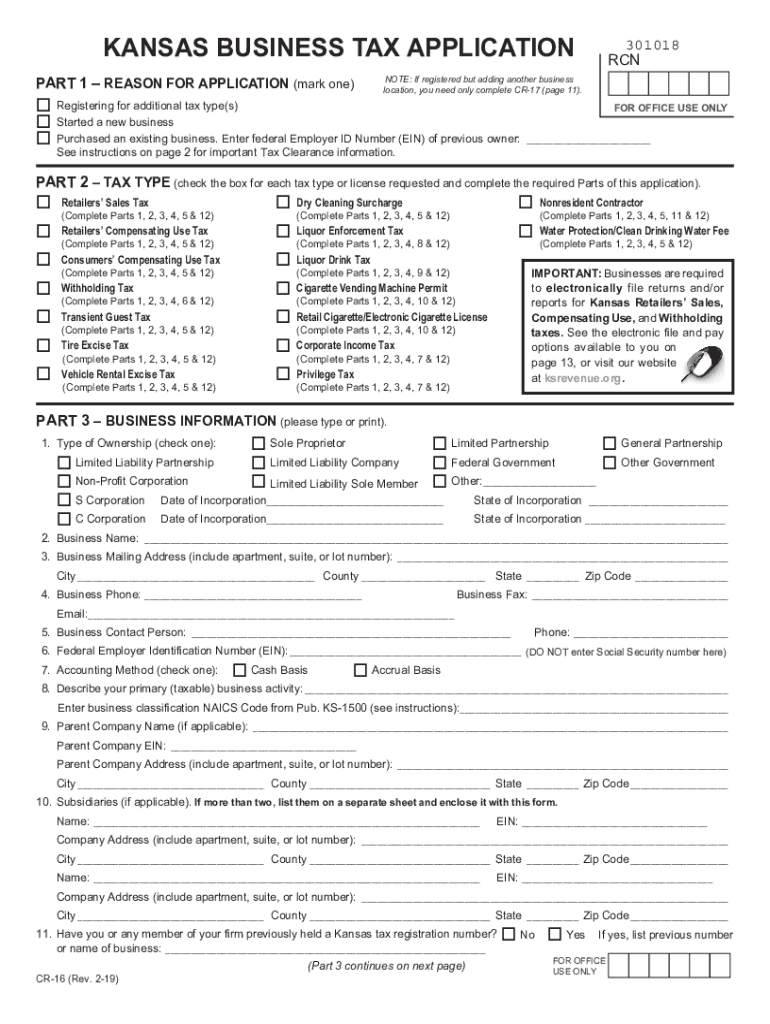

Get the free CR-16 Business Tax Application Rev. 2-19fillable. Business Tax

Get, Create, Make and Sign cr-16 business tax application

How to edit cr-16 business tax application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cr-16 business tax application

How to fill out cr-16 business tax application

Who needs cr-16 business tax application?

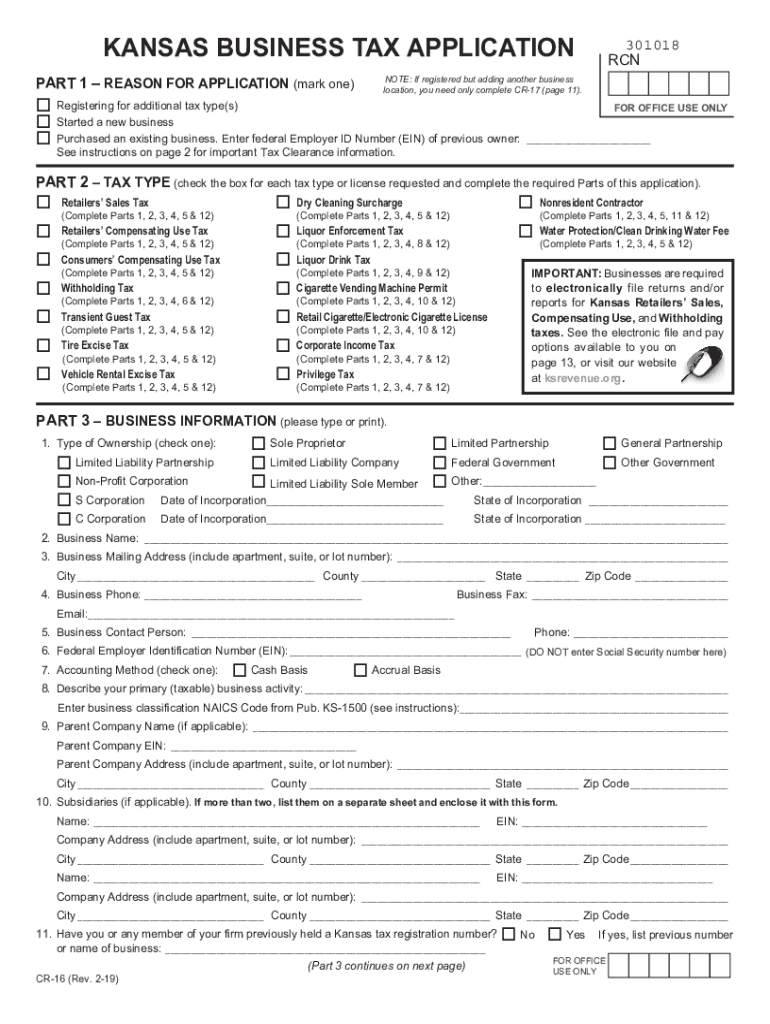

Guide to the CR-16 Business Tax Application Form

Understanding the CR-16 Business Tax Application Form

The CR-16 Business Tax Application Form is a crucial document that enables businesses to register for tax purposes with the state. Primarily designed for tax identification and compliance, this form serves as a means to report essential business details to the tax authorities. Its purpose extends beyond mere paperwork; it establishes your business within the state’s legal framework and tax system.

Completing the CR-16 form is vital for businesses of all sizes, whether you are launching a startup or managing an established corporation. This registration ensures that businesses operate within the legal expectations of their respective states, allowing for compliance with local taxation and revenue laws.

Who needs to fill out the CR-16 form?

Various business entities are required to complete the CR-16 form. Generally, any entity planning to operate a business and generate revenue within the state is eligible. This includes sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each of these structures must declare their intent to do business and comply with tax obligations.

Preparing to complete the CR-16 form

Before diving into the CR-16 Business Tax Application Form, it’s essential to gather all necessary documents and information. This form requires specific paperwork that varies depending on the business structure. Commonly required documents include proof of identity, existing business licenses, and any previous tax filings if applicable. Owners must be ready with business records, such as operating agreements for LLCs or partnership agreements for partnerships.

In addition to documentation, understanding key terms associated with the CR-16 form is vital. For instance, the term 'business entity' refers to the legal structure of the company, while 'tax classification' relates to how the business is categorized for tax purposes. Familiarity with these terms can help mitigate common misconceptions regarding business tax registration, ensuring the process goes smoothly.

Step-by-step guide to filling out the CR-16 form

Accessing the CR-16 form is straightforward. It is available on the official state tax authority website. Users can easily navigate to the relevant section dedicated to business taxes, where they can find the form available for download and printing. Ensure you have the latest version to avoid any discrepancies with outdated formats.

Filling out the CR-16 form involves several sections, each requiring careful attention. The first section demands basic business information, where you’ll need to illustrate the business name and its legal structure. Here’s a closer look at each subsection:

Careful attention is necessary to avoid common pitfalls. Frequent mistakes include omitting necessary details or misrepresenting the business structure. Always double-check each section for accuracy before submission.

Submitting the CR-16 form

Once the CR-16 form is completed, the next step is submission. Depending on your state’s regulations, you can submit your application either physically at your local tax office or digitally via the state’s tax portal. Confirm the submission method to ensure compliance with specific local requirements.

After submission, it’s important to be aware of processing times. Typically, you can expect to wait several weeks for the authorities to process your application. If you want to keep track of your status, many states provide online portals for applicants to check on the progress of their submissions.

After submission: managing your business tax account

Once your CR-16 form is approved, you must manage your tax obligations diligently. Understanding the variety of taxes applicable to your business is crucial. This may include sales tax, income tax, and employment-related taxes. Each of these areas comes with specific deadlines and requirements, so maintaining an organized schedule will help prevent penalties.

To facilitate document management, utilizing tools like pdfFiller can significantly simplify this process. With pdfFiller, business owners can edit, eSign, and collaborate on various documents from a cloud-based platform. This enhances efficiency, as keeping track of necessary forms and obligations becomes a streamlined effort.

Additional resources and tools

To bolster your tax management capabilities, consider leveraging interactive tools like tax calculators or estimators available online. These utilities can provide insights into potential tax implications based on business type, revenue, and location. Additionally, templates for other necessary tax documents are often accessible, making expansion and compliance easier.

Furthermore, many business owners frequently seek answers to common questions about the CR-16 form. Addressing inquiries related to the filing process, fees, or deadlines can help demystify aspects of tax registration. Engaging with local business forums or agencies can also enhance understanding and compliance with state regulations.

Engage with community and support networks

Connecting with other business owners can provide invaluable support and resources. Networking can foster collaboration or guidance through the tax registration process. Many regions have local business alliances or chambers of commerce that offer events and forums for owners to share insights.

To keep up with the latest tax news and updates, following relevant social media accounts or newsletters can be beneficial. Engaging with these communities can ensure you're informed about ongoing tax regulations and business opportunities, enhancing your network while allowing for collaborative growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cr-16 business tax application from Google Drive?

How can I send cr-16 business tax application to be eSigned by others?

How can I edit cr-16 business tax application on a smartphone?

What is cr-16 business tax application?

Who is required to file cr-16 business tax application?

How to fill out cr-16 business tax application?

What is the purpose of cr-16 business tax application?

What information must be reported on cr-16 business tax application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.