IRS 8824 2025 free printable template

Get, Create, Make and Sign IRS 8824

How to edit IRS 8824 online

Uncompromising security for your PDF editing and eSignature needs

IRS 8824 Form Versions

How to fill out IRS 8824

How to fill out form 8824 like-kind exchanges

Who needs form 8824 like-kind exchanges?

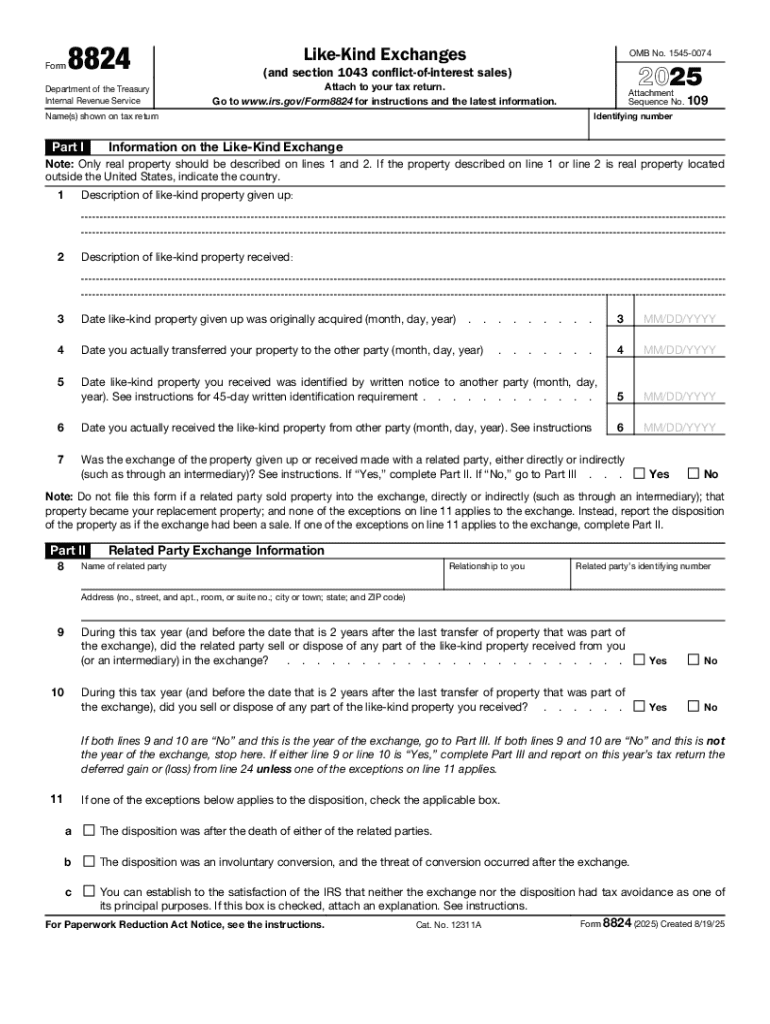

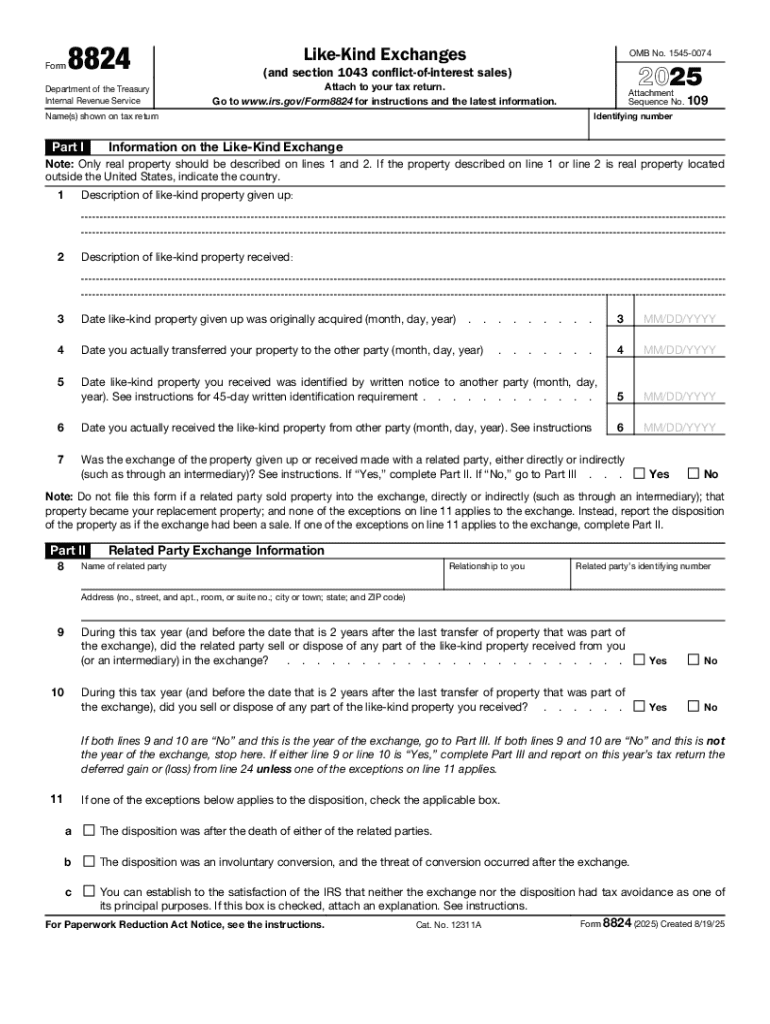

Understanding Form 8824: Like-Kind Exchanges

Overview of Form 8824: Like-Kind Exchanges

A like-kind exchange, as outlined by IRS regulations, allows property owners to defer capital gains taxes on the sale of an asset by exchanging it for a similar one. This is a significant aspect of property investment, allowing for the reinvestment of proceeds without immediate tax implications. Form 8824 is crucial in this process, enabling taxpayers to report the exchanges accurately and adhere to tax regulations.

This form specifically captures the nuances of like-kind exchanges, detailing information about relinquished and acquired properties, calculations of gain or loss, and identifying any boot received. Understanding Form 8824 is essential for investors seeking to maximize their tax-deferral opportunities while complying with IRS requirements.

Key terms and concepts

Several terms are pivotal in grasping like-kind exchanges. 'Like-kind property' refers to properties that are of the same nature or character, even if they differ in grade or quality. This might include exchanging an apartment building for a commercial property. 'Boot' refers to any cash or other property received in an exchange that can be subject to taxation. For instance, if the relinquished property is worth $200,000 and the acquired property is worth $150,000, the $50,000 difference would be considered boot and may result in tax liabilities. 'Real property' encompasses tangible, immovable assets like land and buildings, which are often the subject of like-kind exchanges.

Requirements for completing Form 8824

To effectively utilize Form 8824, it's crucial to know the eligibility criteria for like-kind exchanges. Primarily, properties exchanged must both qualify as like-kind, which generally includes real estate held for productive use in a trade, business, or investment. Properties not classified as like-kind include personal residences and inventory held for sale.

Additionally, the IRS stipulates important deadlines that must be adhered to. After selling the relinquished property, taxpayers have 45 days to identify potential replacement properties and must complete the exchange within 180 days. Missing these deadlines can nullify the tax-deferral benefits.

Step-by-step guide to filling out Form 8824

Filling out Form 8824 requires careful attention to detail. Begin by gathering all necessary data regarding your properties. This includes details about the relinquished property such as its fair market value, adjusted basis, and any debt owed or relieved.

Ensure you have transaction dates documented, as well as any financial records relating to the exchange's boot. Without accurate records, filing the form can become challenging and potentially lead to errors.

Each section of the form has specific requirements.

Common mistakes to avoid when filling out Form 8824

Taking the time to understand the common pitfalls associated with Form 8824 can save you time and prevent headaches. Often, taxpayers incorrectly classify their properties, which can lead to immediate tax consequences. It's essential to refer to the IRS definitions critically and verify that your properties meet the criteria.

Misreporting exchange details is another frequent error. This can happen when financial records are not accurately reflected on the form. Cross-checking entries and maintaining comprehensive records throughout the year can significantly enhance accuracy.

Interactive tools and resources for Form 8824

pdfFiller provides a user-friendly platform for populating Form 8824 online. With tools tailored for document handling, users can create, edit, and manage their forms seamlessly. Notably, the platform allows for collaboration among team members, ensuring that all stakeholders have access to the necessary information.

Further, pdfFiller supports users via live chat and detailed tutorials, making it easy to navigate the complexities of the form-filling process. This is crucial for individuals or teams who require reliable solutions for document management and compliance.

Real-life examples and case studies

Examining real-life case studies can illuminate common processes associated with Form 8824. For example, a property investor recently completed a successful like-kind exchange by trading a residential investment property for a commercial space. When filling out Form 8824, they accurately reported both properties' details and included the necessary calculations for gain recognition.

As a result, they efficiently deferred tax liabilities, showcasing how proper filing of Form 8824 can lead to favorable outcomes. Learning from such examples can be beneficial for future transactions.

Navigating complex scenarios with Form 8824

For experienced investors, managing multiple property exchanges can be particularly complex. In cases of exchanges involving various properties, it’s vital to engage qualified intermediaries to facilitate transactions and ensure compliance with IRS rules. These intermediaries, often referred to as 1031 exchange qualified intermediaries, can streamline the process and help manage timelines effectively.

When handling international like-kind exchanges or circumstances involving boot, understanding how these scenarios affect tax liabilities is critical. Boot received during an exchange can lead to taxable events; thus, appropriately calculating and reporting such transactions using Form 8824 becomes essential.

Compliance and security considerations

Filing Form 8824 accurately requires compliance with IRS regulations. Staying updated on any changes to tax laws concerning like-kind exchanges is crucial for accurate reporting. Regulatory developments can directly influence both the exchanges themselves and the implications of filing Form 8824.

Additionally, protect your sensitive information during the filing process. pdfFiller employs strong encryption and security measures to ensure your data remains confidential. This focus on security makes it an ideal platform for managing your tax-related forms.

Frequently asked questions about Form 8824

Addressing common queries can illuminate various aspects surrounding Form 8824. For example, individuals often wonder what specific properties can qualify under like-kind exchanges. Generally, properties that are held for productive use—including investment and business properties—qualify. However, personal use properties typically do not meet the criteria.

Another frequent concern is how boot affects tax liabilities. Understanding that receiving boot could trigger immediate tax consequences is vital. Engaging tax professionals can provide clarity and assist with complex scenarios.

Expert insights and tips

Tax professionals often advise being proactive when dealing with like-kind exchanges. This can include comprehensive planning before transactions, thorough documentation, and ensuring compliance with all timelines set by the IRS. Such diligence can pave the way for successful exchanges without unforeseen liabilities.

Also, considering how future tax laws may affect like-kind exchanges can lead to better strategic decisions. By staying informed, investors can adjust their strategies to align with potential regulatory changes, thus safeguarding their investments.

People Also Ask about

How do I record a 1031 exchange?

What is the 95% rule in a 1031 exchange?

Does a 1031 get a stepped up basis?

Which of the following qualifies as a like-kind exchange?

Which of the following would not qualify as a 1031 exchange?

How do you calculate basis for a new 1031 property?

What qualifies as a like kind exchange?

How do you calculate adjusted basis for a 1031 exchange?

How to complete 8824?

What happens if you don't use all the money in a 1031 exchange?

How do you calculate adjusted basis of property?

What exchanges are not considered a like-kind exchange?

What is the new basis in a like-kind exchange?

Who holds the cash in a 1031 exchange?

How do you calculate adjusted basis of like-kind property given up?

What can you roll a 1031 exchange into?

Do I have to spend all the money in a 1031 exchange?

How do I prepare for a 1031 exchange?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS 8824 directly from Gmail?

Can I sign the IRS 8824 electronically in Chrome?

How do I complete IRS 8824 on an iOS device?

What is form 8824 like-kind exchanges?

Who is required to file form 8824 like-kind exchanges?

How to fill out form 8824 like-kind exchanges?

What is the purpose of form 8824 like-kind exchanges?

What information must be reported on form 8824 like-kind exchanges?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.