Get the free STANDARD Financing

Get, Create, Make and Sign standard financing

How to edit standard financing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out standard financing

How to fill out standard financing

Who needs standard financing?

Comprehensive Guide to the Standard Financing Form

Understanding standard financing forms

Standard financing forms are essential documents used in the process of securing loans, including mortgages and personal loans. These forms outline the terms of a loan agreement between borrowers and lenders, ensuring transparency and legality in the financing process. By employing standard financing forms, both parties can clearly understand their obligations, rights, and costs, minimizing disputes and enhancing trust.

The importance of these forms in the financing process cannot be overstated. They serve as a foundational documentation layer, allowing lenders to process applications efficiently while offering borrowers a detailed view of their financial commitments. Standard financing forms are commonly used across various sectors, from individual home purchases to business financing, making them integral to both consumer and commercial finance.

Types of standard financing forms

There are various types of standard financing forms, each designed to cater to specific types of financial transactions. Understanding these forms is critical for planners, borrowers, and lenders alike. The most recognized include the Loan Estimate Form, which provides a detailed breakdown of costs associated with a mortgage, and the Closing Disclosure Form, offering final terms before signing.

Different forms serve unique purposes and vary subtly in their requirements and content. For example, while the Loan Estimate Form outlines estimated monthly payments and fees, the Closing Disclosure focuses on validating the terms once the financing is nearly complete, detailing costs in clear language to enable informed signing.

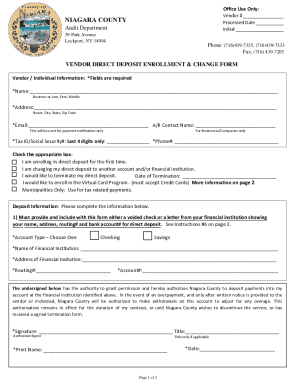

Components of a standard financing form

The essential components of a standard financing form typically include borrower information, loan terms, and estimated closing costs. Each part plays a crucial role in determining not just the approval of a financing application, but also the satisfaction of the borrower post-agreement.

Borrower information includes personal identification and contact details, fundamental for validating the identity of the applicant. Loan terms elaborate on principal amounts, interest rates, repayment schedules, and any provisions related to the loan's maturity. Estimated closing costs list associated fees, including those for inspections and appraisals, which can significantly affect the total financial outlay of a borrower.

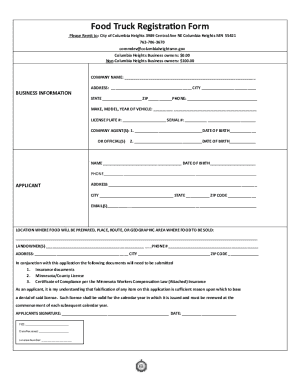

How to fill out a standard financing form

Filling out a standard financing form correctly is crucial for a smooth financing process. Here’s a step-by-step guide to ensure every detail is captured accurately and efficiently:

Common mistakes to avoid include entering incorrect information or failing to gather necessary signatures. It's advisable to conduct thorough checks before submission to mitigate complications later on.

Tips for editing and managing standard financing forms

Editing and managing standard financing forms has become significantly easier thanks to digital tools. Using platforms like pdfFiller, users can efficiently edit PDFs, ensuring that all documents remain up to date without the hassle of reprinting.

Best practices for managing these documents include maintaining an organized system for changes and ensuring version control to avoid confusion among multiple parties. Collaborative tools also allow teams to work together seamlessly, making necessary adjustments with ease.

Digital signing of financing forms

E-signatures have revolutionized the signing process for standard financing forms. With electronic signing methods, parties can swiftly and securely authorize documents without the need for physical presence. This not only speeds up the overall process but also offers a level of convenience that traditional methods cannot match.

To sign financing forms electronically using pdfFiller, users can follow a few straightforward steps to ensure their signatures are legally binding. Understanding the legal framework surrounding e-signatures is crucial, as many jurisdictions recognize electronic signatures as equivalent to handwritten signatures, provided specific guidelines are followed.

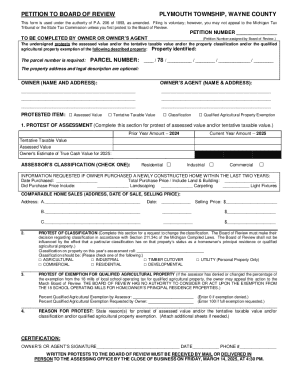

Common scenarios encountered with standard financing forms

Navigating standard financing forms involves various scenarios, whether it’s for a home purchase, refinancing, or securing a loan for a small business. For instance, when pursuing a mortgage for a home purchase, meticulous attention to detail in the forms can make or break a deal, particularly concerning loan types and rates.

Challenges can arise, such as discovering errors after submission. In such cases, it's essential to promptly contact the lender and provide corrected information. Understanding your rights as a borrower ensures that you are informed regarding the possible steps you can take in these instances.

Interactive tools for standard financing forms

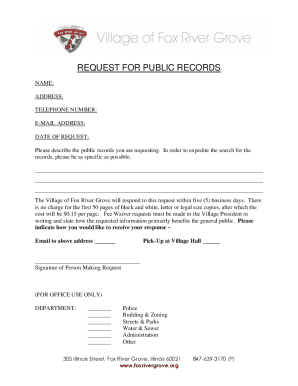

Interactive tools available on platforms like pdfFiller transform how users engage with standard financing forms. Accessible fillable forms and templates cater to various financing situations, enabling a streamlined approach for individuals and teams.

These interactive tools come with several advantages — they are accessible from anywhere with an internet connection, enhancing collaboration among different stakeholders. This feature is particularly beneficial when parties need to contribute or amend documents synchronously.

Frequently asked questions (FAQs) about standard financing forms

A variety of questions often arise concerning standard financing forms, particularly related to terminology and the conditions surrounding their use. For example, borrowers frequently inquire about what constitutes an acceptable citation and how to manage revisions effectively.

Resources such as pdfFiller’s support and guidance documents are valuable for addressing common queries, ensuring that users feel confident navigating the complexities of financing forms.

Finalizing the standard financing process

After submitting a standard financing form, users should expect an evaluation period where lenders assess the application against their criteria. Understanding the follow-up actions required post-submission, such as additional documentation requests or communication with loan officers, can greatly streamline this process.

Living within the expectations set by lenders and being mindful of timelines can aid in securing favorable financing. Resources available on pdfFiller can help track the progress of applications and ensure necessary documentation is supplied promptly.

Understanding compliance and regulations

Compliance with regulatory obligations related to standard financing forms is essential for borrowers and lenders alike. Such compliance ensures that all parties proceed within the framework of the law and maintain accountability, particularly when it comes to disclosure citations and adherence to provisions outlined in agreements.

Using solutions like pdfFiller can facilitate adherence to these regulations. Features that provide template integrations can help users ensure they remain compliant with the latest standards without unnecessary manual input.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit standard financing from Google Drive?

Can I create an electronic signature for signing my standard financing in Gmail?

Can I edit standard financing on an iOS device?

What is standard financing?

Who is required to file standard financing?

How to fill out standard financing?

What is the purpose of standard financing?

What information must be reported on standard financing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.