Get the free ShareholderArticle 69(1) or (2) and Article 69a (1) or (3) of the Act on public offe...

Get, Create, Make and Sign shareholderarticle 691 or 2

How to edit shareholderarticle 691 or 2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out shareholderarticle 691 or 2

How to fill out shareholderarticle 691 or 2

Who needs shareholderarticle 691 or 2?

Navigating the Shareholder Article 691 or 2 Form: A Comprehensive Guide

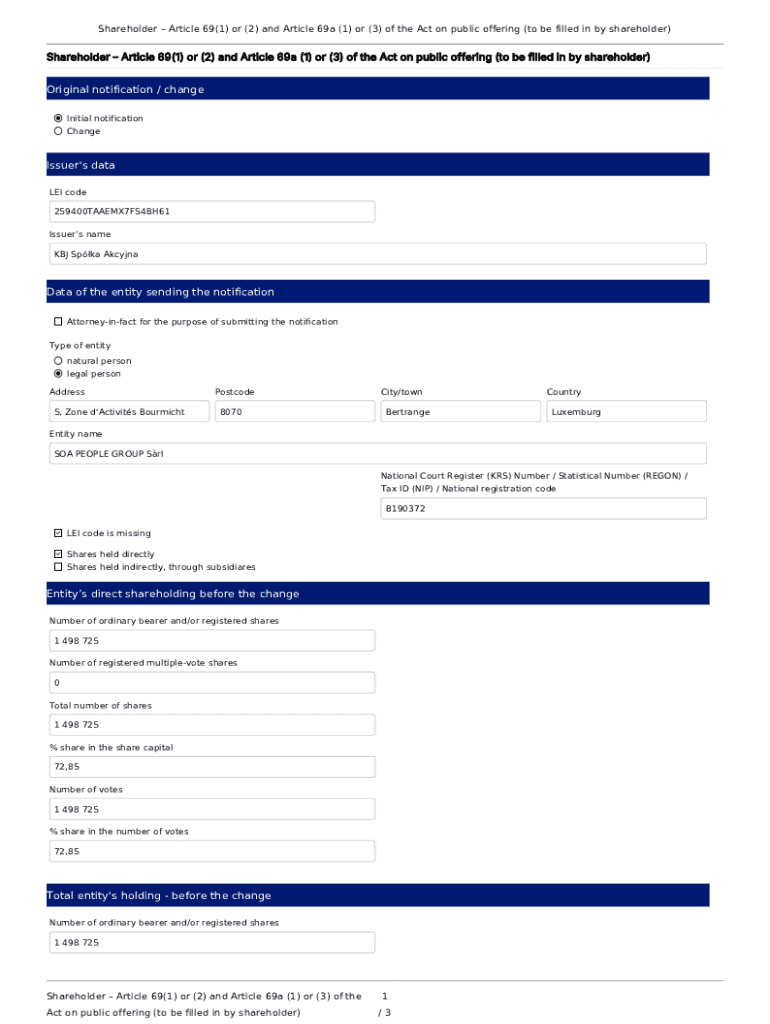

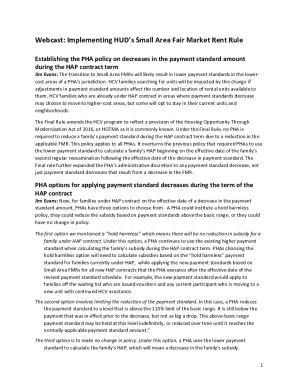

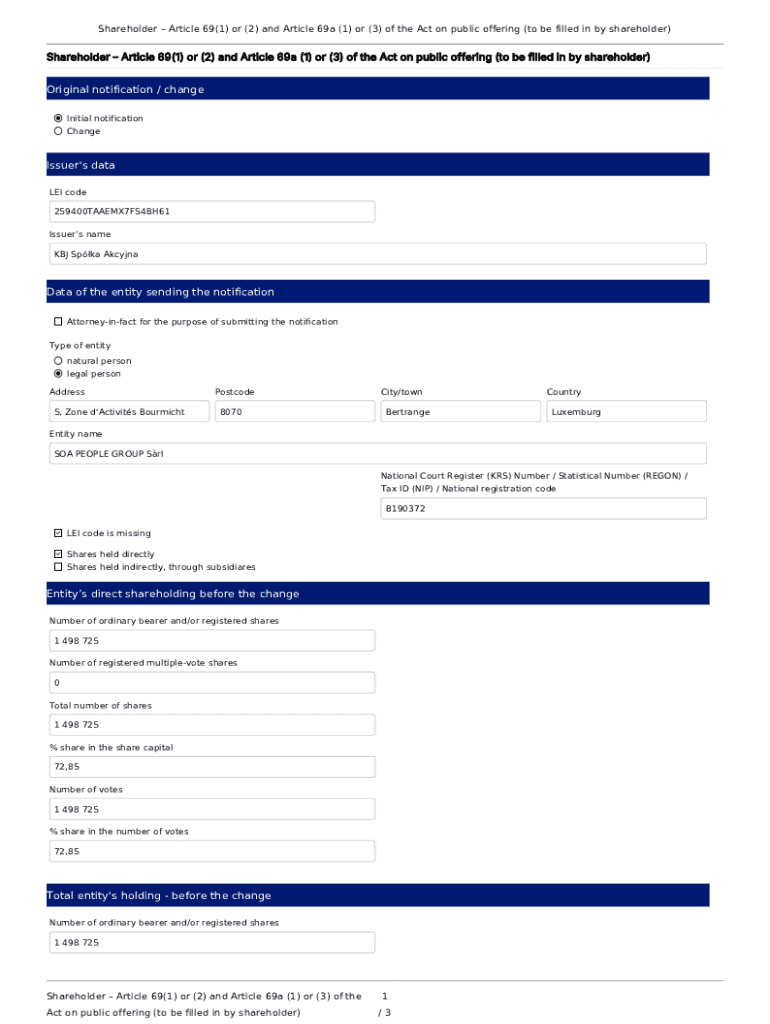

Understanding the shareholder article 691 or 2 form

The Shareholder Article 691 or 2 Form serves as a critical document allowing shareholders to maintain compliance with corporate governance and manage their shareholdings effectively. This form is essential for recording any changes in share ownership or structure within a company, ensuring that all transactions are legally recognized and documented according to the Companies Act 2006.

The importance of this form cannot be overstated, as it protects shareholders' rights and provides clarity regarding their ownership status. It establishes clear records that can prevent disputes among shareholders and serves as formal documentation for audits or regulatory reviews.

Current regulations and compliance

The Shareholder Article 691 or 2 Form is subject to a range of regulations outlined in the Companies Act 2006, which governs company formations and operations within the UK. Compliance with these regulations is mandatory for all private limited companies, and it requires accurately documenting share ownership changes.

Key compliance considerations include maintaining up-to-date records and ensuring that all information submitted is accurate. Failure to do so can lead to legal repercussions, including penalties or disputes that could jeopardize shareholder agreements or even company operations.

When to use the shareholder article 691 or 2 form

Understanding when to utilize the Shareholder Article 691 or 2 Form is vital for shareholders and companies alike. The form is primarily required during significant events such as share transfers within private limited companies, share buybacks initiated by the company, or changes in share ownership due to restructuring or liquidation.

Common scenarios where filing this form is necessary include the resignation or dismissal of a shareholder, as this can affect the company's equity structure. Another scenario is the occurrence of corporate arrangements, such as mergers or acquisitions, where the share structure must reflect new ownership configurations.

Step-by-step guide to completing the shareholder article 691 or 2 form

To effectively complete the Shareholder Article 691 or 2 Form, it is crucial to gather all the necessary information beforehand. Required information includes personal details of the shareholders, the company in question, and specific details about the shares involved, such as their class and quantity.

The procedure for filling out the form is straightforward, but accuracy is paramount. Follow these steps to ensure correct completion:

Double-check all entries before submission to avoid unnecessary delays or issues. This includes verifying all numbers and personal details to enhance clarity and accuracy.

Editing and modifying the shareholder article form

Once the Shareholder Article 691 or 2 Form is completed, you must take steps to modify any incorrect information as it comes to light. To update the form, it’s essential to follow these steps:

Using tools like pdfFiller offers a cloud-based solution that simplifies the editing of this form. You can quickly adjust details, add electronic signatures, and store documents securely. This approach is essential for efficient document management, especially for companies managing multiple shareholders.

Signing and submitting the shareholder article form

Properly signing and submitting the Shareholder Article 691 or 2 Form is crucial for its validity. You need to determine who must sign the form, which typically includes all shareholders whose details are included. Additionally, it’s important to understand the differences between electronic signatures and traditional handwritten signatures as they impact submission processes.

The submission process involves several critical steps:

Managing ongoing compliance and documentation

Post-submission, it is essential to manage compliance and document retention effectively. Best practices for record-keeping include maintaining accurate and organized files of all forms submitted and related share transactions.

Utilizing electronic tools for tracking and storage enhances compliance and allows easier access to documents when required. Regularly monitor changes in shareholder status and be alert to any regulatory updates affecting share transactions, ensuring your company remains compliant with evolving laws.

Frequently asked questions (faqs) on the shareholder article 691 or 2 form

Many shareholders have common concerns regarding the use of the Shareholder Article 691 or 2 Form. These include questions like whether share transfers can proceed without this form, the possible risks of neglecting it, or how share buybacks influence its necessity.

Further clarifications involve inquiry into the implications of providing incorrect information or the potential penalties for not filing the form in a timely manner. It’s crucial to answer these questions accurately to foster understanding and encourage responsible shareholder practices.

Interactive tools and resources for document management

Taking advantage of pdfFiller’s extensive features for document management can simplify the completion, editing, and storage of the Shareholder Article 691 or 2 Form. With capabilities for eSigning, collaboration, and easy access to templates, users can streamline their processes and maintain a consistent approach to shareholder documentation.

Accessing templates and custom solutions tailored for specific business needs ensures that every shareholder has the resources necessary for compliant operations. These tools enhance the shareholder experience and promote a more organized and efficient management approach.

Conclusion: empowering your shareholder experience

The Shareholder Article 691 or 2 Form is a vital component of managing shareholder relationships and ensuring compliance within the framework of company law. Leveraging tools like pdfFiller not only simplifies the document management process but enhances overall efficiency in handling these essential forms.

Sharing this knowledge equips individuals and teams with the understanding necessary to navigate the complexities of shareholder documentation efficiently while embracing cloud-based solutions for a seamless experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit shareholderarticle 691 or 2 in Chrome?

Can I create an electronic signature for the shareholderarticle 691 or 2 in Chrome?

How do I complete shareholderarticle 691 or 2 on an iOS device?

What is shareholderarticle 691 or 2?

Who is required to file shareholderarticle 691 or 2?

How to fill out shareholderarticle 691 or 2?

What is the purpose of shareholderarticle 691 or 2?

What information must be reported on shareholderarticle 691 or 2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.