Get the What is an LLC Annual Report? (+ Free Template)

Get, Create, Make and Sign what is an llc

How to edit what is an llc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out what is an llc

How to fill out what is an llc

Who needs what is an llc?

What is an Form? A Comprehensive Guide for Business Owners

Understanding the form

An LLC, or Limited Liability Company, is a popular business structure that combines elements of both corporations and partnerships. It provides LLC members— the owners of the company—limited liability protection, which means that their personal assets are generally shielded from business debts and legal claims. This structure is particularly appealing to small and medium-sized enterprises due to its flexibility and straightforward management.

Understanding the LLC form is crucial for entrepreneurs as it delineates their business's legal identity. By completing an LLC form, business owners not only formalize their operations but also gain various advantages, including tax benefits and a more reputable position in the marketplace. As the business landscape becomes increasingly competitive, using the LLC structure can set a foundation for longevity and credibility.

Benefits and drawbacks of an

Forming an LLC comes with significant benefits that can drive the growth and sustainability of a business. The ability to shield personal assets from business debts is one of the most critical advantages. This separation means that if the LLC faces lawsuits, creditors cannot pursue the personal assets of its members. Additionally, LLCs have flexible tax classifications; they can opt to be taxed as a sole proprietorship, partnership, or even a corporation, allowing them greater liquidity in income management.

However, forming an LLC is not without its challenges. One major drawback is the variability in state regulations, which can complicate the formation process. Each state has different requirements for LLCs, and navigating these can be burdensome for new entrepreneurs. Furthermore, while LLCs can enjoy advantageous tax treatment in many states, some jurisdictions may impose higher taxes on LLC income. Finally, LLCs might encounter limitations when it comes to raising capital; for instance, attracting venture capital is often easier for corporations than for LLCs due to their structural format.

The step-by-step process to create an

Creating an LLC involves several key steps, each crucial to ensuring that the business is set up correctly and legally. The first step is choosing a unique name for your LLC. This name must be distinguishable from existing businesses registered in your formation state and typically must include 'LLC' or 'Limited Liability Company' in the title. A compelling name not only impacts branding but also plays a role in the legal establishment of your business.

Next, you'll need to select a registered agent. This person or business will receive legal documents on behalf of the LLC. Choosing a qualified registered agent is essential, as they ensure that important correspondence is delivered accurately and in a timely manner. After this, the next critical step involves filing the Articles of Organization, the formal document that officially establishes your LLC's existence. This includes essential information such as the business name, address, and the registered agent's details.

Drafting an operating agreement is another vital step in the LLC formation process. Although not mandatory in all states, it outlines the ownership and management structure of the LLC, detailing each member's roles and responsibilities. Lastly, it is essential to obtain any necessary licenses and permits, which can vary significantly depending on the nature of the business and the state in which you operate.

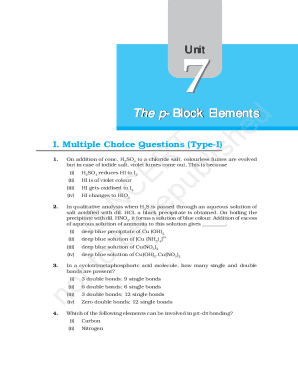

types and their specific forms

There are several types of LLCs, including Single-Member LLCs and Multi-Member LLCs. A Single-Member LLC is owned by one individual, providing simplicity and ease of management. It is particularly popular among individual entrepreneurs. On the other hand, a Multi-Member LLC includes two or more members and allows for more diverse expertise and investment capabilities, though it requires more complex management agreements.

Another type is the Series LLC, which lets a single LLC establish multiple separate entities or series under one umbrella. This structure is advantageous for businesses that want to manage several projects or properties without creating multiple LLCs. Lastly, a Professional LLC (PLLC) is designated for licensed professions, such as medical or legal practitioners, allowing them to operate with limited liability while maintaining compliance with state licensing rules.

vs. other business structures

When considering what an LLC form is, it’s also essential to compare it with other business structures like corporations, partnerships, and sole proprietorships. The key difference between an LLC and a corporation lies in liability and taxation. While corporations provide similar liability protection, they face stricter regulations and tax requirements, meaning they might not be as advantageous for small businesses. LLCs provide more flexible management roles, unlike the often rigid hierarchy seen in corporations.

When comparing an LLC with a partnership, one significant distinction is that an LLC limits personal liability, while partners in a partnership can be personally liable for business debts. This could expose partner assets to risk, making the LLC a safer choice for many entrepreneurs. Also, a sole proprietorship lacks the liability protection that an LLC offers, which makes it a less attractive option for those wishing to shield personal assets while conducting business.

How to file and submit your form

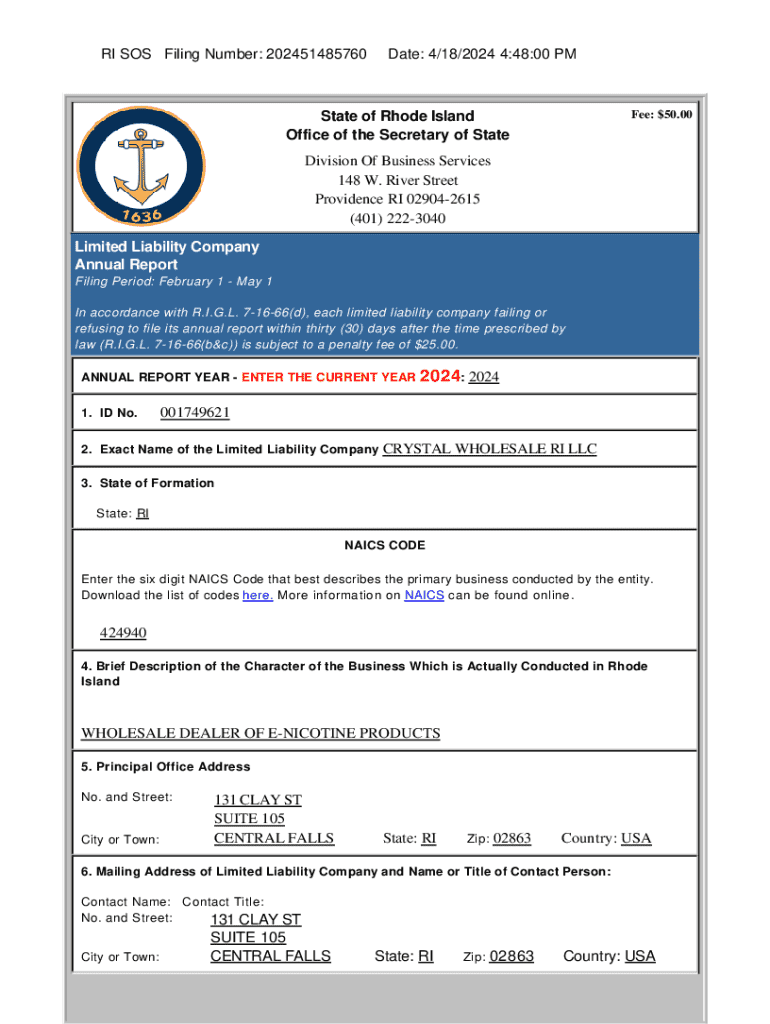

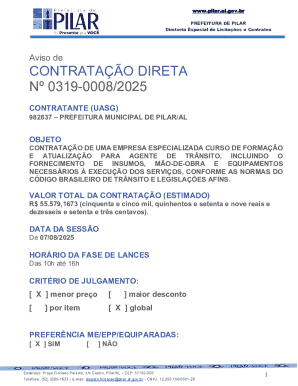

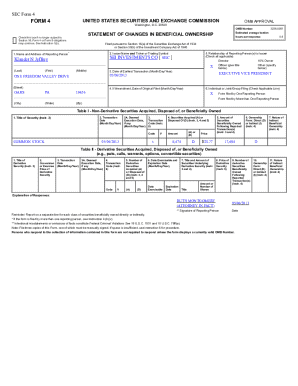

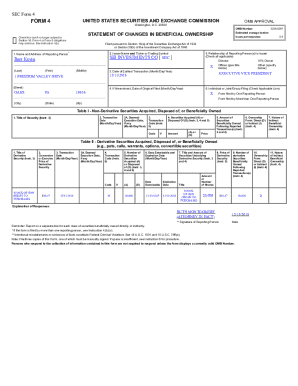

Filing your LLC form is a crucial step in establishing your business. The process generally involves completing the Articles of Organization and submitting them to your state's Secretary of State office. Many states permit online filings, which can streamline the process considerably. However, whether you choose to submit online or in-person, ensuring compliance with state laws is paramount. Each state has unique requirements, so checking local guidelines is essential.

Once you've submitted the forms, remember to check for any specific post-filing requirements such as fee payments or additional documentation. To avoid delays, carefully review your filings for any mistakes. Common pitfalls include inaccuracies in the business name, failure to include the registered agent information, and not adhering to state-specific formatting guidelines. Taking the time to review your documents can save you considerable time and frustration later.

Maintaining your form after creation

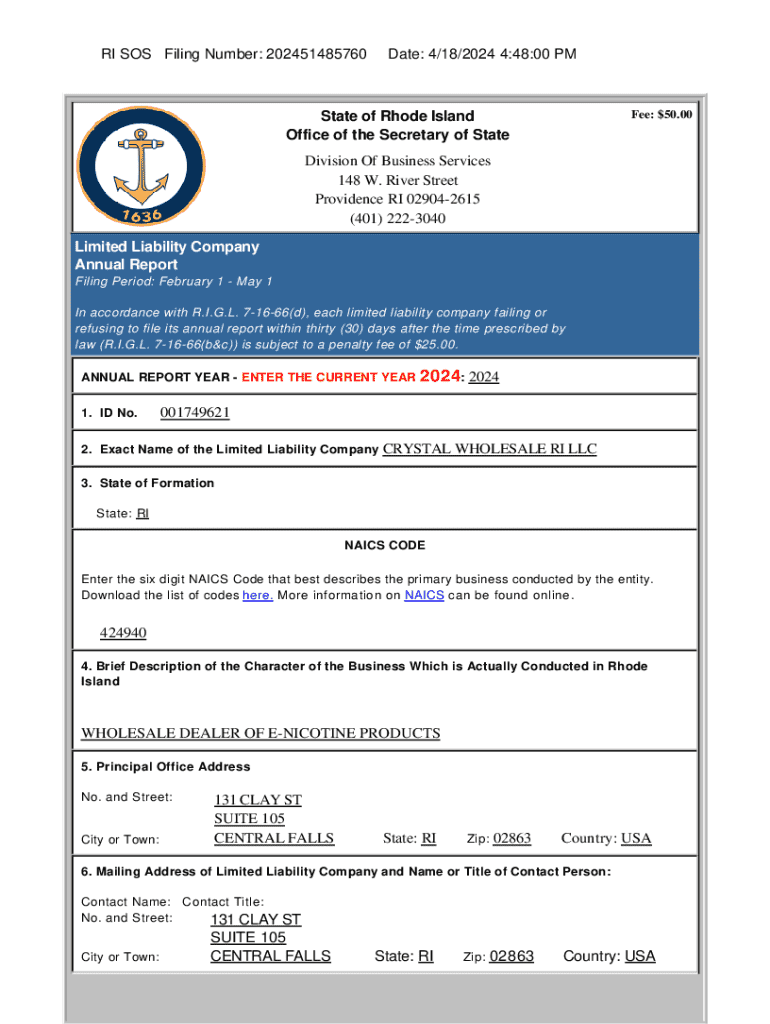

Once your LLC is established, it's important to maintain good standing by adhering to state regulations. One key aspect of this is filing annual reports, which typically include updates about business address, ownership changes, and other relevant details. Many states require an annual fee as well; neglecting these obligations can lead to penalties or even the dissolution of your LLC.

Additionally, it's essential to keep your LLC operational and well-managed. This includes holding regular meetings, maintaining clear records of decisions made, and updating the operating agreement as necessary. If your LLC experiences changes in membership, structure, or operations, adjustments must be documented accordingly. Staying proactive in managing these aspects will help ensure that your LLC continues to thrive.

FAQs

As with any business structure, questions around LLCs abound. Entrepreneurs often wonder about the feasibility of forming an LLC after establishing a sole proprietorship or if they can convert a partnership into an LLC for added liability protection. Clarifications on ongoing costs, such as franchise taxes and annual fees, are also common inquiries. Additionally, many people are misinformed about LLCs, believing they are overly complex or unnecessary for small businesses, when in reality, they can be quite beneficial.

Additional insights on management and growth

Managing an LLC effectively requires organization and proactive practices. Tools like pdfFiller are instrumental in this aspect, providing users the ability to edit PDFs, eSign documents, and collaborate efficiently. This cloud-based platform simplifies document management, ensuring that important papers, such as operating agreements and tax forms, are easily accessible and securely stored. Budding entrepreneurs can leverage such tools to streamline their workflow and focus on business growth.

Continual education about LLC operations is also invaluable. Engaging with resources, webinars, and professional advice can keep you informed about any industry changes, tax laws, or regulations that may affect your LLC. Staying educated ensures that you are making the best choices for your LLC’s progress, competitive positioning, and compliance efforts.

Related topics to explore

While forming an LLC is a significant step, it is just one part of the broader business journey. Entrepreneurs should consider exploring business taxes specifically applicable to LLCs, including the implications of self-employment taxes. Additionally, those considering scalability might research transitioning from an LLC to a corporation as a business grows. Financial strategies for securing funding within an LLC framework are also important to address for long-term viability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit what is an llc from Google Drive?

How do I edit what is an llc online?

How do I fill out the what is an llc form on my smartphone?

What is an LLC?

Who is required to file an LLC?

How to fill out an LLC?

What is the purpose of an LLC?

What information must be reported on an LLC?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.