Get the free . . . . Revenue

Get, Create, Make and Sign revenue

How to edit revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out revenue

How to fill out revenue

Who needs revenue?

Revenue Form: A Comprehensive How-to Guide

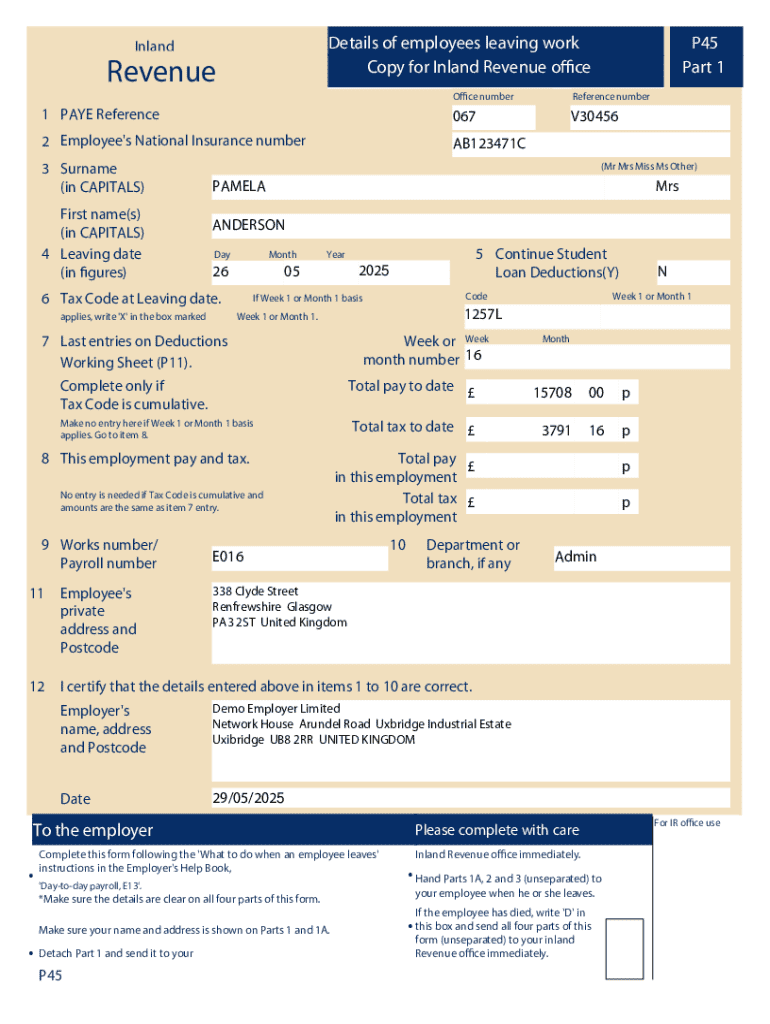

Understanding the revenue form

A revenue form is a crucial document used for reporting income sources, capturing all forms of revenue generated by a business or individual. Its primary purpose is to ensure accurate financial reporting, compliance with tax regulations, and to facilitate informed decision-making based on financial data. Both individuals and organizations rely on revenue forms to track earnings, analyze financial performance, and fulfill legal obligations.

The importance of these forms cannot be overstated, as they help users demonstrate transparency in their financial records while allowing tax departments to verify reported income against relevant regulations. A well-prepared revenue form can significantly impact a business's fiscal responsibilities and overall profitability.

Types of revenue forms

Revenue forms can take various forms, depending on the context in which they are used. Below are some common types based on revenue origins:

Key features and benefits of using revenue forms with pdfFiller

pdfFiller offers a user-friendly platform to streamline the process of creating and managing revenue forms. One of the standout features is seamless PDF editing, which allows users to effortlessly modify existing forms or create new templates tailored to specific needs. Customizing fields is particularly useful for businesses or teams that require unique information to be captured on their forms.

Another significant benefit of pdfFiller is the eSigning capability. Users can easily obtain legally binding signatures without any hassle, ensuring that documentation is not only complete but also compliant with regulatory standards. Digital signatures eliminate the need for physical presence, speeding up processes and enhancing efficiency.

Collaboration tools provided by pdfFiller further enhance the process by allowing teams to work together in real-time on revenue forms, making sharing and reviewing documents straightforward. This feature is particularly important for teams requiring input from multiple members on financial documents to ensure accuracy before submission.

Lastly, pdfFiller’s document management solutions make organizing completed revenue forms easy, enabling users to access documents from anywhere, anytime. This flexibility is particularly appealing for businesses that operate remotely or for individuals on the go.

Step-by-step guide to filling out a revenue form

Filling out a revenue form accurately is crucial for ensuring compliance and avoiding penalties. Here’s a detailed step-by-step guide to help you navigate the process efficiently.

Step 1: Gathering necessary information

Before starting the completion of a revenue form, it’s essential to gather all necessary documentation and data, which may include:

Accuracy in financial data is paramount; therefore, take the time to double-check current figures against financial records.

Step 2: Accessing the revenue form on pdfFiller

To start filling out a revenue form using pdfFiller, navigate to the platform's dashboard. Here’s how you can locate and select the appropriate template:

Step 3: Filling in the revenue form

When entering information into the revenue form, follow these detailed instructions for best practices:

Step 4: Reviewing and confirming information

The review process before submitting is pivotal. Consider the following aspects:

Step 5: Saving and exporting the completed form

After reviewing the entries, save the filled revenue form correctly. You can choose to save it in multiple formats. Here's how:

Common pitfalls when working with revenue forms

When using revenue forms, individuals and teams commonly encounter pitfalls that can lead to errors or compliance issues. Here are the mistakes to avoid:

Additionally, understanding submission requirements is crucial. Each jurisdiction has different methods for submitting revenue forms, including electronic submissions or traditional mailing. Failing to comply with specific requirements, such as deadlines, can lead to penalties or additional scrutiny from the department of revenue.

Frequently asked questions about revenue forms

Navigating the world of revenue forms can provoke several questions, especially regarding documentation and compliance. Here are some frequently asked questions:

Best practices for managing revenue forms

Implementing best practices when managing revenue forms is vital for optimizing efficiency and ensuring accuracy. Users should consider:

Leveraging pdfFiller for mastering revenue forms

Leveraging the tools available within pdfFiller allows users to master the intricacies of revenue forms effectively. Interactive tools make the process easier, providing workflows that help simplify complex tasks.

Users can take advantage of case studies showcasing how individuals and teams improved their revenue form submission process through pdfFiller. These real-life experiences highlight unique approaches and the platform’s ability to adapt to various business needs.

User feedback often reflects satisfaction with the integration of such tools. Testimonials indicate a marked improvement in speed, accuracy, and overall user experience while managing revenue forms, showcasing the effectiveness of pdfFiller as a comprehensive solution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my revenue directly from Gmail?

How do I edit revenue online?

How do I edit revenue on an iOS device?

What is revenue?

Who is required to file revenue?

How to fill out revenue?

What is the purpose of revenue?

What information must be reported on revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.