Get the free Tax Collection Scams - Fraud and Consumer Alerts - Texas.gov

Show details

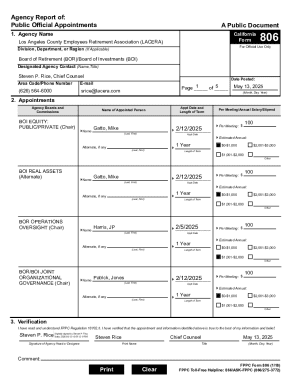

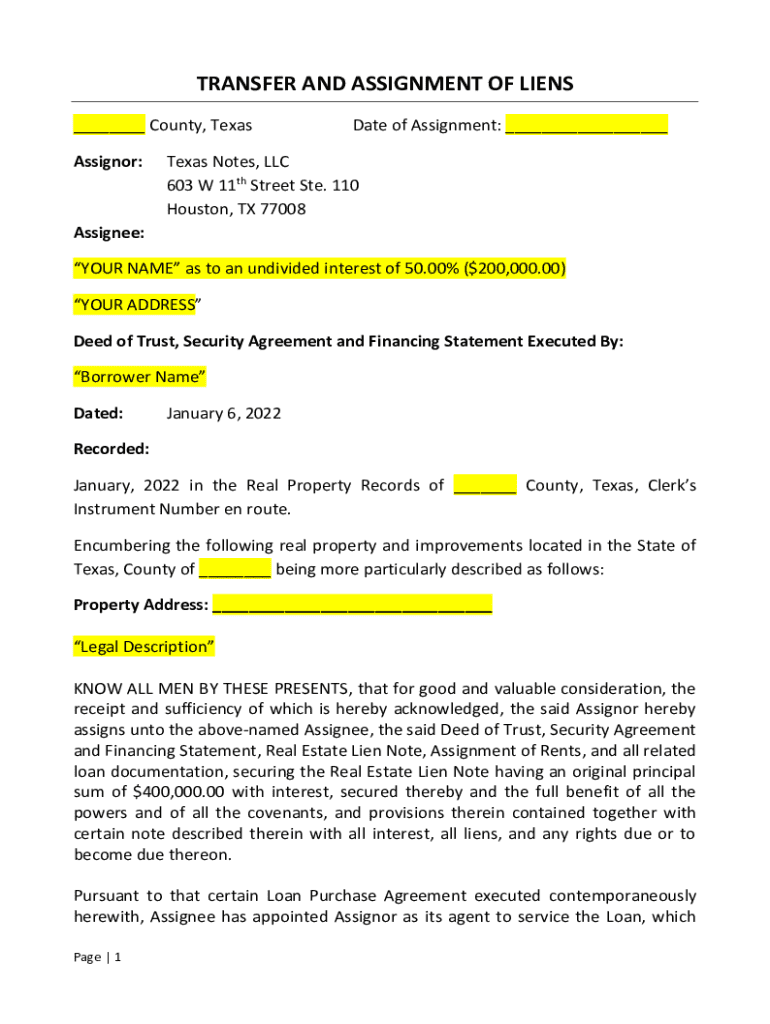

TRANSFER AND ASSIGNMENT OF LIENS ___ County, Texas Assignor:Date of Assignment: ___Texas Notes, LLC 603 W 11th Street Ste. 110 Houston, TX 77008Assignee: YOUR NAME as to an undivided interest of 50.00%

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax collection scams

Edit your tax collection scams form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax collection scams form via URL. You can also download, print, or export forms to your preferred cloud storage service.

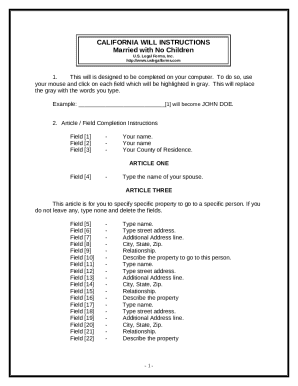

Editing tax collection scams online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax collection scams. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax collection scams

How to fill out tax collection scams

01

Research the particular tax collection scam to understand its nature.

02

Gather relevant personal and financial information that could make you susceptible to scams.

03

Provide details about official tax agencies and their legitimate communication methods to identify red flags.

04

Understand common techniques used by scammers, such as threatening messages or unauthorized requests for payment.

05

Document examples of tax collection scams for awareness and education purposes.

Who needs tax collection scams?

01

Individuals who are unaware of legitimate tax collection practices.

02

People who may be vulnerable to scams due to financial stress or confusion regarding their tax obligations.

03

Tax professionals and advisors who need to warn clients about potential scams.

04

Educational institutions that teach financial literacy and consumer protection.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax collection scams without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including tax collection scams, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit tax collection scams online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your tax collection scams to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete tax collection scams on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your tax collection scams. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is tax collection scams?

Tax collection scams refer to fraudulent schemes where scammers impersonate tax authorities to trick individuals into providing personal information or making payments under false pretenses.

Who is required to file tax collection scams?

No one is required to file tax collection scams; instead, individuals should report any suspected scams to the relevant tax authorities.

How to fill out tax collection scams?

There is no legitimate form for 'tax collection scams' as they are fraudulent; instead, individuals should report scams to the authorities and avoid engaging with scammers.

What is the purpose of tax collection scams?

The purpose of tax collection scams is to deceive individuals into revealing personal information or making payments to fraudsters posing as tax officials.

What information must be reported on tax collection scams?

Individuals should report information such as the nature of the scam, any communication received, and details about the scammers (if available) to local tax authorities.

Fill out your tax collection scams online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Collection Scams is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.