Get the free Tax Office / Treasurer - About

Get, Create, Make and Sign tax office treasurer

Editing tax office treasurer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax office treasurer

How to fill out tax office treasurer

Who needs tax office treasurer?

Essential Guide to the Tax Office Treasurer Form

Understanding the tax office treasurer form

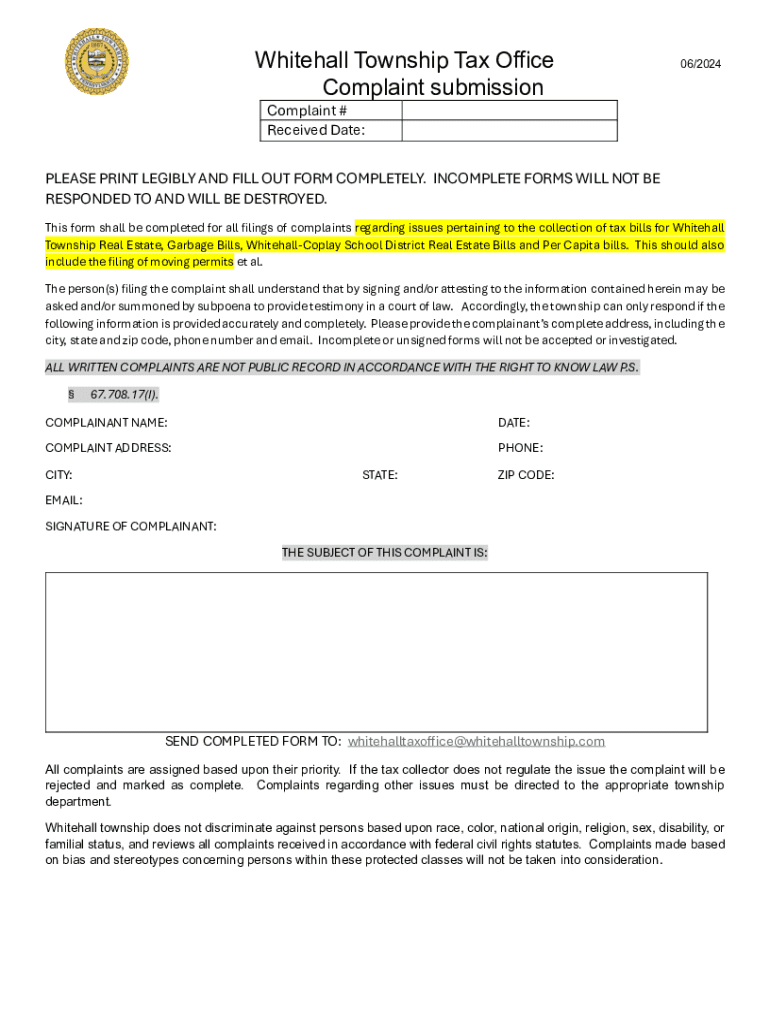

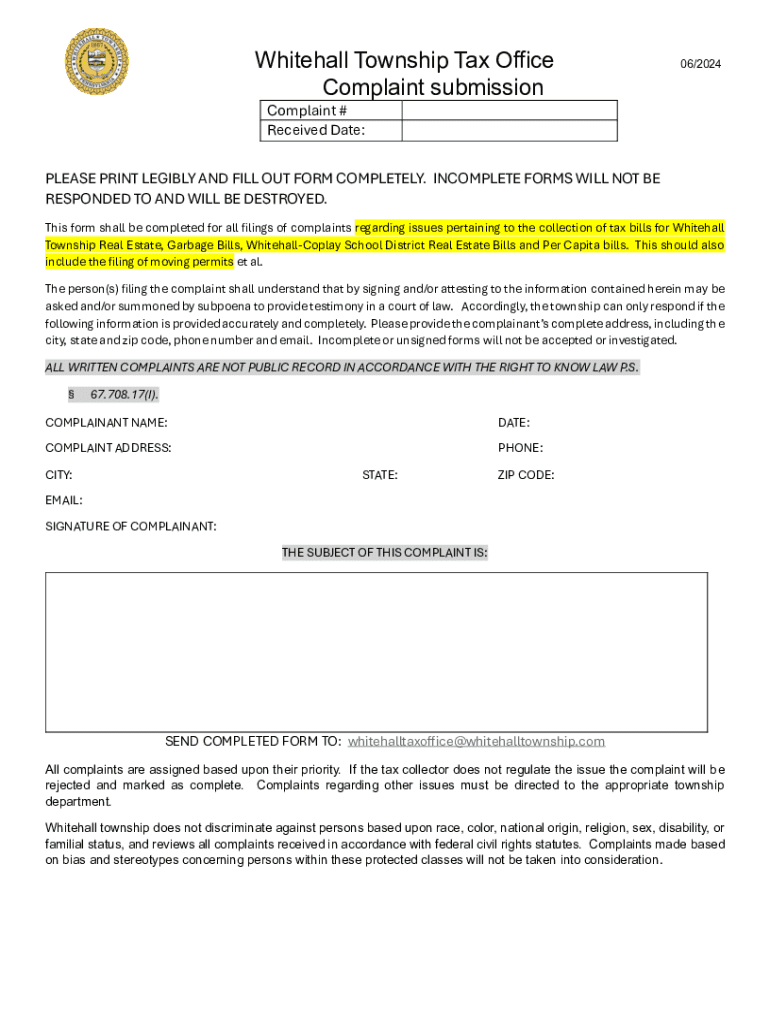

The tax office treasurer form is a vital document utilized by taxpayers and local governmententities. Its primary purpose is to facilitate the management of property taxes and associated payments. This form ensures that payments are well-documented and that funds are allocated appropriately by the treasury department. Furthermore, it plays a crucial role in record-keeping and transparency, making it an essential element in tax management for both the government and taxpayers.

You might encounter the tax office treasurer form in various scenarios, including when buying or selling property, appealing property tax assessments, or at the start of a new fiscal year. It serves as a structured way to gather necessary information, ensuring that all parties are aware of their obligations and rights concerning property tax.

Accessing the tax office treasurer form

Locating the tax office treasurer form can be straightforward. Most local government websites will have a dedicated section for forms. To find the form, navigate to the official tax office website, then look for sections labeled as 'Forms', 'Taxpayer Services', or 'Documents.' If you prefer to utilize digital platforms, resources like pdfFiller also host the form, allowing for easy access.

Once you've located the form, it's essential to check the available formats for download. The tax office treasurer form can typically be accessed in a variety of formats including PDF, DOCX, and sometimes even as an interactive online form that can be filled out electronically. Ensure you choose the version that suits your needs best.

Detailed instructions for filling out the form

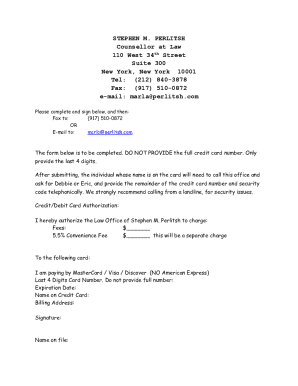

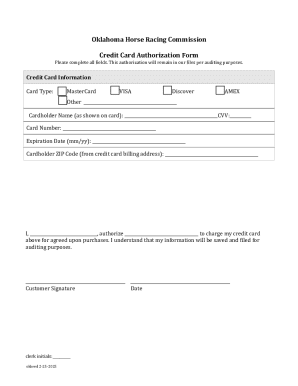

Filling out the tax office treasurer form requires attention to detail. The form is generally segmented into multiple sections, including Personal Information, Property Details, and Payment Information. Each section serves a unique purpose and must be filled out accurately to avoid delays in processing.

To ensure accurate completion, it's prudent to double-check all entries for typos and errors before submission. You can also use a checklist to ensure every required field is filled out.

Editing and customizing the tax office treasurer form

Once you've downloaded the tax office treasurer form, you may need to make edits. Utilizing pdfFiller tools provides an efficient way to customize your form. The platform offers features that enable you to fill out fields directly, eliminating the need for a print-out and manual entry.

With pdfFiller, users can take advantage of interactive fields, which allow you to enter text and checkboxes free of hassle. Furthermore, adding annotations or comments is straightforward, making it easier to communicate any additional information to the tax office or to keep track of changes that you considered.

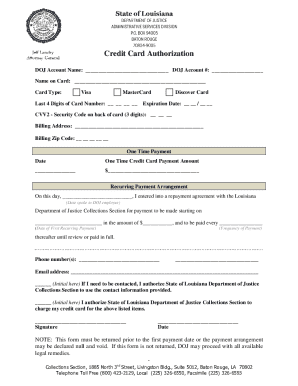

Signing the tax office treasurer form

Once the tax office treasurer form is completed, signing it is the next crucial step. With pdfFiller, eSigning has been simplified. Users can easily add their electronic signature with just a few clicks, ensuring that the form is officially recognized without the need for printing and scanning.

Security is paramount when it comes to eSigning. pdfFiller incorporates several security measures to protect user signatures and personal information. Encrypted connections and secure storage ensure that your data remains confidential and safeguarded against unauthorized access.

Submitting the tax office treasurer form

After completing and signing your form, the next step is submission. Always refer to the guidelines provided by your local tax office for specific submission protocols. Many offices allow forms to be submitted electronically, via mail, or in person.

Be aware of key deadlines, as missing these can lead to penalties or delayed processing. Check your local tax office’s calendar or website for updates on submission timelines.

Managing your submitted tax office treasurer form

Once your tax office treasurer form is submitted, it's vital to keep track of its status. Most tax offices offer online access to check the status of submitted documents. Utilizing these resources can provide peace of mind and ensure a smooth process.

If you find yourself needing to recover or modify a submitted form, understanding the procedure beforehand can save time. Typically, you would need to contact the tax office directly. Many departments appreciate knowing that changes are needed in a timely manner – just be cautious as there may be deadlines governing such modifications.

Common issues and troubleshooting

As with any process, individuals may encounter issues when working with the tax office treasurer form. Some frequently asked questions include concerns about processing delays or what to do if the form is rejected. It’s essential to consult the tax office or their publicly available FAQs for specific inquiries.

Developing familiarity with the typical challenges can help you anticipate and navigate situations successfully, minimizing frustration.

The importance of keeping records

Maintaining accurate records is a vital practice in tax management. As you use the tax office treasurer form, ensure that you keep digital copies of all submitted forms. pdfFiller’s document storage features allow you to manage these documents efficiently, offering a centralized location for easy access and organization.

From a legal perspective, retaining copies of submitted forms is crucial, as they may be required for future inquiries or reconciliations with the tax office. Proper documentation can serve as evidence of compliance and assist in any disputes that may arise later on.

Conclusion: Why choose pdfFiller for your tax office treasurer needs

Choosing pdfFiller for handling the tax office treasurer form simplifies the entire process. Its user-friendly platform allows for easy editing, secure eSigning, and effective management of your documents. Taxpayers and local governments alike can benefit from the streamlined workflow that pdfFiller offers, ensuring all details are accurately captured and submitted on time.

By leveraging the full capabilities of pdfFiller, anyone can navigate the complexities of tax-related documentation with heightened efficiency and ease of use. Embrace the future of tax form management and experience a smoother process today.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax office treasurer in Chrome?

How do I fill out tax office treasurer using my mobile device?

Can I edit tax office treasurer on an iOS device?

What is tax office treasurer?

Who is required to file tax office treasurer?

How to fill out tax office treasurer?

What is the purpose of tax office treasurer?

What information must be reported on tax office treasurer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.