Get the free Local-City-Tax-form-Royster-Memo-Exemption. ...

Get, Create, Make and Sign local-city-tax-form-royster-memo-exemption

How to edit local-city-tax-form-royster-memo-exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out local-city-tax-form-royster-memo-exemption

How to fill out local-city-tax-form-royster-memo-exemption

Who needs local-city-tax-form-royster-memo-exemption?

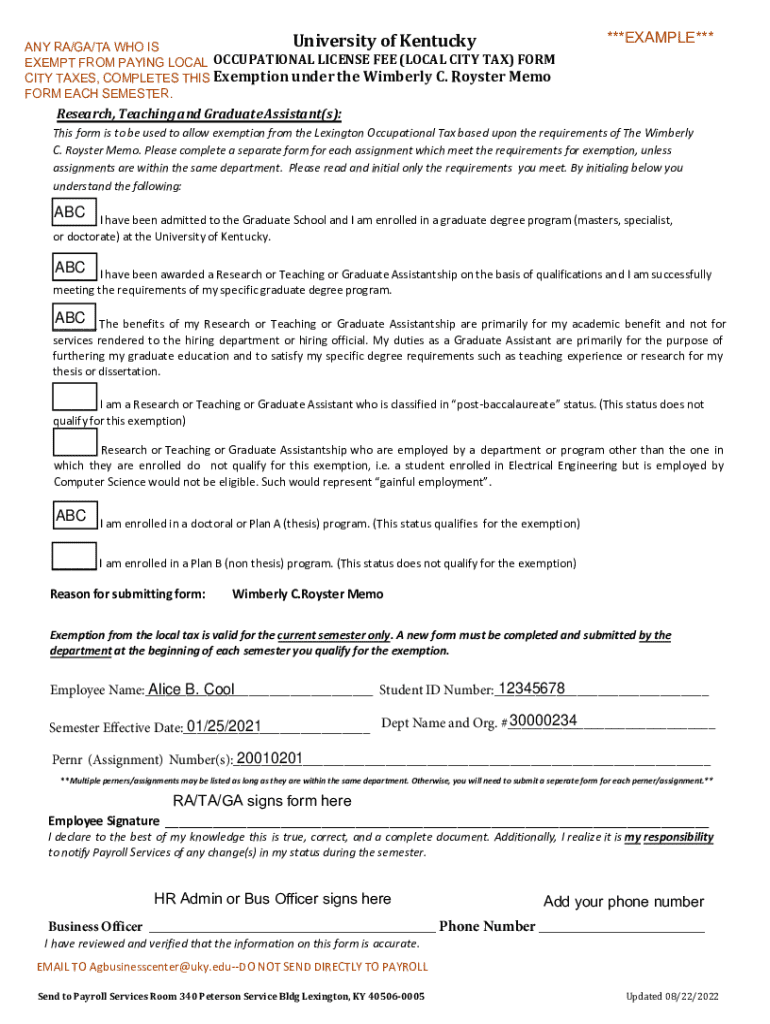

Local City Tax Form Royster Memo Exemption Form: A Comprehensive Guide

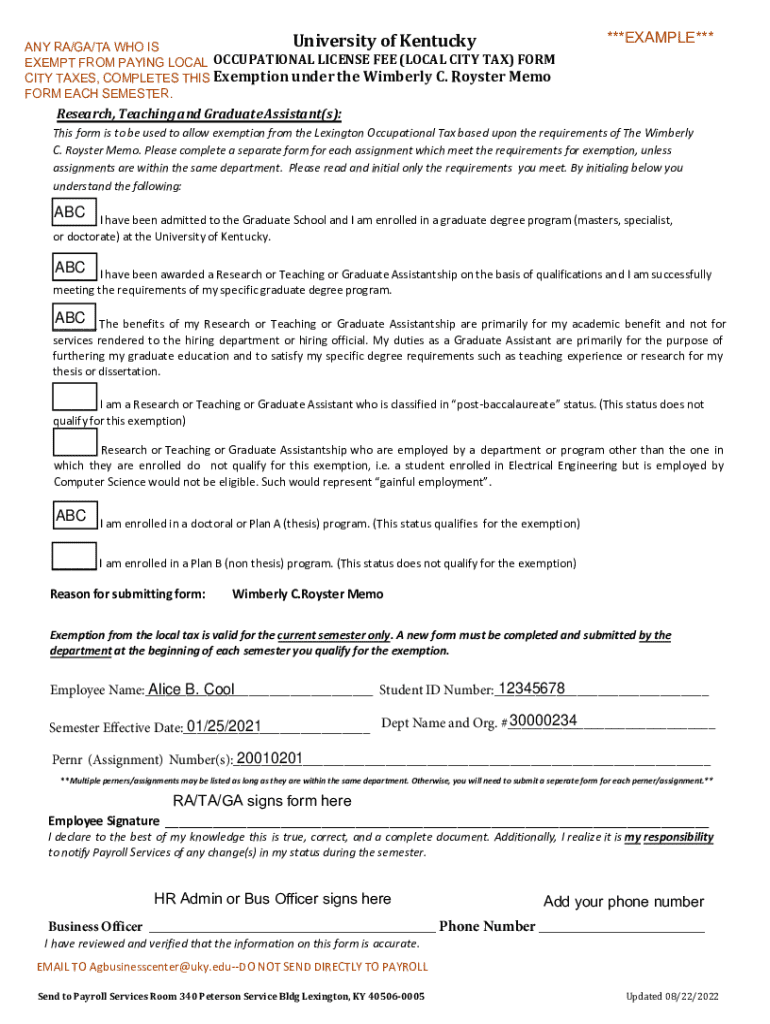

Understanding the Local City Tax Form Royster Memo Exemption

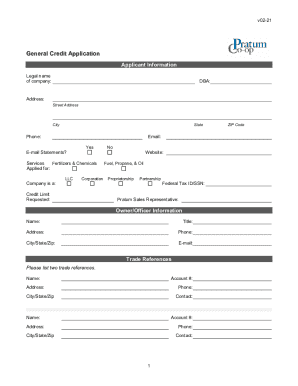

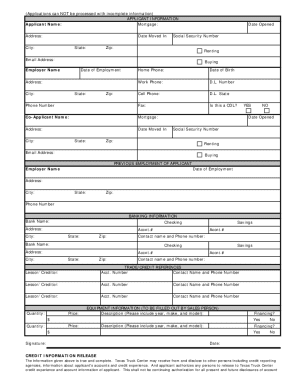

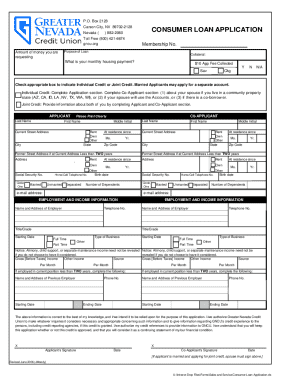

The Local City Tax Form Royster Memo Exemption is designed to provide specific exemptions on local taxes for qualifying individuals or businesses. This form outlines the necessary criteria under which certain taxpayers can benefit from reduced tax rates or complete exemptions, significantly impacting financial obligations.

The importance of the Local City Tax Form cannot be overstated. It ensures compliance with local tax regulations and streamlines the determination of tax obligations. By completing this form accurately, taxpayers can avoid penalties associated with incorrect tax submissions.

This form is required for anyone seeking to claim an exemption under the Royster Memo. Typically, this includes small business owners, non-profit organizations, and individuals who meet specific income criteria. Understanding who needs to complete this form will preempt complications during tax filing.

Key features of the Royster Memo Exemption Form

The Royster Memo Exemption Form is structured to collect essential information that validates a taxpayer’s eligibility for exemption. It includes various sections designed to capture comprehensive details. The layout remains user-friendly, facilitating easy completion.

Key information required includes:

Utilizing the Royster Memo Exemption Form offers numerous benefits, including reduced tax liabilities and streamlined paperwork for eligible individuals, which ultimately leads to improved compliance.

Step-by-step guide to completing the Local City Tax Form

Completing the Local City Tax Form Royster Memo Exemption can seem daunting, but breaking it down into manageable steps can simplify the process significantly. Here’s a step-by-step guide.

By methodically following these steps, taxpayers can minimize errors and optimize their chances of claiming the exemption successfully.

Tips for editing and managing the Royster Memo Exemption Form

Using pdfFiller provides users with robust tools for editing and managing the Royster Memo Exemption Form efficiently. For instance, if additional information is required or corrections must be made after initial completion, pdfFiller’s editing features allow users to easily modify their entries.

Collaboration is also crucial, especially for teams. Sharing capabilities enable multiple users to access and provide feedback on the form, ensuring accuracy and completeness before submission.

Keeping track of form versions is another essential practice. Regularly saving updated versions of the Royster Memo Exemption Form ensures that all stakeholders are informed of any changes, preventing miscommunication.

Troubleshooting common issues with the Local City Tax Form

While completing the Local City Tax Form Royster Memo Exemption is straightforward, users may encounter some common issues. Identifying these obstacles is the first step in resolving them effectively.

Common errors can include incorrect personal information, misplaced financial data, and misunderstandings regarding the exemption criteria. Addressing these swiftly can prevent delays in processing.

Should technical problems arise while using pdfFiller, users can reference the platform's comprehensive support guide or contact customer support for prompt assistance with their issues.

Frequently asked questions about the Local City Tax Form Royster Memo Exemption

Several common questions arise regarding the Local City Tax Form Royster Memo Exemption, addressing taxpayer concerns.

Additional resources for navigating local city taxes

For taxpayers seeking support beyond this guide, several valuable resources can aid in navigating local city taxes effectively.

Linking to government websites can provide direct access to the most current tax guidelines and forms. Engaging in community forums offers a platform for asking questions and sharing experiences among fellow taxpayers.

Through pdfFiller, not only can users manage the Local City Tax Form, but they are also equipped to handle other local forms and applications, creating a one-stop solution for document management needs.

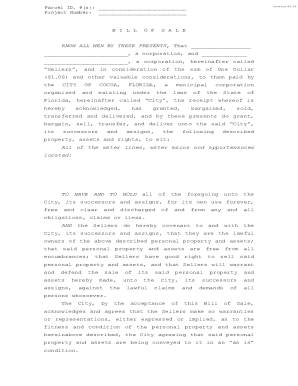

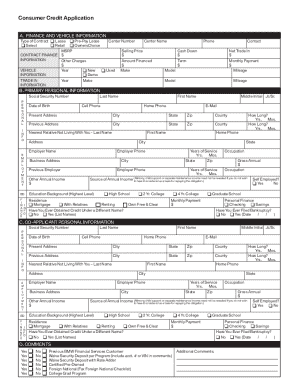

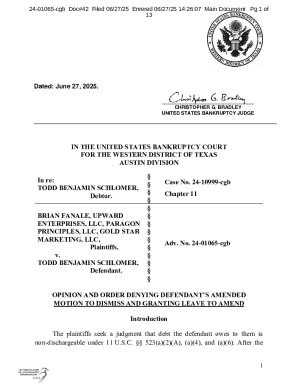

Navigating related forms for local financial compliance

In addition to the Local City Tax Form Royster Memo Exemption Form, various other forms play a crucial role in local financial compliance. Understanding these forms enhances overall financial literacy and management.

With pdfFiller, users can efficiently access multiple forms crucial for local compliance, making it easier to stay organized and compliant without the hassle of navigating each document separately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete local-city-tax-form-royster-memo-exemption online?

How do I edit local-city-tax-form-royster-memo-exemption in Chrome?

How do I edit local-city-tax-form-royster-memo-exemption on an Android device?

What is local-city-tax-form-royster-memo-exemption?

Who is required to file local-city-tax-form-royster-memo-exemption?

How to fill out local-city-tax-form-royster-memo-exemption?

What is the purpose of local-city-tax-form-royster-memo-exemption?

What information must be reported on local-city-tax-form-royster-memo-exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.