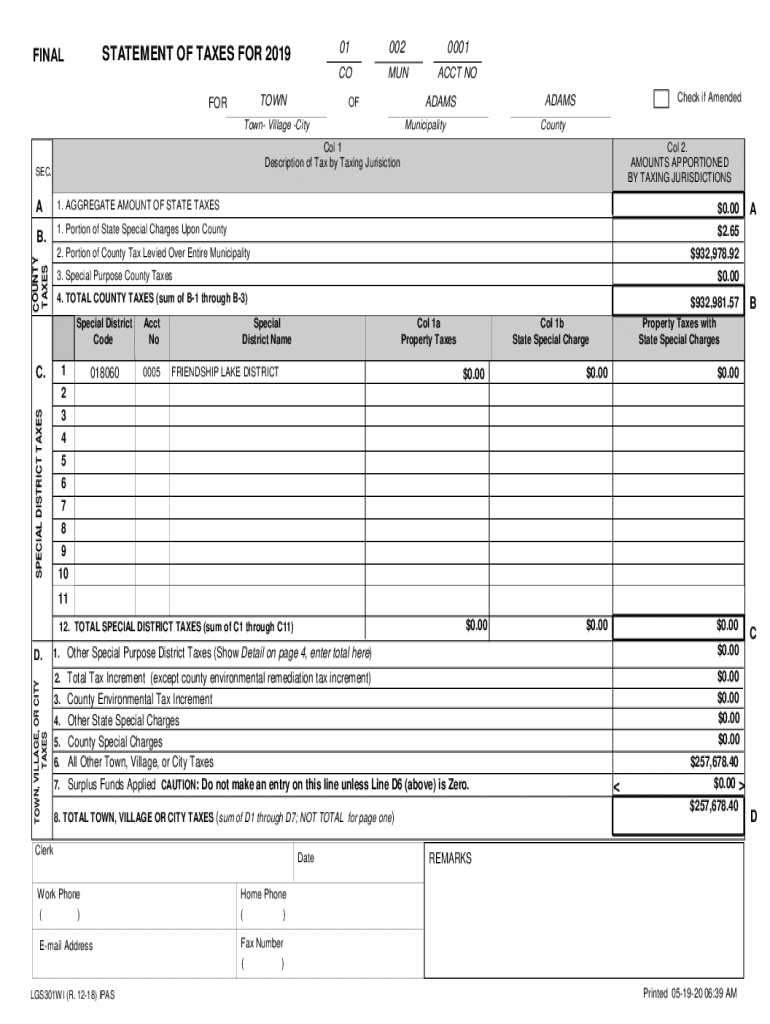

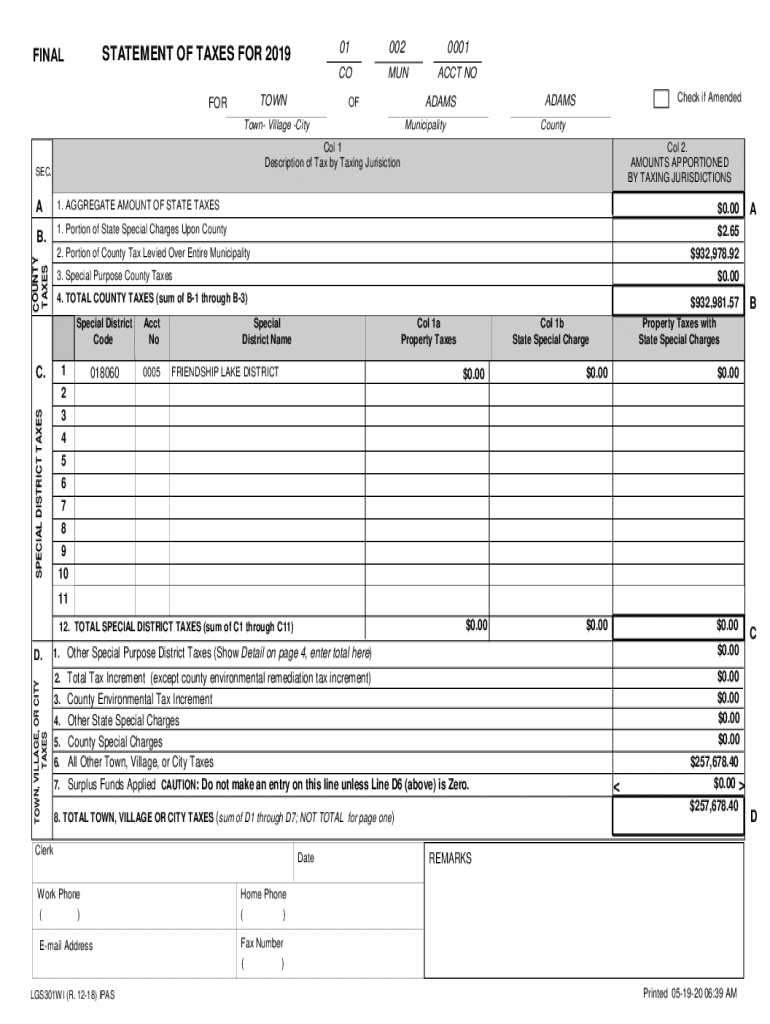

Get the free Statement of Taxes for 2019

Get, Create, Make and Sign statement of taxes for

How to edit statement of taxes for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out statement of taxes for

How to fill out statement of taxes for

Who needs statement of taxes for?

Comprehensive Guide to Statement of Taxes for Form

Overview of tax statements

A statement of taxes for form is a vital document that summarizes all tax-related financial information for the given year. Its primary purpose is to provide taxpayers with the necessary details to accurately report their income and calculate tax due. Accurate reporting is critical, as even minor discrepancies can lead to penalties or an audit.

Tax statements are particularly important for individuals and businesses alike because they facilitate compliance with federal and state tax regulations. Commonly used types of tax forms include the individual income tax return forms, wage and tax statements, and various forms for self-employed individuals or partnerships.

Each form serves a specific purpose and is designed to capture distinct financial activities. Understanding the role of each form is the first step toward seamless tax filing.

Common tax forms explained

Several key tax forms are essential for reporting various types of income and deductions. Understanding these forms can clarify which documents you'll need to provide as you prepare to file your statement of taxes.

Key components of a tax statement

A properly filled tax statement includes several critical components that summarize your financial year. Understanding what to include can dramatically ease the tax filing process.

How to fill out your tax form

Filing your tax forms might feel overwhelming, but breaking it down into manageable steps can simplify the process. It’s a great idea to approach the task methodically to ensure you capture all necessary information.

Be mindful of common mistakes like transposing numbers, missing forms, or forgetting to sign. These can lead to processing delays or penalties.

Utilizing pdfFiller for efficient tax statement management

Managing tax forms doesn’t have to be a cumbersome process, and pdfFiller can enhance your experience. The platform is equipped with advanced features that streamline document management significantly.

Frequently asked questions (FAQ)

Tax filing often brings up a series of questions, and it’s crucial to find answers before you proceed with your statement of taxes for form. Here are some frequently asked questions.

Interactive tools and resources

To aid your tax filing process, several interactive tools and resources are available that provide essential support.

Next steps after filing your tax statement

Completing your statement of taxes for form is just the beginning. After filing, it’s essential to track the next steps to ensure a smooth experience.

Contact support for personalized assistance

If you encounter issues or have specific concerns related to your tax filings, reaching out for personalized help is a great option. pdfFiller offers reliable customer support for users needing assistance.

Success stories: users share their experiences

Numerous users have transformed their tax filing processes through pdfFiller, and their success stories reflect the benefits of employing the platform for managing tax documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send statement of taxes for to be eSigned by others?

How do I complete statement of taxes for online?

Can I create an electronic signature for the statement of taxes for in Chrome?

What is statement of taxes for?

Who is required to file statement of taxes for?

How to fill out statement of taxes for?

What is the purpose of statement of taxes for?

What information must be reported on statement of taxes for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.