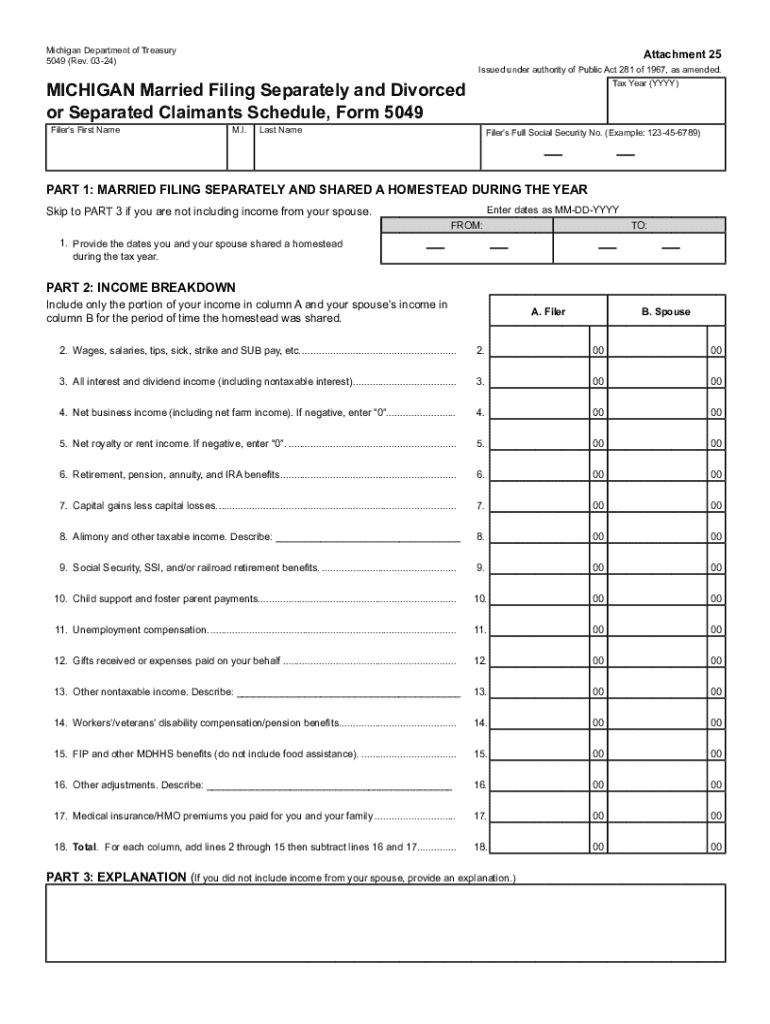

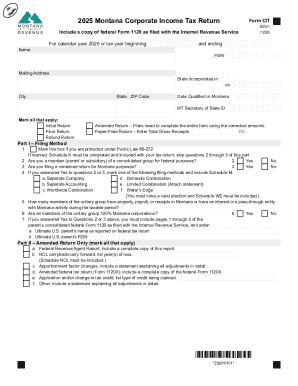

Get the free 5049, Michigan Married Filing Separately and Divoirced or Separated Claimants Schedu...

Get, Create, Make and Sign 5049 michigan married filing

How to edit 5049 michigan married filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 5049 michigan married filing

How to fill out 5049 michigan married filing

Who needs 5049 michigan married filing?

5049 Michigan Married Filing Form: A Comprehensive Guide

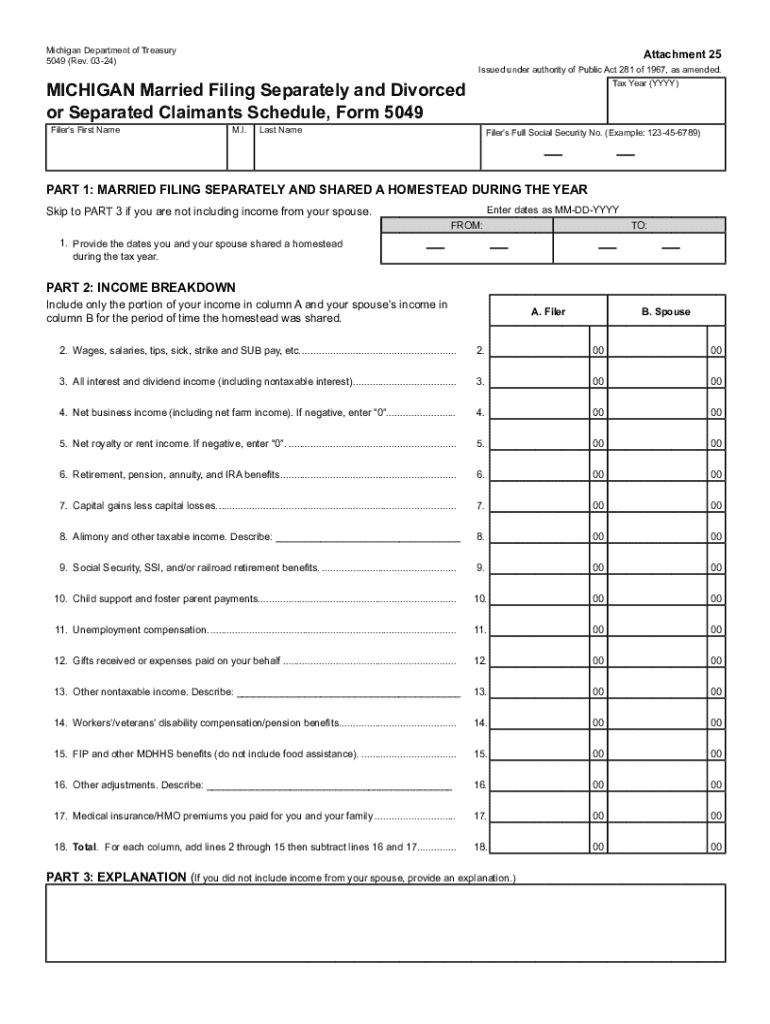

Understanding the 5049 Michigan married filing form

The 5049 Michigan Married Filing Form is a vital document for couples in Michigan seeking to file their state taxes jointly. This form allows married couples to report their income, deductions, and credits collectively, which can often lead to significant tax savings. Understanding this form is crucial not only for compliance with state tax laws but also for effective financial planning.

Married filing status is recognized by the IRS and state tax authorities, and using the 5049 form can simplify the reporting process while maximizing available deductions. In addition, it can provide tax benefits that are typically unavailable to single filers, like increased deduction limits and eligibility for specific credits. However, it's essential to determine eligibility before proceeding.

To use the 5049 form, couples must be legally married and must consider their combined income for the tax year. Understanding your eligibility ensures you don't miss out on these benefits or face penalties for improper filing.

Gathering necessary documentation

Before diving into completing the 5049 form, you need to gather the right documentation. Having all necessary paperwork ready can make the filing process smoother and reduce the chances of errors. Here’s a list of required financial documents you’ll typically need:

In addition to financial documents, you will also need basic personal information. Gather this essential data:

Step-by-step instructions for filling out the form

Filling out the 5049 Michigan Married Filing Form involves several key sections. Here’s a breakdown of each section:

Section 1: Personal Information

In this section, you will need to input your names, addresses, and Social Security numbers. Pay attention to the accuracy of these details; a minor error can cause major issues with your filing.

Section 2: Income Reporting

This is where you report your total income. Make sure to combine your incomes from all sources accurately. You can include W-2 forms and any applicable 1099 forms here, ensuring you account for all earnings.

Section 3: Credits and Deductions

Understanding available tax credits and allowable deductions is key to maximizing your refund. For married filers, look for credits such as the Earned Income Tax Credit or deductions for mortgage interest, charitable contributions, and medical expenses. Ensure you document these properly.

Section 4: Tax Calculation

Finally, calculate your total tax based on your income, deductions, and credits. Make sure to double-check your math or consider using a calculator to ensure you report accurately which may lead to a refund or balance due.

Editing the 5049 form

Sometimes, errors can slip into your initial filing. Fortunately, you can use pdfFiller's tools to easily edit the 5049 Michigan Married Filing Form. This cloud-based solution makes it straightforward to revise your information without needing to start from scratch.

To edit your form in pdfFiller, follow this step-by-step process:

The benefits of using a cloud-based editor include easy access from any device and the ability to collaborate in real-time with others if necessary.

eSigning the 5049 form

As part of the filing process, the 5049 Michigan Married Filing Form must be signed. Using pdfFiller, you can quickly eSign your document. This process is legally valid in Michigan, making it a convenient option for busy couples.

Here’s how to navigate the eSignature process using pdfFiller:

This method not only speeds up the process but also offers peace of mind knowing your signatures are securely stored.

Collaborating on the 5049 form

If you and your spouse want to work on the 5049 form together or if you're seeking assistance from a financial advisor, pdfFiller provides various collaborative tools to enhance your experience.

These collaborative methods make it easier to ensure that you don’t miss key inputs or overlook important details, thereby enhancing the integrity of the form.

Managing your 5049 form

After successfully completing the 5049 Michigan Married Filing Form, it’s crucial to manage your document properly. pdfFiller offers a range of features to help you save, store, and organize your forms effectively.

These management features allow for efficient retrieval and ensure your documents remain confidential and well-organized, easing the headache come tax season.

Common mistakes to avoid when filing the 5049 form

Filing taxes can be complex, and errors on the 5049 form may lead to penalties or delays. Here’s a checklist of common mistakes to avoid:

By being aware of these potential pitfalls, you can take proactive steps to ensure your filing is accurate.

FAQs about the 5049 Michigan married filing form

Many filers have questions regarding the 5049 Michigan Married Filing Form. Here are some common queries and insights to clarify the process:

Addressing these concerns upfront can make you more confident as you prepare to fill out and submit your 5049 form.

Additional features of pdfFiller for a seamless filing experience

pdfFiller offers various unique features designed to streamline your tax filing experience. Some standouts include:

These functionalities not only enhance usability but also improve your overall efficiency throughout the tax filing process. Customer testimonials frequently highlight how pdfFiller has transformed their document management experiences for the better.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 5049 michigan married filing online?

Can I create an electronic signature for the 5049 michigan married filing in Chrome?

How do I edit 5049 michigan married filing on an iOS device?

What is 5049 Michigan married filing?

Who is required to file 5049 Michigan married filing?

How to fill out 5049 Michigan married filing?

What is the purpose of 5049 Michigan married filing?

What information must be reported on 5049 Michigan married filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.