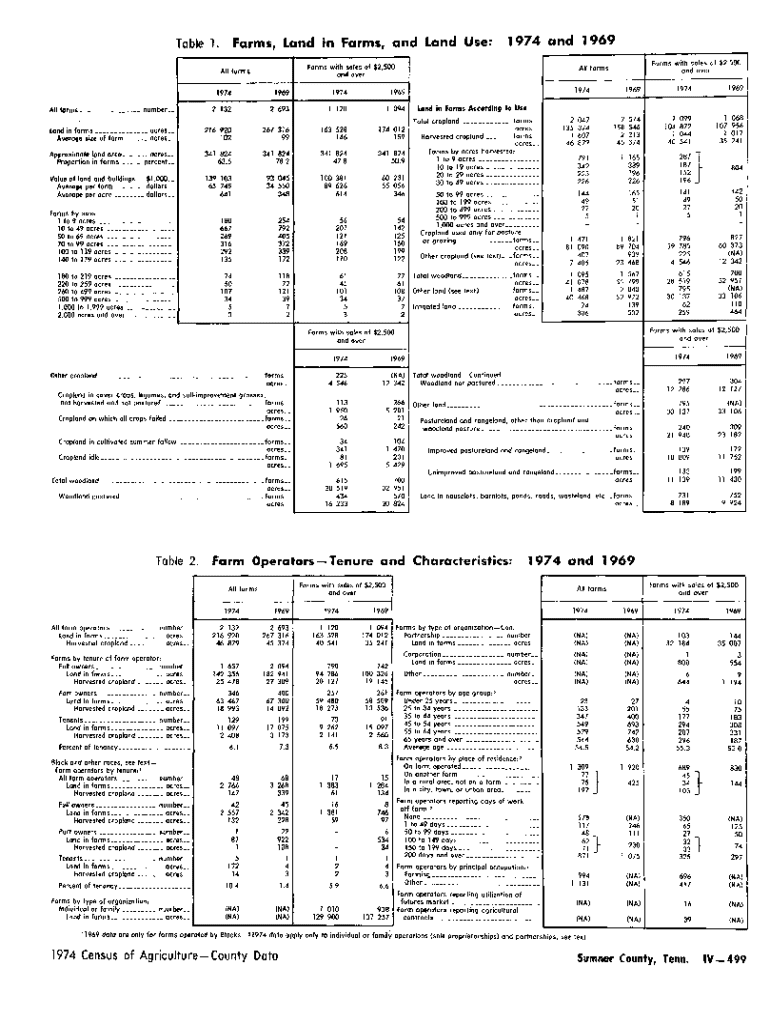

Get the free All farms ---- number -

Get, Create, Make and Sign all farms ---- number

How to edit all farms ---- number online

Uncompromising security for your PDF editing and eSignature needs

How to fill out all farms ---- number

How to fill out all farms ---- number

Who needs all farms ---- number?

All farms ---- number form: Your comprehensive guide

Understanding the importance of a farm number

A farm number is a unique identifier assigned to farming operations by government agencies. This number plays a crucial role in the agricultural industry, serving as a means of managing farm-related records and entitlements. Different states have varying requirements for obtaining a farm number, often necessitating specific documentation and proof of farming activities.

How & why to get a farm number

Obtaining a farm number involves a straightforward process that is vital for any farmer looking to access government programs and resources. Here are the essential steps you need to follow to get your farm number:

Having a farm number is essential for various reasons. It establishes your eligibility for government programs, provides access to agricultural resources and information, and enhances your credibility and business recognition in the agricultural community.

Benefits of obtaining a farm number

Acquiring a farm number opens the door to numerous benefits that can significantly bolster your agricultural operations. One of the most notable advantages is access to financial support. As a recognized farm, you can apply for grants and loans specifically designed for farmers, which can help you invest in your business.

Additionally, participation in agricultural programs offers subsidies for equipment and resources, while educational workshops enable farmers to broaden their skills and knowledge. Moreover, having a farm number can streamline your business operations by unlocking potential tax benefits and simplifying record-keeping processes.

Three ways to identify yourself as a farmer

Establishing your identity as a farmer is crucial for legitimacy and accessing essential resources. Here are three effective ways to do so:

Tax exemption and its implications

Tax exemption is an essential consideration for farmers, allowing qualifying operations to reduce their taxable income. Understanding what qualifies for exemption is critical. Generally, property used for production, certain sales tax exemptions on farm equipment, and other specific operational expenses can be eligible.

Implementing robust tax management strategies is crucial for maintaining financial health. Keeping accurate financial records helps track income and expenses effectively, while working with tax professionals ensures compliance with complex agricultural tax regulations.

Are you a hobby farmer or is this a business?

Distinguishing between hobby farming and commercial farming is vital for understanding your responsibilities and potential tax implications. Hobby farming is typically characterized by smaller-scale operations with personal enjoyment taking precedence over profit-making. In contrast, a successful business-focused farm often has a structured business plan, financial projections, and marketing strategies.

Each approach has distinct financial implications, especially concerning taxation. Hobby farmers may face fewer reporting requirements, yet registration as a business can provide valuable legal protections and access to broader resources.

Frequently asked questions (FAQs)

Many questions arise when considering obtaining a farm number. Here are some frequently asked questions and their answers:

Challenges in securing a farm number

Many individuals face challenges when attempting to secure a farm number. Common pitfalls include submitting incomplete applications or failing to demonstrate a clear purpose for their farming activities. To avoid these setbacks, it is advisable to meticulously review application requirements and ensure all documentation is accurate and complete.

Solutions to this challenge include seeking guidance from agricultural experts, who can assist in navigating the application process, and utilizing online resources and tools that provide comprehensive information and documentation assistance.

Navigating transition: Ready to get started?

Transitioning into farming, whether by taking over a family farm or moving to higher-value markets, entails significant planning and awareness. For those taking over a family business, it’s pivotal to consider legal aspects and obligations. Ensuring that land ownership and business structures are clarified can prevent future complications.

For those looking to navigate towards higher-value markets, identifying niche opportunities in agricultural markets that align with consumer demand can enhance profitability. Implementing strategies to enhance product value and marketability ensures you capture the attention of potential buyers.

Supporting and advocating for sustainable and just farming communities

Farmers play a critical role in shaping sustainable food systems. Understanding various frameworks for just food systems—economic, racial, and ecological—is essential for fostering inclusive farming practices. Engaging in these frameworks enables farmers to promote equitable access to resources and support.

By actively engaging in advocacy and community-building efforts, farmers can work together to create a responsive agricultural landscape that prioritizes sustainability and equitable resource distribution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my all farms ---- number directly from Gmail?

How do I execute all farms ---- number online?

How do I fill out the all farms ---- number form on my smartphone?

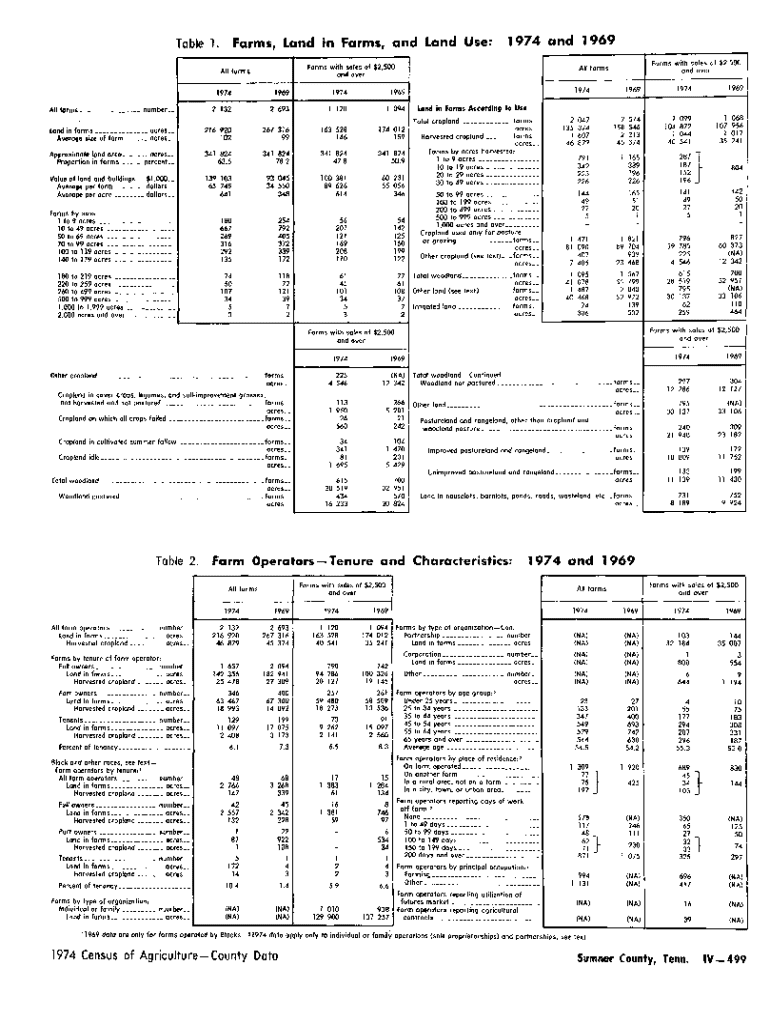

What is all farms ---- number?

Who is required to file all farms ---- number?

How to fill out all farms ---- number?

What is the purpose of all farms ---- number?

What information must be reported on all farms ---- number?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.