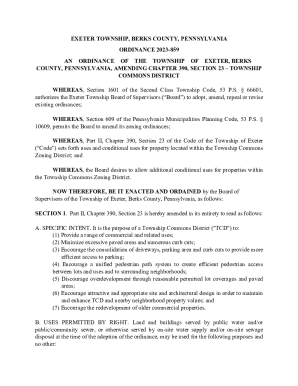

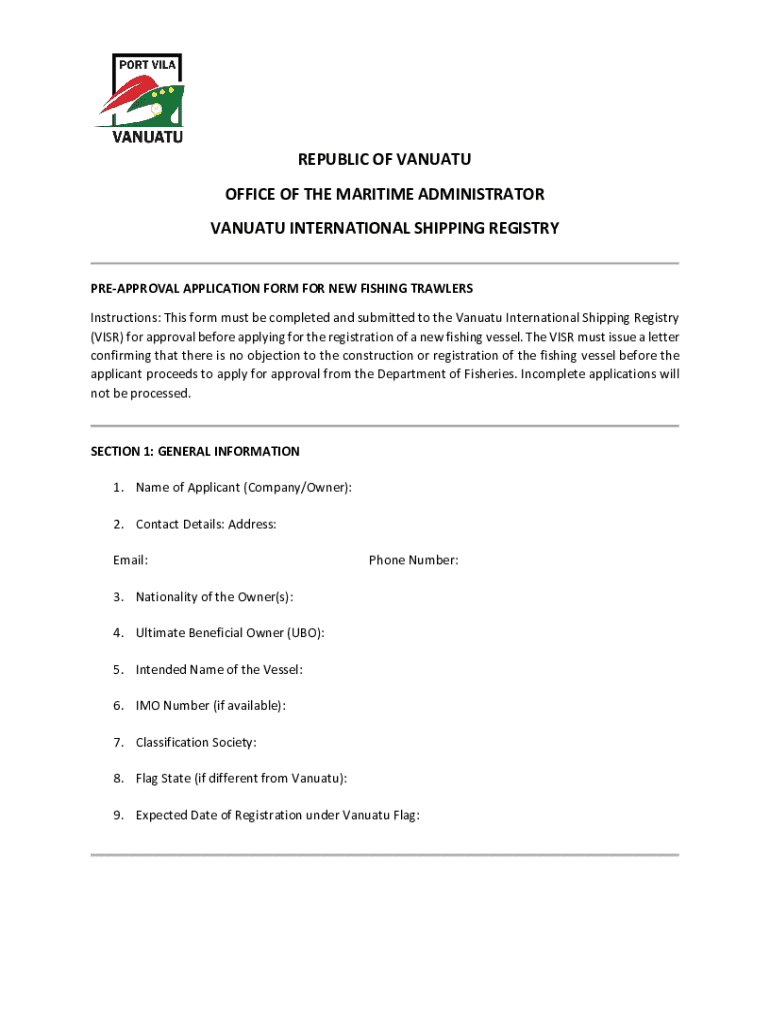

Get the free Pre-approval Application Form for New Fishing Trawlers

Get, Create, Make and Sign pre-approval application form for

How to edit pre-approval application form for online

Uncompromising security for your PDF editing and eSignature needs

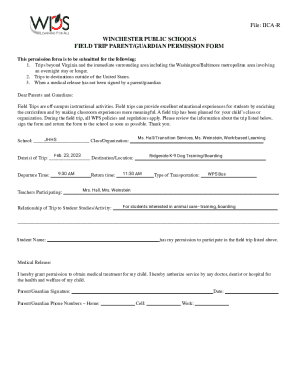

How to fill out pre-approval application form for

How to fill out pre-approval application form for

Who needs pre-approval application form for?

Comprehensive Guide to Pre-Approval Application Form for Form

Understanding pre-approval application forms

A pre-approval application form represents a critical step in the loan process, particularly for those seeking a mortgage. This form serves as a formal request submitted to lenders to assess your financial eligibility for a loan amount. The process involves compiling and reviewing key financial information, which aids lenders in determining how much you can borrow based on your current financial situation.

Obtaining a pre-approval is pivotal since it not only provides a sense of budget and affordability but also indicates to potential home sellers that you are a serious buyer. Understanding the distinction between pre-approval and its cousin, pre-qualification, is essential. Pre-qualification is often a more informal analysis of your financial status, requiring less documentation and resulting in a more generalized estimate of how much you can borrow.

Benefits of obtaining a pre-approval

The advantages of acquiring a pre-approval are multifaceted. Firstly, it establishes a clear budget for your borrowing capacity, making it easier to focus your home search within a specific price range. This helps streamline the home-buying process, preventing potential disappointments from exploring properties beyond your financial reach.

Furthermore, a pre-approval enhances your negotiation power with sellers. In competitive markets, having a pre-approval can make your offer more attractive, as it demonstrates financial readiness. Additionally, it significantly speeds up the home-buying process as you have most of the necessary checks and documentation completed in advance.

Components of a pre-approval application form

A pre-approval application form generally consists of several key components critical for assessing your financial profile. The first section typically requests personal information, which includes identification details, such as your name, address, and Social Security number. Lenders also seek employment and income information to gauge your stability.

Following personal information, the financial information section requires a detailed overview of your assets and liabilities. This allows lenders to analyze your current financial health thoroughly. Additionally, supporting documentation such as credit score reports, recent tax returns, and bank statements are often required. These documents provide lenders with a complete picture of your financial history and creditworthiness.

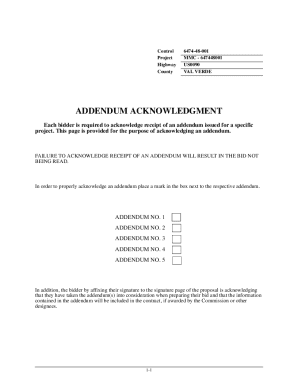

How to fill out the pre-approval application form

Filling out the pre-approval application form can seem daunting, but breaking it down into manageable steps enhances clarity and efficiency. Begin by reviewing your financial situation; calculate your monthly income, expenses, and existing debts. This assessment allows you to ascertain how much you can realistically afford when seeking financing.

Next, complete the personal information section accurately, ensuring that all details match your identification documents. Common mistakes often involve typos or inconsistent information that could lead to unnecessary delays. Thus, it is essential to double-check your entries. Collecting all necessary documentation ahead of time will streamline the process, as you will be prepared to provide lenders with immediate access to your financial records.

The pre-approval process timeline

After submitting your pre-approval application form, many borrowers often wonder about the length of the process. Typically, a pre-approval application may take anywhere from a few hours to a few days. However, numerous factors can influence processing time, such as the lender's current workload and the completeness of your supplied documentation.

Once your application is submitted, lenders will conduct a thorough review, often performing a credit check and evaluating your financial situation based on the documents provided. After the evaluation, you will receive a response informing you about the extent of your pre-approval, outlining the potential loan amount and any expected conditions.

Validity of pre-approvals

Understanding the validity of pre-approvals is vital for potential borrowers. Typically, a pre-approved loan lasts for about 60 to 90 days, though this can vary among lenders. Should your pre-approval expire, it's essential to know the steps to take. You can either reapply with your current lender or approach a new lender for a fresh pre-approval, depending on your satisfaction with the initial process.

Reapplying can be particularly advantageous if significant changes in your financial situation have occurred that may improve your borrowing potential. For borrowers experiencing fluctuations in credit scores or financial stability, keeping abreast of when to reapply can make a substantial difference in securing favorable loan terms.

FAQs about pre-approval application forms

It's common for potential borrowers to have numerous questions regarding pre-approval application forms. Many wonder what loan pre-application forms exactly entail. In essence, these are documents requesting lenders to evaluate your financial status and creditworthiness rather than simply giving an estimate of borrowing power.

Another frequent concern includes qualifying for pre-approval with a poor credit score. Some lenders do offer options for borrowers with less-than-perfect credit, albeit often with strict terms. If you find yourself in this situation, shopping around for various lenders can reveal options best suited for your financial profile.

Related document templates

When navigating the loan application landscape, many users may seek various document templates related to pre-approval. Familiarizing yourself with other forms can enhance your understanding and efficiency. For instance, comparing different pre-approval templates allows you to find one matching your specific needs and the lender's requirements.

Accessing editable forms via pdfFiller can ease the document creation process significantly. With a myriad of templates available, you can customize forms as per your preference, enabling ease in tracking and managing your application.

Interactive tools for managing your pre-approval application

Using interactive tools to manage your pre-approval application can dramatically enhance your experience. pdfFiller’s cloud-based document creation tools empower users to format, edit, and format their pre-approval application forms seamlessly. This platform provides easy collaboration options, allowing you to share documents with relevant stakeholders or co-signers without hassle.

In addition to editing, eSigning features allow fast and secure signing of your pre-approval forms. You can also track your application’s progress via pdfFiller, ensuring you remain knowledgeable about your application status and any additional steps necessary for completion, making the entire process smooth and transparent.

Embracing a digital approach to pre-approval

The shift towards a digital approach in handling pre-approval applications has provided users with multiple advantages. Utilizing pdfFiller to manage your pre-approval forms enables enhanced convenience, as you can edit and store your documents securely in an accessible online platform. This adaptability is particularly beneficial in today’s fast-paced environment, allowing you to handle your documents from anywhere.

The process for using pdfFiller is streamlined. Users can dive into document creation, manage their forms, and collaborate on edits with ease. With its user-friendly interface, pdfFiller simplifies complex document workflows, ultimately enhancing productivity and helping you keep your applications organized and on track.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pre-approval application form for?

Can I create an eSignature for the pre-approval application form for in Gmail?

How do I fill out the pre-approval application form for form on my smartphone?

What is pre-approval application form for?

Who is required to file pre-approval application form for?

How to fill out pre-approval application form for?

What is the purpose of pre-approval application form for?

What information must be reported on pre-approval application form for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.