Get the free 25-26 Loan Request Form

Get, Create, Make and Sign 25-26 loan request form

Editing 25-26 loan request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 25-26 loan request form

How to fill out 25-26 loan request form

Who needs 25-26 loan request form?

Your Complete Guide to the 25-26 Loan Request Form

Understanding the loan request process

The loan request process is a vital step for individuals seeking financial assistance. Understanding the different formats of loan requests can simplify this process significantly. Various lenders may have specific forms they prefer, but the fundamental principle of providing accurate information remains the same across all platforms. When completing any loan request, clarity and honesty are essential to avoid delays and ensure approval.

Key terminologies like principal amount, interest rates, and repayment terms are crucial in the loan request dialogue. Familiarizing yourself with these terms can enhance your understanding and help you communicate effectively with lenders. Misunderstandings can lead to mistakes that could otherwise be avoided.

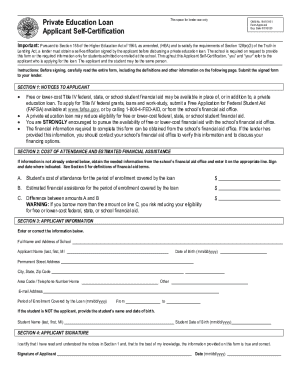

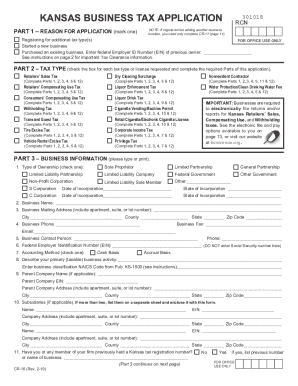

What is the 25-26 loan request form?

The 25-26 loan request form is a specific document used in certain lending scenarios, aiming to gather detailed information about the applicant's financial status, loan purpose, and repayment capability. Its primary purpose is to assist lenders in making an informed decision about loan approval.

Unlike other loan request forms, the 25-26 form is unique in its comprehensive approach to collecting data, ensuring that all necessary information is provided in one structured document. This reduces the chances of back-and-forth communication between the applicant and the lender, streamlining the approval process.

Preparing to fill out the 25-26 loan request form

Before diving into the 25-26 loan request form, it’s crucial to gather all necessary documentation. This preparatory step can save you time and potential errors. You’ll need identification documents to confirm your identity and address. Common examples include a driver's license or passport.

Financial statements provide insight into your overall financial health, which is essential for lenders. Most applicants would need to submit bank statements, any existing loan agreements, and pay stubs as part of your employment verification. To ensure you apply successfully, create a comprehensive checklist of required information, including:

Step-by-step instructions for completing the 25-26 loan request form

Completing the 25-26 loan request form is straightforward if approached systematically. Begin with the personal information section, ensuring that all provided details such as your name, address, and contact information are accurate. It’s best practice to cross-check this information with your identification documents.

Next, move to the loan details section, where you need to specify the loan amount you're requesting and the purpose behind it. Being clear about how you plan to use the funds can help establish your credibility with the lender.

In the financial information section, provide a thorough summary of your income, debts, and assets. Use precise figures and ensure they align with the documentation you've prepared. If you're considering including a co-signer, be aware of the requirements. Define when this is necessary and what information is needed from them, such as their identification and financial details.

Finally, make sure to review and confirm all information on the form. Attention to detail is paramount. Common mistakes include incorrect figures, missing signatures, or failing to attach essential documents. A second glance could mean the difference between a quick approval and a prolonged review process.

Editing and signing the 25-26 loan request form

Using pdfFiller for editing the 25-26 loan request form adds convenience to the process. The platform allows easy adjustments, ensuring that all information is current and accurate even after initial completion. The drag-and-drop feature is especially useful for those who may not be tech-savvy.

eSigning is another valuable aspect of pdfFiller, allowing users to sign documents electronically with various integrated features that enhance user experience. Document security is a priority; pdfFiller implements robust encryption methods, ensuring your information is kept safe from unauthorized access.

Submitting the 25-26 loan request form

When it comes to submitting the 25-26 loan request form, you typically have multiple options, including online submissions via secure portals or in-person options at your lender’s office. Depending on the lender’s preferences, you may choose either method. Ensure that you double-check submission guidelines to adhere to specific lender requirements.

After submission, processing times can vary based on the lender's policies. Generally, it takes anywhere from a few days to a couple of weeks. Be prepared for updates regarding your application status and know what to expect next, such as potential requests for additional information.

Managing your loan request after submission

After you have submitted the 25-26 loan request form, tracking the status of your request is essential. Most lenders provide an online platform or phone contacts for applicants to follow up on their applications. Maintaining communication can keep you informed about any outstanding requirements or approvals.

In the event of a response from the lender, understand their feedback clearly. Lenders may offer conditions, require further documentation, or request additional information. Being proactive will position you as a reliable borrower.

Common FAQs regarding the 25-26 loan request form

Mistakes on the form can happen. If you realize you made an error post-submission, promptly contact your lender to address it. They can often guide you through the correction process and help mitigate any impacts on your application timeline.

The approval time varies significantly. Factors include the type and amount of loan, along with the lender’s specific processing timeline. Generally, you should expect anywhere from a few days to several weeks.

If you need to amend your request after submission, it largely depends on lender policies. Some lenders are flexible; others may require you to submit a new application form, so it's important to communicate effectively.

Interactive tools and resources

Utilizing templates available on pdfFiller can simplify filling out the 25-26 loan request form significantly. The platform provides numerous forms customized to your needs that can be accessed easily from anywhere. Furthermore, online calculators for loan affordability can help determine how much you can realistically afford to borrow, ensuring you make informed decisions.

Additional tools like links to related forms and documents help keep your process organized. pdfFiller is a versatile platform that equips you with the tools you need to succeed.

Testimonials and user experiences

Success stories from pdfFiller users highlight the efficiency of the platform in handling loan requests. Many customers have reported reduced timeframes from application to approval thanks to the tools and resources offered by pdfFiller.

One user shared how their team saved hours on document preparations and approvals through the collaborative features available on pdfFiller, illustrating how the platform effectively simplifies the loan request process for both individuals and teams.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 25-26 loan request form without leaving Google Drive?

How do I complete 25-26 loan request form online?

Can I create an electronic signature for the 25-26 loan request form in Chrome?

What is 25-26 loan request form?

Who is required to file 25-26 loan request form?

How to fill out 25-26 loan request form?

What is the purpose of 25-26 loan request form?

What information must be reported on 25-26 loan request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.