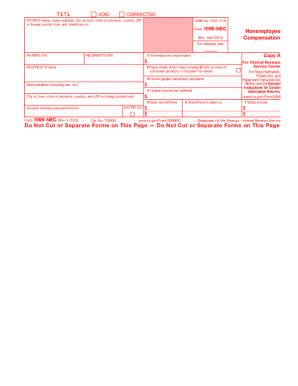

IRS 1099-LTC 2025-2026 free printable template

Instructions and Help about IRS 1099-LTC

How to edit IRS 1099-LTC

How to fill out IRS 1099-LTC

Latest updates to IRS 1099-LTC

All You Need to Know About IRS 1099-LTC

What is IRS 1099-LTC?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

FAQ about IRS 1099-LTC

What should I do if I realize I made an error on my IRS 1099-LTC form after submitting it?

If you notice a mistake on your IRS 1099-LTC form after submission, you should file an amended form as soon as possible. Use IRS Form 1099-LTC to correct the errors and indicate it as a correction on the new form. Keep a copy of both the original and amended forms for your records.

How can I track the status of my IRS 1099-LTC submission?

To track your IRS 1099-LTC submission, you can use the IRS e-file status tool available on their website. You may also receive updates through correspondence from the IRS regarding the processing of your form. Keep an eye out for any communication that may require further action from you.

Are there any special considerations for filing an IRS 1099-LTC for a nonresident payee?

When filing an IRS 1099-LTC for a nonresident payee, it’s crucial to check the withholding tax obligations and specific reporting requirements for nonresident taxpayers. Taxes may differ based on treaties between the United States and the payee's country, so it’s advisable to consult IRS guidance or a tax professional.

What if I receive a notice from the IRS about my submitted IRS 1099-LTC?

If you receive a notice from the IRS regarding your IRS 1099-LTC, carefully read the letter for instructions. Depending on the notice, you may need to provide additional documentation or correct information. Keep all related documents organized to address any requests efficiently.