Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

A Comprehensive Guide to SEC Form 4

Understanding the SEC Form 4

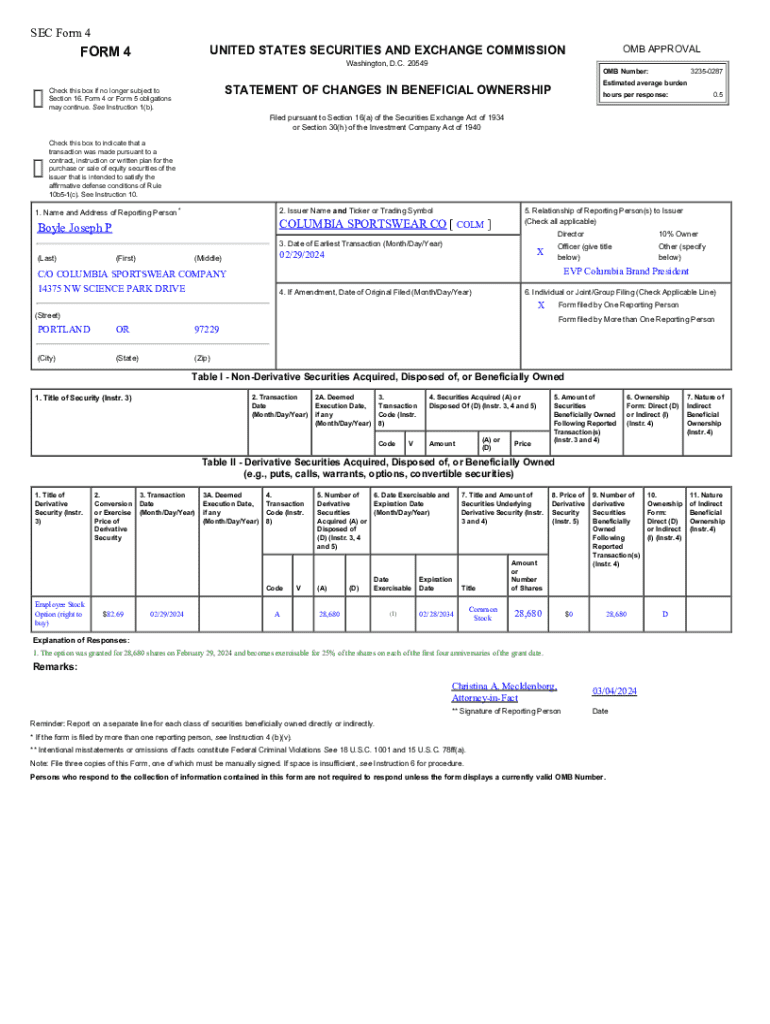

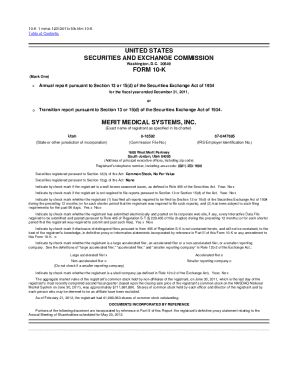

SEC Form 4 is a crucial document that must be filed with the Securities and Exchange Commission (SEC) whenever there is a change in the ownership of a company's stock by its insiders. This form primarily serves to provide key insights into transactions made by individuals with access to confidential information about the company. By mandating the disclosure of such transactions, SEC Form 4 plays a pivotal role in promoting transparency in the securities markets.

Insider trading, often scrutinized for its potential to be abusive, is monitored through the diligent reporting requirements imposed on insiders. When insiders—such as company executives, directors, or substantial shareholders—file Form 4, it signals their trading activities to the public and regulatory bodies. This not only enhances investor trust, but also acts as a deterrent against fraudulent practices.

Purpose of SEC Form 4

The primary purpose of SEC Form 4 is to ensure that transactions conducted by insiders are publicly reported, reflecting their confidence in the company's future. This timely reporting provides essential data to investors, analysts, and market observers, enabling them to make informed decisions based on actual insider moves. The transparency helps maintain a level playing field in the market, as all investors have access to the same information regarding stock trading by insiders.

In addition to promoting transparency, Form 4 also holds insiders accountable for their trading decisions. By requiring immediate disclosure of stock transactions, the SEC can investigate anomalies that may suggest insider trading violations. Moreover, this oversight fosters a sense of responsibility among insiders, as their actions are subject to public scrutiny.

Who needs to file SEC Form 4?

The SEC requires that certain individuals, commonly referred to as 'insiders', file Form 4. Insiders include company executives, directors, and individuals or entities that hold over 10% of a company's stock. This broad classification ensures that all significant decision-makers and influential stakeholders are transparent about their trading activities.

While most insiders are obligated to report their transactions, there are specific exemptions. For example, certain trusts and investment funds might have different reporting obligations based on their structures. Furthermore, there can be unique scenarios where indirect holdings, like those through family members or entities, might be exempt or reported differently. Understanding these nuances is essential for compliance.

Key components of SEC Form 4

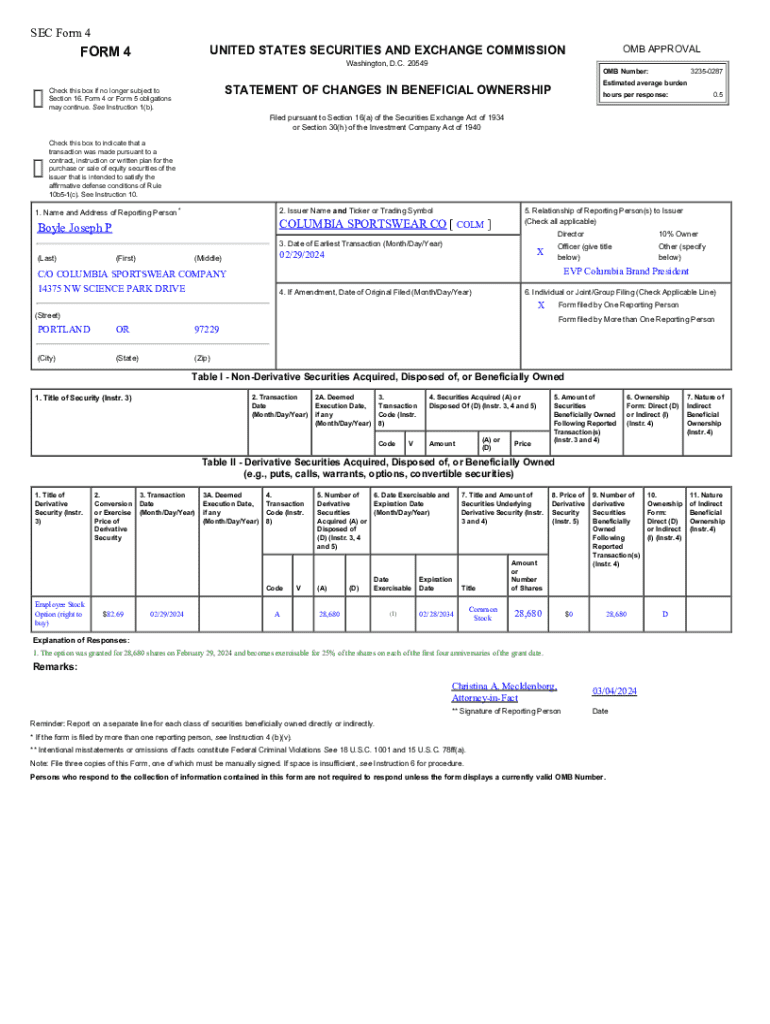

SEC Form 4 is designed to capture comprehensive details about an insider's trading activities. The document comprises several key sections, including basic information about the reporting individual, specifics regarding the transaction, and a summary of ownership changes. This structured approach ensures clear communication and helps avoid any ambiguity by clearly stating essential details.

The document begins with the reporting person's details, which encompass their name and relationship to the company. Next, the transaction details elucidate the type of transaction—be it a purchase or sale—along with the quantity and price per security. Finally, Section three provides an overview of how the holdings will change once the transaction completes, offering transparency into the insider's updated stock ownership.

Document sections overview

Step-by-step breakdown of each section

To ensure clarity, here's a step-by-step breakdown of each section's requirements. First, entering Filing Information provides the date and time of the transaction, which is crucial for compliance. Next, the Nature of Indirect Ownership section allows insiders to report any indirect stakes held through other entities, ensuring thorough transparency. For added understanding, sample entries can showcase ideal representations of complete Form 4 sections, enhancing insight into how data is typically filled out.

Filing process for SEC Form 4

Filing SEC Form 4 requires careful attention to detail. Here's a step-by-step guide to streamline the filing process and ensure compliance. Starting with gathering necessary information, individuals should compile personal details, transaction specifics, and existing ownership data, which can save time during the actual filing.

Next, accessing the SEC EDGAR system is essential for submitting Form 4 electronically. Users can easily navigate to the platform, where templates and filing instructions are readily available. Upon completing the form, it's advisable to conduct a review and verification process—double-checking for any incomplete sections or errors, particularly with transaction dates and ownership details. Finally, the submission must adhere to digital submission guidelines, marking the process complete.

Common mistakes to avoid

Editing and managing SEC Form 4

After the submission, there may be circumstances requiring revisions to SEC Form 4. Situations such as errors in reported transactions or changes in ownership post-filing may necessitate amendments. It's crucial for insiders to understand the amendment process, another layer of compliance necessary to maintain transparency in the market.

Managing these documents can become cumbersome without effective solutions. Utilizing tools like pdfFiller can simplify this process, offering editing features that allow for seamless updates and corrections. Moreover, the platform's eSigning capabilities expedite the process, ensuring that documents are completed and submitted in a timely manner.

Document management solutions

The advantages of using pdfFiller extend beyond simple edits. Organizations looking for collaborative tools can benefit greatly from pdfFiller’s real-time document-sharing features, which enable teams to work together on multiple filings. This promotes coherent communication and faster turnaround times, particularly for those handling numerous SEC compliance documents.

Checking and tracking SEC Form 4 filings

Keeping track of SEC Form 4 filings is essential for monitoring insider activities and market movements. Investors and analysts can leverage the SEC's EDGAR database, wherein they can access filings from various companies. Navigating this resource is straightforward, and a comprehensive understanding of the interface allows individuals to filter results effectively depending on specific companies or transaction types.

Analyzing Form 4 data can yield valuable insights regarding trends in insider trading. Recognizing patterns within hedge fund activity or identifying significant ownership shifts can influence investment strategies. Therefore, utilizing various analytical tools can enhance clarity and improve decision-making when it comes to trading stocks based on insider activity.

Useful tips for analyzing Form 4 data

FAQs about SEC Form 4

The SEC receives numerous inquiries regarding SEC Form 4, particularly about the implications of late filings. A question often posed is, 'What happens if a form is filed late?' The SEC typically imposes penalties for late submissions, which highlights the importance of timely filings.

Another common question is whether someone other than the insider can file Form 4. Generally, insiders themselves must file, unless they have designated an alternative individual to report on their behalf. Lastly, the frequency of filings also raises interest—insiders must file Form 4 whenever there is a change in ownership, thus ensuring continuous transparency regarding their securities dealings.

Best practices for insiders

Establishing best practices around the timing of SEC Form 4 submissions can significantly enhance compliance. Insiders should strive to report transactions as soon as possible to ensure transparency and accountability. Timeliness not only complies with SEC regulations but also helps in building investor relations by fostering trust.

Incorporating technology into the process can also streamline compliance efforts. Utilizing platforms like pdfFiller, which sharpen the process of completing and managing SEC Form 4 filings, suggests a forward-thinking approach to regulatory obligations. Such tools empower insiders to focus on strategic decision-making while being assured of seamless compliance.

Interactive features of pdfFiller

pdfFiller ensures that completing SEC Form 4 is both user-friendly and efficient. Its interactive tools allow users to fill out the form quickly, without hassle. The platform's integration of electronic signatures simplifies the endorsement process, further enhancing the speed of compliance.

Collaboration capabilities within pdfFiller make it easy for teams to manage multiple filings simultaneously. This feature is particularly beneficial when several insiders are involved, as it allows for streamlined workflows and minimizes the potential for errors.

Conclusion on SEC Form 4

Overall, the SEC Form 4 is not just a regulatory form; it represents a commitment to transparency and ethical trading practices within the market. Ensuring timely and accurate submissions can strengthen an insider's relationship with investors and positively reflect on the company's credibility.

Utilizing advanced solutions like pdfFiller can streamline the complexities of managing SEC Form 4, ultimately making the compliance process more efficient and less daunting. Embracing these digital tools encourages a proactive approach to regulatory reporting in an increasingly complex financial landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find sec form 4?

How do I fill out sec form 4 using my mobile device?

How do I complete sec form 4 on an iOS device?

What is SEC Form 4?

Who is required to file SEC Form 4?

How to fill out SEC Form 4?

What is the purpose of SEC Form 4?

What information must be reported on SEC Form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.