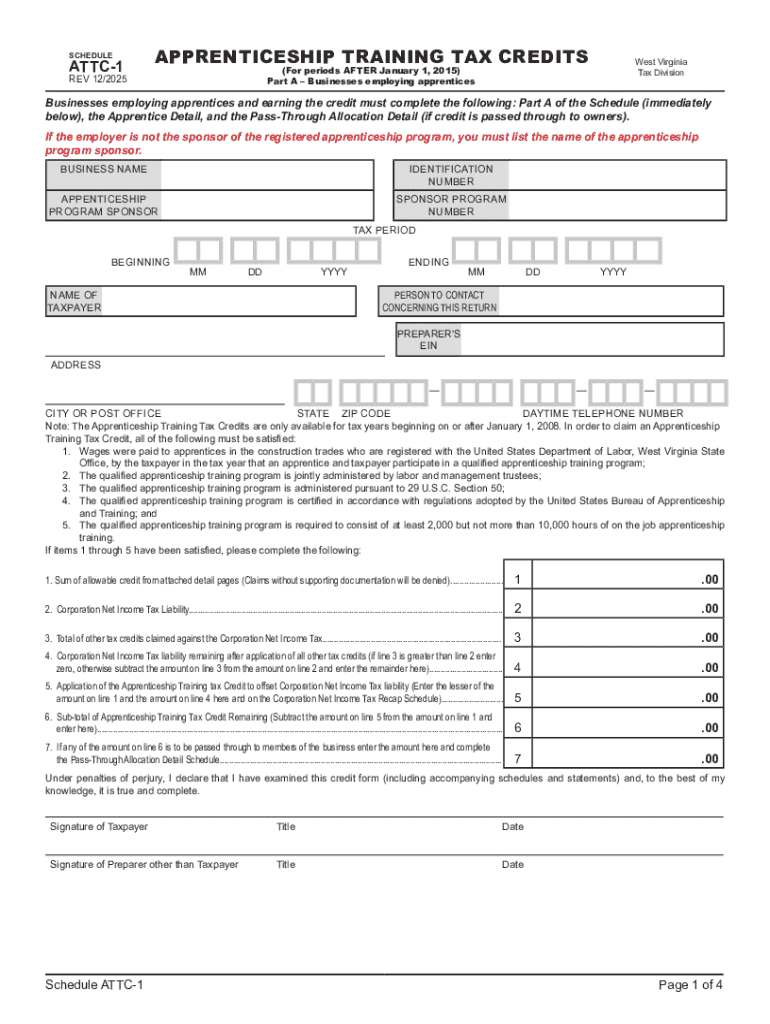

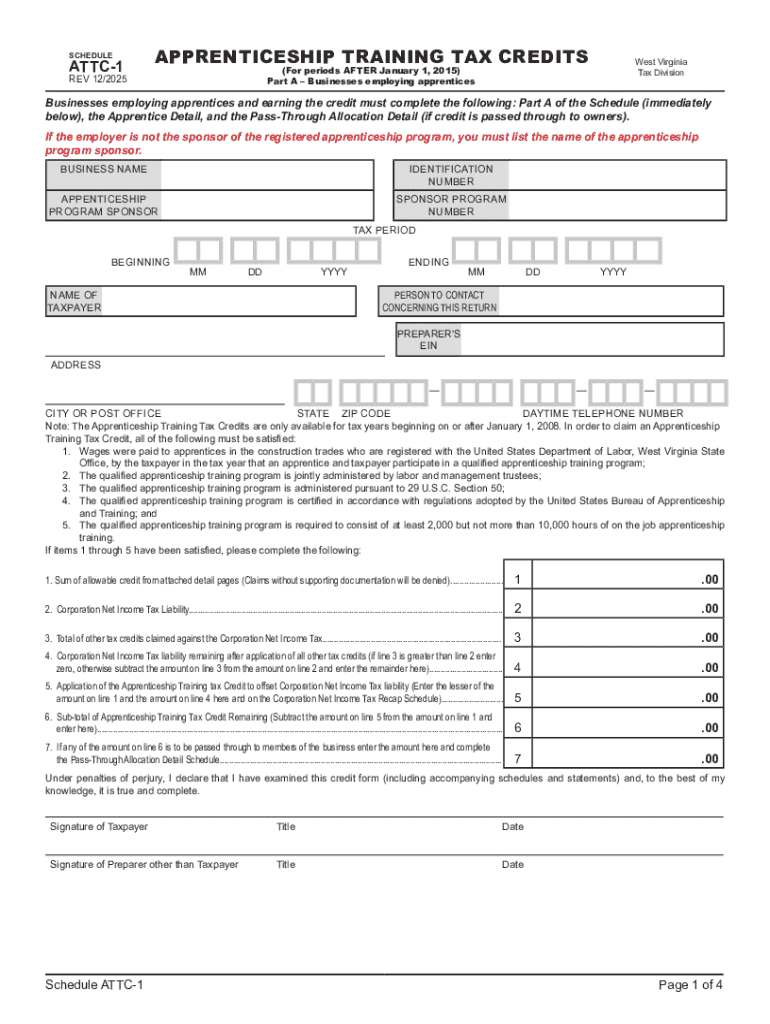

WV ATTC-1 2025 free printable template

Get, Create, Make and Sign WV ATTC-1

How to edit WV ATTC-1 online

Uncompromising security for your PDF editing and eSignature needs

WV ATTC-1 Form Versions

Maximizing Efficiency: The Comprehensive Guide to Forms and Form Management on pdfFiller

Understanding the importance of forms

Forms are essential tools in various sectors, serving as structured documents that capture information efficiently. They can range from simple questionnaires to complex data collection tools used in businesses for gathering feedback, processing transactions, or managing tasks. Their significance cannot be overstated; they enable streamlined communication and ensure that vital information is documented appropriately.

The shift towards digital forms has transformed traditional data collection and management. Digital forms offer remarkable benefits, enhancing accessibility and user experience. With the right tools, users can fill out and submit forms from any device with internet access, making it easier for teams to collect data on-the-go.

Types of forms: A breakdown

Understanding the different types of forms is critical for selecting the right tool for your needs. Standard forms are pre-designed and commonly used for specific tasks, such as applications or surveys. They ensure consistency and can be easily filled out by users familiar with the format. A few examples include job applications, registration forms, and feedback surveys.

Custom forms, on the other hand, are tailored to meet specific needs of a business or project. They can include unique fields and layouts that accommodate specialized data collection. Interactive forms enhance user engagement and can include dynamic elements such as conditional logic, which changes the form based on previous answers. This not only captures more relevant information but also improves user experience.

Key features of pdfFiller for enhancing form management

pdfFiller stands out in the realm of form management with a wealth of comprehensive PDF editing tools designed to accommodate a range of user needs. Users can effortlessly edit text and images within their forms, ensuring professional presentation and accuracy. Editing capabilities allow for the addition of annotations and comments, vital for collaboration and feedback processes.

The eSignature functionality offered by pdfFiller also adds tremendous value. Electronic signatures are not just about convenience; they have legal validity in many jurisdictions, making it easier for businesses to streamline contract signing. Users can add their signature directly on the document and track its usage, enhancing traceability and accountability within workflows.

Step-by-step guide to creating and managing forms using pdfFiller

Creating a new form on pdfFiller is straightforward. Users start by choosing a template or opting to create a form from scratch. Customizing fields and layout ensures the form meets the specific requirements of the task at hand. This process can involve changing text fields, adding images, or incorporating checkboxes, depending on the details needed.

For those looking to edit existing PDF forms, pdfFiller allows easy import and modification, ensuring that all necessary updates can be made. Users can enhance the design of the document to align with brand guidelines or personal preferences. Formatting tips like maintaining consistent font sizes and color schemes can significantly improve the appearance of the forms.

Advanced strategies for form utilization

To maximize the efficiency of form management, integrating forms with other software systems is vital. Connecting pdfFiller with a business intelligence platform or CRM can greatly enhance data usability, allowing for better decision-making and workflow automation. This integration enables businesses to collect relevant data and streamline processes, reducing time spent on administrative tasks.

Utilizing automation is another effective strategy. By automating repetitive tasks within form management, teams can focus on more critical aspects of their roles. For example, automating the distribution of forms to various stakeholders can ensure timely responses and enhance organizational efficiency. Analyzing collected form data further aids in decision making and operational improvements, uncovering insights that can guide business strategies.

Best practices for form design and usage

Creating user-friendly forms involves clear instructions and logically organized fields. When users can clearly understand what information is required, it reduces confusion and enhances completion rates. Ensure that forms are optimized for mobile access to accommodate users across different devices, as many people prefer to fill out forms on smartphones or tablets.

Compliance with legal standards is also paramount. It is essential to understand the regulations surrounding document management to avoid potential legal issues. Security features that protect user data, such as encryption and secure access protocols, should be a priority when designing and deploying forms.

Real-world applications of pdfFiller in form management

Various industries have successfully leveraged pdfFiller for form management, showcasing its versatility. For instance, healthcare organizations use customized forms for patient intake, ensuring all necessary information is collected efficiently. Restaurants have integrated electronic menus and order forms to streamline service and enhance customer experience.

Testimonials from users highlight significant improvements in efficiency. Many report that the ability to easily edit and share forms digitally has revolutionized their operations. By reducing the time spent on manual document handling, teams can focus on more strategic initiatives that drive business growth.

Future of form management in a digital world

The future of forms is promising, with trends indicating a greater shift towards automation and integration of advanced technologies. Artificial intelligence is playing an increasingly vital role, enhancing form usability through features such as auto-fill and smart data validation that helps ensure accuracy in submissions. As businesses aim for more data-driven decision-making, these trends will lead to more effective form management processes.

Moreover, as digital regulatory frameworks develop, organizations will need to stay informed about evolving legal and compliance standards. This vigilance will ensure that their form management practices remain robust and secure, meeting the demands of both users and regulatory bodies alike.

People Also Ask about

Who is legally required to file a tax return?

What is WV it 140 form?

Do all seniors have to file a tax return?

Does West Virginia have a state withholding form?

Does West Virginia have a state tax form?

Is there state tax in West Virginia?

How long do you have to be a resident of West Virginia to get in state tuition?

Do you have to file a state tax return in West Virginia?

At what point are you a resident?

How long do you have to live in WV to become a resident?

How do you qualify for in state tuition in West Virginia?

Do you have to make estimated quarterly tax payments?

Does West Virginia require estimated tax payments?

How long can you live somewhere without becoming a resident?

What is an IRS Form 140?

Who do I make check out to for WV state taxes?

Who has to file a WV tax return?

Who is exempt from filing a tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my WV ATTC-1 directly from Gmail?

How can I modify WV ATTC-1 without leaving Google Drive?

How do I complete WV ATTC-1 on an iOS device?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.