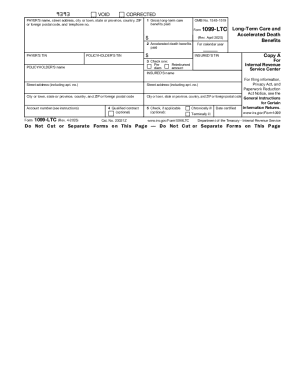

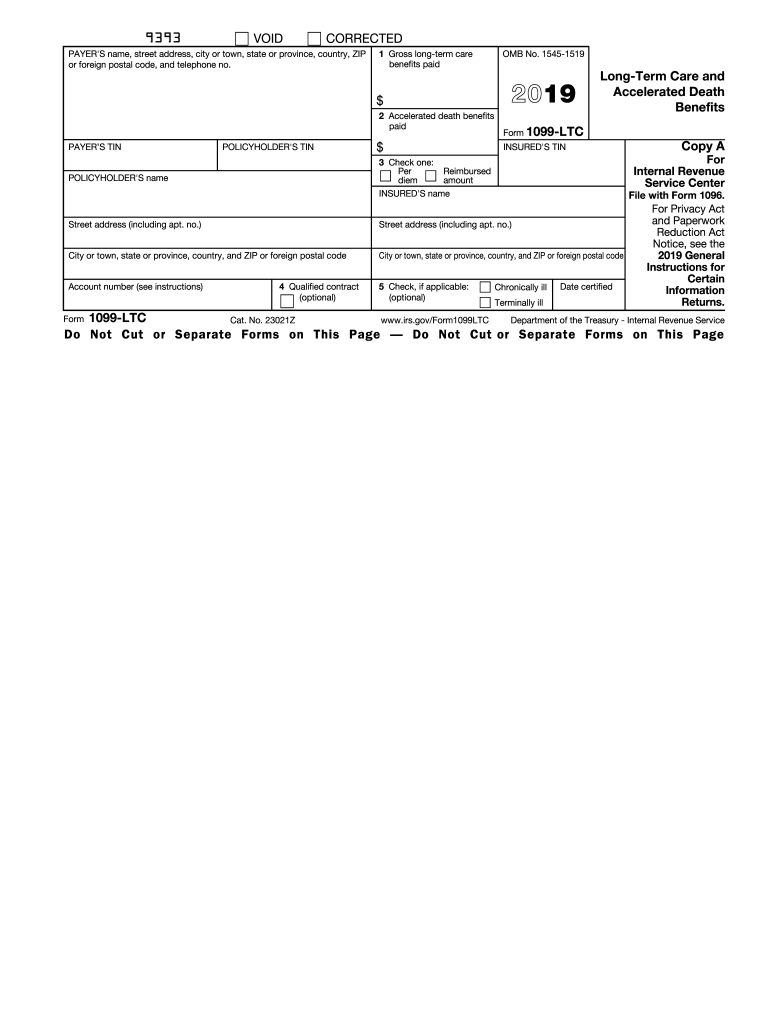

IRS 1099-LTC 2019 free printable template

Instructions and Help about IRS 1099-LTC

How to edit IRS 1099-LTC

How to fill out IRS 1099-LTC

Latest updates to IRS 1099-LTC

About IRS 1099-LTC 2019 previous version

What is IRS 1099-LTC?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

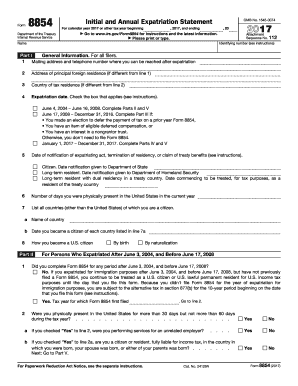

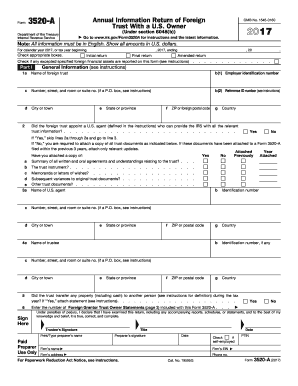

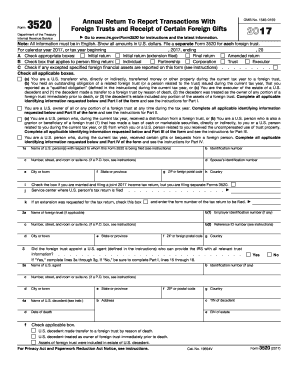

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1099-LTC

What should I do if I realize I made a mistake on my IRS 1099-LTC?

If you discover an error on your IRS 1099-LTC after filing, you need to submit a corrected form. This involves checking the IRS instructions for the specific corrections needed and properly issuing the amended information to both the IRS and the recipient. Make sure to keep records of the corrections as part of your compliance documentation.

How can I track the status of my IRS 1099-LTC submission?

Tracking the status of your IRS 1099-LTC can be done through the IRS e-file provider if you submitted electronically. You can verify receipt with the provider's tracking tool, and if your form is rejected, they will notify you with a rejection code. Once accepted, it typically takes a few weeks for processing.

Are e-signatures acceptable for filing the IRS 1099-LTC?

Yes, e-signatures are acceptable for IRS 1099-LTC filings as long as they comply with IRS guidelines. Ensure that you retain records of the electronic consent and signature as part of your filing documentation. This practice enhances both the efficiency and security of your submission process.

What common mistakes should I avoid when submitting my IRS 1099-LTC?

Some common mistakes include incorrect recipient Tax Identification Numbers (TINs) and failure to file for non-resident payees properly. Moreover, not adhering to the IRS formatting requirements can lead to delays or rejections. Review all information carefully to avoid these issues during submission.

What steps should I take if I receive an IRS notice regarding my 1099-LTC?

Upon receiving an IRS notice related to your IRS 1099-LTC, read it thoroughly to understand the issue. Gather all relevant documentation and prepare a clear response to address the IRS concerns. It’s advisable to respond promptly to avoid potential penalties or complications.