Get the free Vendor ACH Authorization Form Portage, MI

Get, Create, Make and Sign vendor ach authorization form

How to edit vendor ach authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vendor ach authorization form

How to fill out vendor ach authorization form

Who needs vendor ach authorization form?

Understanding Vendor ACH Authorization Forms

Understanding Vendor ACH Authorization Forms

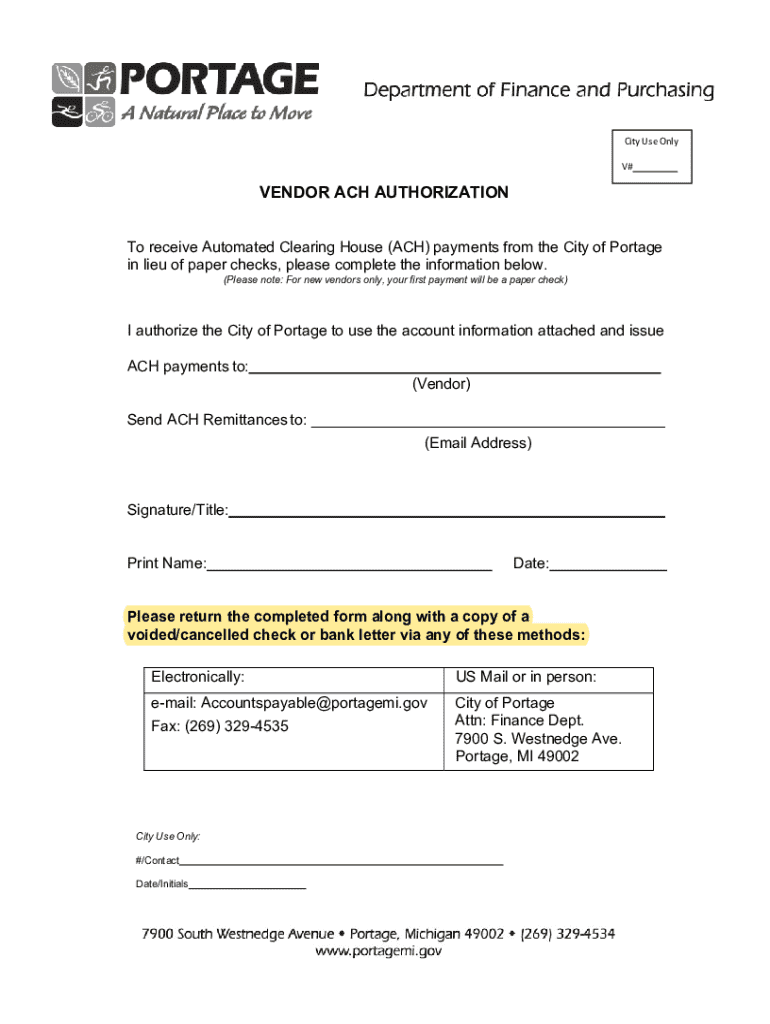

A Vendor ACH Authorization Form is a crucial document utilized by businesses to authorize electronic transfers of funds directly from their bank accounts to their vendors. This form allows businesses to streamline their payment processes, ensuring that transactions are efficient and timely.

The primary purpose of this form is to provide the necessary consent and details for a vendor to initiate Automated Clearing House (ACH) transactions. Such transactions are favorable as they are typically faster and more cost-effective compared to traditional payment methods, like checks.

Key elements of the Vendor ACH Authorization Form

Key elements of a Vendor ACH Authorization Form include essential details such as vendor name, address, contact information, and the bank account specifics including account number and routing number. Additionally, an authorization section is necessary where the vendor confirms their agreement for ACH payments. Optional fields may involve secondary contact details, payment amounts, or frequency of transactions, providing further detail for more complex payment arrangements.

Benefits of using Vendor ACH Authorization Forms

Utilizing Vendor ACH Authorization Forms offers numerous benefits for businesses. One significant advantage is the streamlined payment process. ACH transactions are often faster than traditional methods, resulting in quicker access to funds for vendors. Moreover, the reduction in paperwork associated with moving from check payments to electronic payments leads to increased efficiency for both parties.

Cost efficiency is another significant benefit. Businesses save on printing, mailing checks, and the costs associated with accounting discrepancies due to missed or late payments. ACH transactions typically incur lower fees compared to credit card payments, providing further savings over time.

Security and reliability are key considerations as well. ACH transfers come with enhanced security features, ensuring that sensitive financial information is handled with care. Adopting this method builds trust between businesses and their vendors, strengthening their relationship and reducing the chances of fraud.

When to use a Vendor ACH Authorization Form

There are specific situations that necessitate the use of a Vendor ACH Authorization Form. Setting up new vendor relationships is a primary instance where this form is essential. It formalizes the agreement to facilitate electronic payments, ensuring clarity on both sides regarding payment methods.

Another common scenario occurs when transitioning from traditional check payments to electronic payments. This shift not only enhances efficiency but requires proper documentation to protect all involved parties. Compliance with legal regulations plays a crucial role in this process, as ensuring proper consent and authorization reduces risk and establishes trust in business transactions.

Step-by-step guide to completing a Vendor ACH Authorization Form

Completing a Vendor ACH Authorization Form requires careful attention to detail. Start off by gathering all necessary information. Information related to the vendor including their name, address, and contact information is critical. Additionally, ensure that you have the correct bank account information, including both the account number and routing number.

Next, fill out the form accurately. Each section typically requires specific details, so following instructions closely is vital. Common mistakes include misspelling names or providing incorrect routing numbers, which can lead to payment issues. Once completed, review and verify all the entered information, double-checking for any discrepancies that could impact the transaction.

Submitting the form can be done through various channels such as email, fax, or secure online portals. It’s crucial to choose a method that ensures the safety of the sensitive financial data contained in the form.

Frequently asked questions about Vendor ACH Authorization Forms

Understanding the nuances of Vendor ACH Authorization Forms can lead to numerous questions. For instance, what happens if an ACH payment fails? Such situations often result in a reversal of the transaction, and both parties must communicate to address any issues promptly.

Another common inquiry is whether a Vendor ACH Authorization Form can be revoked. The answer is yes; businesses typically need to notify vendors in writing that they wish to cease ACH payments. Regarding how long authorizations remain valid, most organizations state that they remain valid until explicitly revoked, ensuring clarity on payment continuity.

Managing Vendor ACH Authorizations

Effective management of Vendor ACH Authorizations is vital for any business. Storing completed forms securely is a priority. Digital storage solutions offer the advantage of easy retrieval and access, while physical storage must ensure privacy and protection of sensitive information. Leveraging platforms like pdfFiller can enhance this process, as users can securely store and manage all forms in one location.

Periodic reviews of vendor authorizations can prevent discrepancies and ensure that information remains current. This entails regularly verifying vendor details and conducting audits for compliance and security purposes. Maintaining up-to-date records not only fosters trust but also ensures that businesses are prepared for any financial audits or fiscal responsibilities.

Enhancing your document management with pdfFiller

pdfFiller makes managing Vendor ACH Authorization Forms exceptionally user-friendly. With interactive tools that allow users to easily fill out forms, pdfFiller streamlines the entry process, minimizing the likelihood of errors. This is especially beneficial for businesses that require multiple forms to be filled out by various team members.

The eSigning capabilities further enhance the efficiency of getting approvals swiftly. Collaboration tools enable teams to securely share documents, track edits, and maintain version control. In an age where accessibility is key, a platform like pdfFiller empowers users to create, edit, and manage documents from anywhere, making it an essential tool for modern businesses.

Conclusion

Utilizing Vendor ACH Authorization Forms is essential for businesses seeking to enhance their payment methods and vendor relationships. The advantages of electronic payments, coupled with the structured documentation provided by these forms, create a reliable environment for all financial transactions. As businesses adapt to modern solutions, platforms like pdfFiller can significantly improve both efficiency and reliability, positioning organizations for continued success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit vendor ach authorization form online?

How do I edit vendor ach authorization form in Chrome?

How do I edit vendor ach authorization form on an Android device?

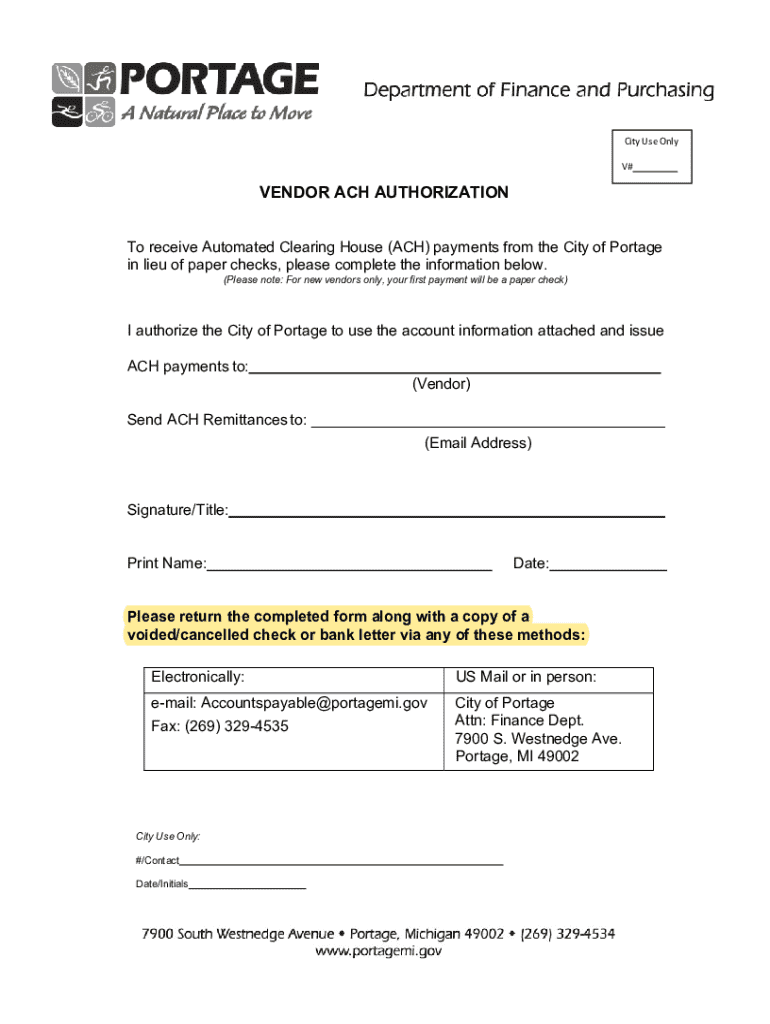

What is vendor ach authorization form?

Who is required to file vendor ach authorization form?

How to fill out vendor ach authorization form?

What is the purpose of vendor ach authorization form?

What information must be reported on vendor ach authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.