Get the 24 Deed Of Trust Form - Free to Edit, Download & Print

Get, Create, Make and Sign 24 deed of trust

How to edit 24 deed of trust online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 24 deed of trust

How to fill out 24 deed of trust

Who needs 24 deed of trust?

Comprehensive Guide to the 24 Deed of Trust Form

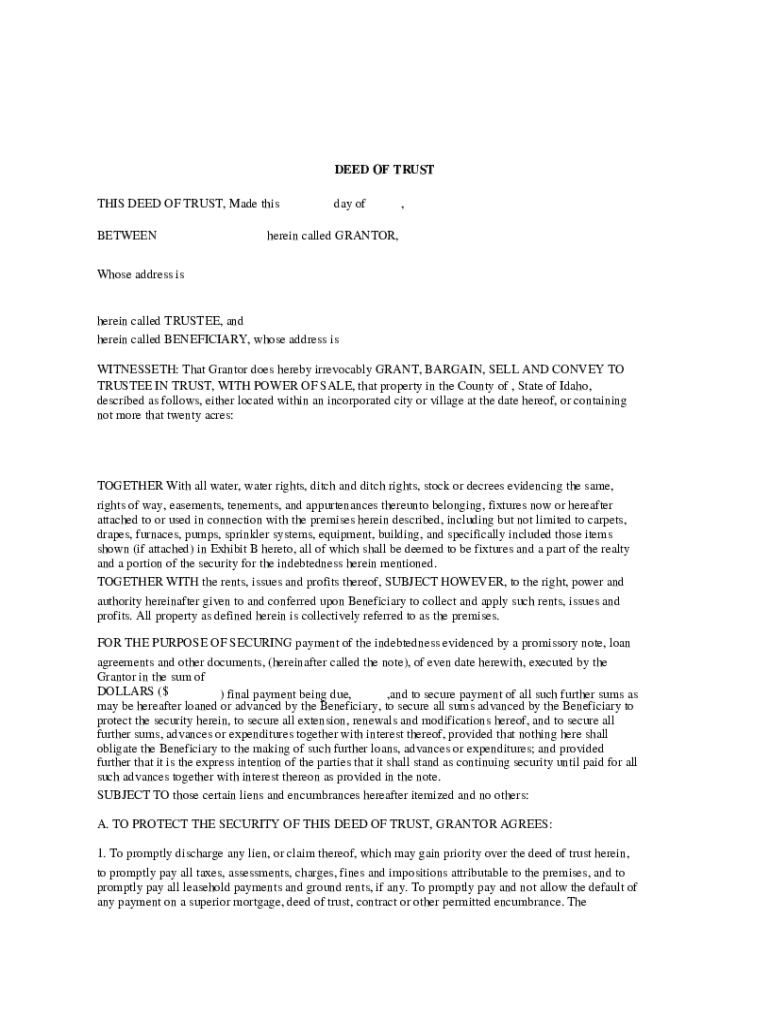

Understanding the 24 deed of trust form

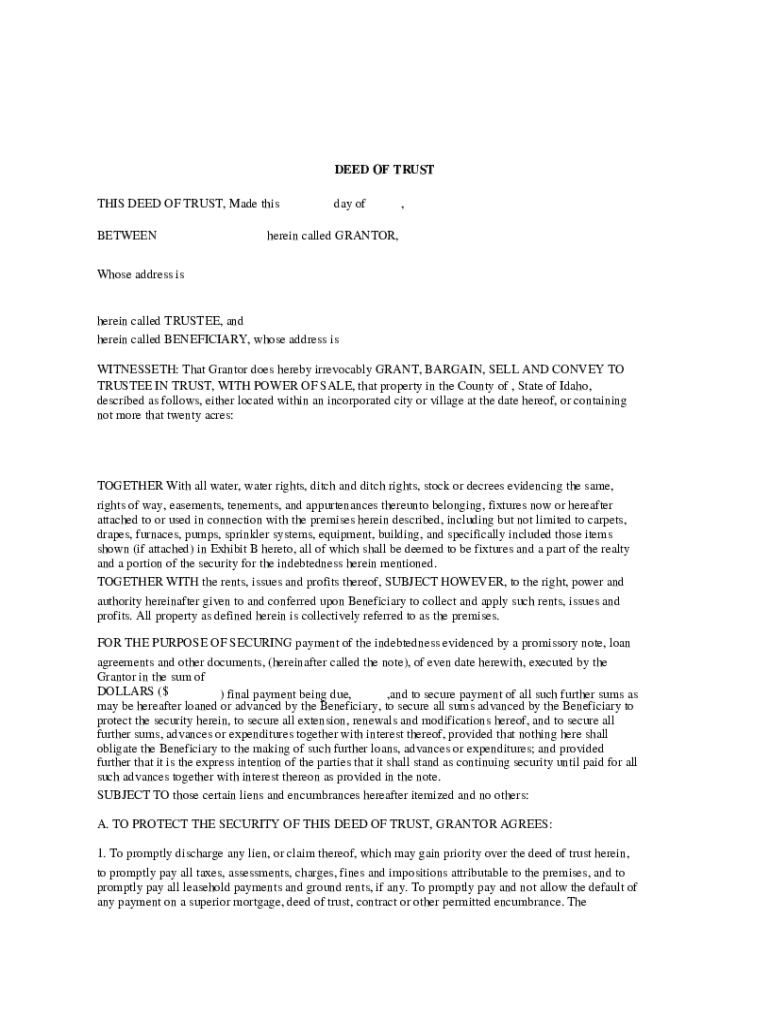

A 24 deed of trust form is essential in real estate transactions, serving as an agreement between a borrower, lender, and a third-party trustee. The document plays a crucial role in securing the loan by placing a lien on the property, ensuring that the lender can recover the debt in the event of default.

The deed of trust differs from a traditional mortgage in that it involves three parties instead of two. This arrangement provides greater security for the lender, facilitating a smoother transaction process. Key components of the deed include the property description, details about the borrower and lender, loan amount, and the terms and conditions governing the loan.

Using the correct form is vital, as legal implications can arise from any inaccuracies. A standardized form ensures all necessary details are included, minimizing mistakes that might affect the enforceability of the deed.

Overview of the 24 deed of trust form

The 24 deed of trust form consists of a structured layout designed for clarity. Each section serves a specific purpose, detailing the agreement between the parties involved. The standard format of the form includes key elements like parties' names, property details, loan terms, and signatures.

Variations of the form exist depending on the state, as each jurisdiction may have its specific requirements. Therefore, it's important to ensure that the document complies with local laws. Users can find state-specific forms through legal resources or websites like pdfFiller, which provide a range of templates tailored to different legal standards.

Interactive tools for the 24 deed of trust form

Accessing the 24 deed of trust form online is straightforward, especially through platforms like pdfFiller, which hosts a digital version of the form. Users can locate it quickly by searching for '24 deed of trust form' directly on the site. This functionality ensures users can complete necessary paperwork efficiently.

On pdfFiller, a variety of interactive tools are available for filling out the form. These features simplify the editing, collaboration, and signing processes. Users can also save their progress, collaborate with stakeholders in real-time, and eSign documents directly on the platform, enhancing convenience.

Step-by-step instructions for filling out the 24 deed of trust form

Before filling out the 24 deed of trust form, preparation is key. Gather all necessary information such as the legal description of the property, identifying details of the borrower and lender, and the specific terms of the loan. Knowing which parties are involved will streamline the process.

Filling in the form requires careful attention to detail. Begin with the property information, ensuring to enter the legal description and address accurately. Next, include the borrower and lender details, specifying each party’s role in the agreement. Clearly outline the terms of the loan, including interest rates, payment schedules, and maturity dates.

Common mistakes include overlooking critical fields or failing to include necessary parties, which can lead to inefficiencies or legal issues. Double-check the form before submission to ensure completeness and accuracy.

Tips for managing your deed of trust

Storing your deed of trust documents securely is paramount. Best practices suggest using reliable digital storage solutions, such as cloud-based services, to safeguard your documents. Keeping backup copies is essential to mitigate risks of data loss, providing peace of mind for all parties involved.

If the need arises to amend or modify a deed of trust, it's crucial to understand when such changes are necessary. Common reasons for amendments could include changes in loan terms or modifications due to legal circumstances. Following the correct steps and maintaining thorough documentation during the modification process is essential for ensuring validity.

FAQs related to the 24 deed of trust form

Understanding the potential consequences of not filing the form properly is critical. If the 24 deed of trust form is not filed correctly, it could jeopardize the lender's ability to assert a claim against the property. This might result in financial loss or legal complications for both parties.

When it comes to filling out the form, individuals often wonder who can assist them. While legal professionals can guide the process effectively, self-service options through online platforms like pdfFiller offer a streamlined, user-friendly approach for those who prefer to handle it independently.

Resources for further assistance

pdfFiller simplifies the process of managing legal documents, including the 24 deed of trust form. The platform integrates various features allowing users to edit, sign, and collaborate on documents seamlessly. By centralizing document management, pdfFiller empowers users with the tools they need to ensure their agreements are properly executed.

For support related to filling out the 24 deed of trust form or other inquiries, users can reach out to pdfFiller's customer service. They offer dedicated assistance to guide users through any challenges they may face, ensuring a smooth experience from start to finish.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 24 deed of trust in Chrome?

How do I fill out 24 deed of trust using my mobile device?

How can I fill out 24 deed of trust on an iOS device?

What is 24 deed of trust?

Who is required to file 24 deed of trust?

How to fill out 24 deed of trust?

What is the purpose of 24 deed of trust?

What information must be reported on 24 deed of trust?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.