Understanding the Pre-Suit Disclosure of Liability Form

Understanding the pre-suit disclosure of liability form

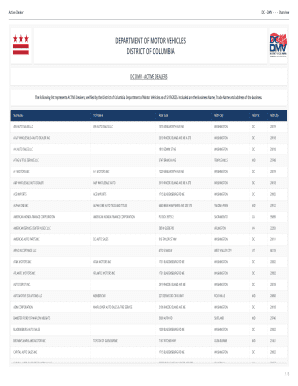

A pre-suit disclosure of liability form is a critical document utilized in the early stages of a potential legal dispute, particularly in matters involving insurance claims. The primary purpose of this form is to facilitate transparency between the claimant and the liability insurer before any official lawsuit is filed. It details essential information surrounding an incident that may result in a claim, thereby streamlining the investigative process and promoting fair negotiation.

This form is particularly important in the context of insurance, where accurate and timely information can influence coverage determinations and settlement talks. Key stakeholders involved in this process include the claimant, the insurance provider, and, in some cases, legal counsel representing either party. By clearly outlining the facts surrounding an incident, the pre-suit disclosure of liability form helps to manage expectations and clarify rights before escalating to litigation.

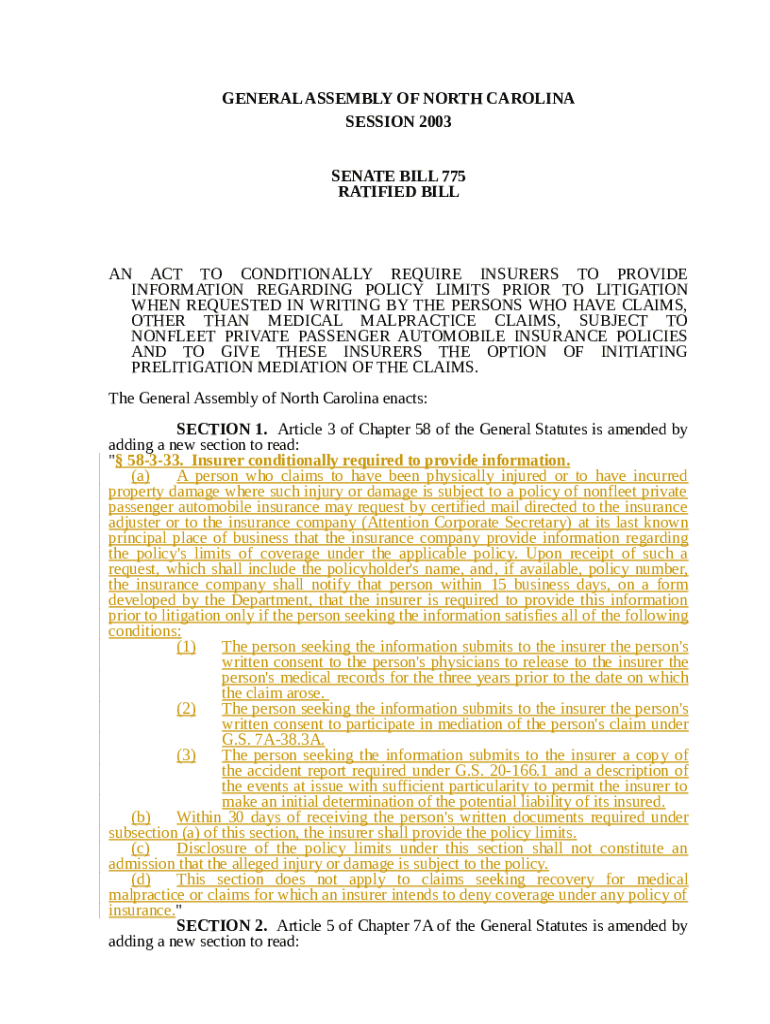

Legal framework governing disclosure of liability

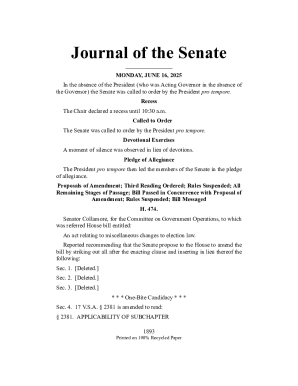

The pre-suit disclosure of liability is governed by a complex web of legal frameworks that vary by jurisdiction. Generally, certain laws mandate that parties involved in an insurance claim disclose relevant information to facilitate swift resolutions. State laws can influence what is required in a disclosure, emphasizing the need for claimants to be aware of both local statutes and the obligations set forth within their liability policy limits.

Jurisdictions may also have differing requirements regarding the level of detail necessary in disclosures. For example, some require a complete account of all damages, while others may only want a summary of the incident. More importantly, the consequences of not adhering to these regulations can impact the legal outcomes dramatically, potentially resulting in adverse judgments against a party or a claim being denied.

When and why to use a pre-suit disclosure of liability form

There are specific situations where a pre-suit disclosure of liability form becomes essential. For instance, if an incident has occurred that could lead to a claim, completing this form promptly can demonstrate good faith and transparency. This proactive approach is not only beneficial for the claimant in managing their rights but also assists insurers in assessing their exposure quicker, potentially avoiding lengthy litigation.

Early disclosures have several benefits: they promote transparency by ensuring that all parties are on the same page regarding the details of an incident. Moreover, this approach can facilitate negotiations, allowing for a quicker settlement without the need for protracted legal battles. Common scenarios warranting the use of such forms include motor vehicle accidents, workplace incidents, or any event where negligence may have occurred and could lead to financial liability.

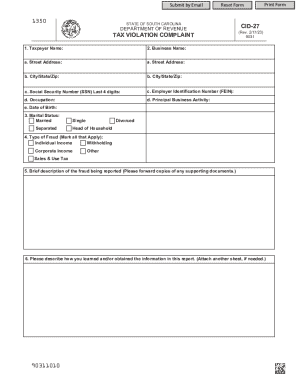

Preparing the pre-suit disclosure of liability form

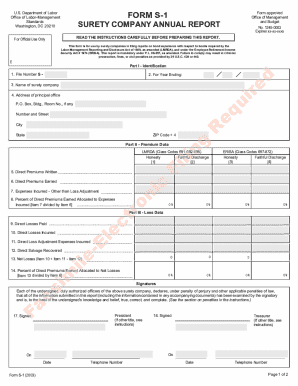

Filling out a pre-suit disclosure of liability form requires meticulous attention to detail. Initially, key information such as the policyholder’s information, details regarding the incident, and insurance coverage specifics must be documented. It’s vital to provide comprehensive narratives surrounding the event in question, including dates, parties involved, and any relevant communications that have occurred.

Best practices to ensure that the form is completed accurately include verifying all information for correctness. Incomplete or ambiguous disclosures can lead to misunderstandings and might jeopardize the claimant’s rights. Additionally, using tools such as pdfFiller can aid in creating and managing these documents by offering templates and editing capabilities. Remember to check for common mistakes like missing dates or neglecting to properly specify coverage limits.

Step-by-step guide to filling out the pre-suit disclosure of liability form

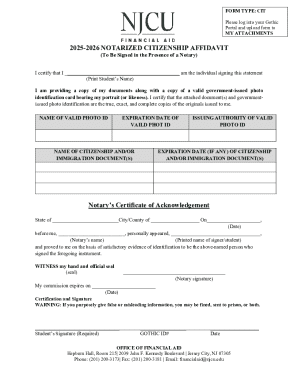

Filling out a pre-suit disclosure of liability form can seem daunting, but breaking it down into manageable steps can simplify the process. Start by gathering all necessary documentation, including any evidence related to the incident, statements, bills, or photographs. Next, complete the personal and incident information sections thoroughly, ensuring all details are consistent and accurate.

Follow with specifications regarding insurance coverage and limits associated with the liability policy. After filling out all sections, take time to review and edit the form for clarity and accuracy. Finally, sign the document and submit it, often via email or through a secure platform like pdfFiller, which offers online tools for editing and eSigning.

Gather necessary documentation.

Complete personal and incident information.

Specify insurance coverage and limits.

Review and edit the form for accuracy.

Sign and submit the form.

Managing responses to pre-suit disclosures

After submitting a pre-suit disclosure of liability form, it’s important to know what to expect. Generally, the insurer or involved party will respond within a specified time frame, indicating whether they require additional information. Handling such requests efficiently is crucial; it shows readiness and cooperation, laying the groundwork for effective communication moving forward.

Effective communication strategies include promptly addressing requests for information and maintaining clarity in exchanges. Keeping a detailed record of all correspondence is also beneficial, helping to ensure that no vital information is overlooked. By fostering good relationships with insurers and legal counsel, claimants can navigate the complexities of pre-suit disclosures more successfully.

Common pitfalls in pre-suit disclosure

Several common pitfalls can occur during the pre-suit disclosure process. One major issue is misunderstanding the obligations pertaining to information disclosure; being unclear about what needs to be shared could lead to incomplete filings. Also, failing to appreciate the serious consequences that follow an incomplete or incorrect disclosure can severely affect a claimant’s rights and coverage.

To proactively avoid legal pitfalls, it's essential to fully understand both the legal framework and specific requirements regarding liability disclosures. Engaging legal counsel or consulting resources like pdfFiller can provide helpful guidance. By being informed and taking the disclosure process seriously, incidents of miscommunication and subsequent legal issues can often be avoided.

Case studies: Real-world examples of pre-suit disclosures

Real-world examples illustrate the significant impact of pre-suit disclosures on legal outcomes. In several success stories, effective and timely disclosure of facts surrounding an incident has led to favorable settlements for claimants. These positive outcomes often stem from the clarity and transparency established early on, enabling negotiations that avoid the need for formal lawsuits.

Conversely, inadequate disclosures have resulted in unfavorable outcomes. In these instances, miscommunication or missing information has led to denied claims or extended disputes. Such cases underscore the importance of accurately completing the pre-suit disclosure of liability form to safeguard rights and facilitate smoother resolution processes.

The role of pdfFiller in pre-suit disclosure

Using a cloud-based platform like pdfFiller can significantly enhance the pre-suit disclosure process. Its advantages include easy access to document templates and the ability to edit forms in real time. Users can also collaborate with legal teams, ensuring that all necessary input is captured before submission. This access-from-anywhere capability makes it easier for claimants to manage their documents effectively from any device.

Furthermore, pdfFiller offers advanced tools for eSigning, reducing the delays often associated with traditional signing methods. Its commitment to maintaining document security and compliance ensures that users can submit their disclosures with confidence. This streamlined approach ultimately enhances the efficiency of managing pre-suit disclosures and related documentation.

Conclusion

In summary, the pre-suit disclosure of liability form plays a pivotal role in the initial stages of resolving potential legal disputes. By utilizing this form effectively, claimants can not only protect their rights but also promote transparency and foster negotiations that can lead to quicker resolutions. By partnering with pdfFiller, individuals and teams can enjoy a seamless process for preparing, managing, and submitting their disclosures, making the overall experience more efficient and user-friendly.