Get the free Stock/share Transfer Form

Get, Create, Make and Sign stockshare transfer form

How to edit stockshare transfer form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out stockshare transfer form

How to fill out stockshare transfer form

Who needs stockshare transfer form?

Understanding the Stock Share Transfer Form

Understanding stock share transfers

A stock share transfer refers to the process through which ownership of shares in a company is changed, whether through sale, gift, or other means. This transaction is critical for maintaining accurate records of ownership and ensuring that the rights associated with share ownership, such as voting and dividend rights, are properly assigned.

The importance of stock share transfers goes beyond mere ownership changes. They play a significant role in corporate governance and can influence share price and market perception. Moreover, understanding the dynamics of stock transfers is vital for both individual shareholders and corporate entities.

The mechanics of transferring stock shares

Stock transfers can be categorized into two main types: voluntary and involuntary transfers. Voluntary transfers occur when a shareholder decides to sell or gift their shares to another party. This includes market transactions or personal gifts. In contrast, involuntary transfers involve circumstances beyond the owner's control, such as court orders or enforced shareholder agreements.

Legal requirements for stock share transfers vary by jurisdiction but generally include adherence to securities regulations, such as those mandated by the SEC. These regulations are designed to ensure transparency and protect all parties involved, preventing fraudulent transfers and ensuring compliance with corporate bylaws.

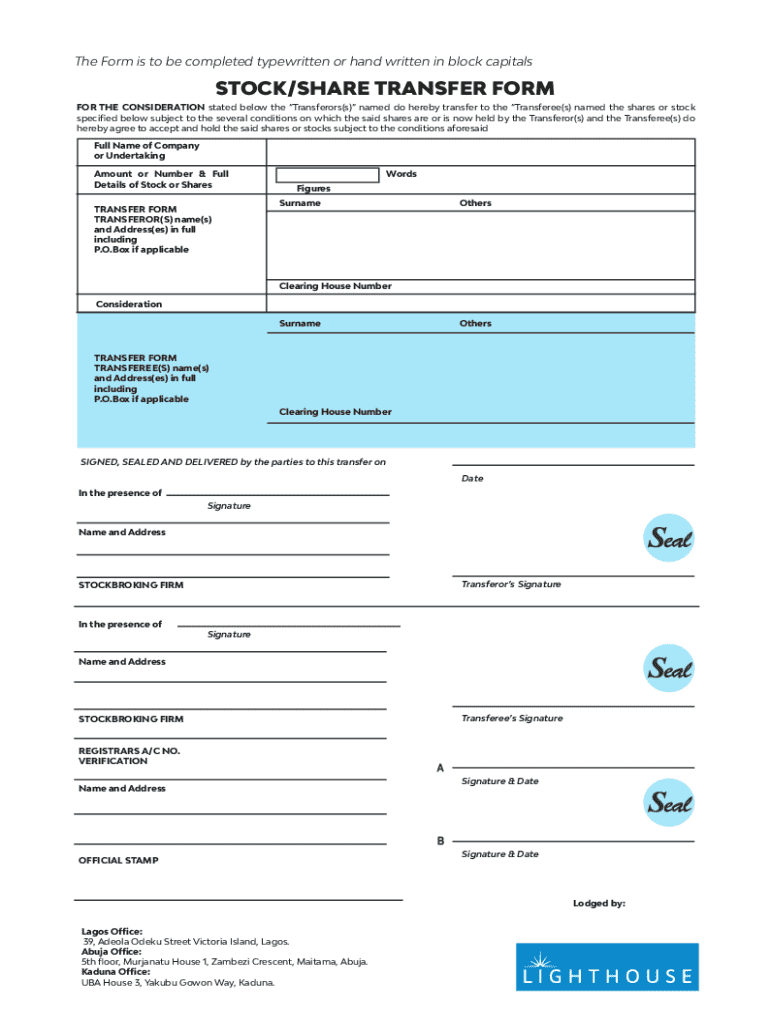

Preparing the stock share transfer form

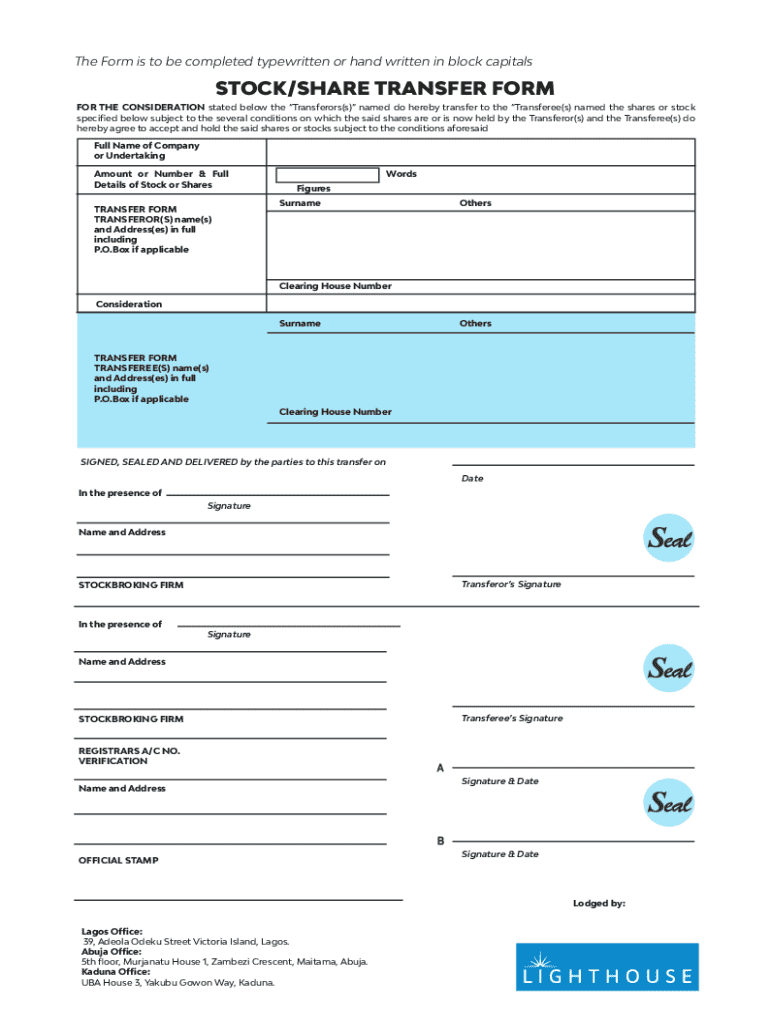

When preparing a stock share transfer form, certain key elements must be included. These particulars typically involve the full names and addresses of both the seller and buyer, the number of shares being transferred, and details about the shares themselves, such as the class or type of stock.

Additional required documentation may include original stock certificates, identification, and possibly a shareholder agreement. Choosing the right form is also crucial, as different shares (common vs. preferred) may necessitate different types of share transfer forms, ensuring the transfer is legally valid.

Step-by-step instructions for filling out the stock share transfer form

Filling out the stock share transfer form requires careful attention to detail. Starting with seller information, the seller's full legal name and address must be accurately provided. For the buyer, similar information is needed, ensuring that both parties are clearly identifiable.

Next, it’s crucial to specify the shares being transferred. This includes stating the class and the exact number of shares. Equally important is the signature section, where both parties must sign and date the form, indicating their agreement and acknowledgment of the transfer.

Common mistakes when filling out the transfer form often include incorrect names, insufficient details about the shares, and missing signatures. Avoiding these errors is essential for a smooth transfer process.

Finalizing the transfer

Once the stock share transfer form is completed, the next step is submitting it to the appropriate authority, typically the corporation’s secretary or registrar. Ensuring that the form is correctly filed is paramount to effectuate the transfer legally.

It’s also important to notify relevant parties about the transfer, including other shareholders and the board of directors, to maintain open communication and transparency. After the transfer is processed, updating company records is vital; this involves revising the stock ledger and any other pertinent corporate documentation.

Taxes and fees associated with stock transfers

Stock share transfers can have tax implications, notably capital gains tax, which may apply if shares are sold for a profit. Understanding these implications is critical for both sellers and buyers to avoid unexpected tax burdens.

Additionally, exemptions do exist, such as those for small business stocks, which can provide significant tax relief under specific conditions. It’s vital for shareholders to familiarize themselves with these potential exemptions to optimize their financial strategies.

Beyond taxes, other fees may apply in processing the transfer. These can include administrative fees imposed by the corporation or registrar for updating records and providing documentation.

Example of a stock share transfer agreement

A stock share transfer agreement can outline the terms and conditions governing a complex transfer. Key components typically include identification of the parties involved, a detailed description of the shares being transferred, and the price or consideration for the transfer, if applicable.

To customize this agreement for specific circumstances, it's recommended to tailor language that reflects the unique conditions of the deal. Providing additional clauses, such as confidentiality or dispute resolution, may also enhance the agreement, ensuring all parties' interests are protected.

Utilizing technology for efficient document management

Utilizing digital tools like pdfFiller can significantly streamline the stock share transfer form process. This platform allows users to easily edit, sign, and manage their documents electronically, enhancing accessibility and efficiency.

The platform offers interactive tools and features such as pre-designed templates and cloud storage options that facilitate collaboration among parties involved in the transfer process. These features help ensure that all documentation is accurate, timely, and easily retrievable.

Next steps after completing the transfer

After finalizing the stock share transfer, tracking the transfer status is essential to ensure it has been successfully recorded. This can typically be done by consulting with the transfer agent or corporate secretary to confirm the details.

Maintaining comprehensive records post-transfer is vital. Not only does this ensure compliance with regulations, but having accurate records can also provide reference for future transactions and allow shareholders to track their investments effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the stockshare transfer form electronically in Chrome?

Can I create an eSignature for the stockshare transfer form in Gmail?

Can I edit stockshare transfer form on an iOS device?

What is stockshare transfer form?

Who is required to file stockshare transfer form?

How to fill out stockshare transfer form?

What is the purpose of stockshare transfer form?

What information must be reported on stockshare transfer form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.