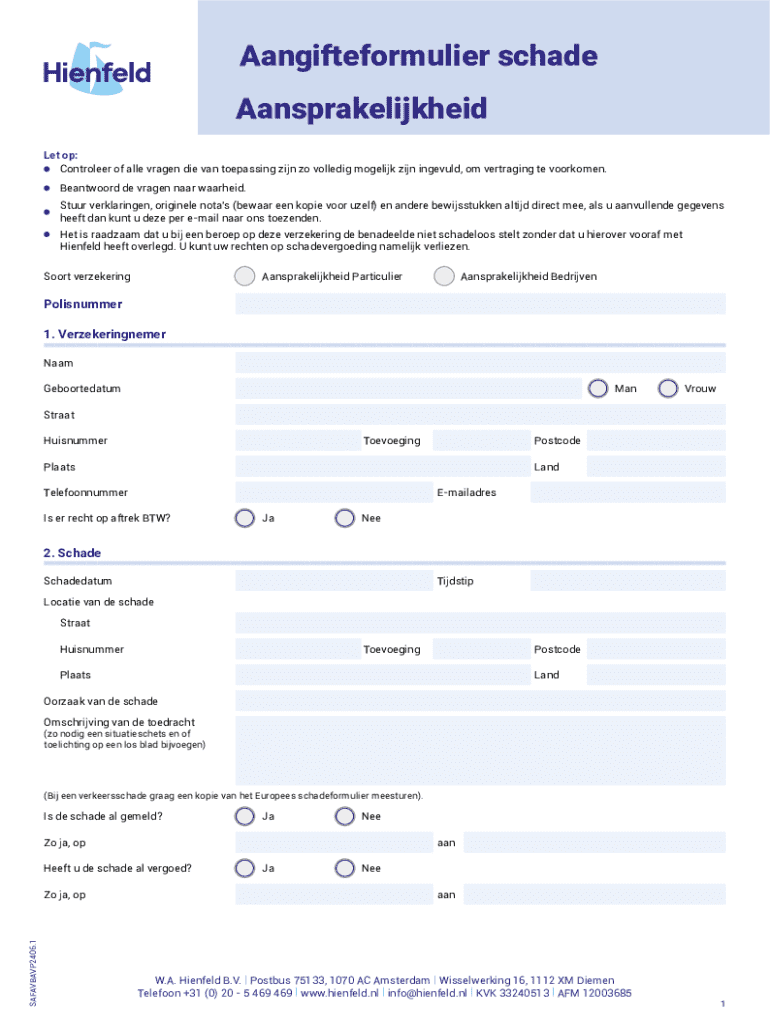

Pak de gratis Aangifteformulier schade Business Travel Insurance

Ophalen, creëren, maken en ondertekenen pak de gratis aangifteformulier

Hoe pak de gratis aangifteformulier online bewerken

Ongecompromitteerde beveiliging voor uw PDF-bewerkingen en eSignature-behoeften

Invullen pak de gratis aangifteformulier

Hoe u aangifteformulier schade business travel invult

Wie heeft aangifteformulier schade business travel nodig?

Pak de gratis aangifteformulier form: Your Complete Guide to Tax Filing

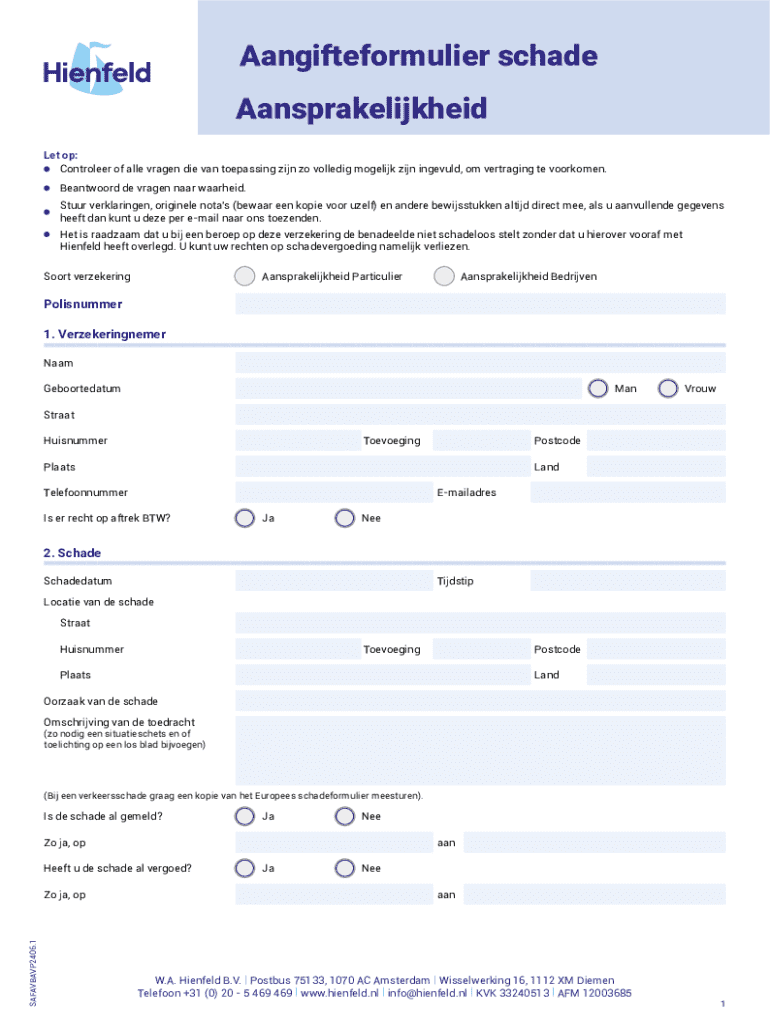

Overview of the gratis aangifteformulier

The gratis aangifteformulier is a free tax declaration form provided for individuals filing their taxes in the Netherlands. It serves as an essential resource for taxpayers to report their income, deductions, and tax credits accurately. This form is designed for those who prefer a self-service approach to tax filing, allowing users to navigate the paperwork independently.

Targeted primarily at individuals and small business owners, this form plays a pivotal role in ensuring compliance with Dutch tax regulations. Mastering how to utilize the form can lead to significant benefits in terms of refunds and deductions, making it crucial for anyone looking to manage their financial affairs effectively.

Importance of the gratis aangifteformulier for tax filing

Filing taxes using the gratis aangifteformulier accurately impacts your tax return directly. It ensures that you report all necessary income, which can affect your overall tax liability. Mistakes or omissions can result in penalties or delays in refunds, so understanding its importance cannot be overstated.

Moreover, properly utilizing this form can unlock various financial benefits. Accurately claiming deductions or credits can lead to lower taxable income and higher potential refunds. Thus, managing your form well translates to both compliance and financial advantages for individuals.

Step-by-step guide to accessing the gratis aangifteformulier

Accessing the gratis aangifteformulier through pdfFiller is a straightforward process. Just follow these steps to reach the form quickly.

To enhance user understanding, pdfFiller often provides visuals and screenshots throughout the navigating process.

Identifying necessary documents for completion

Before diving into filling out the form, gather all necessary documents to streamline the process. Key documents include:

Having these documents ready helps reduce time spent on filling out the form and minimizes the risk of errors.

Detailed instructions on filling out the gratis aangifteformulier

Once you have the gratis aangifteformulier open in pdfFiller, it's time to start filling it out. Here’s how to tackle each section effectively.

Personal information section

Start with the personal information section, where you will need to enter your full name, address, date of birth, and BSN (Burger Service Number). Double-check this information for accuracy, as it serves as the foundation for the rest of the document.

Income details section

Next, move to the income details section. Report all sources of income, including your employment earnings and any freelance work. If you have investment income or income from rental properties, ensure to include that information as well. Each entry must match the documentation (like your jaaropgave) to avoid discrepancies that could delay your tax return.

Deductions and credits section

In this section, you can claim various deductions and credits. Familiarize yourself with potential deductions applicable to your circumstances, such as medical expenses or educational costs. Label documentation clearly to track which deductions you've claimed.

Final review process

Before proceeding to submit, engage in a final review of your entries. Cross-check all figures against your documents to ensure accuracy. It is crucial to confirm that no sections are left incomplete, as this can lead to complications in processing your tax return.

Editing and signing the gratis aangifteformulier

Once your form is complete, pdfFiller provides tools for easy editing. Review your data and make any needed adjustments leveraging the platform's editing capabilities.

Utilizing pdfFiller's editing tools

pdfFiller's editing features allow users to modify text, add comments, and highlight important sections. This functionality ensures that you can create a polished and professional looking document that meets all requirements.

How to eSign your document securely

When you're ready to sign the form, pdfFiller offers a secure eSignature feature. This electronic signing option eliminates the need for printing and scanning, streamlining your submission process even further. To eSign, simply follow the prompts on the platform, ensuring that your signature is applied seamlessly.

Submitting your gratis aangifteformulier

Submitting the completed gratis aangifteformulier is straightforward. pdfFiller allows for various electronic submission methods.

Electronic submission methods

You can submit your completed form directly through pdfFiller, or download it and email it to the relevant tax authority. Ensure that you use the correct channels for submission to avoid potential processing delays.

Deadline for submission

The deadline for submitting your tax return in the Netherlands typically falls on the 1st of May, but this can vary depending on specific circumstances. Mark important dates on your calendar to keep your submission on track, reducing the stress of last-minute filing.

Common issues and FAQs related to the gratis aangifteformulier

Despite careful preparation, users may sometimes encounter issues while filling out the gratis aangifteformulier. Let's explore common problems and frequently asked questions.

What to do if you encounter errors while filling out the form

If you discover any errors in your entries during the form-filling process, take immediate action. Review the affected sections, cross-reference the details with your documents, and make necessary corrections. pdfFiller allows you to save your progress, ensuring you can revisit the form as needed.

Frequently asked questions about tax returns and refunds

Common queries often revolve around submission status, expected refund timelines, or needed documents for specific deductions. Investigate available resources or customer support offerings from pdfFiller to guide you through any uncertainties to ensure a smooth filing experience.

Strategies for managing your tax documents efficiently

Effective document management can enhance your tax filing experience. Implementing strategies can help you stay organized and prepared.

Organizing your financial records

Begin by creating a dedicated folder on your computer for all tax-related documents. Use subfolders to categorize by type (income, deductions, receipts). Maintain these throughout the year to ensure easy access come tax time.

Leveraging pdfFiller’s cloud-based storage features

pdfFiller offers cloud-based storage, allowing you to save and share documents securely. This means you can access your tax documents from anywhere—essential for collaboration or review. Utilizing this feature can keep all financial records centralized and easily retrievable.

Support and resources available through pdfFiller

pdfFiller offers extensive support and resources for users navigating the complexities of the gratis aangifteformulier.

Accessing customer support for assistance

Should you require assistance, pdfFiller's customer service team is readily available. Options for contacting support include live chat, email, or phone support, ensuring that help is just a click or call away.

Tutorials and guides to maximize your use of pdfFiller

The platform also features a wealth of tutorials and guides designed to help you maximize the benefits of pdfFiller. From learning about specific tools to understanding advanced functionalities, these resources equip users to manage their documents more effectively.

Voor veelgestelde vragen over pdfFiller

Hieronder vindt je een lijst met de meest voorkomende vragen van klanten. Kun je het antwoord op je vraag niet vinden, neem dan gerust contact met ons op.

Hoe kan ik pak de gratis aangifteformulier bewerken in Chrome?

Kan ik het pak de gratis aangifteformulier elektronisch ondertekenen in Chrome?

Kan ik pak de gratis aangifteformulier bewerken op een Android-apparaat?

Wat is aangifteformulier schade business travel?

Wie moet aangifteformulier schade business travel indienen?

Hoe vul je aangifteformulier schade business travel in?

Wat is het doel van aangifteformulier schade business travel?

Welke informatie moet worden gerapporteerd op aangifteformulier schade business travel?

pdfFiller is een end-to-end-oplossing voor het beheren, maken en bewerken van documenten en formulieren in de cloud. Bespaar tijd en moeite door uw belastingformulieren online op te stellen.