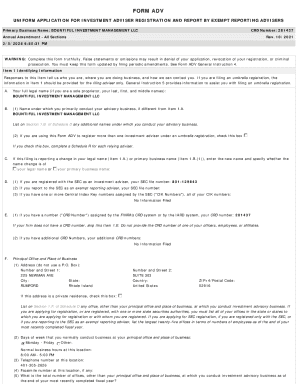

Get the free articles of incorporation california sample: fillable, printable & ...

Get, Create, Make and Sign articles of incorporation california

Editing articles of incorporation california online

Uncompromising security for your PDF editing and eSignature needs

How to fill out articles of incorporation california

How to fill out articles of incorporation california

Who needs articles of incorporation california?

Understanding Articles of Incorporation in California: A Comprehensive Guide

Understanding articles of incorporation in California

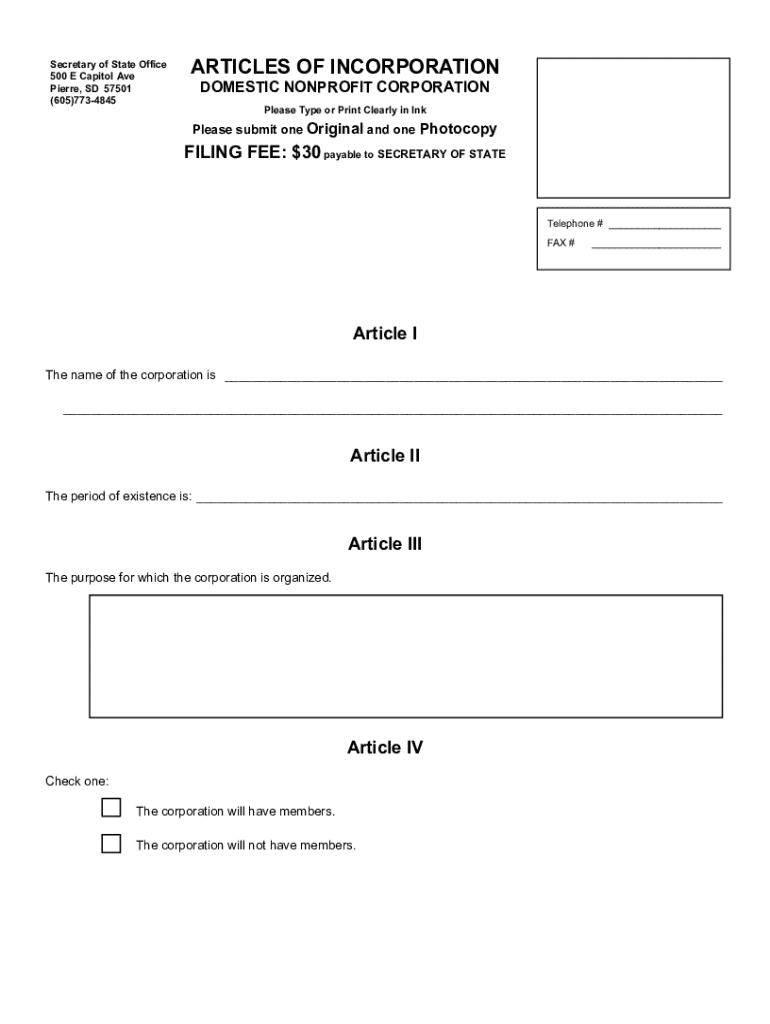

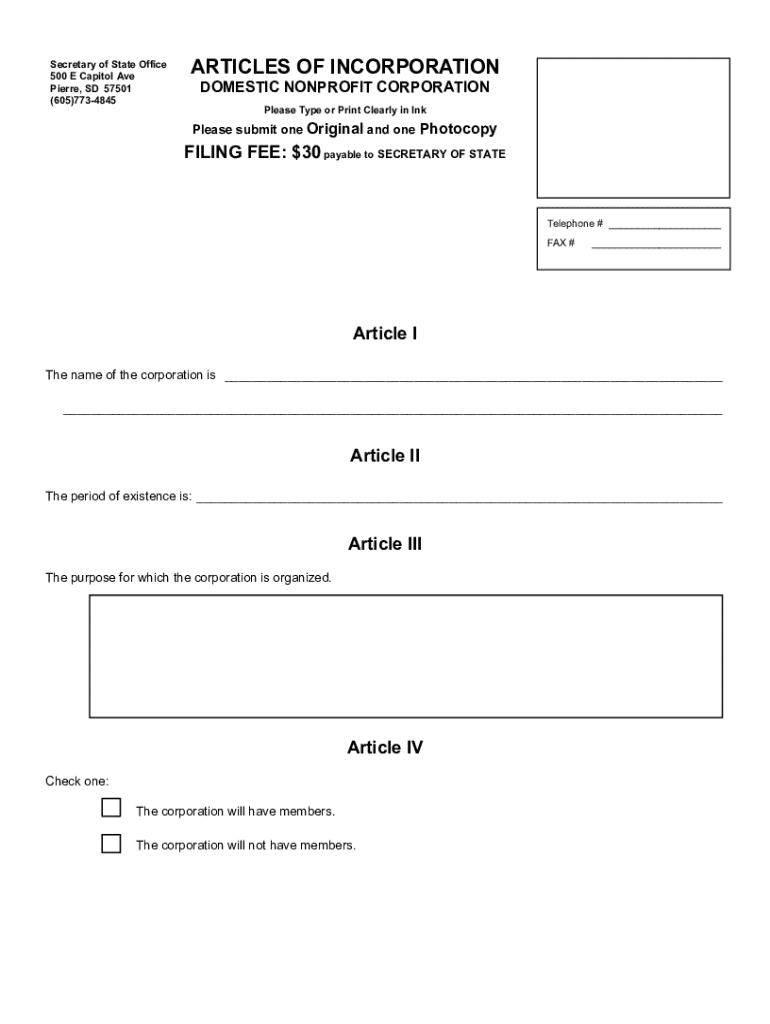

Articles of incorporation are the foundational documents required to legally form a corporation in California. This form is pivotal as it establishes the existence of a corporation in the eyes of the state. The primary purpose of these articles is to outline key information about the corporation, including its name, purpose, and structure. By filing this document with the Secretary of State, business owners gain legal recognition and the ability to operate as a corporation.

The key components of articles of incorporation typically include the corporate name, a statement of the corporation's purpose, the agent for service of process, and, if applicable, the stock structure. Each component plays a vital role in defining the corporation’s identity and operational framework. The corporate name must be unique and comply with state naming regulations, while the purpose statement outlines the business activities the corporation intends to engage in.

Importance of filing articles of incorporation

Filing articles of incorporation confers several legal benefits and protections for business owners. One of the most significant advantages is achieving legal recognition. Corporations are treated as separate legal entities, which distinguishes the business’s liabilities from those of its owners. This separation inherently provides liability protection for the owners, meaning personal assets are typically insulated from business debts. Additionally, this separation fosters credibility with stakeholders, potential investors, and clients who may seek assurance that the business operates within legal bounds.

Another key benefit of filing is that it establishes a formal structure for governance and operation, often necessitating the drafting of bylaws, which further define management procedures and corporate responsibilities. By having a clear documentation in place, businesses are better positioned to attract investment, secure loans, and forge partnerships. These benefits underscore why facilitating a thorough understanding of the incorporation process and the articles is essential for prospective business owners.

Who needs to file articles of incorporation?

Various types of business entities require filing articles of incorporation. Primarily, corporations—whether for profit or nonprofit—must prepare and submit this document to formally establish their operations in California. Professional corporations, such as law firms or medical practices, also need to file articles to receive the benefits afforded to incorporated entities. Understanding the specific requirements is crucial as these can differ significantly based on the type and size of the business.

Furthermore, small businesses planning to incorporate should consider their growth potential and the associated legal requirements. A limited liability company (LLC)—while a different entity type—may choose to incorporate for added protections, but will instead file Articles of Organization. Business entities that anticipate growth or risks associated with personal liabilities should strongly consider this filing as part of their foundational strategy.

Step-by-step guide to filing articles of incorporation

Filing articles of incorporation in California involves several essential steps. The process begins with gathering the necessary information about the proposed corporation. This includes selecting a unique business name that complies with state regulations, providing the business address, and detailing the incorporators' information. Next, it’s vital to determine the organizational structure, including any designations for stock issues.

After gathering the required details, choose the correct form to file. The California Secretary of State offers different forms for various types of corporations—standard for profit corporations and a distinct one for nonprofit organizations. Once the appropriate form is selected, it needs to be meticulously completed, ensuring that all sections are accurately filled without discrepancies, as mistakes can lead to delays.

Finally, choose a submission method that suits your needs. The California Secretary of State allows for online filing through their webpage, which is often the quickest and most efficient option. If you prefer traditional methods, you can file by mail or in person. Ensure to review the payment requirements, as there are fees associated with filing, which can vary significantly depending on the entity type and any expedited service arrangements.

Interactive tools for your articles of incorporation

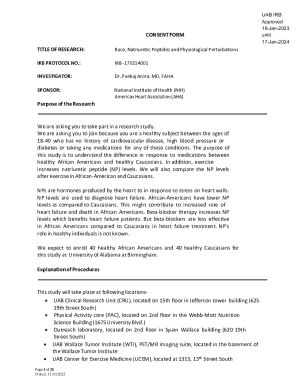

Utilizing digital tools like pdfFiller can significantly streamline the process of creating your articles of incorporation. With pdfFiller’s user-friendly platform, individuals and teams can easily edit and customize their documents directly in the cloud. The editing capabilities allow users to fill out the necessary forms, making changes as needed without worrying about formatting issues.

Additionally, pdfFiller offers eSignature options, providing a convenient way to obtain approvals digitally. This functionality is especially beneficial for teams that may need to collaborate across different locations. By using collaborative features within the platform, team members can work together on the articles of incorporation, ensuring all necessary input is captured before finalization. These tools not only enhance efficiency but also help to maintain legal compliance throughout the incorporation process.

Understanding fees associated with filing

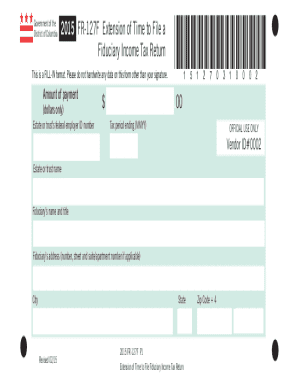

When filing articles of incorporation in California, it’s essential to consider the associated fees. The state imposes standard filing fees that vary depending on the type of entity you are establishing. Generally, corporations face higher fees than limited liability companies. For instance, the California Secretary of State charges a standard fee for filing articles for both profit and nonprofit corporations, which may increase if expedited service is requested.

In addition to state fees, businesses may encounter additional costs related to name reservations or obtaining certified copies of filed documents. These costs can add up, particularly for startups that need multiple copies for banking and legal requirements. To avoid unexpected expenses, it's beneficial for business owners to develop a clear understanding of all potential costs associated with their filing.

Resources and samples for successful filing

Accessing sample articles of incorporation can serve as a valuable starting point for designing your own document. Organizations and websites like pdfFiller provide sample templates that can be tailored to meet specific business needs. Utilizing these resources helps ensure that you include all necessary components while adhering to state requirements.

Additionally, the California Secretary of State’s office offers extensive online resources, including FAQs that address common filing questions and potential issues. Such resources ease the process, allowing business owners to compile their documents with confidence, knowing they are following the correct procedures. It’s advisable for entrepreneurs to invest time in exploring these resources, as they can lead to more efficient filings and reduce the likelihood of mistakes.

Post-filing steps to consider

Once articles of incorporation are successfully filed, there are several post-filing tasks businesses must consider to remain compliant with state regulations. One critical step is to draft an operating agreement, which outlines the internal management structure and procedures for the corporation. While not required, having this document is highly beneficial for internal governance and clarity.

Furthermore, businesses should prioritize observing corporate formalities to maintain their limited liability status. This includes holding regular meetings, keeping detailed records, and fulfilling ongoing reporting requirements as mandated by the California Secretary of State. By doing so, companies ensure they comply with legal obligations and protect the personal assets of their owners, reinforcing the separation between personal and corporate liabilities.

Related documents and forms

In addition to articles of incorporation, there are several other documents that businesses must be aware of to ensure comprehensive compliance. For instance, the Statement of Information is required to be filed after incorporation and provides essential updates about the corporation’s structure, officers, and address. Bylaws, while not filed with the state, are critical for outlining the governance model of the corporation.

Keeping these documents updated is just as important as the initial filing. Companies should regularly review their bylaws and Statement of Information to maintain accuracy and reflect any changes in personnel or business practices. By staying current with all business forms and requirements, organizations can mitigate risks associated with noncompliance.

Contact support for your articles of incorporation needs

Should you need assistance while navigating the articles of incorporation process, reaching out to pdfFiller's support team can provide invaluable help. With options for live chat or direct inquiries through their platform, users can obtain expert advice on document management and submission alternatives. Whether you face challenges while completing forms or simply need clarification on the filing requirements, pdfFiller offers resources to assist users.

In addition to direct support, pdfFiller maintains a user community where individuals share experiences and tips on successful incorporation practices. Engaging with this community can provide practical insights based on real experiences, which is particularly beneficial for first-time business owners or those who are new to the incorporation process.

Receive updates on changes to filing requirements

Staying informed of any changes in filing requirements is essential for ongoing compliance. Business owners should consider subscribing to notifications from the California Secretary of State’s office or pdfFiller for the latest updates on regulations and procedures. By receiving timely notifications, business owners can make informed decisions and maintain compliance without missing critical updates that may affect their operations.

Being proactive rather than reactive can save businesses time and resources, allowing them to focus on their core activities. Awareness of changes can also present new opportunities or cause shifts in best practices, all of which can contribute to a corporation’s long-term success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my articles of incorporation california directly from Gmail?

How do I make changes in articles of incorporation california?

How do I edit articles of incorporation california straight from my smartphone?

What is articles of incorporation california?

Who is required to file articles of incorporation california?

How to fill out articles of incorporation california?

What is the purpose of articles of incorporation california?

What information must be reported on articles of incorporation california?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.