Get the free Montana MW3 Withholding Tax Form Instructions

Get, Create, Make and Sign montana mw3 withholding tax

Editing montana mw3 withholding tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out montana mw3 withholding tax

How to fill out montana mw3 withholding tax

Who needs montana mw3 withholding tax?

Montana MW-3 Withholding Tax Form How-to Guide

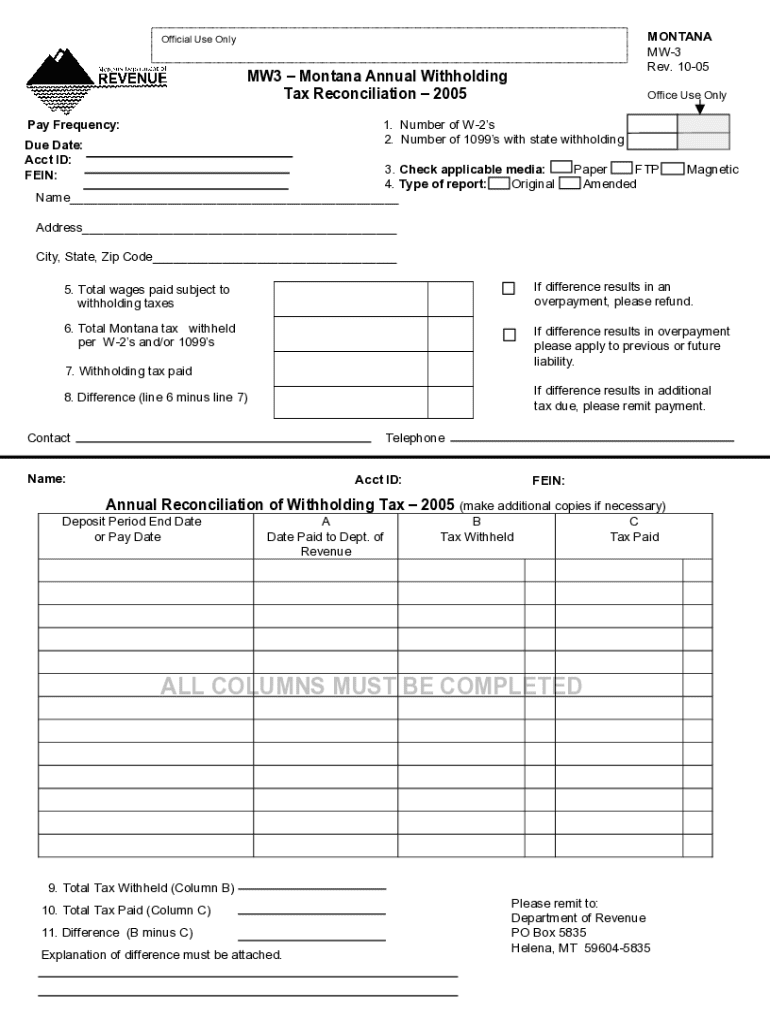

Understanding the Montana MW-3 Withholding Tax Form

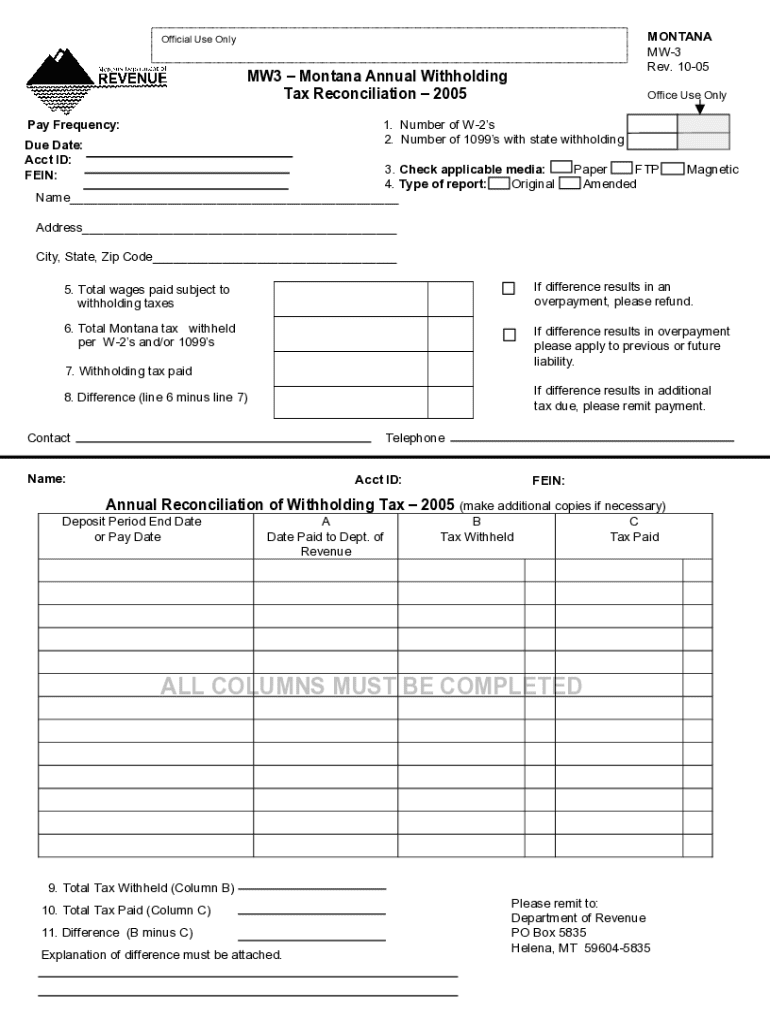

The Montana MW-3 form serves as a crucial report for employers in the state, summarizing the total income tax withheld from employees throughout the tax year. It acts as a bridge between the withheld taxes and the state’s revenue, ensuring compliance with state tax regulations. The primary purpose of this form is to provide the Montana Department of Revenue with a comprehensive view of the total tax withholdings from W-2 forms issued, allowing the state to accurately assess income tax liabilities.

For employers, timely and accurate filing of the MW-3 is crucial. It not only fulfills legal obligations but also contributes to accurate tax reporting for employees. Employees depend on these filings for their individual tax returns; thus, any discrepancies can lead to tax complications. Additionally, understanding withholding taxes is paramount, as Montana taxes employers on the taxes withheld from employees to fund essential state programs and services.

Who needs to file the MW-3 form?

Any employer who has withheld income taxes from employees in Montana must file the MW-3 form. This includes businesses of all types, whether they are large corporations or small sole proprietorships. The eligibility criteria primarily revolve around the fact that if you have employees for whom you withhold state income tax, filing the MW-3 is mandatory. This form plays a significant role in summarizing the withheld amounts for each employee, simplifying the submission of taxes to the state.

Common scenarios leading to filing include paying employees wages, commissions, or bonuses. Even if an employer has only had a short-term employee or seasonal worker, the MW-3 must be filed, capturing all withholdings accurately during the tax year. Employers who fail to file or incorrectly fill out this form may face penalties, thus reinforcing the necessity for compliance.

Key components of the MW-3 form

The MW-3 form consists of several key sections that need to be filled out correctly to ensure a seamless filing process. The first section requires detailed employer information, including the business name, address, and employer identification number (EIN). Providing accurate information here is essential for identifying the filing entity.

Next is the summary of W-2 forms filed. This section collects important details like the total number of W-2s issued and the aggregate amount of taxes withheld. Finally, the withholding amounts summary presents a comprehensive view of state taxes collected, helping to streamline the calculation process during audits. Care should be taken to avoid common mistakes, such as transposing figures or misreporting the number of employees, as these can lead to discrepancies that may necessitate amendments.

Step-by-step instructions for completing the MW-3 form

To ensure accurate completion of the MW-3 form, follow these steps meticulously. Step 1 involves gathering necessary information such as employee details, which includes Social Security numbers and wages earned, as well as previous year’s withholding records for referenced values. Having these documents ready allows for a smoother completion process and aids in ensuring no vital information is missed.

Step 2 is the actual filling out of the MW-3 form. Begin with the employer information, ensure the EIN is accurate, and systematically move through to the W-2 summary and withholding amounts. Step 3 is reviewing and validating the information entered. A checklist for ensuring accuracy might include verifying all names against IRS records and confirming that the total withholding amount matches the records. Lastly, Step 4 involves filing the MW-3 form, available in both paper and electronic formats. Understanding the filing deadlines, like the January 31 deadline for annual submissions, is crucial for timely compliance.

Filing requirements and procedures

Filing the MW-3 in Montana follows stringent timelines. Employers need to file this annual return by January 31 of the year following the end of the tax year. This ensures that the Montana Department of Revenue receives the necessary paperwork in time for processing individuals' tax returns. Submission can be performed electronically via the state’s taxation portal or through postal mail, but it is crucial to retain documentation of the filed MW-3 for a minimum of seven years in accordance with state record-keeping laws.

Employers are encouraged to submit their forms electronically to expedite the processing time and reduce the chances of error often associated with paper filing. Upon submission, employers should confirm receipt by checking with the Department of Revenue or retaining postal service receipts as part of their record-keeping best practices to safeguard against any potential disputes.

Frequently asked questions about the MW-3 form

A common question is what to do if a mistake is made on the MW-3 form. Employers often worry about inaccuracies; however, in Montana, corrections can be made by submitting an amended MW-3 form along with an explanation of the changes. Another frequent concern regards penalties for late filing; Montana imposes penalties based on the amount due and the length of the delay. It's vital for employers to understand the specifics to avoid unnecessary fines.

Regarding modifications after submission, while changes to the MW-3 are possible through amendments, post-filing modifications on W-2 forms must also be considered. Employers seeking assistance with filing can rely on resources provided by the Montana Department of Revenue and various online platforms, like pdfFiller, that simplify document editing and submission processes.

Accessing and managing the MW-3 form with pdfFiller

Using pdfFiller to access the Montana MW-3 form online greatly enhances convenience for employers. Users can quickly find the form within pdfFiller's extensive database, ensuring that they always have the latest version readily available. The platform provides features that allow users to edit and fill out the MW-3 electronically, reducing the chances of errors associated with handwritten submissions.

Moreover, pdfFiller offers tools to collaborate on the MW-3 form with team members, making it easy to coordinate across departments. For secure storage and document management, pdfFiller’s cloud system allows employers to keep all tax-related documents organized and accessible at any time. This ease of access can be especially beneficial when needing to retrieve historical documents for audits or tax assessments.

Tips for efficient withholding tax management in Montana

Managing withholding taxes efficiently in Montana involves implementing best practices. First, regularly tracking employee withholdings can help identify discrepancies before they escalate, ensuring that the required amounts are being withheld correctly. Utilizing technology, such as payroll software integrated with tax reporting tools, can further enhance accuracy and reduce the administrative burden on staff responsible for payroll tasks.

Staying informed about updates in Montana tax laws is essential for compliance. Employers should subscribe to state newsletters or follow the Montana Department of Revenue’s announcements, as changes in tax regulations can significantly impact withholding rates and filing requirements. Finally, engaging in continuous education through workshops or webinars can equip businesses with the knowledge they need to navigate tax management adeptly.

Real-life examples and case studies

Many employers have successfully leveraged pdfFiller for their MW-3 filing, finding it reduces the time and effort associated with annual tax reporting. One notable example includes a small business in Billings that transitioned from manual paperwork to pdfFiller’s online tools. They reported a 50% reduction in filing time and appreciated the compliance peace of mind that came from better organization.

Common errors encountered by others often include incorrect employee information or miscalculating total withholdings. Those that utilized pdfFiller found the drop-down features and automated calculations significantly decreased these types of mistakes. This not only ensured accurate filings but also improved their overall workflow, showcasing the benefits of adopting cloud-based tax document management tools.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get montana mw3 withholding tax?

How can I edit montana mw3 withholding tax on a smartphone?

How can I fill out montana mw3 withholding tax on an iOS device?

What is montana mw3 withholding tax?

Who is required to file montana mw3 withholding tax?

How to fill out montana mw3 withholding tax?

What is the purpose of montana mw3 withholding tax?

What information must be reported on montana mw3 withholding tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.