Get the free Smart CA Indias Trade Agreements (FTAs), Trade War- Meaning & Impact-

Get, Create, Make and Sign smart ca indias trade

How to edit smart ca indias trade online

Uncompromising security for your PDF editing and eSignature needs

How to fill out smart ca indias trade

How to fill out smart ca indias trade

Who needs smart ca indias trade?

Smart CA India's Trade Form – A How-to Guide

Understanding Smart CA India's trade form

Smart CA India's Trade Form is a streamlined digital document designed to facilitate the complexities of trading in India. This form captures essential information required for various business transactions, ensuring compliance with national regulations while enhancing the efficiency of trade processes.

The importance of this trade form cannot be understated. As businesses engage in international and domestic trade, having a precise and well-structured trade form supports smoother operations and minimizes the risk of errors. From securing a letter of credit to managing import/export processes, this form serves as a foundational document.

Key features of the Trade Form include a user-friendly interface for easy data entry, customized sections tailored for both importers and exporters, and options for online submission. By utilizing this comprehensive trade form, businesses can significantly enhance their trade documentation efficiency.

Who needs the Smart CA India's trade form?

The Smart CA India's Trade Form is essential for a diverse array of users. This includes individuals and teams across various business sectors who seek to engage in international commerce. Entrepreneurs, particularly non-resident Indians (NRIs) who handle business from abroad, will find it particularly beneficial.

Additionally, importers and exporters requiring customized trade documentation are key users of this form. These entities will appreciate the bespoke digital solutions provided by the Smart CA Trade Form, which allows for tailored inputs that meet specific trade requirements.

Getting started with Smart CA India's trade form

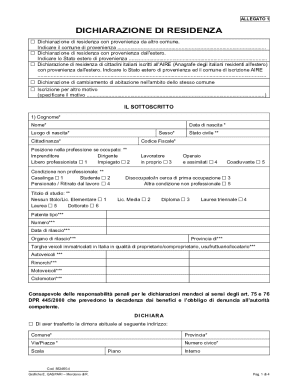

Before accessing the Smart CA India’s Trade Form, it’s important to prepare by gathering necessary information and documentation. The legal requirements for trade vary, so understanding your obligations as a trader is vital. Documents such as business registration details, account numbers for savings accounts or current accounts, and relevant product information should be ready.

To access the trade form, simply visit the pdfFiller website. Here’s a step-by-step guide: First, navigate to the forms section. Secondly, search for 'Smart CA India’s Trade Form' in the search bar. Finally, click on the link provided to open the form. By utilizing our tips for quick access, such as saving the link or bookmarking the page, you can save valuable time.

Filling out the Smart CA India's trade form

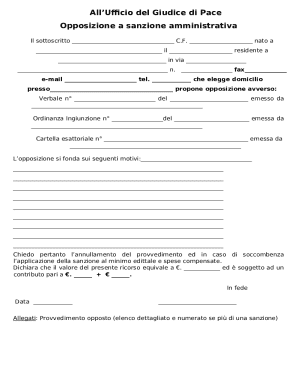

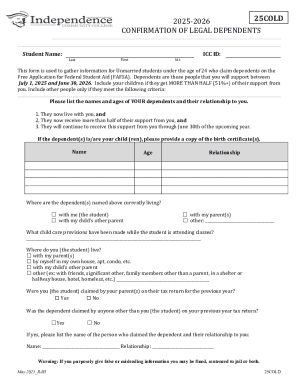

Filling out the Smart CA India’s Trade Form involves detailing several key sections: The first section includes basic information such as your company name, registration details, and addresses. Ensure this is accurate to prevent any administrative issues.

The Trade Details section requires specifics about imports and exports including product descriptions and values. Be meticulous with numbers here, as incorrect values can affect customs processes. The Financial Information section asks for banking details, which may involve your current account or salary account for payment processing.

Lastly, the Compliance Requirements section requires that you list any necessary certifications or permits, crucial for legal trading. It's wise to double-check requirements specific to your field or geographical area to avoid complications.

While filling out the form, watch for red flags such as missing signatures or incomplete sections, as these can lead to delays or rejections in trade processing.

Editing and modifying the Smart CA trade form

Utilizing pdfFiller tools for document editing is straightforward. This platform offers a user-friendly interface that allows for easy modifications. To edit the form, open it in pdfFiller, then select the areas you wish to change. The options allow for typing directly or using drag-and-drop features for uploads.

For effective collaboration, pdfFiller enables users to add comments and feedback. This is crucial for teams working on trade forms together—attaching notes can clarify specific requirements and create a more streamlined submission process.

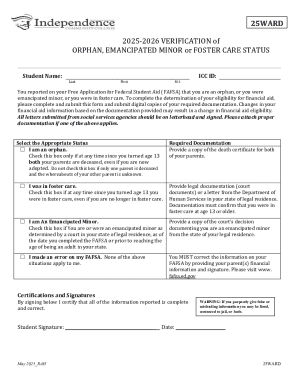

Signing and finalizing the Smart CA India's trade form

Once the Smart CA India's Trade Form is completed, the next step is signing the document. pdfFiller offers options for electronic signatures, which can be easily integrated into your workflow. This feature ensures secure signing, preventing unauthorized changes while allowing for quick finalization.

To verify the completion of the document, utilize a checklist. Ensure all sections are filled out correctly and that all necessary attachments, such as permits or commercial invoices, are included. This diligence helps avoid submission delays and enhances overall efficiency.

Submitting the trade form

Submitting your completed Smart CA India's Trade Form can be done through various methods. Online submission is often the fastest, requiring you to follow the platform's submission guidelines carefully. Additionally, alternative options may be available, including physical mail, although these methods take longer.

Understanding the review process is crucial. After submission, expect a review period during which the relevant authorities evaluate your documentation. Typically, this can take anywhere from a few days to several weeks, depending on the complexity of the trade and regulatory volume.

Managing and storing your Smart CA India's trade form with pdfFiller

Storing documents on a cloud platform like pdfFiller offers numerous benefits. You gain the advantage of easy access from anywhere, allowing you to retrieve important documents on-the-go. Furthermore, with organization and searchability features, locating past submissions becomes simple, saving you time and effort.

Ensuring document security and compliance is also a priority. Implementing best practices for data protection, such as using strong passwords and two-factor authentication, can safeguard sensitive information regarding your trade transactions.

FAQs about Smart CA India's trade form

Many users have questions about the Smart CA India’s Trade Form. If your submission is rejected, reviewing the feedback from authorities is crucial for understanding what needs rectification. You may also inquire about the potential for information changes after submission, as some details may be amendable under specific circumstances.

Handling multiple trade forms can be simplified by using pdfFiller’s organizational features, allowing you to manage various submissions efficiently. Keeping track of different submissions ensures you don’t miss any compliance deadlines.

Success stories and use cases

Businesses across India have successfully utilized the Smart CA India’s Trade Form, leading to smoother trading experiences. For instance, an export company reported a 30% reduction in documentation time after implementing the Smart CA Form, illustrating its efficiency. Feedback from users highlights increased confidence in compliance and the clarity provided by the form.

Case studies showcase various scenarios where quick access to trade data allowed businesses to effectively navigate customs checks and fulfill urgent orders, resulting in improved sales and customer satisfaction.

Advancing your document management strategy with pdfFiller

Beyond trade forms, pdfFiller offers a wide range of forms and templates that cater to various business needs. This expansion can streamline document management across different areas, enhancing operational efficiency. Leveraging an all-in-one document solution means less time juggling multiple platforms and more time focusing on business growth.

Additionally, collaboration tools enhance productivity by streamlining communication within teams. Enhanced collaboration ensures that everyone involved in the trade process is on the same page, reducing delays attributable to misunderstandings or miscommunications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find smart ca indias trade?

How do I edit smart ca indias trade online?

How do I edit smart ca indias trade on an iOS device?

What is smart ca indias trade?

Who is required to file smart ca indias trade?

How to fill out smart ca indias trade?

What is the purpose of smart ca indias trade?

What information must be reported on smart ca indias trade?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.