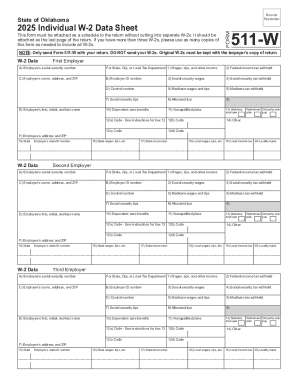

Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

A Comprehensive Guide to SEC Form 4

Understanding SEC Form 4

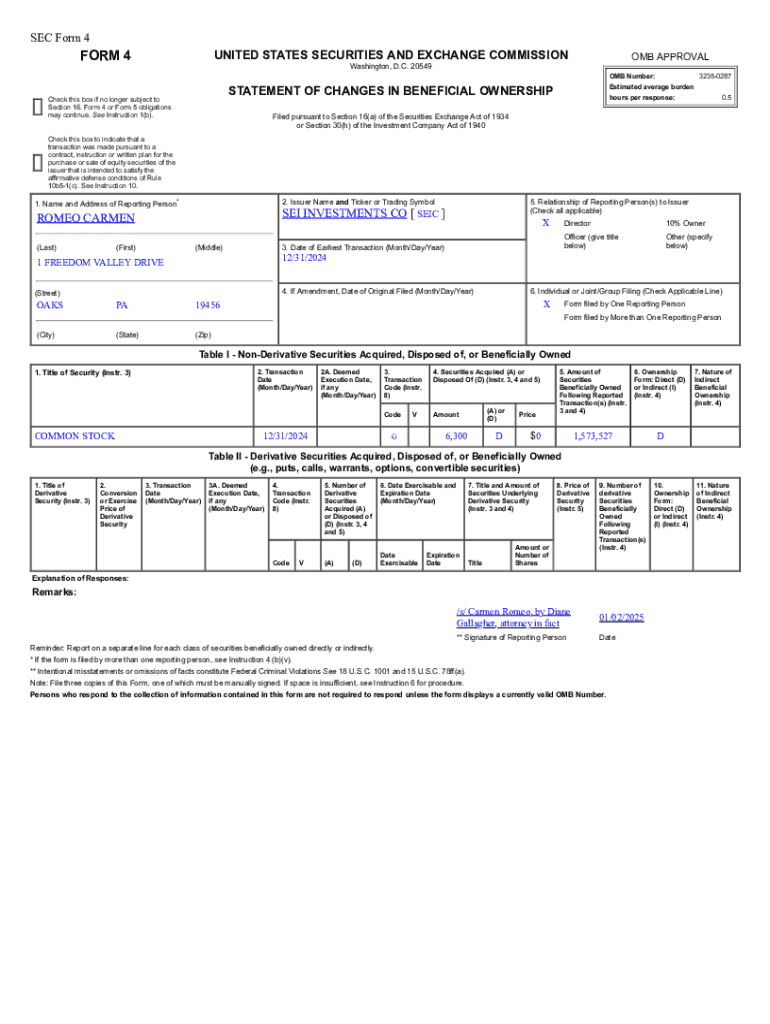

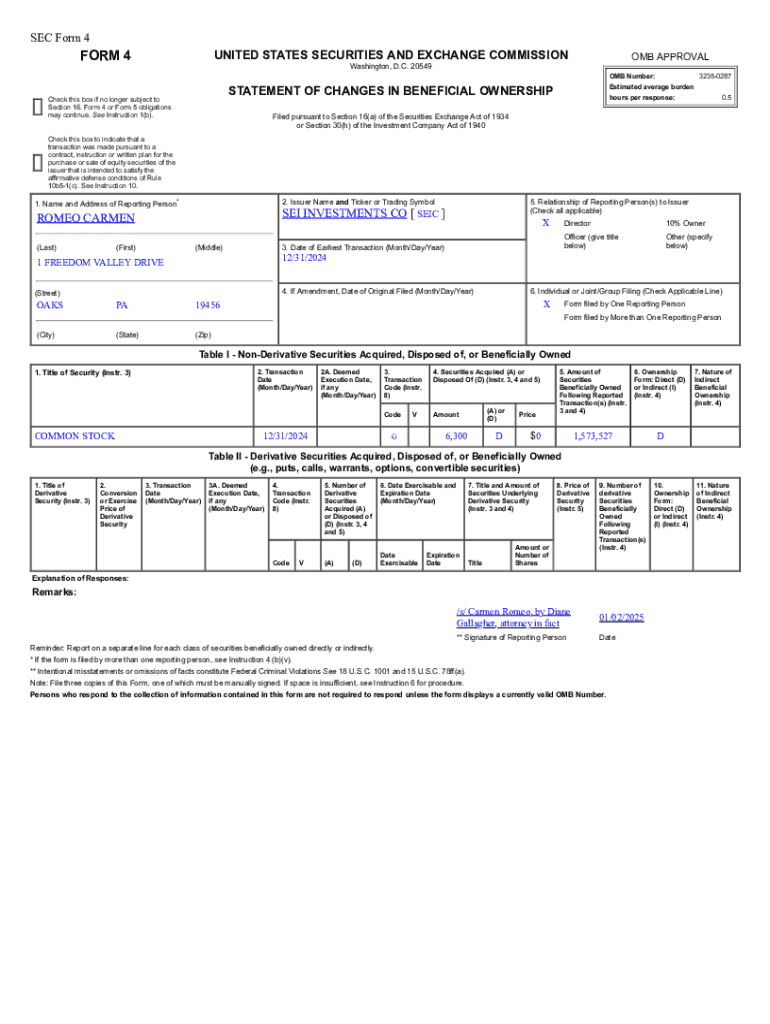

SEC Form 4 is a crucial document used in the realm of corporate finance, providing significant insights into insider trading activities. This form is specifically designed for executives, directors, and beneficial owners of a company’s securities to report changes in their ownership interests. Primarily, it serves to disclose any transactions involving the purchase or sale of company stock and must be filed with the Securities and Exchange Commission (SEC) within two business days of a transaction.

The key players involved in SEC Form 4 are insiders who hold positions of influence in a company, the companies themselves, and the SEC, which regulates and enforces securities laws. By mandating the filing of Form 4, the SEC aims to protect investors and maintain fair market conditions through enhanced transparency.

Importance of SEC Form 4 in market transparency

The importance of SEC Form 4 extends beyond compliance; it plays a pivotal role in maintaining investor trust and market integrity. By requiring insiders to disclose their stock transactions, this form allows investors to make informed decisions based on the actions of those at the helm of the company. When insiders buy shares, it typically signals confidence in the company’s prospects; conversely, insider selling can raise red flags about a company’s future.

Additionally, the implications of Form 4 filings on stock price movements and trading decisions are profound. Investors often react to insider activities, leading to increased volatility and price changes. Analyzing Form 4 data can thus offer valuable insights into market trends and help investors identify profitable trading opportunities.

Key aspects of SEC Form 4

Not every individual is required to file SEC Form 4; only designated insiders need to do so. This includes executives, company directors, and any shareholders owning more than 10% of a company's stock. These designated individuals must file Form 4 whenever there is a transaction that that involves buying or selling of shares.

The conditions under which filing is obligatory generally involve transactions where insiders engage in buying or selling securities, as well as in scenarios involving options or other equity-related instruments. It is crucial for these insiders to be aware of their filing obligations to avoid potential penalties from the SEC.

What information is included in SEC Form 4?

SEC Form 4 includes several key pieces of information crucial for maintaining transparency. Firstly, it details personal information about the insider, including their name, address, and role within the company. Next, it specifies the transaction date, type (purchase or sale), and the amount of securities involved, helping to track insider activity closely. Finally, the form indicates the insider's aggregate ownership post-transaction, enabling a clear view of how much of the company insiders hold after their trading activities.

Such transparency is vital, as it allows investors to see the level of confidence insiders have in their company's future. A high level of insider holdings post-transaction might suggest a positive outlook, while significant selling could potentially indicate underlying issues.

Filling out SEC Form 4: A step-by-step guide

Filling out SEC Form 4 may seem daunting, but it can be straightforward if you follow these steps. First, gather all necessary information. You'll need identification details about the insider such as their full name, address, and title within the company. Details regarding the security involved are also important, including the class of securities, and specifics about the transaction such as the date and price.

The next step is filling out each section of the SEC Form 4 accurately. Start with the personal information section, followed by the transaction details, including the number of shares bought or sold and the type of transaction (e.g., exercise of option). Once filled out, the insider or representative must sign the form and ensure timely submission to the SEC to avoid any compliance issues.

Common mistakes to avoid

While filling out SEC Form 4, there are common pitfalls that insiders should avoid. Incomplete information is a frequent issue; ensure all required fields are filled out accurately. Missing details can lead to misunderstandings or, worse, penalties from the SEC for non-compliance. Additionally, being aware of the filing deadlines is crucial. Late submissions can invite scrutiny or sanctions, which could harm an insider's reputation as well as investor trust.

Filing options for SEC Form 4

There are primarily two avenues for filing SEC Form 4: online through the SEC’s EDGAR system or via third-party filing services. Filing online through the EDGAR system is the most direct way to ensure timely and correct submission. It requires creating an account and following specific instructions for uploading the form.

For those who prefer a more user-friendly experience, numerous third-party services offer filing assistance. These services often provide platforms that simplify the form completion process and ensure compliance. However, while using third-party services can save time, it's important to research and choose a reputable service.

Online filing through SEC’s EDGAR system

To file SEC Form 4 online through the EDGAR system, start by creating an EDGAR account. Ensure your security access is up-to-date, as filings must comply with the SEC's technical requirements. Once logged in, navigate to the filing section where you can upload your form. Make sure to follow the instructions meticulously to prevent errors that may result in filing rejections.

EDGAR allows for real-time access and tracking of submitted filings, which is beneficial for maintaining updates on compliance activities. Knowing the system's requirements is essential for a successful filing.

Filing via third-party services

Using third-party filing services can alleviate the complexities associated with SEC Form 4. These platforms typically offer user-friendly interfaces and assist with compliance checks, which can be especially beneficial for companies that lack dedicated compliance teams. However, fees associated with these services can vary, and users should assess the pros and cons before making a decision.

Advantages of using third-party services include reduced administrative burden and enhanced accuracy, as these providers often specialize in regulatory filings. It's wise to verify their credibility by checking user reviews and ensuring they comply with SEC guidelines.

Monitoring SEC Form 4 filings

Access to SEC Form 4 filings is readily available through the EDGAR database, allowing investors and analysts to track insider activity in real-time. By regularly monitoring these disclosures, one can gauge trends in insider trading and ownership changes, which can inherently impact investment decisions. The EDGAR database is user-friendly, yet investors often resort to alternative platforms that provide enhanced analytics and tracking features.

Utilizing analytical tools can also aid investors in interpreting the nuances of Form 4 filings. Features such as alert systems or dashboards tailored to track specific insiders or companies can provide invaluable insights into market sentiment and potential stock movements.

Understanding insider trading trends

Insider trading trends gleaned from Form 4 filings can offer actionable insights into the market. By evaluating the frequency and nature of insider trades, investors can assess the confidence levels of executives and directors in their companies. High levels of insider buying may suggest a positive outlook, whereas consistent selling could indicate broader concerns. Utilizing metrics such as net insider trading activity can provide a comprehensive view of ownership trends.

Analytics tools can further allow users to evaluate the performances of stocks in conjunction with insider trading patterns. This data can serve as an essential resource for making strategic investment decisions, with the potential for identifying lucrative opportunities in alignment with insider sentiment.

Related SEC filings to be aware of

Understanding SEC Form 4 requires a broader context of related filings that serve similar purposes. SEC Form 3, for example, is the initial ownership report that must be filed by insiders when they initially acquire their shares. This form is crucial as it establishes a baseline for future transactions reported on Form 4.

In addition, SEC Forms 13D and 13G are important filings for shareholders, allowing those who own a significant portion of a company to disclose their ownership and intentions. Understanding the distinctions between these forms helps investors place insider trading activities into a comprehensive context, ultimately enhancing their analytical abilities.

Frequently Asked Questions about SEC Form 4

When it comes to SEC Form 4, several questions frequently arise. One common inquiry is: What happens if I miss the filing deadline? Delays in filing can lead to penalties, including fines imposed by the SEC, which can tarnish an insider's reputation. Therefore, it’s crucial for insiders to be diligent about timely submissions.

Another common concern revolves around amending an SEC Form 4 filing. If there are errors in a submitted Form 4, the insider can submit an amended form detailing the correct information. Being proactive about corrections is essential for maintaining transparency with the SEC and the investing public.

Lastly, many wonder how SEC Form 4 affects stock market predictions. By analyzing trends tied to insider trading activity, investors can derive insights that may indicate future stock performance. A pattern of buying or selling shares by executives often correlates with anticipated corporate developments.

Utilizing pdfFiller for SEC Form 4 management

pdfFiller offers an intuitive platform tailored for those managing SEC Form 4 filings. By utilizing pdfFiller, individuals and teams can benefit from seamless editing and eSigning capabilities that enhance efficiency and accuracy in completing this important form. The platform's cloud-based nature allows users to access forms anytime, anywhere, making it ideal for busy professionals.

Collaboration tools also enable teams to work together effectively on multiple filings, ensuring all pieces of information are synchronized and complete. The interactive features provided by pdfFiller improve user experience further, helping insiders navigate the often complex world of SEC filings with ease, thereby maintaining compliance effortlessly.

Conclusion

SEC Form 4 is an integral component of maintaining market transparency and supporting investor trust. By understanding its purpose, filing requirements, and how to effectively monitor filings, insiders can not only comply with SEC requirements but also leverage insider information responsibly. Comprehensive tools like those offered by pdfFiller facilitate this process, empowering users to manage their SEC Form 4 filings with confidence and precision.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sec form 4 for eSignature?

Can I create an electronic signature for signing my sec form 4 in Gmail?

How do I edit sec form 4 straight from my smartphone?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.