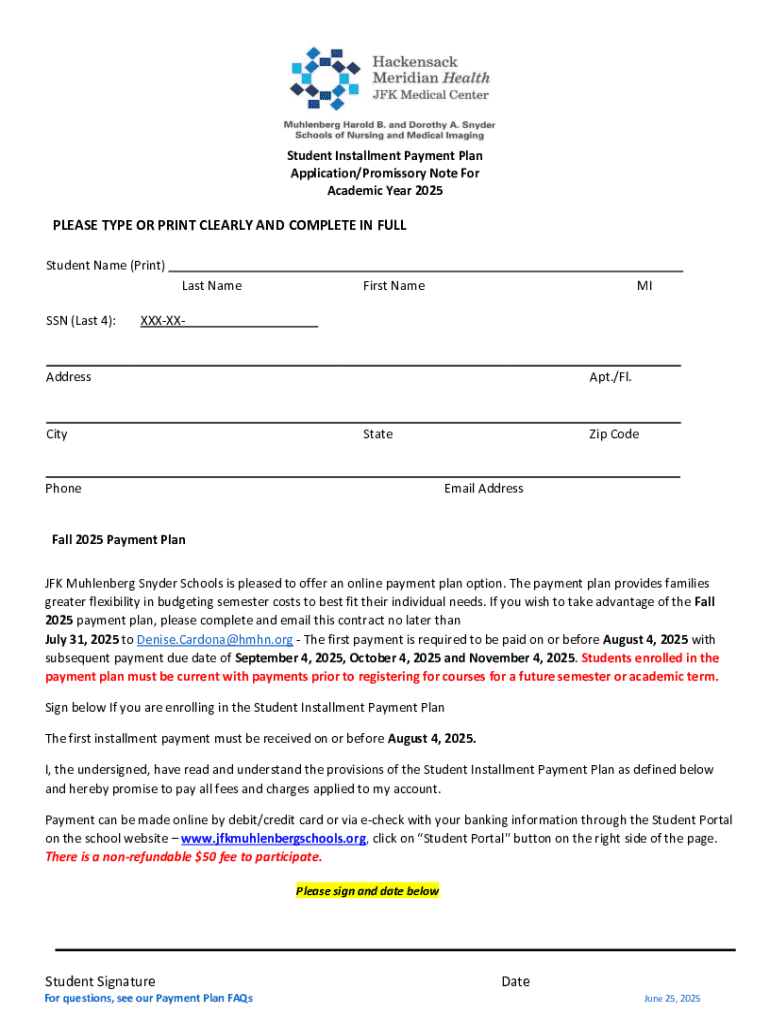

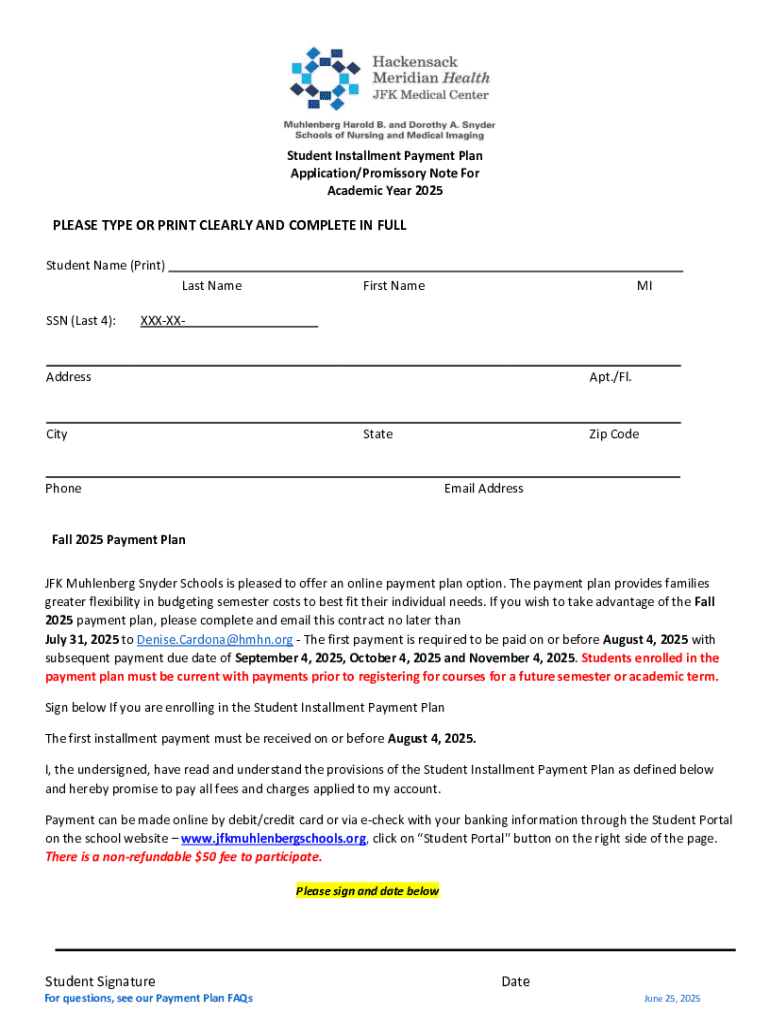

Get the free Student Installment Payment Plan Application/promissory Note

Get, Create, Make and Sign student installment payment plan

How to edit student installment payment plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out student installment payment plan

How to fill out student installment payment plan

Who needs student installment payment plan?

Navigating the Student Installment Payment Plan Form: A Comprehensive Guide

Understanding the student installment payment plan

A Student Installment Payment Plan is a flexible financial option offered by educational institutions that allows students to pay their tuition and fees in manageable installments rather than in a lump sum. This system alleviates the financial pressure that often accompanies the costs of college education. By breaking down payments into smaller, more convenient amounts, students can better manage their budgets and focus on their studies.

The key benefits of utilizing an installment payment plan include enhanced financial flexibility, reduced stress related to upfront payments, and the ability to spread out educational expenses over a semester or academic year. This benefit is particularly appealing for students who may rely on part-time jobs or financial aid packages. Moreover, installment plans typically have fewer fees compared to traditional loan options, making it a practical choice for many students.

Eligibility for enrollment in a student installment payment plan generally requires students to maintain a good academic standing and be officially registered in a degree or certificate program. Specific eligibility criteria may vary by institution, and students are advised to check with their school's financial department for particular requirements.

How the student installment payment plan works

Understanding how the student installment payment plan works is crucial for effective financial planning. The process begins with an application, where students must express their intent to enroll in the payment plan. This often involves completing a dedicated form, which is available through the institution’s website or financial aid office.

1. **Application Process**: Students need to fill out an application form, which may require personal and financial information as well as details about their intended course. It’s essential to apply before the specified deadlines to ensure enrollment.

2. **Payment Schedule**: Once the application is approved, students will receive a payment schedule outlining their installment amounts and due dates. Payments may typically be structured to fall monthly or bi-monthly, depending on the institution’s policies.

3. **Payment Methods**: Institutions often support a variety of payment methods to ease the payment process. Common options include bank transfers, credit and debit card transactions, and sometimes checks. Each institution will indicate the accepted methods clearly in their payment plan guidelines.

Important deadlines, including enrollment periods and payment due dates, should be clearly marked on the official school calendar. Awareness of these deadlines ensures students avoid late fees and disruptions in their academic enrollment.

Completing the student installment payment plan form

Completing the Student Installment Payment Plan form is a crucial step in successfully managing educational finances. Students can typically locate the form on pdfFiller, which provides a user-friendly interface for document management. Students are encouraged to use this platform as it simplifies the form-filling process.

Essential information required to fill out the form includes:

When filling out the form using pdfFiller, students can leverage its editing tools for easy formatting. It’s advisable to review the completed form thoroughly to ensure all details are accurate before submission.

Common questions about the student installment payment plan

Students frequently have questions regarding eligibility and the specifics of the installment payment plan. A common concern is whether students receiving financial aid can still enroll in the payment plan. Generally, this is allowable, and financial aid packages can often be accommodated within the payment structure.

Another question pertains to enrollment in specific programs, such as RN to BSN. Students in specialized programs should consult their program coordinator to understand how the payment plan applies to their specific situation.

Making amendments to an established payment plan can also cause uncertainty. Students can usually request modifications directly through the financial office of their institution, but it’s advised to make changes promptly to avoid complications.

Lastly, students often wonder what happens if they miss a payment. Late payment penalties vary by institution, but most schools offer grace periods or options for catch-up payments. Remaining proactive by contacting the financial services office can help resolve missed payments expediently.

Managing your payment plan with pdfFiller

Managing a student installment payment plan is significantly streamlined through the features offered by pdfFiller. This platform empowers students to collaborate with their financial advisors and family members by securely sharing documents and payment agreements.

Students can leverage the tracking features on pdfFiller to keep tabs on their payments and remaining balance. This clarity can aid in ensuring that payment schedules are adhered to without surprises.

Additionally, pdfFiller’s eSigning function allows users to securely sign their installment payment agreements from anywhere. This feature is particularly beneficial for those juggling multiple responsibilities, as the documentation can be completed on the go.

Troubleshooting common issues

Sometimes, students may experience issues related to their installment payment plans. If a payment doesn’t process, the first step is to verify the payment method and ensure sufficient funds are available in the account linked to the payment.

If there are discrepancies in payment amounts, students should gather documentation of their payment schedule and contact the financial office immediately. Providing clear records will help expedite the resolution of any issues.

In cases where a student may need to withdraw from the payment plan, it’s essential to understand the institution’s withdrawal policy. Most schools require students to formally notify the financial department to initiate the withdrawal process.

Tips for successfully managing your payments

To effectively manage payments under the installment plan, students should adopt sound budgeting techniques. This can include creating a monthly budget that allocates funds specifically for installment payments, minimizing unnecessary expenses.

Setting reminders for payment due dates is crucial in avoiding late fees. Utilizing digital tools such as calendars or apps can help maintain awareness of upcoming payment deadlines.

Students can maximize the utility of pdfFiller’s tools to stay organized, ensuring all documentation related to the payment plan is easily accessible. Keeping digital copies of contracts and correspondence aids in maintaining clear communication about finances.

Conclusion on effective utilization of payment plans

Effective planning and management of finances are integral to a successful college experience. The student installment payment plan represents a valuable option that can help alleviate financial strain during your educational journey. By understanding how to utilize tools like pdfFiller, students can ensure that their documentation process is smooth and their educational expenses are manageable.

Encouraging responsible financial habits and utilizing the resources available will significantly impact a student’s academic and personal growth. With the right planning, students can focus on what truly matters: their education.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify student installment payment plan without leaving Google Drive?

Can I create an eSignature for the student installment payment plan in Gmail?

How do I edit student installment payment plan straight from my smartphone?

What is student installment payment plan?

Who is required to file student installment payment plan?

How to fill out student installment payment plan?

What is the purpose of student installment payment plan?

What information must be reported on student installment payment plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.