Get the free 2 Filing Date: November 19, 2025 3 No. A-1-CA-41 - coa nmcourts

Get, Create, Make and Sign 2 filing date november

How to edit 2 filing date november online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2 filing date november

How to fill out 2 filing date november

Who needs 2 filing date november?

Comprehensive Guide to the 2 Filing Date November Form

Understanding the importance of filing dates

A filing date is a crucial timestamp that signifies when a document has been officially submitted to a relevant authority. It often determines eligibility for various benefits, claims, and procedures. For many forms, particularly the 2 filing date November form, November is significant due to critical year-end deadlines that impact individual and business tax obligations.

November marks a turning point in the tax calendar; many entities must prepare filings to ensure compliance with governmental regulations. Familiarizing yourself with the specific deadlines related to the 2 filing date November form can help you avoid unnecessary penalties and maximize your claims. Key deadlines often vary based on the context; it is essential to recognize how your personal circumstances align with these important dates.

Overview of the 2 filing date November form

The 2 filing date November form is a specific document that individuals and businesses use to declare their intentions or comply with obligations set by tax authorities. This form generally applies to claims, returns, or documents tied to various financial activities. Understanding its purpose is vital to ensure proper submission at the end of the fiscal year, as failure to comply can lead to loss of benefits.

Those who need to file this form typically include taxpayers who are adjusting prior submissions, applying for deductions, or responding to audits. The implications of missing the filing deadline can be severe, resulting in potential fines, loss of refunds, or even legal issues. It is crucial to be proactive about filing to prevent adverse consequences.

Detailed instructions for completing the 2 filing date November form

Completing the 2 filing date November form accurately is essential for ensuring your submission is accepted without delay or rejection. Follow this step-by-step guide for a smooth filing process.

Step-by-step guide to filling out the form

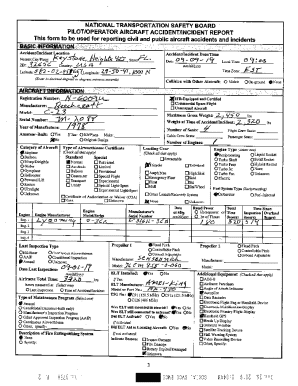

**Step 1:** Start by gathering all necessary information, including your personal details, financial records, and previous filings that are relevant to the current submission. This step is crucial to avoid inconsistencies.

**Step 2:** Complete Section A: Provide your personal information, including your name, address, and taxpayer identification number. Accuracy is key, as any discrepancies could lead to processing delays.

**Step 3:** Fill Out Section B: Detail the case specifics. Clearly outline the nature of your claim or correction. Use clear, concise language to convey your situation.

**Step 4:** Double-check document requirements. Ensure you have all necessary supporting documents attached before submitting the form.

Common mistakes during completion include not including supporting documents and errors in personal information. It is advisable to use a checklist to review before submitting the form.

Filing process: where and how to submit

You have several options for submitting the 2 filing date November form, each with its advantages. Understanding the distinctions between online and mail-in submission will help streamline your filing experience.

Online submission is often faster and allows for immediate confirmation of receipt. Many tax authorities have interactive tools that guide you through the process, ensuring that you meet the necessary requirements.

Mail-in submission, while traditional, can be subject to delays. It's critical to ensure your submission is postmarked by the deadline to avoid complications. Utilize tracking options when mailing.

Consider using online tools to check the status of your submission method and receive updates on your filing.

Understanding the impacts of timely filing

Filing the 2 filing date November form on time can have significant impacts on your claims or benefits. Timely submissions ensure that you are in compliance with regulations while maximizing your chances of receiving refunds or benefits.

Late submissions can result in various penalties, such as fines or loss of eligibility for certain benefits. It is essential to be aware of these repercussions and to take action if you miss the deadline. If you find yourself in this situation, seeking legal or financial advice is often the best course of action to mitigate the impacts.

Post-submission management

Once you've submitted the 2 filing date November form, it's vital to manage the post-submission phase effectively. Start by tracking the status of your submission to ensure that it has been received and is being processed appropriately. Many tax authorities provide online tools to aid you in this endeavor.

Upon processing your form, you will receive a response that may include approval, rejection, or requests for additional information. Understand how to interpret these responses correctly, as they will guide your next steps.

In the event of a rejection or requests for more information, respond timely and comprehensively to avoid further complications. Document all correspondence to maintain clarity.

Tips and best practices for a smooth filing experience

To ensure a hassle-free experience while filing the 2 filing date November form, here are some best practices to keep in mind. Setting reminders for important dates can alleviate the stress associated with missed deadlines. Consider using tools that integrate with your calendar application to ensure timely notifications.

Maintaining clear records of all your documents is crucial. Store them in a secure, accessible location. Additionally, utilizing pdfFiller tools for editing and signing can streamline the preparation process, allowing you to fill out forms quickly and efficiently.

Frequently asked questions (FAQs)

It is normal to have questions regarding the 2 filing date November form. Here are some frequently asked questions that address common concerns. If you encounter issues while filing, first ensure all required documents are included, and if problems persist, contact customer support.

Once you’ve submitted your form, it generally cannot be modified. However, if you need to make changes, consult the appropriate guidelines on amendments. After filing, the typical next steps include monitoring for feedback and preparing for any subsequent communications.

Customer support and additional assistance

When filing the 2 filing date November form, having access to customer support is invaluable. Reach out for help through pdfFiller to address specific concerns regarding your submissions. They offer various channels, including email and live chat, providing quick access to resolve any issues.

Additionally, if you encounter common issues such as submission errors or technical difficulties, an FAQ section on the pdfFiller website can guide troubleshooting. Utilize all resources available to ensure a smooth and efficient filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my 2 filing date november in Gmail?

How do I fill out 2 filing date november using my mobile device?

How do I complete 2 filing date november on an iOS device?

What is 2 filing date november?

Who is required to file 2 filing date november?

How to fill out 2 filing date november?

What is the purpose of 2 filing date november?

What information must be reported on 2 filing date november?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.