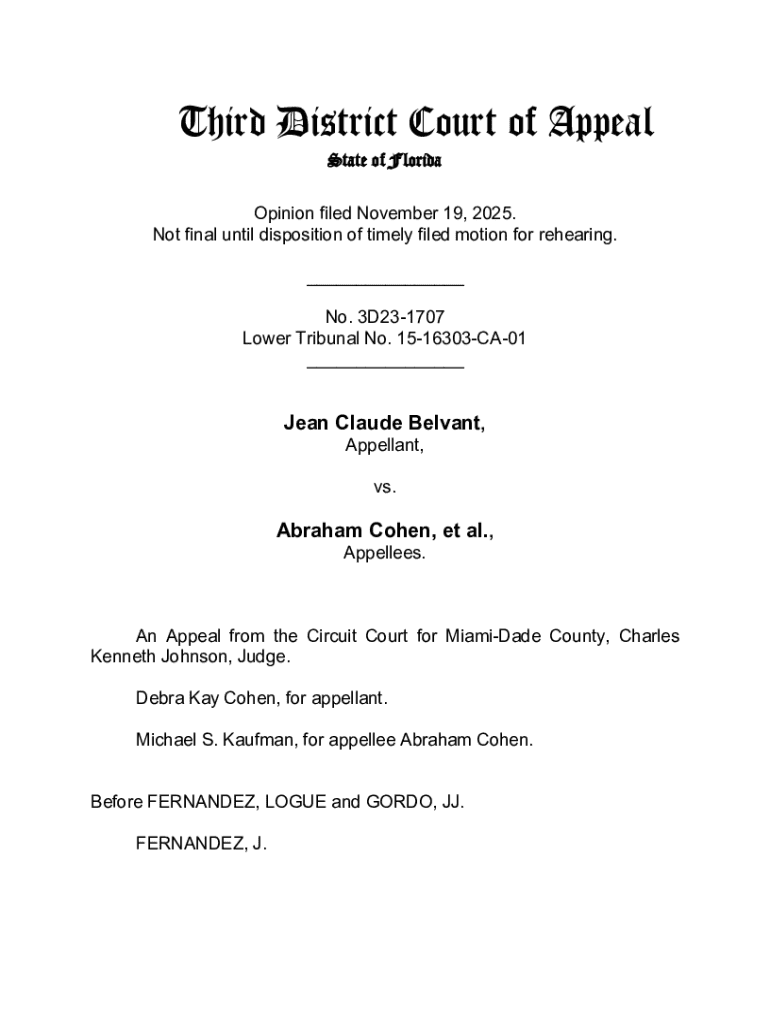

Get the free 15-16303-CA-01

Get, Create, Make and Sign 15-16303-ca-01

How to edit 15-16303-ca-01 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 15-16303-ca-01

How to fill out 15-16303-ca-01

Who needs 15-16303-ca-01?

Your Comprehensive Guide to the 15-16303-CA-01 Form

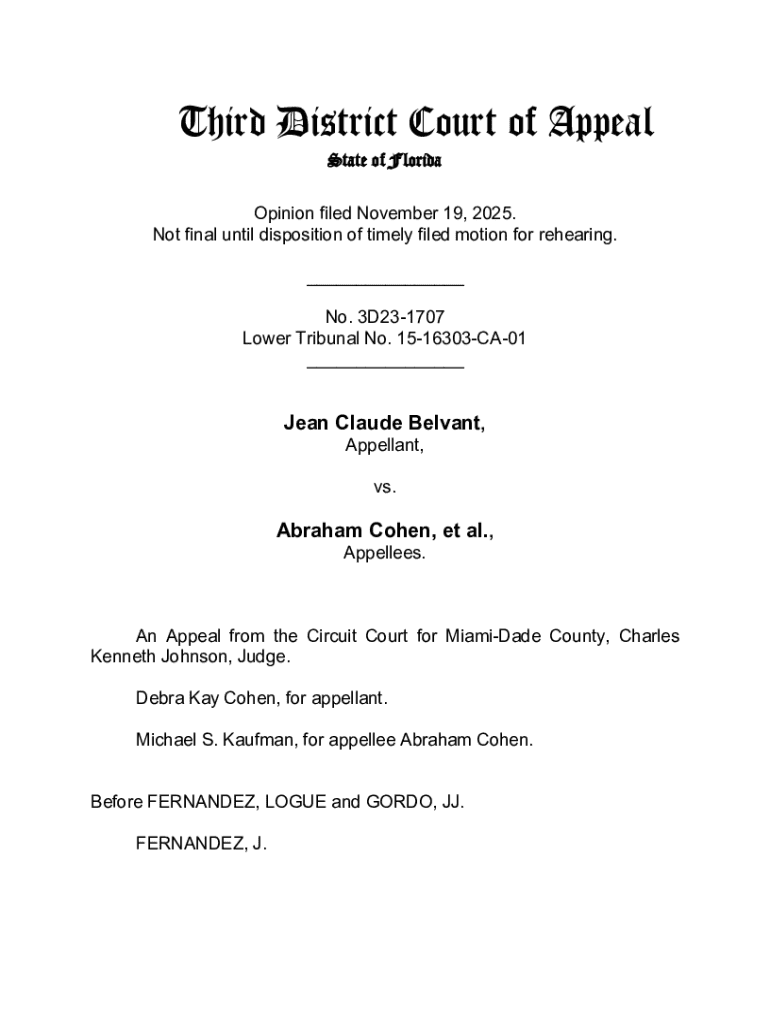

Understanding the 15-16303-CA-01 form

The 15-16303-CA-01 form is a crucial document used primarily in California for various legal and administrative purposes. Its specific design caters to individuals and organizations needing to report or disclose certain information to governmental entities. Often, this form serves as a way to provide essential data in compliance with state regulations, making it significant for legal processes and administrative compliance.

Commonly, the 15-16303-CA-01 form is utilized by businesses or individuals engaged in activities that require formal reporting to state agencies. It can be particularly relevant in real estate transactions, business licensing, and tax reporting. Understanding its role can aid users in fulfilling their obligations and avoiding penalties associated with incomplete or inaccurate filings.

Who needs to use the 15-16303-CA-01 form?

The 15-16303-CA-01 form targets a diverse audience. This includes small business owners, legal professionals, real estate agents, and individuals engaged in personal transactions that require reporting. Each of these groups may encounter circumstances where the proper completion of the form is necessary for compliance with local laws.

Key scenarios include new businesses applying for permits, real estate transactions requiring disclosures, and individuals appealing for certain government benefits where their financial status needs to be detailed. Understanding your need for this form can save you time and help you avoid unnecessary legal complications.

Preparing to complete the 15-16303-CA-01 form

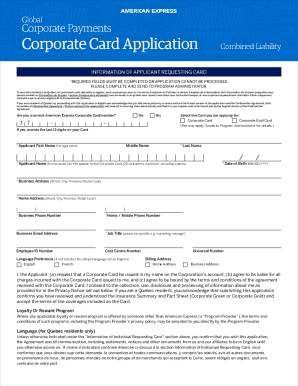

Before diving into the 15-16303-CA-01 form, it's crucial to gather the necessary information. This not only streamlines the filling process but also ensures completeness and accuracy. Key elements to collect include personal identification information, financial details, and any supporting documentation relevant to your disclosure.

Organizing your documents can significantly enhance efficiency. Consider setting up a dedicated folder for digital documents or keeping physical copies in a separate binder. Knowing how the form is structured also plays a critical role in preparation. It’s essential to familiarize yourself with the sections and fields, understanding the specific terminology so as not to be caught off-guard during the filling process.

Step-by-step guide to filling out the 15-16303-CA-01 form

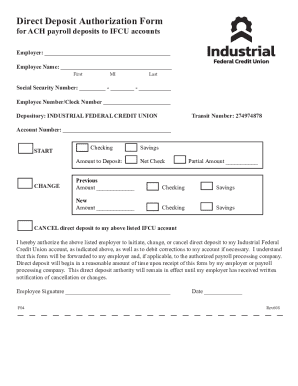

Filling out the 15-16303-CA-01 form requires methodical attention. Start with the basics, where personal information must be accurately recorded. This section typically asks for identifying information such as your name, address, and contact details. Accuracy at this stage is paramount because even minor errors can lead to processing delays or rejections.

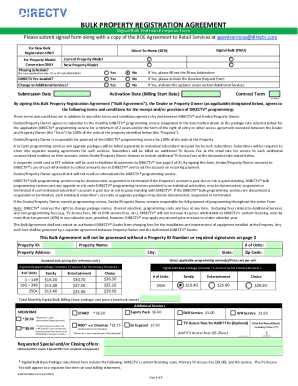

Moving on to the more detailed sections, you will fill out financial details and any other relevant information as required by the form. Each part of the form will likely specify supporting documents that need to accompany your submission. Pay close attention to any notes indicating special considerations, as these can affect the overall validity of your filing.

After completing the details, it's vital to review your information carefully. A useful checklist can include verifying each section for completeness, confirming that no required fields are left blank, and looking out for common mistakes like miscalculating financial data or failing to attach necessary documents.

Editing the 15-16303-CA-01 form

In the digital age, using tools like pdfFiller can enhance your experience when editing the 15-16303-CA-01 form. To begin, upload your form onto the platform, which offers intuitive options for accessing the document. With pdfFiller, you’ll find user-friendly editing tools that allow you to modify the content easily, from simple text edits to more complex layout adjustments.

Additionally, if you’re working in a team, pdfFiller has collaborative features that foster efficient communication. You can share the document with team members, enabling them to review or provide feedback directly on the form. The commenting features and revision tracking make collaboration straightforward, ensuring that everyone remains on the same page.

Signing the 15-16303-CA-01 form

Once you've completed the form, signing it is the next essential step. eSignatures, especially in today’s digital world, offer significant benefits over traditional signing methods. They facilitate quicker turnaround times and eliminate the need for physical transportation of paperwork. Using pdfFiller, the eSignature process is streamlined and uncomplicated, allowing users to sign documents securely and efficiently.

However, it’s important to understand the legal considerations surrounding eSignatures. Ensure that your signed documents comply with relevant eSignature laws applicable in California, thus confirming their validity. This means adhering to the standards set for electronic signatures to avoid potential disputes regarding document authenticity.

Managing your 15-16303-CA-01 form after completion

After successfully completing and signing the 15-16303-CA-01 form, the next steps involve management and storage of the document. Utilizing cloud-based solutions like pdfFiller makes it easier to store and access your completed forms. You can categorize files efficiently, ensuring that important documents remain organized and retrievable whenever needed.

When it comes to sharing the completed form with relevant parties, pdfFiller provides various methods. You can send documents via email directly from the platform or share them through secure links. It's crucial to implement security measures, such as password-protecting sensitive documents when necessary, to safeguard personally identifiable information.

Troubleshooting common issues

Even with careful preparation, issues may arise while dealing with the 15-16303-CA-01 form. Common errors include omissions, inaccuracies in financial reporting, or not attaching required supporting documents. Identifying these errors early can save you time and mitigate risks associated with filing disputes. Always be thorough in your review process, and don’t hesitate to consult resources specific to California's regulations for clarification.

If you need additional assistance, pdfFiller provides extensive support options. Their FAQ sections and customer service can guide you through troubleshooting while addressing frequently asked questions regarding the 15-16303-CA-01 form. Using these resources can significantly better your understanding and handling of potential issues.

Frequently asked questions (FAQs)

As users navigate the complexities of the 15-16303-CA-01 form, many general queries arise. For example, what documents are specifically required alongside the form? Or how can one ensure that the form is filled out correctly? Providing answers to such common questions forms the basis for user confidence and compliance.

For those leveraging pdfFiller, there are also plenty of features available that can enhance your experience. Tips about utilizing the collaborative tools, maximizing document security, and efficiently managing forms can further improve the workflow, ensuring smoother processes from creation to submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 15-16303-ca-01 in Gmail?

How do I make changes in 15-16303-ca-01?

How do I edit 15-16303-ca-01 straight from my smartphone?

What is 15-16303-ca-01?

Who is required to file 15-16303-ca-01?

How to fill out 15-16303-ca-01?

What is the purpose of 15-16303-ca-01?

What information must be reported on 15-16303-ca-01?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.