balance and the amount of time elapsed since the deadline.

Taxpayers can employ strategies to minimize penalties and interest, such as making estimated payments or negotiating a reasonable payment plan with the IRS. Being proactive can ease future burdens and help reestablish compliance.

Navigating complex scenarios with Form 1127-A

Complex financial situations call for careful navigation when using Form 1127-A. For individuals facing bankruptcy or insolvency, it’s crucial to consider additional layers of protection and advice specific to those circumstances. Each case retained by the IRS can involve unique considerations, and understanding the process is paramount.

For businesses, being transparent and maintaining open lines of communication with the IRS during disputes can facilitate negotiations and promote understanding. Collecting and presenting documentation correctly will be essential in establishing opportunities for resolution.

Frequently asked questions about Form 1127-A

It's natural for taxpayers to have questions regarding Form 1127-A. Common inquiries often focus on its applicability, eligibility requirements, and what steps to take post-submission. Misunderstandings arise frequently, with many taxpayers unsure about whether their hardship qualifies or how to follow up with the IRS after submitting the form.

Clarifying these points can alleviate anxiety and encourage timely action. Engaging with the IRS directly and maintaining good records can help ensure taxpayers remain informed throughout the process.

Enhancing your document management experience with pdfFiller

pdfFiller simplifies the process of managing Form 1127-A by providing users with a cloud-based solution for filling out and organizing tax documents seamlessly. The platform offers interactive tools that refine the editing experience, enabling taxpayers to collaborate effectively with advisers or team members during the preparation process.

With features such as e-signatures and secure sharing options, pdfFiller empowers users to expedite the filing process efficiently. This enhances preparedness and confidence in managing important financial documentation.

Tips for seamless document management

Organizing and retaining essential financial records plays a significant role in overall tax management. Best practices include maintaining a comprehensive checklist for documentation, using templates for repetitive forms, and implementing cloud storage solutions for easy access.

By focusing on these organizational strategies, taxpayers can greatly enhance their efficiency and reduce the stress associated with tax management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 1127-a without leaving Chrome?

Can I sign the form 1127-a electronically in Chrome?

How can I edit form 1127-a on a smartphone?

What is form 1127-a?

Who is required to file form 1127-a?

How to fill out form 1127-a?

What is the purpose of form 1127-a?

What information must be reported on form 1127-a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.