Get the free Form 990

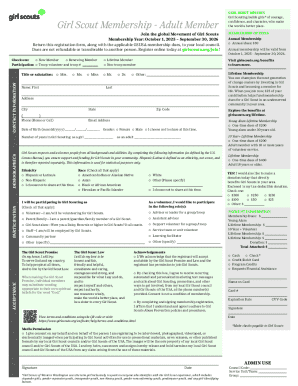

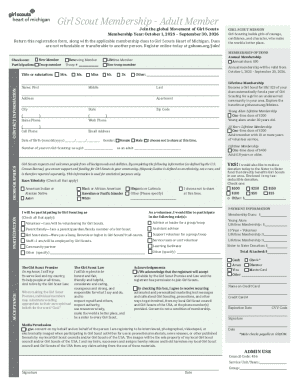

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding the Form 990: A Comprehensive Guide for Nonprofit Organizations

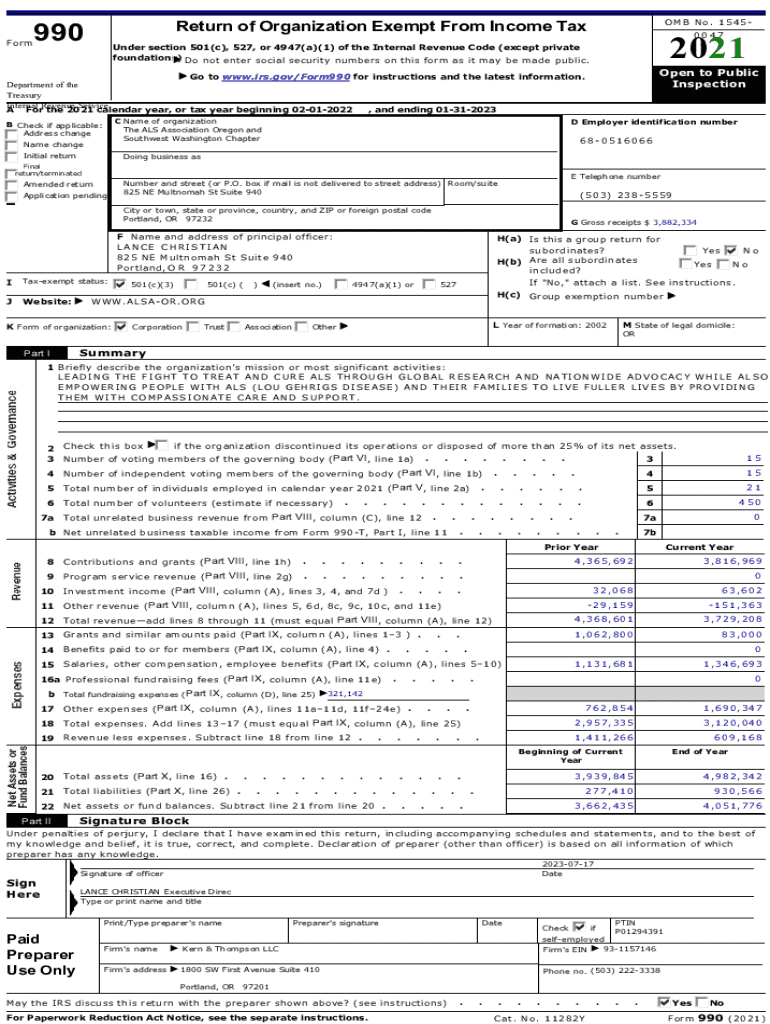

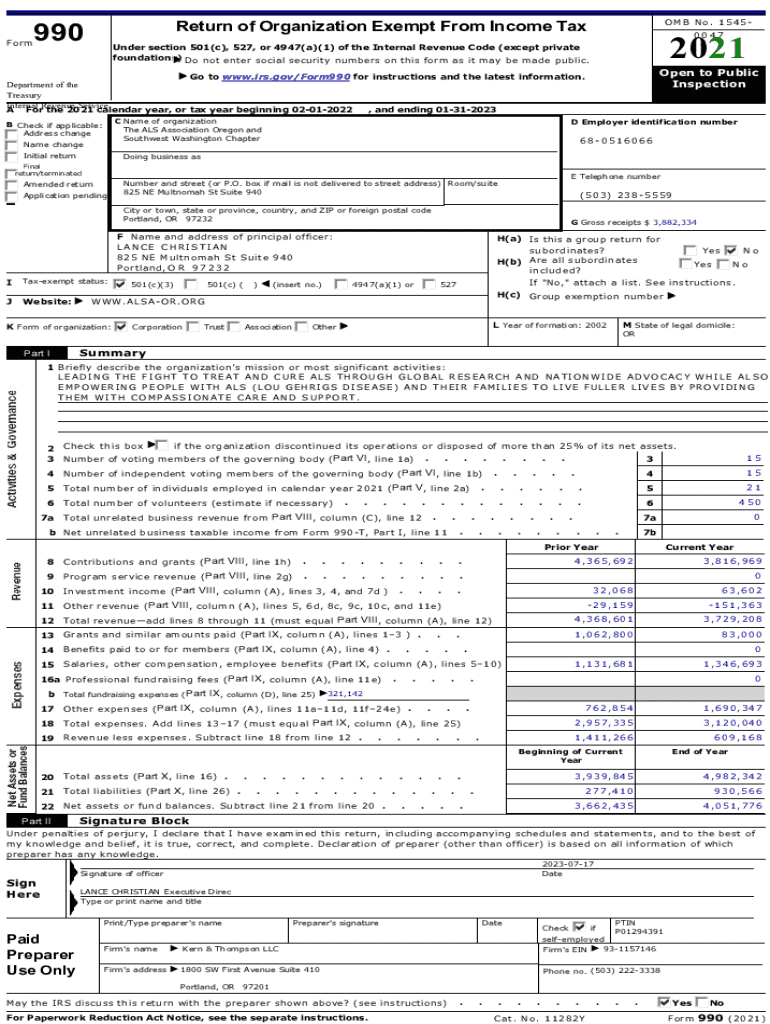

Understanding Form 990

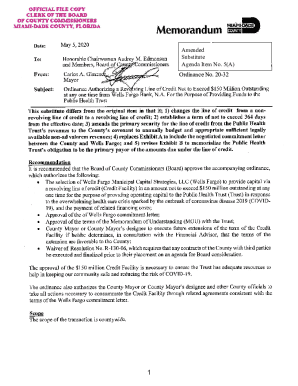

Form 990 is an essential document used by tax-exempt organizations in the United States to report their financial activities to the IRS. This form serves multiple purposes, including transparency, accountability, and ensuring that nonprofits maintain their tax-exempt status. As a publicly available document, Form 990 helps stakeholders, including donors and grant-making organizations, assess the financial health and operational practices of nonprofits.

The importance of Form 990 cannot be overstated; it provides vital information about the organization’s revenue, expenditures, and overall mission, which can influence funding decisions. For nonprofits, accurately completing this form is not just a regulatory requirement but also a way to build trust with donors and the public.

Types of Form 990

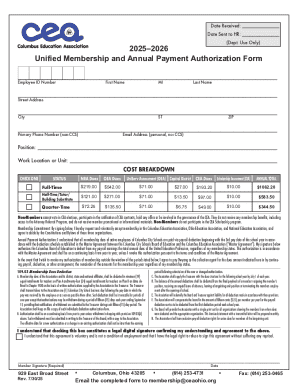

There are several versions of Form 990, tailored to different organizations based on size and revenue. The primary forms include:

Who needs to file Form 990?

Nonprofit organizations must understand whether they are required to file Form 990. Generally, organizations that have tax-exempt status under Section 501(c)(3) are obligated to file this form annually, provided they meet the income thresholds mentioned earlier. It is crucial for organizations to determine their filing obligations early in their fiscal year to avoid penalties.

Organizations exempt from filing include those whose gross receipts are normally $50,000 or less, as they may file Form 990-N instead. Failure to file the appropriate form can lead to serious consequences, such as forfeiture of tax-exempt status, monetary penalties, or loss of public trust.

Step-by-step guide to completing Form 990

Filling out Form 990 can seem daunting, but by following a structured approach, organizations can simplify the process. The first step is gathering necessary information, including detailed financial records, mission statements, and data regarding program services.

Next, organizations should begin filling out the form section by section. Key areas to focus on include:

Moreover, organizations should be cautious of common mistakes such as mismatched figures, incomplete sections, or filing late. Emphasizing consistency and accuracy can save a great deal of time and prevent further complications down the line.

Electronic filing and submission

Submissions for Form 990 can now be completed online, streamlining the filing process significantly. Many organizations opt for platforms like pdfFiller, which provide easy-to-navigate interfaces for e-filing and document management. The electronic submission process typically involves creating an account on the e-filing platform, selecting the correct form version, and following the prompts to enter relevant data.

Organizations must also be aware of specific deadlines for filing Form 990. Generally, nonprofit organizations need to submit their Form 990 by the 15th day of the 5th month after their fiscal year ends. Extensions can be sought, but they must be applied for in advance. Understanding these deadlines is critical to maintaining compliance and avoiding penalties.

Managing and keeping track of your Form 990

After submitting Form 990, organizations have ongoing responsibilities pertaining to recordkeeping and compliance monitoring. Accurate maintenance of records is essential for serving as supporting documentation should the IRS request any additional information or clarification.

Utilizing document management tools like pdfFiller can assist in maintaining organization and tracking Form 990 submissions. Features such as collaborative editing, cloud storage, and e-signing capabilities help teams ensure their documents stay up-to-date and easily accessible.

Frequently asked questions about Form 990

Form 990 often raises questions about disclosure and impacts. For instance, potential filers might wonder what specific information is disclosed on the form. Generally, Form 990 includes details about an organization’s mission, financial activities, governance, and compensatory information about top-paid employees.

This transparency can significantly enhance a nonprofit’s credibility, influencing donor trust and willingness to contribute. In the event of late filings, organizations should know that they may be subject to penalties. However, late filing can be mitigated by promptly taking corrective measures, such as submitting the form as soon as possible.

Advanced topics related to Form 990

Public disclosure of Form 990 plays a crucial role in fostering transparency in the nonprofit sector. The information disclosed, including financial statements and governance details, is essential for maintaining trust between nonprofits and donors. Organizations should leverage this furnished data to highlight their commitment to accountability.

Additionally, how Form 990 is perceived can impact funding and donor relations. For example, grant makers often assess an organization’s Form 990 when determining eligibility for funding. Implementing best practices while preparing Form 990 can enhance relationships with donors and support fundraising efforts, demonstrating effective use of financial resources.

Additional tools and resources

Utilizing interactive tools for filing can significantly ease the preparation of Form 990. pdfFiller's interactive solutions may simplify the data entry process, provide templates, and offer guided instructions to facilitate user understanding of the requirements.

In addition to resourceful tools, training opportunities available through webinars or workshops can help organizations deepen their understanding of Form 990 requirements. Engaging with these educational resources can further empower personnel involved in the filing process.

Finding more information

Organizations seeking to broaden their knowledge regarding Form 990 and its implications can find links to related IRS forms that apply to nonprofits. Familiarity with these additional resources can be beneficial in maintaining compliant practices and understanding broader regulations affecting tax-exempt organizations.

Visiting the IRS website provides access to comprehensive guidelines and updates regarding Form 990, ensuring that organizations stay informed about any legislative changes or updates to filing requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 990 directly from Gmail?

How do I edit form 990 straight from my smartphone?

Can I edit form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.