Get the free Orion Lending Broker Application

Get, Create, Make and Sign orion lending broker application

Editing orion lending broker application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out orion lending broker application

How to fill out orion lending broker application

Who needs orion lending broker application?

Understanding the Orion Lending Broker Application Form: A Comprehensive Guide

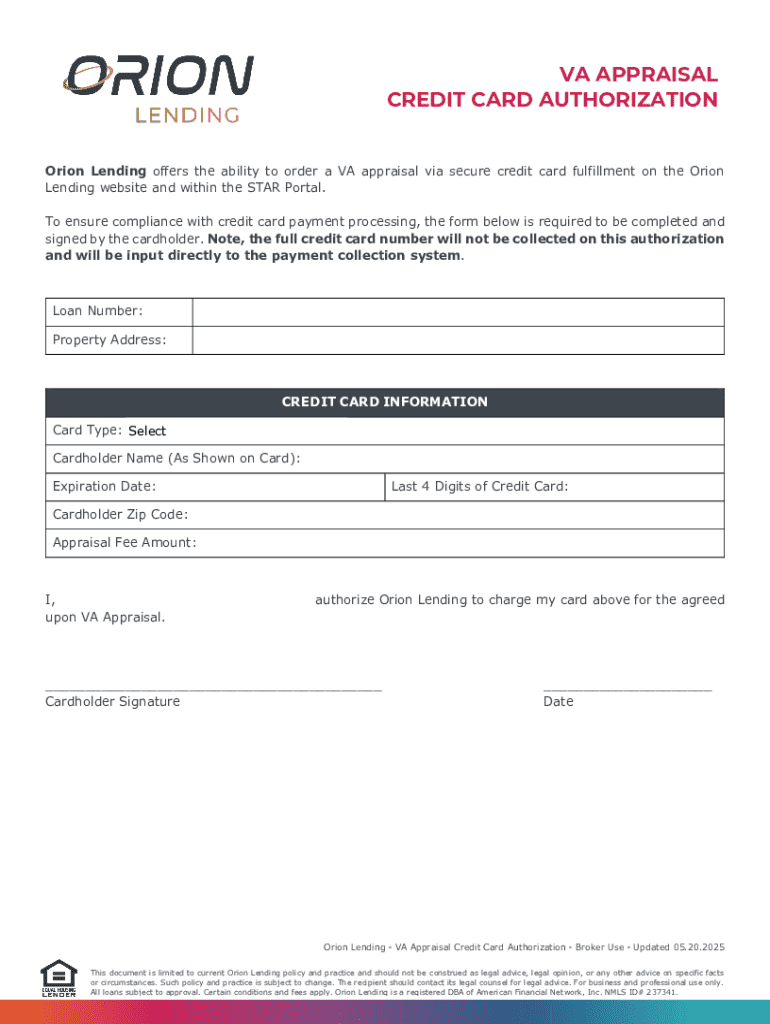

Overview of the Orion Lending Broker Application Form

The Orion Lending Broker application form is a crucial document for individuals seeking to establish a partnership with Orion Lending as a broker. This form is not just a mere formality; it plays a vital role in streamlining the onboarding process, ensuring that prospective brokers meet the necessary criteria and standards set by Orion Lending. Understanding the application workflow is essential for a smooth submission, as it sets the foundation for the ongoing relationship between the broker and lending institution.

Preparing to fill out the form

Before diving into the details of filling out the Orion Lending Broker application form, it's important to prepare adequately. The application requires specific documents and information to be completed effectively. Having everything organized beforehand can minimize errors and ensure a smoother process.

Essential documents and information needed

To avoid delays in your application, gather these documents ahead of time. Organizing your information into a well-structured format will further enhance the accuracy of your application.

Step-by-step instructions for filling out the form

Filling out the Orion Lending Broker application form may seem daunting, but breaking it down into sections simplifies the process. Below, we will guide you through each section one at a time, highlighting essential points to consider.

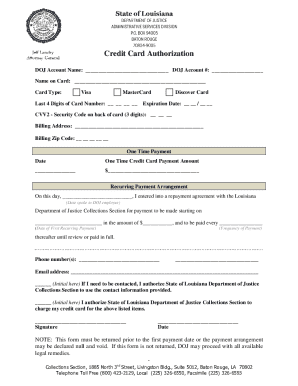

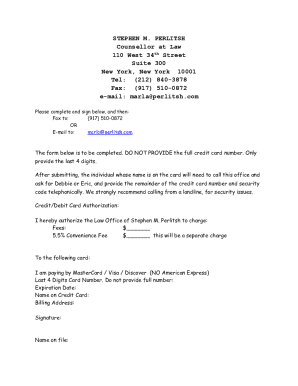

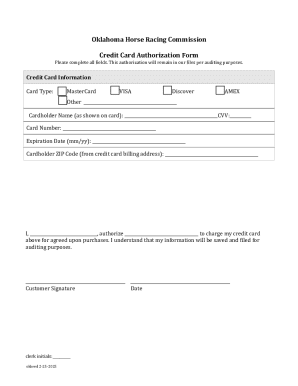

Section 1: Personal information

The first section of the application form focuses on personal information. You will need to provide your full name, address, contact details, and any other identifiers such as Social Security Number, if applicable. Ensure accuracy while entering these details, as discrepancies can cause delays in processing your application.

Section 2: Financial information

In the financial information section, you will be required to report your income, expenses, and any assets. It is essential to provide as accurate and honest data as possible. This section not only evaluates your financial stability but also reflects your capability as a broker.

Section 3: Employment history

Here, you should list all relevant employment history, detailing dates of employment, position titles, and key responsibilities. This section assists Orion Lending in assessing your experience and suitability as a broker. Present your employment history in a chronological order, starting from the most recent position.

Section 4: E-signature

The application concludes with an e-signature section. This allows you to sign your application digitally, making it quicker and more efficient. Signing electronically is legally accepted, offering security and authenticity. To complete this section, follow the prompts to draw or type your signature.

Editing and modifying the form

Mistakes happen, and that's why you might need to edit your application after you've filled it out. Utilizing tools like pdfFiller makes it simple to correct errors in your application form. The platform provides various features allowing you to modify text easily.

Utilizing pdfFiller Tools to edit your application

Here’s a step-by-step guide on how to use pdfFiller’s editing features: first, upload your completed application form onto the platform. Next, select the ‘Edit’ feature, which allows you to click on any text field to modify directly. After making changes, remember to revisit all sections to ensure accuracy.

Finally, after all modifications have been made, save your changes securely. Choose the appropriate file format based on how you plan to submit your application, whether as a PDF or an online form.

Managing your Orion Lending Broker application form

Once your Orion Lending Broker application form is submitted, tracking its status is crucial. pdfFiller offers intuitive tools that allow applicants to keep track of their application easily, ensuring that they remain informed throughout the process.

Tracking your application status

With pdfFiller, you can access the dashboard to monitor your application's status. The platform sends notifications and updates regarding any necessary actions. By enabling notifications, you can receive real-time updates about your application’s progress without needing to reach out for updates frequently.

Sharing the form with others

Should you need to collaborate with a team member or share your application for any reason, pdfFiller makes this process straightforward. Utilize the sharing features that allow you to send a link directly or invite others to collaborate on your application.

Common questions and troubleshooting

While filling out the Orion Lending Broker application form, it is natural to encounter some questions or issues. Below are common queries applicants have regarding the application process, along with troubleshooting guidance.

Understanding these aspects can ease any anxiety during the application process. Reviewing FAQs on the pdfFiller website also helps clarify other potential uncertainties.

Accessing the application from anywhere

One of the unique advantages of using the Orion Lending Broker application form through a cloud-based platform like pdfFiller is accessibility. Users can access their documents anytime and anywhere, whether they're using a computer or a mobile device.

Benefits of a cloud-based platform

The cloud-based nature of pdfFiller means that users do not have to worry about losing files due to hardware issues or local storage problems. Instead, everything is stored securely in the cloud, making collaboration and access convenient and efficient.

Enhancing your application experience

The application experience can be further improved with additional tools and features offered by pdfFiller. Their big library of document templates and resources is designed to simplify forms for users.

Additional tools and features on pdfFiller

By utilizing other resources on pdfFiller, such as integration with various platforms and user-friendly templates, brokers can significantly reduce the time spent on documentation. These features enhance the user experience, ensuring that document-related tasks are straightforward and efficient.

User stories reflect how pdfFiller has streamlined the application process for individuals and teams, making it easier for them to submit their forms, manage documentation, and achieve better results.

Conclusion of filling out the Orion Lending Broker application form

Completing the Orion Lending Broker application form does not have to be a daunting task. By understanding the necessary steps, preparing your documents, utilizing editing tools, and leveraging the benefits of pdfFiller, you can navigate the entire process with confidence.

Take advantage of pdfFiller’s features, not only for this application but for all future forms, ensuring that your document management remains organized and efficient. With the right tools at your fingertips, you're already on the path to success in your lending career.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute orion lending broker application online?

How do I fill out the orion lending broker application form on my smartphone?

How can I fill out orion lending broker application on an iOS device?

What is orion lending broker application?

Who is required to file orion lending broker application?

How to fill out orion lending broker application?

What is the purpose of orion lending broker application?

What information must be reported on orion lending broker application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.