Get the free Colorado Tax Power of Attorney Form (DR 0145) - eForms

Get, Create, Make and Sign colorado tax power of

Editing colorado tax power of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out colorado tax power of

How to fill out colorado tax power of

Who needs colorado tax power of?

Understanding Colorado Tax Power of Form: A Comprehensive Guide

Understanding the Colorado Tax Power of Form

In Colorado, a Tax Power of Attorney (POA) is a legal document that empowers an individual to act on behalf of another regarding tax matters. This form is critical for managing tax-related decisions efficiently and ensuring that your financial affairs are handled properly, especially during times of incapacity or absence. The importance of the Tax Power of Form lies in its ability to streamline communication with tax agencies and facilitate access to sensitive tax information.

The legal and financial implications of designating a POA are significant. Not only does it authorize your agent to engage with the Colorado Department of Revenue, but it also protects your interests in compliance with tax laws. By having a Tax Power of Form in place, taxpayers can mitigate potential complications that arise from missing tax filings or unaddressed financial obligations.

Types of Colorado Tax Power of Forms

There are primarily two types of Tax Power of Forms in Colorado that individuals can use to appoint their agents: General Power of Attorney and Specific Power of Attorney for Tax Matters. Each serves distinct purposes with varying scopes of authority.

General Power of Attorney

A General Power of Attorney grants broad authority to the agent to make decisions across various aspects of the principal's affairs, which may include tax matters. This form is beneficial for individuals seeking a comprehensive representation of their interests. However, it has limitations; the agent’s powers may become invalid if the principal is incapacitated, unless specified.

Specific Power of Attorney for Tax Matters

A Specific Power of Attorney for Tax Matters, on the other hand, is tailored to authorize specific tax-related actions. This form is particularly applicable in scenarios where an individual needs focused representation, such as filing tax returns, addressing disputes, or communicating with tax authorities. It's essential for taxpayers who want to limit their agent's authority to tax matters only.

Eligibility criteria for designating a Tax Power of Attorney in Colorado

To designate a Tax Power of Attorney in Colorado, the principal must meet specific eligibility criteria. Any individual who is a legal adult can appoint an agent, typically a trusted family member, friend, or professional such as an accountant. In Colorado, there are no strict age restrictions for the agent; however, they must be able to understand and execute the responsibilities involved.

When selecting your agent, consider their reliability, knowledge of financial matters, and ability to act in your best interest during critical decision-making moments. The chosen agent must be diligent, trustworthy, and informed about your financial situation as they will be entrusted with sensitive tax-related authority.

Step-by-step guide to filling out the Colorado Tax Power of Form

Filling out the Colorado Tax Power of Form accurately is essential. Here’s a step-by-step guide to assist you through the process:

Common mistakes to avoid when filling out the form

When completing the Colorado Tax Power of Form, it's crucial to avoid common pitfalls that may invalidate the authority granted to your agent. Here are some key mistakes to watch for:

Managing Your Colorado Tax Power of Form After Submission

Once you've submitted the Colorado Tax Power of Form, proper management of the document is crucial. Here’s how you can do this effectively:

Frequently asked questions (FAQ)

Understanding the complexities surrounding the Colorado Tax Power of Form can raise several questions. Here are common inquiries:

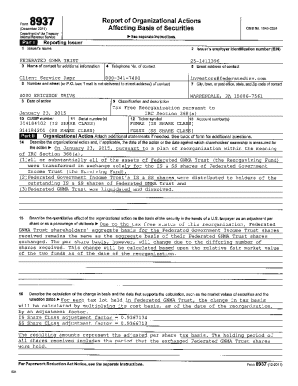

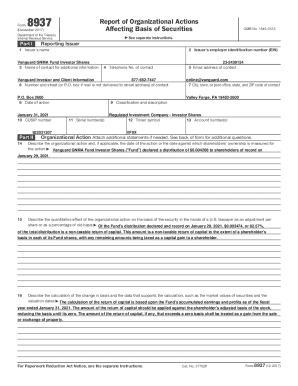

Utilizing pdfFiller for seamless document management

pdfFiller streamlines the process of creating, editing, and managing your Colorado Tax Power of Form. Its platform allows users to easily access templates, fill in the necessary information, and eSign documents with ease.

The benefits of using a cloud-based solution for tax documents are manifold, including enhanced accessibility, real-time updates, and collaborative features that enable family members or tax professionals to be involved in the process. With pdfFiller, you can manage all aspects, ensuring your tax authorization is current and effective.

Interactive tools and resources provided by pdfFiller

pdfFiller offers a range of interactive tools that simplify the management of your Colorado Tax Power of Form. Templates for the Tax Power of Attorney and other tax forms are readily available.

Additionally, pdfFiller allows for collaborative editing, enabling you to involve tax professionals or trusted family members in the document preparation process. The platform’s security features ensure your sensitive tax information is protected while offering access from anywhere, making it a practical choice for busy individuals managing multiple documents.

Real-world applications and case studies

The value of having a Tax Power of Attorney extends beyond mere theory; real-world applications illustrate its importance. For instance, consider a scenario where an elderly individual is unable to manage their taxes due to health issues. In such cases, having a designated POA ensures that tax filings occur on time and financial penalties are avoided.

Users of pdfFiller have shared their positive experiences, noting the platform's ability to simplify document workflows and eliminate stress during tax season. By utilizing pdfFiller, individuals and teams can ensure they remain organized, compliant, and prepared for any tax-related challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit colorado tax power of from Google Drive?

How can I send colorado tax power of for eSignature?

How do I fill out the colorado tax power of form on my smartphone?

What is colorado tax power of?

Who is required to file colorado tax power of?

How to fill out colorado tax power of?

What is the purpose of colorado tax power of?

What information must be reported on colorado tax power of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.