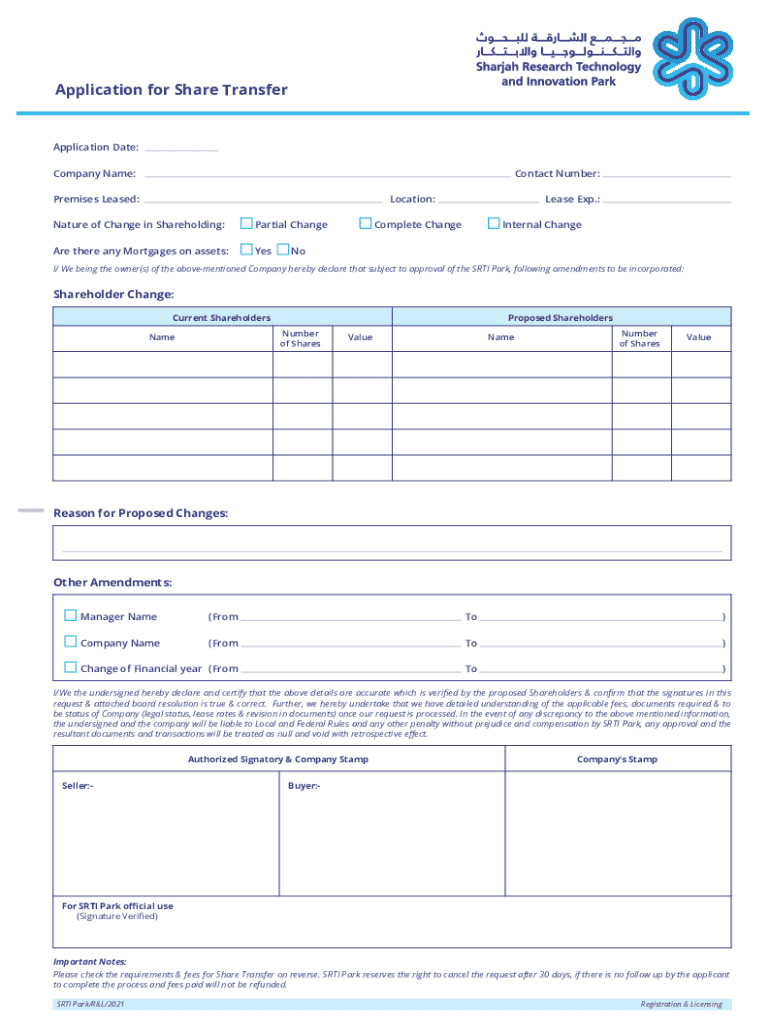

Get the free Application for Share Transfer

Get, Create, Make and Sign application for share transfer

How to edit application for share transfer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for share transfer

How to fill out application for share transfer

Who needs application for share transfer?

Application for Share Transfer Form: A Comprehensive Guide

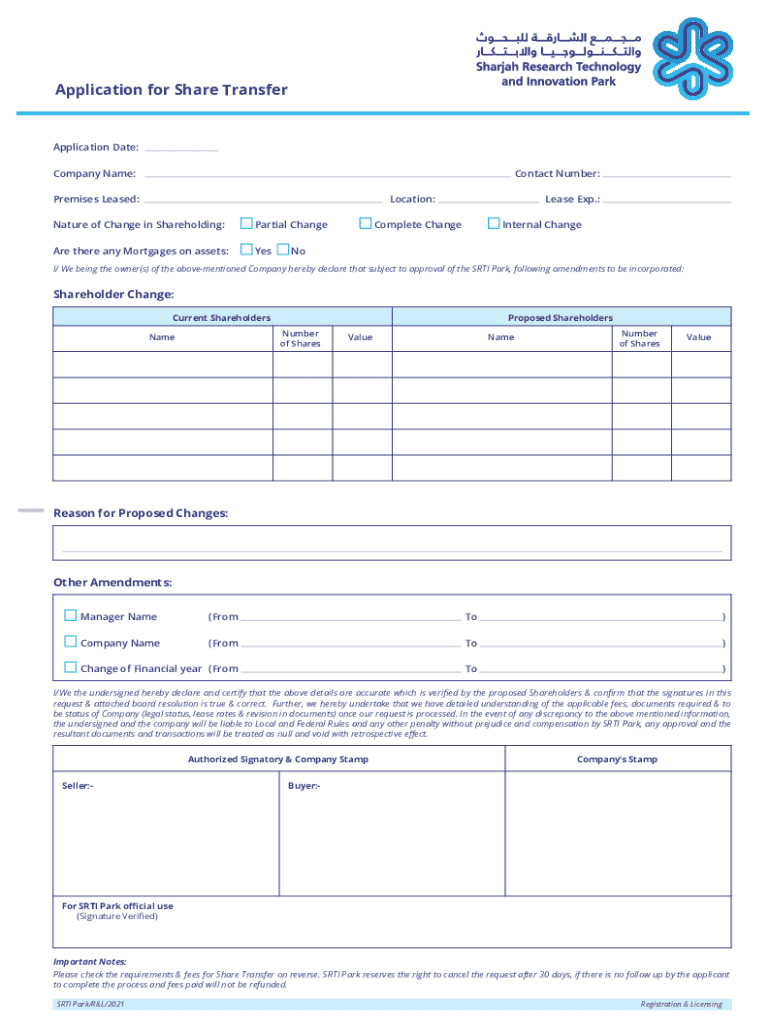

Understanding the share transfer process

Share transfer refers to the process in which ownership of shares in a company is transferred from one party to another. This can occur for various reasons, including sale, gift, or inheritance. Regardless of the purpose, a share transfer requires proper documentation to ensure a legal transfer of ownership is recognized by the company and relevant authorities.

Proper documentation is crucial as it affects the rights of shareholders and legal standing of the transfer. When shares change hands, it's essential that all parties involved—the seller, the buyer, and the company—are aware of their responsibilities and rights. Each has a distinct role in the transaction, with sellers needing to provide accurate information and buyers ensuring proper understanding of what they are acquiring.

Essential components of a share transfer application

Completing the application for share transfer form requires attention to several key components. The form typically requests detailed information about the shareholder, including full name, address, and contact details, alongside identification verification. Additionally, specifics about the shares being transferred, such as the number of shares and their value, are vital to ensure the transaction's accuracy.

The form necessitates signatures and dates from all involved parties to confirm their agreement to the terms outlined. It's common for individuals to overlook fields or provide incomplete details, leading to delays or complications during the approval process. Careful attention to detail can help avoid these pitfalls.

Step-by-step guide to completing the application for share transfer form

Starting the application for share transfer form can be straightforward if you follow a few simple steps. The first step involves gathering all necessary information, which includes identification documents such as passports or driver’s licenses, and the original share certificates that will be transferred.

Next, fill out the form by providing accurate and comprehensive details in each section. This includes personal information of the transferor and transferee, as well as specific share details. After populating the form, ensure you review and verify all the information provided. Finalize the submission by choosing a method—either online or offline—and ensure to keep copies of all submitted documents for your records.

Interactive tools for simplifying share transfer management

Managing share transfers has become significantly easier thanks to digital tools available today. For users seeking a seamless solution, pdfFiller offers features that allow customization and editing of the application for share transfer form. You can fill your document online, ensuring all details are correct before finalizing.

Furthermore, pdfFiller supports real-time collaboration. This means multiple people can work on the document simultaneously, providing instant feedback and making adjustments live. To streamline approvals, utilize the eSignature integration, allowing parties to authenticate the transfer with a few clicks, expediting the process.

Understanding legal considerations related to share transfers

Engaging in share transfers isn't merely a matter of filling out forms; numerous legal regulations govern these transactions. Familiarity with relevant legislation and compliance requirements is essential to ensure that transfers are executed legally. It is crucial to consider consulting with legal counsel, especially in high-value transfers, as the implications of errors can lead to significant financial repercussions.

The potential consequences of improper share transfers can include legal disputes, taxation issues, or even the annulment of the transfer altogether, resulting in loss of funds and time. Thus, understanding these components not only contributes to a smoother transfer process but also minimizes risk for all parties involved.

Specific scenarios for using the share transfer application

While the application for share transfer form serves a general purpose, its application can vary widely across different scenarios. For instance, share transfers between family members might focus less on valuation and more on familial circumstances. Such transfers may also involve reduced documentation, depending on the tax implications and state laws.

Another significant scenario is estate planning, where shares may be transferred as part of a will or trust structure. In corporate finance, transfers can form a part of mergers and acquisitions, requiring more rigorous documentation and compliance checks. Each situation carries unique responsibilities that necessitate careful consideration of the specific requirements pertinent to those transfers.

Tax implications of share transfers

When engaging in share transfers, it's vital to be aware of the tax implications that may arise. Specifically, selling shares could trigger capital gains tax, a tax levied on the profit when capital assets are sold. The specifics of this tax can differ widely based on factors such as how long the shares have been held and the individual or corporation's overall tax situation.

Moreover, certain exemptions exist for small business stocks under Section 1202, allowing some investors to avoid capital gains taxes under specific circumstances. Staying informed about potential tax liabilities and exemptions is critical, as it informs your financial strategy during the transfer.

Sample share transfer agreement

Creating a sample share transfer agreement can streamline the process of transferring shares. This agreement typically includes critical components such as the names of the transferor and transferee, the number of shares, the purchase price, and the date of the transfer. Utilizing a structured agreement helps clarify terms for all parties and creates a legal document that can protect your interests.

You can leverage a sample agreement as a template, modifying it to suit specific situations or conditions agreed upon. It's advisable to ensure that any modifications align with local legal standards and best practices to maintain validity.

Managing and tracking shares post-transfer

Post-transfer management of shares is crucial to ensure that records are updated, and all relevant stakeholders are aware of ownership changes. Best practices for record-keeping should involve maintaining an organized file of transfer documents and any correspondence related to the transaction. Creating a digital archive can also help in quick retrieval and referencing in the future.

Various apps and platforms now exist that facilitate the continual management of shares, enabling you to monitor share performance, dividends, and any necessary actions regarding your stock portfolio. Regular reviews and updates to your records can help prevent discrepancies, ensuring that all documentation accurately reflects the current share ownership structure.

FAQs about the application for share transfer form

Many individuals have questions regarding the application for share transfer form, given the intricacies involved in the process. Common queries often revolve around understanding the required documentation and the timeline for expected approvals from the relevant companies. Users might also face issues during submission, such as format discrepancies or missing signatures, which can hinder the approval process.

If you're experiencing difficulties while submitting your share transfer application, don't hesitate to reach out to support services offered by platforms like pdfFiller. Their support staff are trained to assist with any issues that may arise, helping you navigate challenges effectively.

Exploring future share management and issuance

If interested in expanding your shareholding capabilities, understanding the procedure for issuing new shares is fundamental. This includes knowledge of compliance requirements, the type of shares to be issued, and strategies for management of existing shareholder relationships. It ensures that new issuances are aligned with ongoing business objectives and regulatory standards.

Effective management of existing shareholders is also vital. Maintaining open channels of communication, providing regular updates on company performance, and accurately reflecting shareholders’ interests in any new share issuance can foster loyalty and reduce potential disputes in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send application for share transfer for eSignature?

How can I get application for share transfer?

Can I create an electronic signature for the application for share transfer in Chrome?

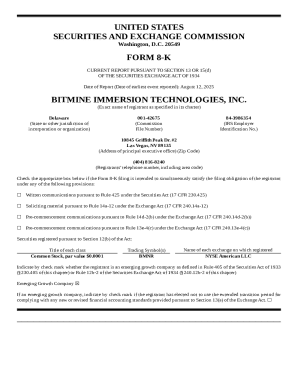

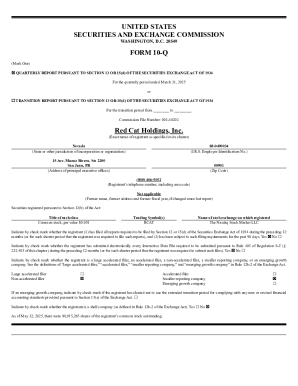

What is application for share transfer?

Who is required to file application for share transfer?

How to fill out application for share transfer?

What is the purpose of application for share transfer?

What information must be reported on application for share transfer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.